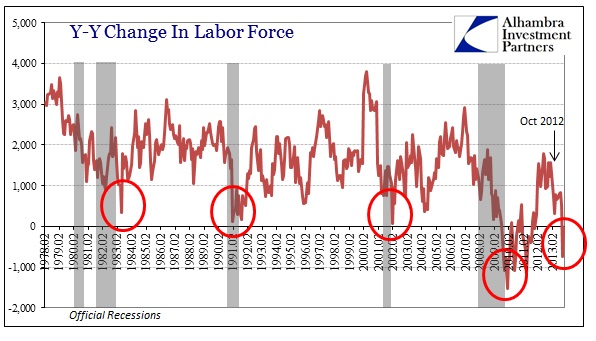

I should clarify from Friday and highlight that the Y/Y decline in the official Labor Force (OLF) is a new occurrence. It is a separate, but related, correlation to the increase in the number of those Not in the Labor Force (NLF). Up until October 2012 (there’s that month again), the size of the OLF and the cohort of undercounted (NLF) were both increasing at a relatively steady pace. That the NLF was rising concurrent to the OLF was due to the weakness in overall recovery flowing through to employer demand for labor resources.

In other words, there was at least some growth that drew in new labor participants, but not nearly enough growth to begin to unravel the structural declines leftover from the Great Recession.

Beginning last October, however, the OLF has shifted to something else entirely. As the economy has wound its way through successive mini-cycles related to QE expectations unfortunately driving inventory demand (through distorted expectations of end user demand), the labor force has begun to respond in a manner that is not picked up in the official unemployment rate.

The first downturn coincided with the inventory drawdown (and nearly negative GDP) after last Christmas. There was a minor revival into the middle of 2012, showing up everywhere from the ISM’s to factory and durable goods orders. That was short-lived as inventory, rather than meeting expected demand, has alarmingly accumulated again.

The result of the mini-cycles is evident in a longer-term view. For the first time, the labor force actually shrank Y/Y in a signal that is uniformly associated with recession. As expected, the NLF shifted far higher at the same time – largely continuing the “recovery” trend at a steeper pace.

It is the OLF that is most significant, and, owing to BLS accounting and theory, drastically opposes the drop in the unemployment rate that has so heartened the mainstream narrative. Until October 2012, the main critique of the official unemployment rate related to the inability of the economy to generate enough momentum to convince employers to hire and expand at a pace that would actually absorb the long-term unemployed (those undercounted by official statistics). It’s not just undercounting that is the problem anymore, as we are now seeing those that actually qualified for the OLF actively giving up in large numbers (particularly since June).

That is why this change in the OLF is consistent with recession, signaling a worsening environment beyond just the dissatisfactory conditions that existed prior to the middle of last year. Whatever little hope existed has now vanished.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch