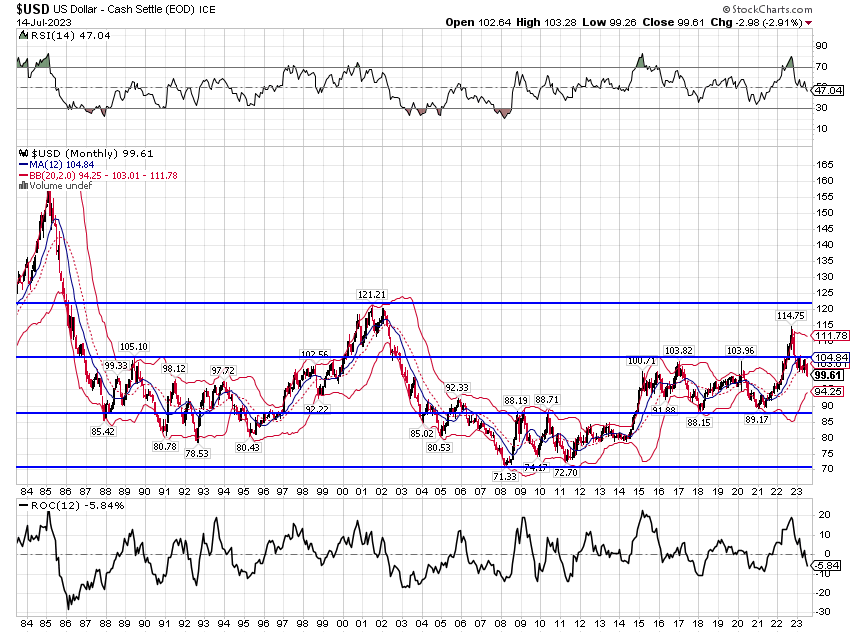

A few weeks ago, it appeared to me that stocks were starting a correction. I was clearly wrong about that as the S&P 500 and NASDAQ have moved higher since then and the rally has broadened out. And thank goodness since the things I own are mostly the parts of the market that benefitted from the broadening. Stocks tend to move together so a correction in the S&P – when it comes and yes I still think it will fairly soon – is likely going to affect the stocks I own too. Maybe. Value and international stocks, of which we have a fair amount, tend to do well when the dollar is falling, which it is conveniently doing right now.

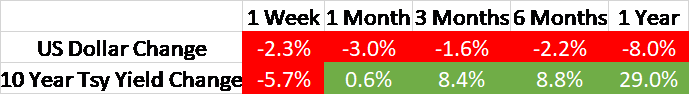

I don’t know what the catalyst for any correction will be. It could be earnings season, but I don’t think I’d bet on that. Expectations for earnings are not all that high and nominal growth still is despite last week’s improved inflation readings. And interest rates may be the more important factor right now in any case. On that front, we did get a considerable bond rally last week but the trend for rates is still up, which is generally negative from a valuation standpoint, especially for growth stocks.

Market sentiment today is the polar opposite of where it was last October when the market was making its bear market low. Well, maybe not polar opposite; we’ve seen bullish sentiment more frothy in the past. But investors and speculators are certainly a lot more positive about stocks than they were 9 months ago. There are a few sentiment indicators we watch that are at extremes that have preceded corrections – put/call ratios for instance – but I can also find plenty of things that are not.

Speculators and hedge funds are still short the S&P 500 at last check (and bonds too by the way). The number of stocks above their 50-day moving average is rising at around 83% but tops usually see that rise to the 90s. Same with the % of stocks above their 200-day MA at 75%; we were higher in February and bull markets often push this up to the high 90s. So it isn’t universal bullishness.

Still, it does seem that a lot of the speculation that marked the 2021 rally is returning. Meme stocks and crypto are rallying again. Cathie Wood’s ARK funds are on a tear and the AI hype is everywhere. It is not a market being driven by deep thinking.

There is also a seasonal factor at work with August and September historically two of the worst months of the year. Expecting a correction this time of year is just playing the odds. The real question is whether you should do anything to your portfolio in preparation for a correction and my answer is no. A correction should be used, in my opinion, to put cash to work. There is still no indication that recession is imminent and non-recessionary bear markets are rare – and we just had one last year. So, yes, prepare for a correction. By building a list of things you want to buy if they get cheaper.

