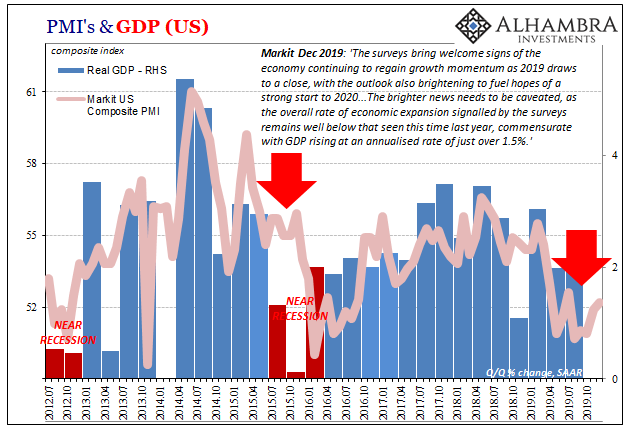

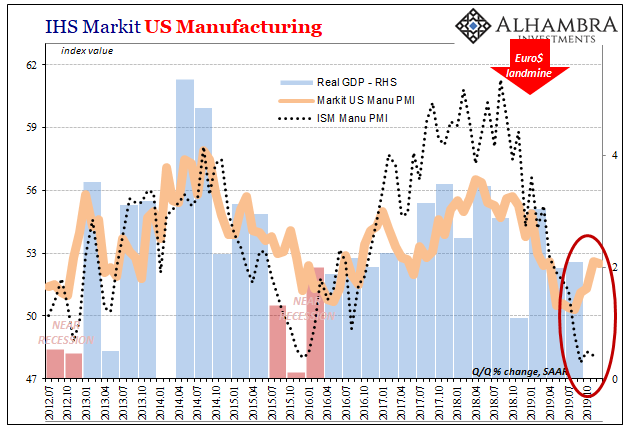

Over the past several months, there has emerged a divergence in sentiment; or, more precisely, sentiment indicators. The ISM’s PMI’s have remained at or near their lowest levels (in years) while IHS Markit’s have moved somewhat higher. Since the narrative has shifted toward “growth scare” at the same time, you can guess which surveys have carried more weight.

But Markit’s contributions toward the numerous descriptions of this resurgent economy hit a bit of a snag in its flash readings for December 2019. For one month, at least, the manufacturing side stumbled while the rise in services sentiment failed to reach expectations. As a result, the composite PMI gained just 0.3 points to come in at 52.2.

In other words, after four months on the rise the index still hasn’t reached July. As of now, even Markit’s composite is maintaining its downward trend for 2019.

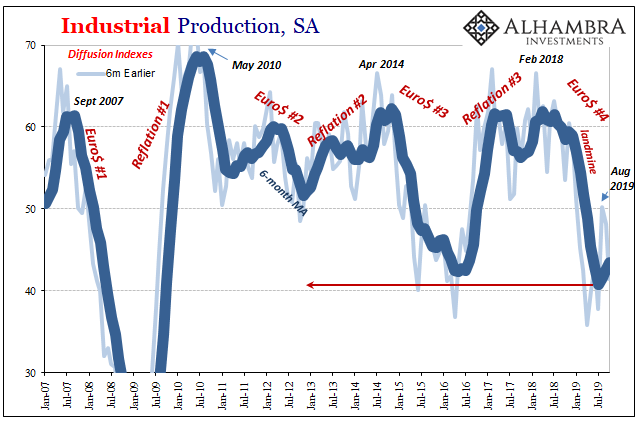

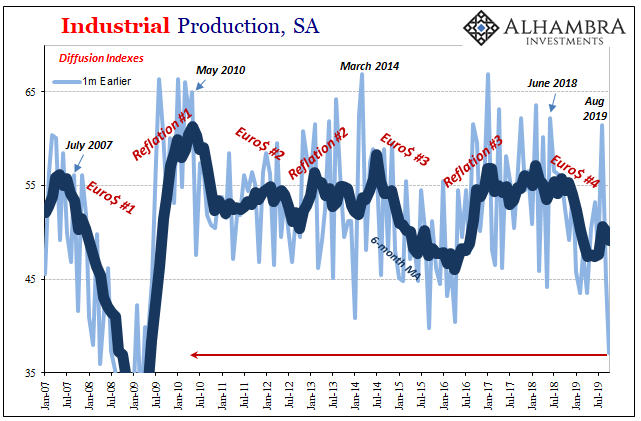

That might suggest downside risks remain, as they are indicated more consistently in other similar type indicators. The Federal Reserve, for example, published its full range of estimates for US Industrial Production today. In addition to the production estimates, the Fed includes diffusion indices which measure the breadth of the data in either direction.

