It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength.

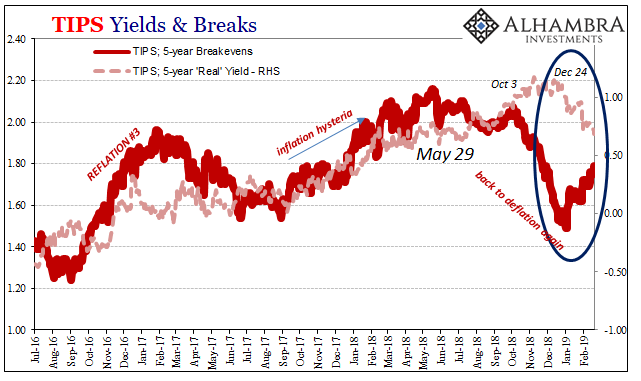

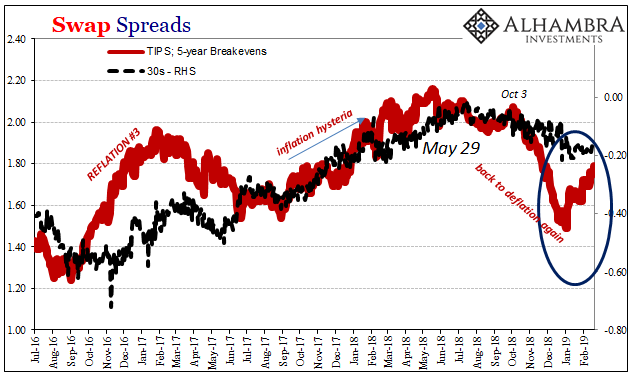

It has been the one constant. Central bankers declare their policies successful, ignoring mountains of market-based contradictory evidence in doing so, and then adjust their economic baselines based on this subjective, highly contentious assumption. The worst of it actually takes place when the global economy manages a mild upswing, reflation, when policymakers simply go nuts extrapolating small improvement into momentous acceleration.

One of the most difficult industries to have been in since 2007 was shipping. Economists never saw 2008 coming, and then when it hit failed to adjust to what amounted to a paradigm shift. Transit rates plummeted because there were too many ships. At least that’s what they said.

Why were there too many? When making new orders for them, it was commonly believed global trade would continue to grow as it had for decades. Global growth was taken as a given because central bankers, everyone knew, would never allow a change in course. Even after 2008, everyone kept believing the recovery story.

Therefore, had global trade not been permanently interrupted by that first eurodollar problem, what’s called the Great “Recession”, there wouldn’t have been too many ships. The problem, therefore, isn’t necessarily the number of vessels it was and is following the mainstream forecasts. That there is still a supply imbalance, and shipping prices reflect this fact, this is actually confirmation of the negative interpretation of something like BDIY.

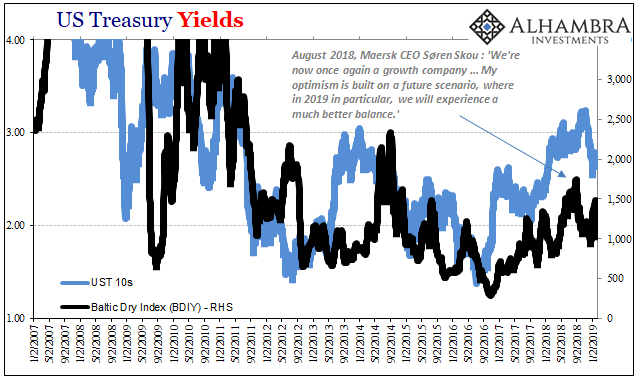

The Baltic Dry Index is a broad measure of shipping rates for raw commodities like iron or coal. It is a useful proxy for gauging the margins of global trade therefore global growth overall. The common excuse for its long-term decline has been overbuilding. But, again, if global trade had turned out the way it was predicted the number of ships would’ve been appropriate.

What happened in 2017, this globally synchronized growth stuff, was central bankers taking one last stab at recovery. This was supposed to have been meaningful, a significance beyond pure numbers how all the world’s major economies were finally at long last on the upswing together.

Regardless, it is astounding how many major companies appear to have followed the narrative. One of them was the largest shipper in the world, Moller Maersk. Despite everyone talking about trade wars last year, Maersk officials remained upbeat anyway. If anyone would be affected by tariffs and retaliations, these would be the people.

After ten years of hardship, CEO Søren Skou was practically giddy last August. More than half a year of Trump vs. Xi hadn’t dented his horizon:

We’re now once again a growth company and we expect to reach a revenue of USD 40 billion. Of this, Hamburg Süd contributes half, and the rest will come organically… My optimism is built on a future scenario, where in 2019 in particular, we will experience a much better balance. Partly because new vessels will arrive on the market.

Maersk had been shrinking its fleet the previous few years, finally recognizing after 2014 drastic action was required. After 2017, they believed it would no longer be necessary. The future is bright.

Or it was. Mr. Skou’s comments today are nothing like his earlier message delivered just six months ago.

Maersk’s guidance for 2019 is subject to considerable uncertainties due to the current risk of further restrictions on global trade and other factors impacting container freight rates, bunker prices and foreign exchange rates.

Sure, trade wars and bunker prices, but what was that something about foreign exchange rates? He’s head of the biggest shipping firm in the world, and yet his management team can only notice the obvious correlation between volatile “foreign exchange rates” and very clear periods where economic performance repeatedly defies official forecasted optimism.

To that end, IHS Markit also reports today what may seem a stunning and, as always, unexpected reversal taking place in the goods economy worldwide. The manufacturing sector seems to have found its danger point, emphatically coloring Maersk’s concurrent downgrade.

Markit’s Japan flash PMI came in at 48.5 for February 2019, down from 50.3 in January. It was the lowest in 32 months. Europe’s was 49.2, a 69-month low, clearly being dragged under by Germany’s still accelerating weakness. That specific country’s manufacturing index plunged to 47.6 in February, a level not seen in more than six years. It was 49.7 last month.

Even the US figure was troubling, at 53.7 the lowest in 17 months and down from 54.9 in January. No one is being spared; some are further along than others.

This is very likely why there is an uncanny resemblance (thanks M. Simmons) between the Baltic Dry Index and the yield on the 10-year benchmark US Treasury. US Treasury yields and shipping rates are actually surveying the same thing if from very different angles. The one imperfectly measures the monetary temperature of the global economy, the latter physical demand to ship around commodities. It takes money to move them just as it takes ships.

And if there isn’t money and then demand to do any of that, like yields shipping rates will fall. Again.

Søren Skou was very optimistic in August 2018, so much so the company he manages managed to celebrate the arrival of new ships and adding capacity. A half year forward, he’s on the verge of forecasting global downturn. World trade may already be that way.

Globally synchronized growth isn’t turning out the way Janet Yellen, Mario Draghi, and Haruhiko Kuroda said it would. It’s still synchronized, just not growth. A lot changed at the end of last year.

Stay In Touch