Environment

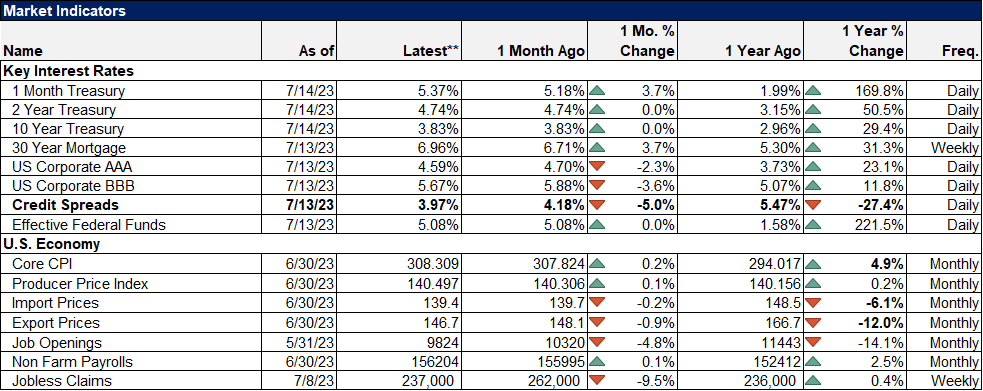

The spike in yields two weeks ago was completely reversed last week but I don’t think anything really changed. The trend for rates is still up. Yes, the trend is trendless since rates peaked in October but consolidating such a rapid advance is pretty normal technical action.

The rally last week was driven by the inflation data which I find a bit odd actually. The CPI and PPI reports were slightly better than expected, I suppose, but it wasn’t enough to change the odds on future Fed policy. Fed funds futures are still pricing in one more rate hike at this month’s meeting and nothing else until early next year.

Furthermore, the Consumer Sentiment report was much better than expected and at 72.6 well above last July’s low of 51.5. That reinforces the much better-than-expected Consumer Confidence survey from a couple of weeks ago. I would not expect to see those surveys improving if we were on the verge of recession. In fact, these readings look suspiciously like what we’d see coming out of recession. What does that tell you?