Like these others, the diffusion numbers had suggested a possible rebound though going back to earlier in the summer. Across all three levels (one-month change, three-month change, six-month change) the indices had gained – but only until August. Over the next two months (the latest IP data is updated through November 2019; the diffusion indices are one month further behind) they’ve given all that back and then some.

What that suggests about the weak IP estimates for October 2019, those released last month, was that the problem couldn’t have been just GM (recall that weak IP estimates were blamed on the 40-day UAW strike affecting General Motors). The one-month diffusion, in particular, dropped all the way to 37.10 – the lowest since 2009 (immediately above).

So, while the GM strike certainly had an effect on the October IP figures, the weakness wasn’t just due to that one idiosyncrasy. In fact, the diffusion indices show that it was widespread mild contraction almost across-the-board.

That’s not what the last few months in Markit’s sentiment had been suggesting.

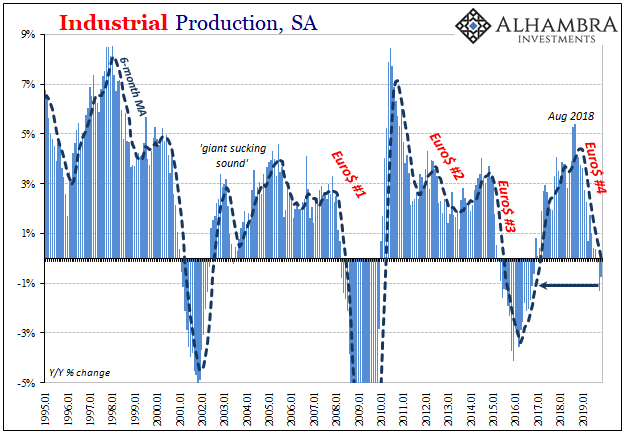

Given the GM strike, Industrial Production did rebound somewhat in November from October. And, as standard procedure, that’s what is being reported and written about (see below).

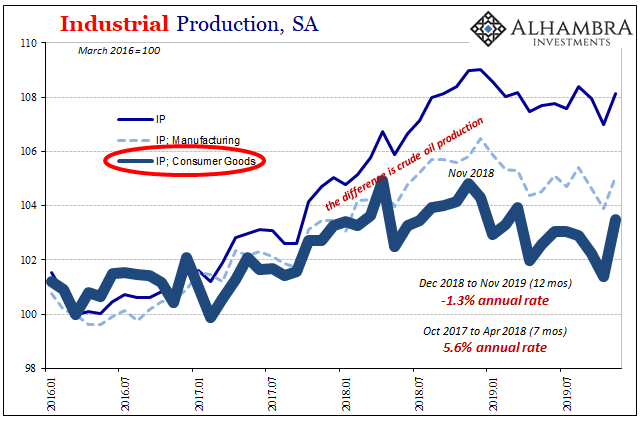

Even with that statistical quirk in its favor, however, IP was still negative year-over-year for the third straight month. The 6-month average is now below zero, too, that for the first time since the first part of Reflation #3 in early 2017.

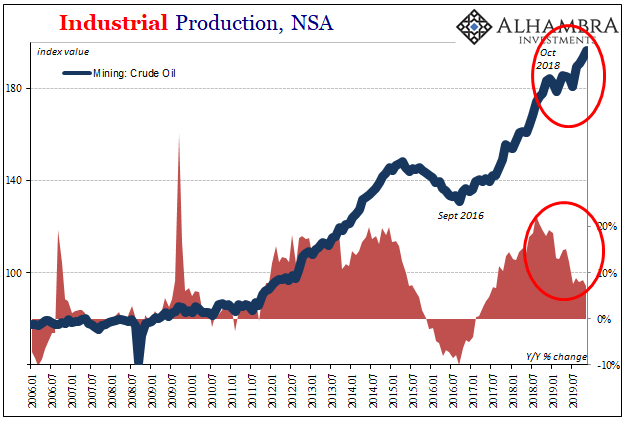

On the plus side, first was, as usual, the mining sector getting huge contributions from oil production. The Fed had figured a pause in the shale boom dating back to last year, but over the last couple of months (the only part consistent with Markit’s data) it was back to accelerating production again. They’ve blown past record levels.

