The fact that China did something will always be treated with hyperventilation, but lately that includes an almost bi-polar nature. Last week, the PBOC branch in Shanghai made what looked to be a “tightening” gesture upon Chinese stocks, ordering commercial banks, in a memo, to check for risks in margin debt. They also banned margin on unregulated accounts and “suddenly” opened Shanghai for short selling.

Against that was positioned a large cut in the RRR, exactly the means that economists have been screaming about as the Chinese economy finds new depths.

China stocks surrendered early gains and dived on Monday in volatile trade as fears of a regulatory crackdown offset the central bank’s boldest policy move yet to bolster the slowing economy.

If this seems familiar that is because this was the same set of moves that PBOC made back in November, the last time “everyone” was sure the PBOC was finally relenting on “stimulus.” If you recall back then, the PBOC had cut repo eligibility in half, thus “tightening” the more speculative ends of especially the Wealth Management Products. This is how AP reported on the “stimulus” portion delivered back then:

China’s central bank unexpectedly slashed interest rates on Friday to re-energize the world’s No. 2 economy, joining a growing list of major economies that are trying to encourage growth in the face of a global slowdown.

After displaying absolutely no effects from that “slash” in interest rates, November’s pieces are now forgotten and the cries for more grow deafening. Five months later, the PBOC repeats the pattern as they “tighten” on one hand and “loosen” on the other. The targets should not be at all surprising since it has been those same WMP’s that moved into Shanghai stocks to begin with; thus illustrating very well the difficulties facing the PBOC’s reform agenda.

To those with an orthodox, monetarist baseline, none of this will make any sense. Growth in that worldview is financial, so all forms of financial are deemed helpful, and thus there is no way to reconcile both “tightening” and “loosening” at the same time.

Indeed, policy watchers were scratching their heads over the series of conflicting announcements. The PBoC is scrambling to ensure stability in China’s notoriously volatile share market, said Mark Andersen, global co-head of Asset Allocation at UBS CIO Wealth Management.

“They want to see markets go up to some extent, but not out of control. With some of this margin financing, they want to see a relatively stable capital market with property prices falling so they don’t mind equity prices moving up a bit to support the broader economy, but they don’t want to see bubble territory,” Anderson said.

No, that is not it at all – that is the orthodox baseline for interpretation intruding. The PBOC, under the reform umbrella, is taking steps to “manage the decline” by cutting back sources of bubbles without disrupting too much “necessary” financial operations. It is Herculean in its scope, as they dare not “tighten” too much lest it unleash full and destructive disorder. That is why these attempts are paired, to give the speculators a good punch but to remove some or all of the sting from the rest.

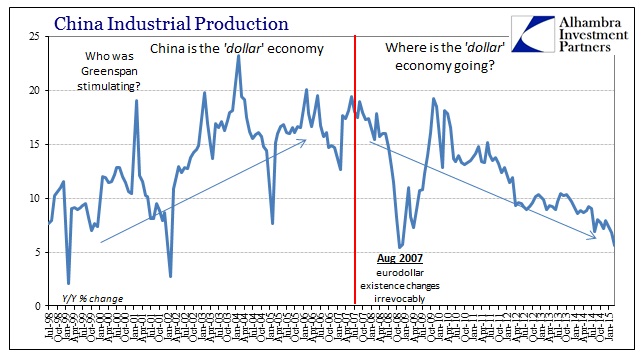

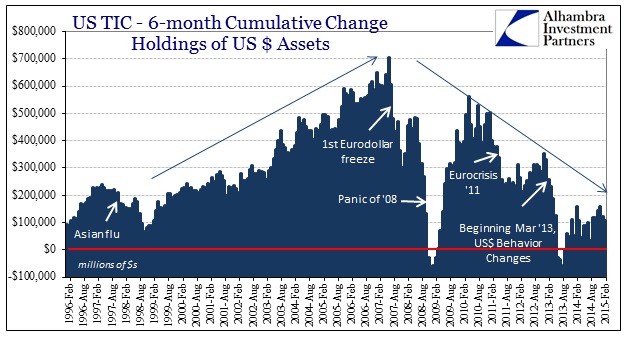

The Chinese have made it plain, to anyone open minded enough to see it, that they view bubbles as the single largest source of instability, not the lack of “inflation” the economists of the monetarism reference point repeat and parrot. It is a profound shift that reprioritized monetary intentions, and there is nothing still to suggest that has ended as the economy draws upon its weakest legs in more than a decade. In fact, the PBOC is more than suggesting that it feels it is/was bubbles that created the mess in the first place, which isn’t really a surprising outlook given that China has been the best representation (both good and bad) of the “dollar” system.

Chinese reform is essentially trying to extricate China’s economy from the fading “dollar” function before it all blows apart, an educated gamble for existential risks. That even means doing very little about economic growth that slows sharply, because the worst case is having enormous asset bubbles in play when there is finally a break.

Actually, that is the second-worst case, as the very bottom and most dangerous is in fact actively injecting further bubbles while the governing dynamic of the eurodollar system lastly fails. In that sense, there is no separation between finance and economy as the lack of recovery is itself closely related to the erosion in function of global monetary efficacy and durability. To those under the orthodox ideology, that looks like China has given up on growth; to those that can appreciate the roll-back and unmistakable decay in the eurodollar system, it actually looks like prudence.

This weekend brought more evidence of exactly that – an attempt at an orderly disentanglement of all that monetarism has brought the rest of the world, bubbles not recovery. In some ways this is nothing more than a “fingers crossed” attempt as it has never been done before. At this point, there may be no going back as the growth end has perpetrated such depths that they may as well just get on with it and see if they can depress the property bubbles (and now stocks) without it all casting into the abyss. That doesn’t mean, however, that they will proceed recklessly.

Stay In Touch