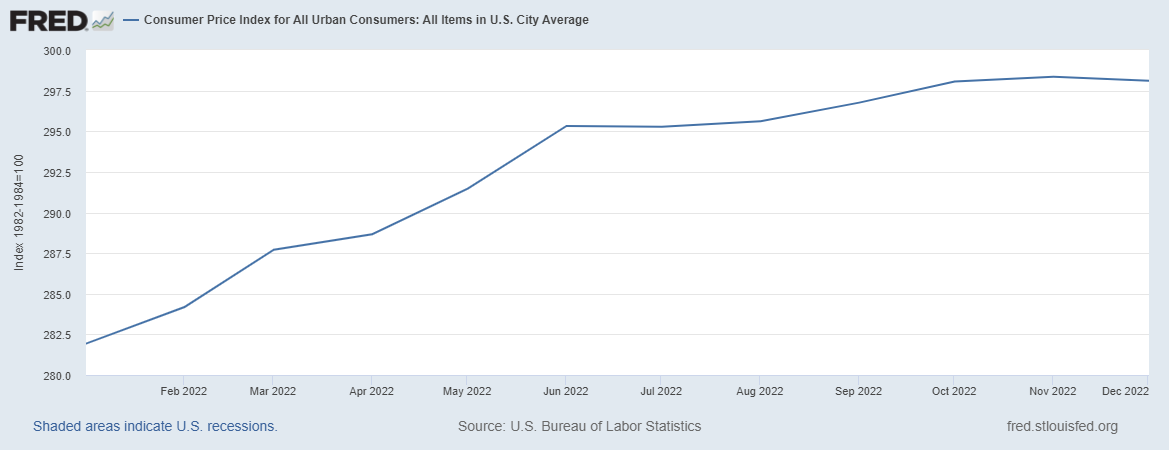

I’ve been writing for over a year about the economy rebalancing back to its pre-COVID trends. The massive fiscal expansion during COVID and the Fed’s accommodation of that spending via QE is what caused the spike in prices over the last 18 months. Yes, there were supply issues too but the size of the demand shock overwhelmed the supply issues. Now that we’ve gotten most of the supply issues under control, demand has moderated and QT is biting, price increases are falling back to the pre-COVID trend of about 2%. The Consumer Price Index was up 5.7% over the last year but is only up 1% over the last 6 months. With a target of 2%, if I was Jerome Powell I’d declare victory and retire.

Unfortunately, I don’t think the Fed had a lot to do with the moderation of prices. The main conduit for interest rates to affect prices is via real estate/rent and we’ve definitely seen an impact on the housing market. But because of the way rent is calculated for CPI, the effect hasn’t shown up yet in the price index. Owner’s equivalent rent was up 7.1% over the last year and 3.6% over the last six months; the rate of change is the same. Overall inflation has already dropped back to a rate consistent with the Fed’s target and rents will pull the index lower in coming months. There may have been some impact through higher rates on autos and other durable goods, but the trend of sales in durable goods hasn’t changed much recently. Real PCE of durable goods is down just 0.4% over the last six months and auto sales are essentially unchanged. So, if the Fed is having an impact, it isn’t very much.

