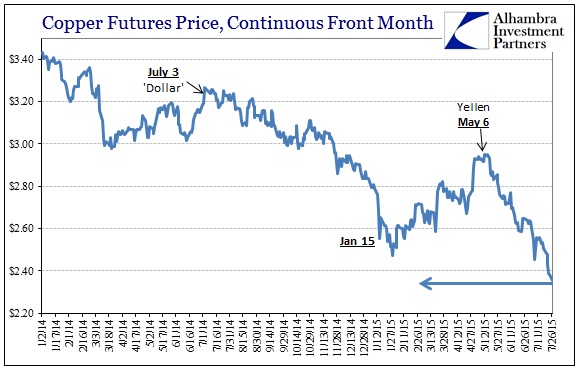

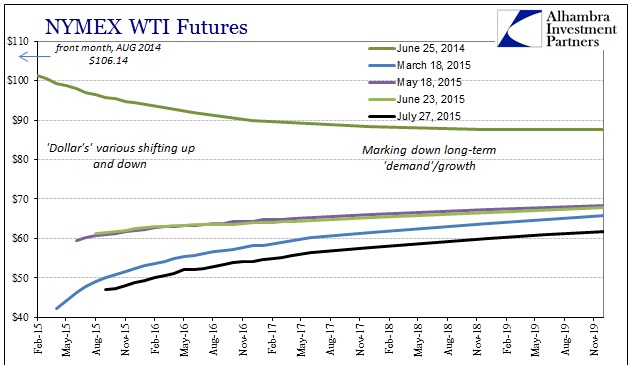

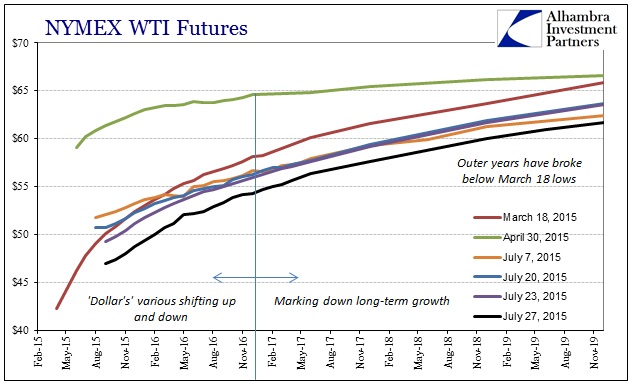

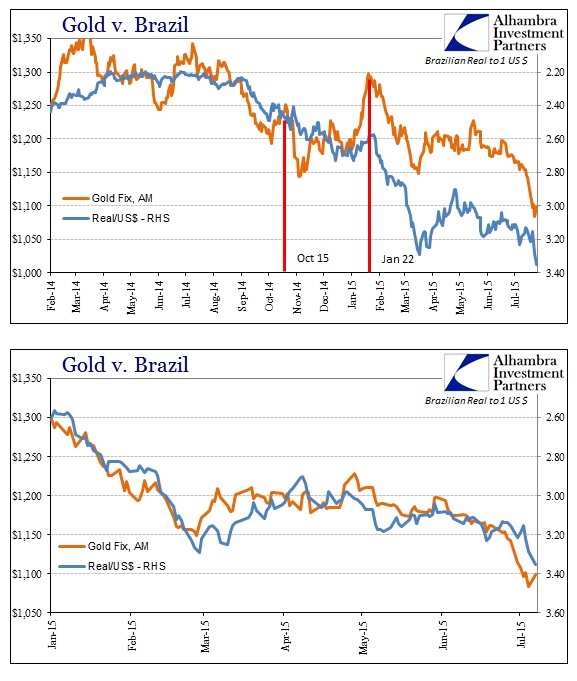

The “dollar” problems continued this morning as several proxies continued toward new lows. Copper fell to as low as $2.342 (July contract still) while crude is down close to $47 in the front months. The back end of the WTI curve, perhaps more importantly with respect to growth and fundamentals tied to the “dollar”, fell to new lows. The Brazilian real dropped to 3.38 to the dollar while gold only rebounded by the smallest amount from Friday’s low.