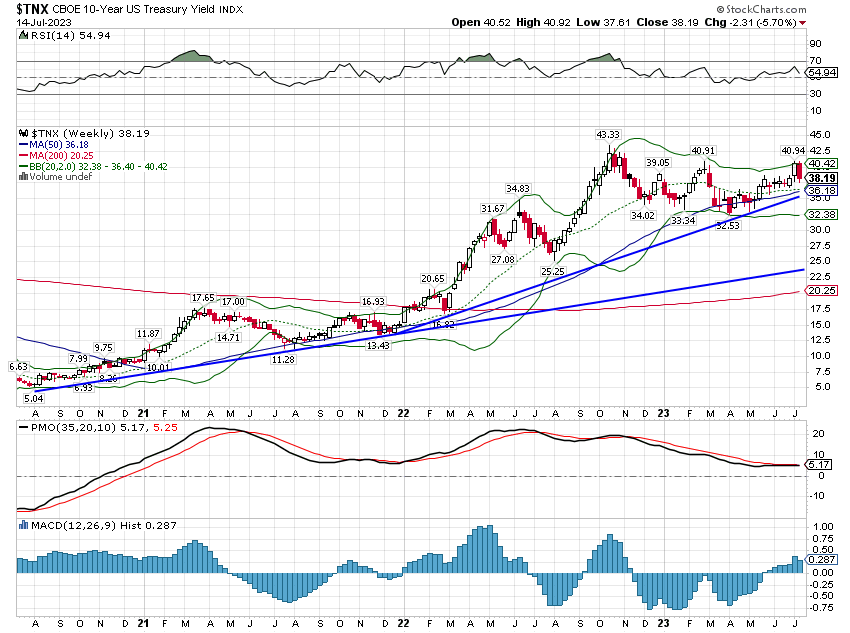

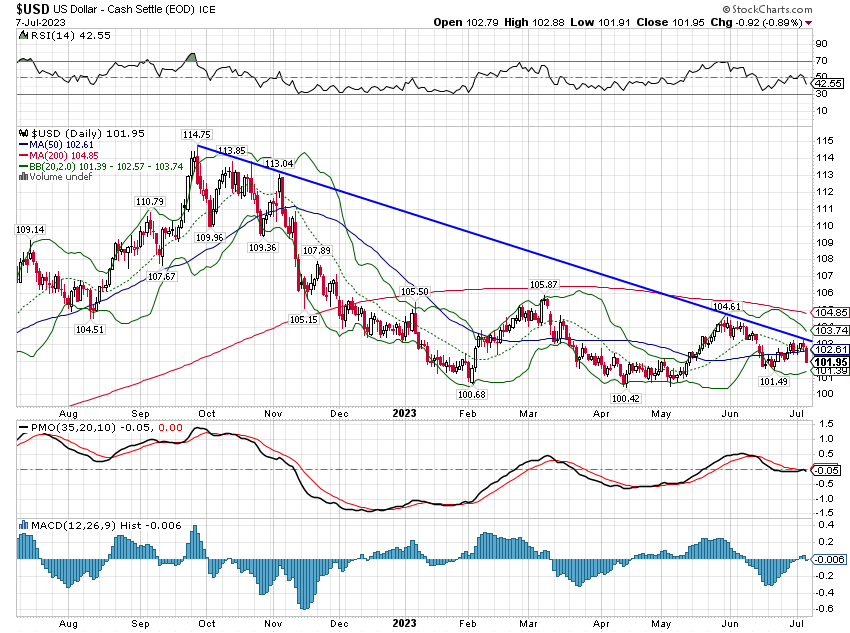

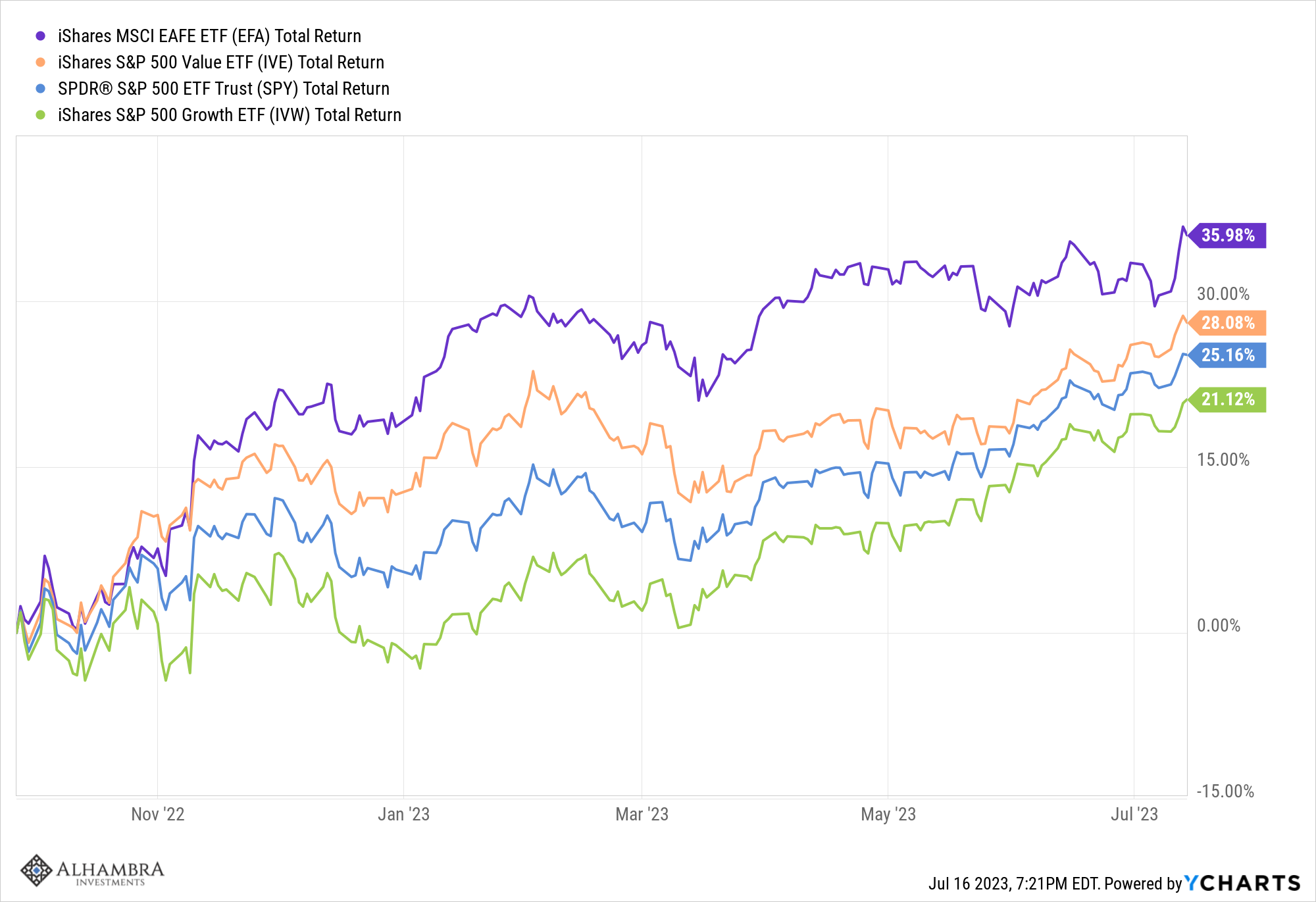

The dollar took a beating last week, down over 2%, a large move for any currency in a week but especially the dollar. Again, I’m somewhat surprised by the move because the data really wasn’t that much of a surprise. But whatever the cause the short-term trend is down. Since the dollar peaked in late September, it is down over 11% and counting. That currency tailwind is a big reason international stocks have outperformed US stocks by over 10% during that time. A weak dollar would also tend to favor value and small-cap stocks but I don’t think this