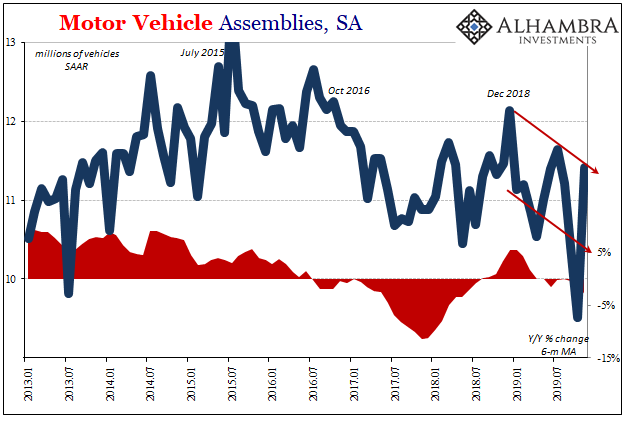

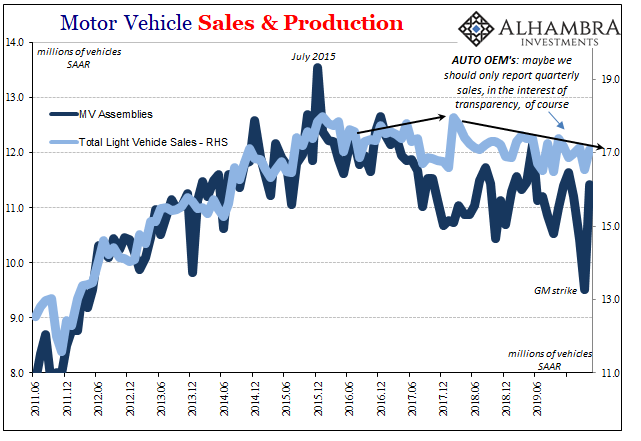

Joining the oil patch – for one month anyway – was Motor Vehicle Assemblies (MVA). Again, the strike. After being artificially held down in October, MVA’s of just 9.5 million (revised SAAR), domestic auto production rebounded smartly to 11.4 million in November.

But while that sounds like a huge jump, it was a production level slightly less than during last November. It wasn’t as meaningful as it is being portrayed. Despite what should have been, and almost certainly was, a rush and therefore temporary boost at GM to catch up for October’s shutdown, total domestic assemblies still couldn’t match production levels in the same month of last year (unaffected by any labor issues).

In fact, the trend for the auto industry remains both noisy on a short-term basis, even in those months where strikes don’t arise, as well as on a lower trajectory. The Census Bureau’s Retail Sales estimates indicate that auto sales have rebounded a little since mid-year (which would be consistent with Markit) but the BEA’s figures aren’t picking that up at all (which would be consistent with the ISM’s PMI’s as well as these from the Fed’s IP series).

Typically, the Industrial Production numbers are afforded the same level of attention and respect as the ISM’s, both due to their extremely long histories (the IP data goes back more than a century). But because they aren’t reflecting the same signs of “regaining momentum”, they aren’t being given this consideration.

One example from the WSJ today:

“Against a backdrop of slightly brighter global conditions, easing trade tensions easing and a stable dollar, the prospects for the industrial sector look set to brighten a touch in 2020,” Capital Economics economist Michael Pearce said in a Tuesday client note.

The jump in November output followed recent weak readings and came after the United Auto Workers union ended its nationwide 40-day strike at General Motors factories in late October.

Doesn’t matter, apparently, that the “jump in November” leaves both autos and overall IP this November less than last November. Sentiment is rebounding, so everything is “set to brighten.”

So long as you don’t factor the measures of sentiment that, like production, aren’t rebounding.

Stay In Touch