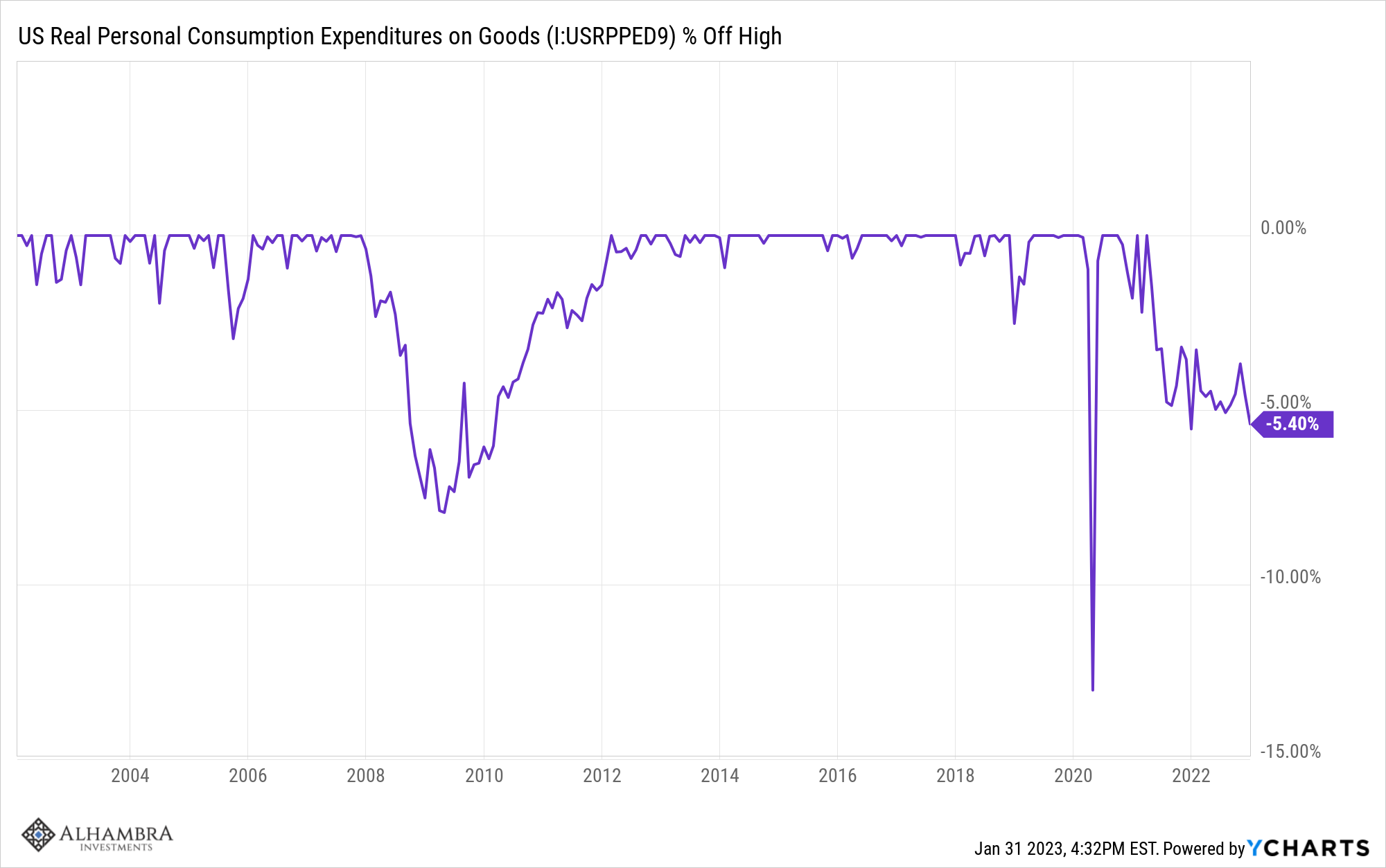

Spending on goods spiked in early 2021 because of the $1.9 trillion spending plan passed by the Biden administration called the American Rescue Plan. Spending fell back and has essentially been trending sideways since. Goods spending is now back to trend.

One reason this business cycle has been so hard to analyze is that the drop in spending after the spike looks like what we see during recession. Measured from the peak it sure looks like a recession.

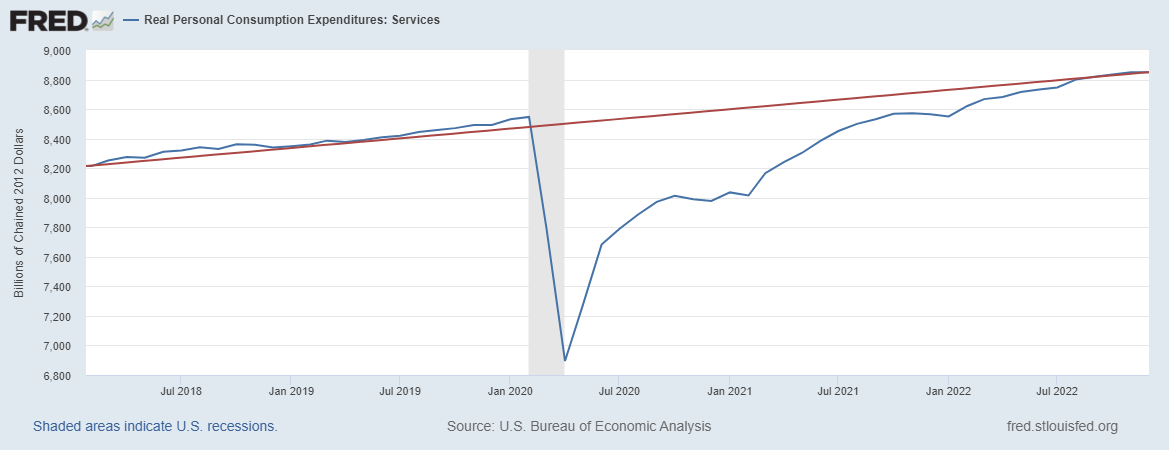

At the same time goods spending was stagnating, services spending was rising back to trend. Services took longer to recover because it started later when the shutdowns and COVID restrictions ended. And now, services spending is back up to trend.

This is the soft landing. But it is, of course, just a point in time. Whether this turns into recession or not depends on what consumption does from here. If consumption resumes its previous growth trend from here, we will probably avoid recession. If it doesn’t we won’t. The market seems to be betting that it will because the Fed’s tightening cycle is nearing its end. I’m not so sure about that because as I just pointed out, the Fed’s rate hikes didn’t really have much impact (except on stock prices). But one area where they have had an impact is on psychology. On quarterly conference calls almost every CEO says their company is preparing for recession. And if preparing for recession means cutting investments and laying people off – we’ve seen little of the former and some of the latter – then recession can be a self fulfilling prophecy. If the end of rate hikes reverses that negative psychology, this soft landing might stick.

There are some recession indicators that are flashing warnings right now. Everyone knows about the inversion of the yield curve for instance. But reliable indicators of recession are surprisingly scant. Credit spreads, for instance, are still below average and interest rates are still in intermediate term uptrends. We would normally expect short and long term rates to start falling prior to recession and it isn’t happening. Credit spreads would likely need to widen to at least 7% (from 4.25% currently) before the onset of recession. And frankly, we’ve seen wider spreads than that in the past and still avoided recession. So, while the consensus is for recession this year the indicators of such are not yet in place. And if consumption re-accelerates in coming months the recession warnings may not come at all.

Stay In Touch