qualifies as “weak” just yet; falling from a multi-year high is not necessarily weak even if it is weakening.

I must also point out that the dollar is still in an uptrend measured from its 2011 low; the intermediate-term trend is still up. The long-term trend, as I’ve discussed on numerous occasions is quite neutral and we are back in the middle of the long-term range. Next target on the dollar index is the mid-90s.

Markets

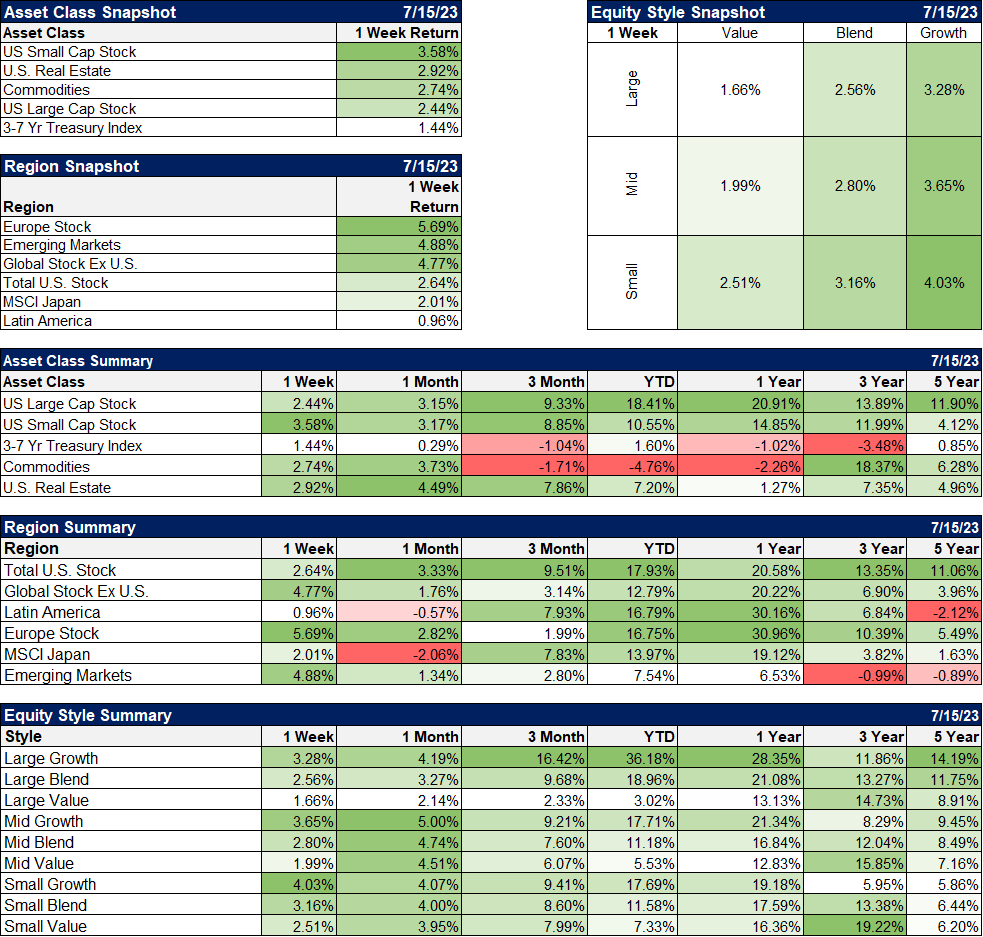

Small cap, real estate, and commodities continue to play catch up to large-cap stocks (although they didn’t gain on large-cap growth). Falling rates and a falling dollar were both a help in that regard.