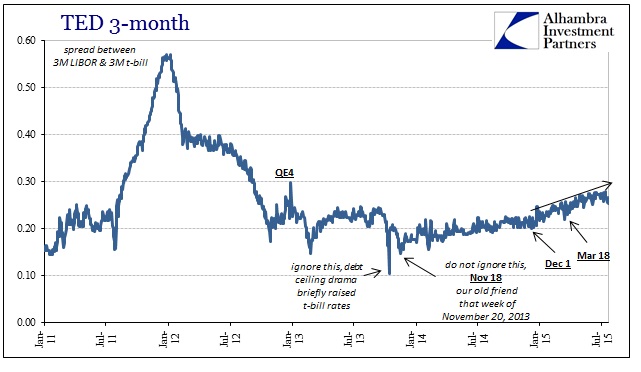

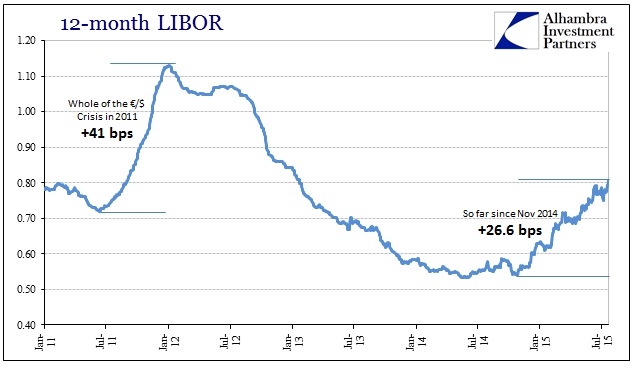

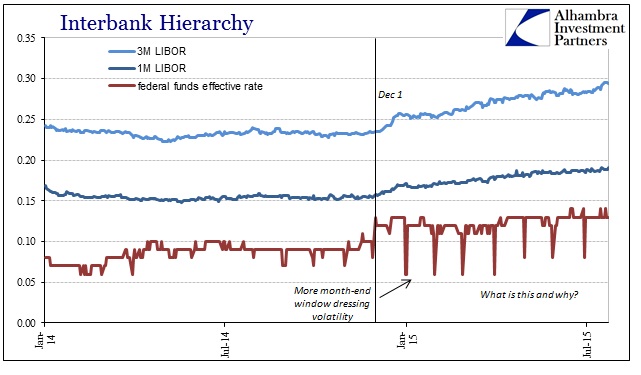

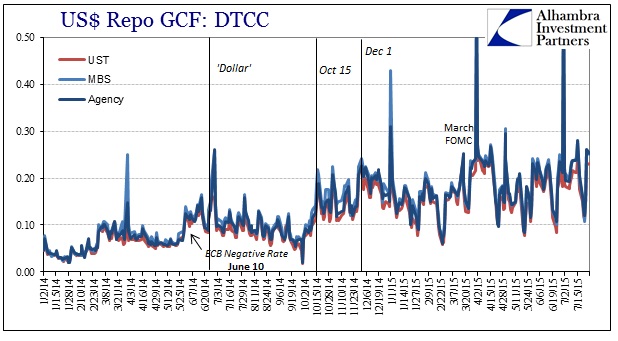

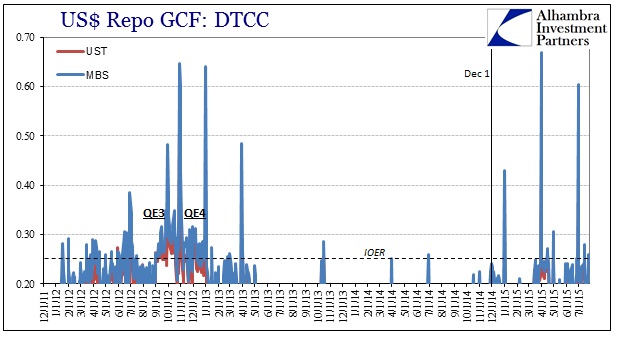

Those are not unexpected given the overall “dollar” tone, but I think interbank conditions should be highlighted alongside those depressing proxies as they are all related. LIBOR rates jumped a few basis points last week (which doesn’t sound like much, but it is especially in the context of what is going on more broadly), with 12-month LIBOR now over 80 bps. Even the GC repo rate surged above IOER in MBS and Agency trading (both Friday and Monday).

With UST’s bid across especially the bank end and the belly, these are clearly the most serious “dollar” conditions since before the March FOMC. Given economic data from Japan to China to continued contraction for the US consumer and business investment, this is not, again, surprising but it also suggests, as prior “dollar” turmoil, that there is more negative to come.

Stay In Touch