By the time you read this, markets around the world will be reacting to the Trump administration’s imposition of tariffs on Canada and Mexico and additional tariffs on China. I don’t know what exactly that reaction will be although it seems unlikely to be positive, at least initially. Regardless of the market reaction, investors need to be careful not to to let their feelings about President Trump – positive or negative – inform their investment decision making. Our job is to interpret the market reaction and try to determine whether portfolio changes are necessary and if so, when and how they should be implemented. You’ll notice that the preceding statement says nothing about trying to guess what the Trump administration will do next or what policy you or I think might be better. We are not politicians or a policymakers and there is no point in wasting our time on things over which we have no influence or control. We have to invest in the world we have, not the one we want.

The imposition of these tariffs shouldn’t be a surprise to anyone. President Trump announced that he would impose these tariffs, in exactly these amounts, weeks ago. The market has not been notably affected by his repeated insistence that the tariffs would go forward on the deadline of February 1. Yes, stocks have sold off at times when he has repeated his intention to the press but it hasn’t lasted long, with buyers immediately stepping in to buy the dip. Is that because investors didn’t think he would do what he so clearly said he would do? Did they think that someone in his administration would stop him? I don’t know how anyone could have believed that when Trump has shown repeatedly that he will do whatever he wants, whenever he wants, regardless of any advice to the contrary. And given his grip on the Republican party, “advice to the contrary” isn’t likely to be forthcoming. The last possibility is that, contrary to the vast majority of economists, investors don’t believe the tariffs will be harmful.

I am not a fan of tariffs because I know their history. Our country has been down this path before – repeatedly – and the results have never been favorable. From Thomas Jefferson’s embargo on trade in 1807 (during which prices for exports collapsed, prices of imports soared and it is estimated the economy shrank by 5%) to the Tariff of Abominations in 1828 (which led John C. Calhoun to pen the South Carolina Exposition and Protest, created the nullification crisis and was a precursor to the Civil War) to McKinley’s tariffs of 1890 (which raised prices steeply and led to the loss of about half of Republican seats in the House in the next election) to the Smoot Hawley tariff of 1930 (that was at least partially responsible for the crash of 1929 – markets anticipate – and likely worsened the Great Depression), the history of tariffs is one that should not require repeating to understand that past performance may not be a guarantee of future results but it’s all we have to go on.

President Trump has talked favorably of President McKinley’s use of tariffs but the tariffs he proposed as an Ohio Congressman were very unpopular once passed and the resulting price increases were a political disaster for Republicans. Notably, as president, McKinley was much more forward-looking and thought it was time to embrace freer trade and move away from protective tariffs. In his second inaugural address he said:

Reciprocal trade arrangements with other nations should in liberal spirit be carefully cultivated and promoted.

In his last public speech at the Pan American Exposition in Buffalo in 1901 he said:

Every exposition, great or small, has helped to some onward step. Comparison of ideas is always educational, and as such instruct the brain and hand of man. Friendly rivalry follows, which is the spur to industrial improvement, the inspiration to useful invention and to high endeavor in all departments of human activity. It exacts a study of the wants, comforts and even the whims of the people and recognizes the efficiency of high quality and new pieces to win their favor. The quest for trade is an incentive to men of business to devise, invent, improve, and economize in the cost of production.

Business life, whether among ourselves or with other people, is ever a sharp struggle for success. It will be none the less so in the future. Without competition we would be clinging to the clumsy antiquated processes of farming and manufacture and the methods of business of long ago, and the twentieth would be no further advanced than the eighteenth century. But though commercial competitors we are, commercial enemies we must not be…

This portion of the earth has no cause for humiliation for the part it has performed in the march of civilization. It has not accomplished everything from it. It has simply done its best, and without vanity or boastfulness, and recognizing the manifold achievements of others, it invites the friendly rivalry of all the powers in the peaceful pursuits of trade and commerce, and will co-operate with all in advancing the highest and best interests of humanity.

The wisdom and energy of all the nations are none too great for the world’s work. The success of art, science, industry and invention is an international asset and a common glory….

The world’s products are exchanged as never before, and with increasing transportation facilities come increasing knowledge and larger trade. Prices are fixed with mathematical precision by supply and demand. The world’s selling prices are regulated by market and crop reports.

We travel greater distances in a shorter space of time and with more ease than was ever dreamed of by the fathers. Isolation is no longer possible or desirable…

A system which provides a mutual exchange of commodities, a mutual exchange is manifestly essential to the continued and healthful growth of our export trade. We must not repose in fancied security that we can forever sell everything and buy little or nothing. If such a thing were possible, it would not be best for us or for those with whom we deal. We should take from our customers such of their products as we can use without harm to our industries and labor. Reciprocity is the natural outgrowth of our wonderful industrial development under the domestic policy now firmly established. What we produce beyond our domestic consumption must have a vent abroad. The excess must be relieved through a foreign outlet and we should sell everywhere we can, and buy wherever the buying will enlarge our sales and productions, and thereby make a greater demand for home labor.

The period of exclusiveness is past. The expansion of our trade and commerce is the pressing problem. Commercial wars are unprofitable. A policy of good will and friendly trade relations will prevent reprisals.

McKinley started his career as a staunch protectionist like most other Republicans of that time. But by the end of his career, he talked of a modern age of freer trade. He learned over his career that “commercial wars are unprofitable” and that “the expansion of our trade and commerce is the pressing problem” and solving it required not conflict but cooperation. He understood that we can’t expect to “sell everything and buy nothing” from the rest of the world. Let’s hope that President Trump learns too and that the lessons are not too painful for the rest of us.