International markets (Europe and EM) outperformed as well with the weak dollar. EM is one of the best performers when the dollar is falling but the index today is heavily weighted to China (29% of the fund). If you want EM exposure but don’t want China, there is an EM ex-China ETF (EMXC) and it has outperformed the total index since inception in 2017. The larger point is that EM currencies have been strong and are attracting capital flows. That has proven a potent mix in the past. In the last weak/falling dollar period from 2002 through 2007, EEM returned 377.7% vs 81.5% for the S&P 500.

Value is maintaining its lead over the last 3 years but growth still has a large lead over the last year. Value does tend to outperform during weak dollar periods which is why I continue to favor it.

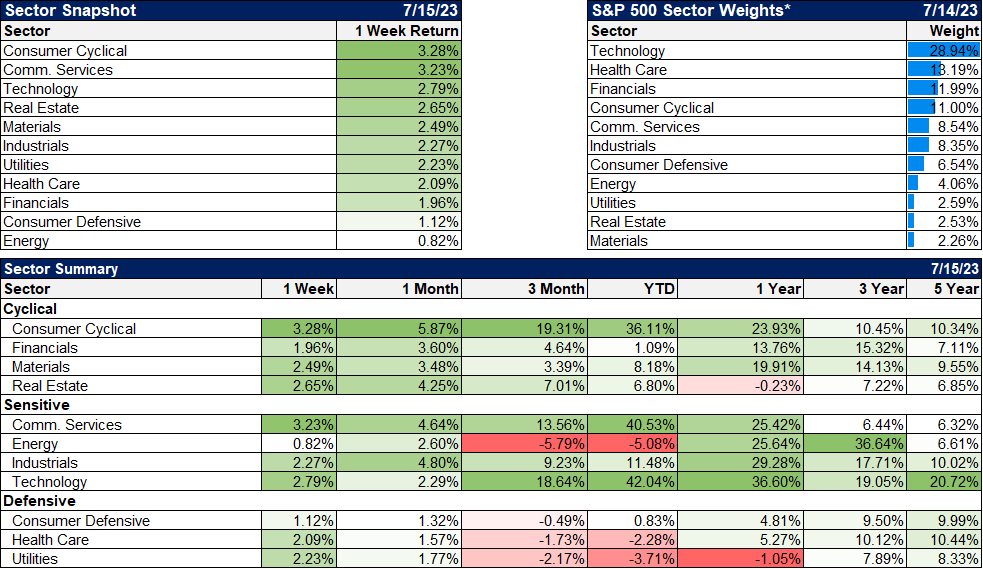

Cyclicals led on a sector basis last week but communication services did well on the back of a big week from Meta (+6.3%). Technology continues to perform well and real estate continued its comeback. Materials also did well with the weakening dollar.

Market/Economic Indicators

Credit spreads continue to surprise to the downside, falling under 4% last week. That’s down 27% from last year and indicates little to no stress in the credit markets.

As I said above, the inflation data was a little better than expected and is certainly coming down. But core inflation at the consumer level is proving sticky and is still nearly 5% higher than a year ago.

Corrections are a normal part of being an investor. It is why we diversify across multiple asset classes, with varying degrees of correlation. The traditional hedge against stock market weakness has been bonds but I think most people misunderstand that relationship. For most of history, bonds were a diversifying asset for stock investors but mostly through dilution of the equity risk. In other words, bonds carried lower risk and so lowered the overall risk profile of the portfolio.

But that doesn’t mean they provided a positive return when stocks went down. For most of the last 100 years, that just wasn’t true. It is only over the last 20 years, the post-GFC period, that the stock/bond correlation turned negative for any appreciable period. What happened last year, when stocks and bonds fell together is actually more the norm; it is the last 20 years that is the outlier.

I also think it is significant that some of the highest correlations came in the 1970s, the last high inflation period. That high degree of correlation didn’t last a few years and then fade away. It lasted roughly 30 years from the late 60s to the late 90s. So, if the relationship has reverted to the old normal, it may persist for quite some time. Which means, to me anyway, that investors need more than just US stocks and bonds in their portfolios.

Joe Calhoun

Stay In Touch