And so, yes, you might say that I have a dim view of tariffs and President Trump’s odd combination of isolationism and imperialistic ambition.

However, my job at present does not include making public policy nor the description “economic historian”. My job is to interpret the market reaction to the policies that are enacted in the real world and I can’t do that until I know what the reaction is. I also cannot know the economic outcome of President Trump’s policies because we don’t know yet what they all will be; we don’t even know if these tariffs are part of a long-term economic plan or serve some other purposes. The imposition of these tariffs is a negative for the US economy, of that I have little doubt but that still leaves the matter of how much and how long? Further, the negative of tariffs may well be offset by some other policy not yet enacted or they may be dropped after some negotiating. Indeed, it is possible that the drag of tariffs could be more than fully offset by other policies that provide a positive impact. Unfortunately, the market at present only knows of the negative of tariffs with the potential positives more uncertain and distant.

As I warned prior to the election, the worst possible outcome was one party control of the federal government. That, I said, would lead to efforts by that party to do “big things”, which take time and creates uncertainty. To say that the new Trump administration is trying to do “big things” is the understatement of the year…so far and it’s only January. And we have uncertainty galore:

Trade Policy

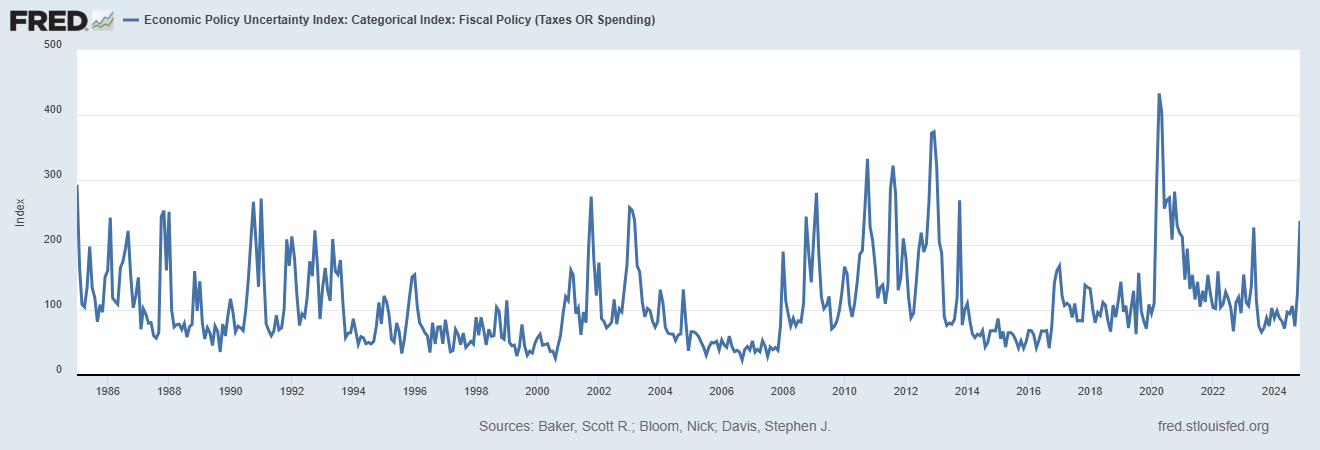

Fiscal Policy

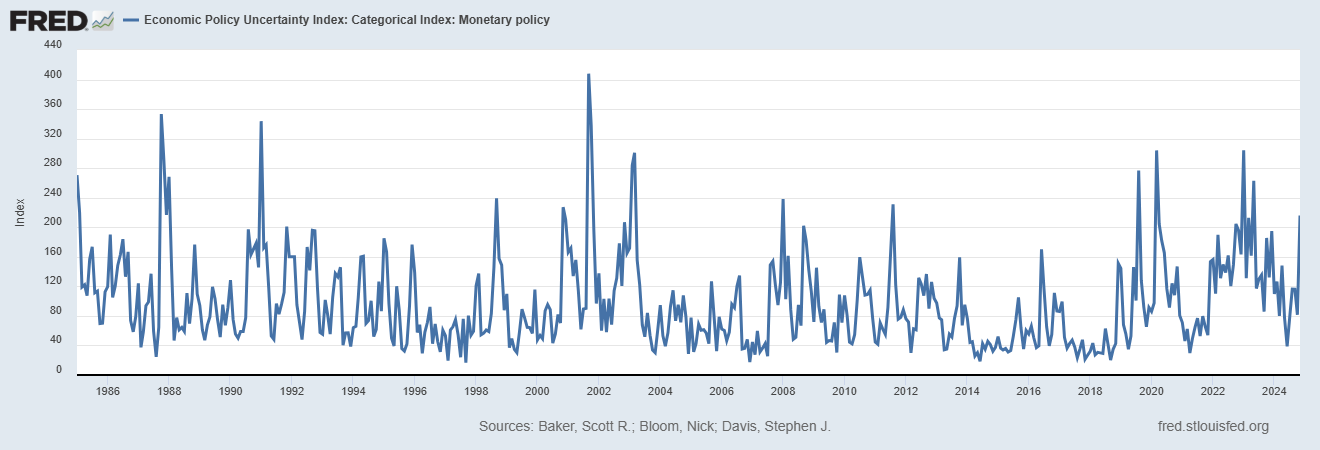

Monetary Policy

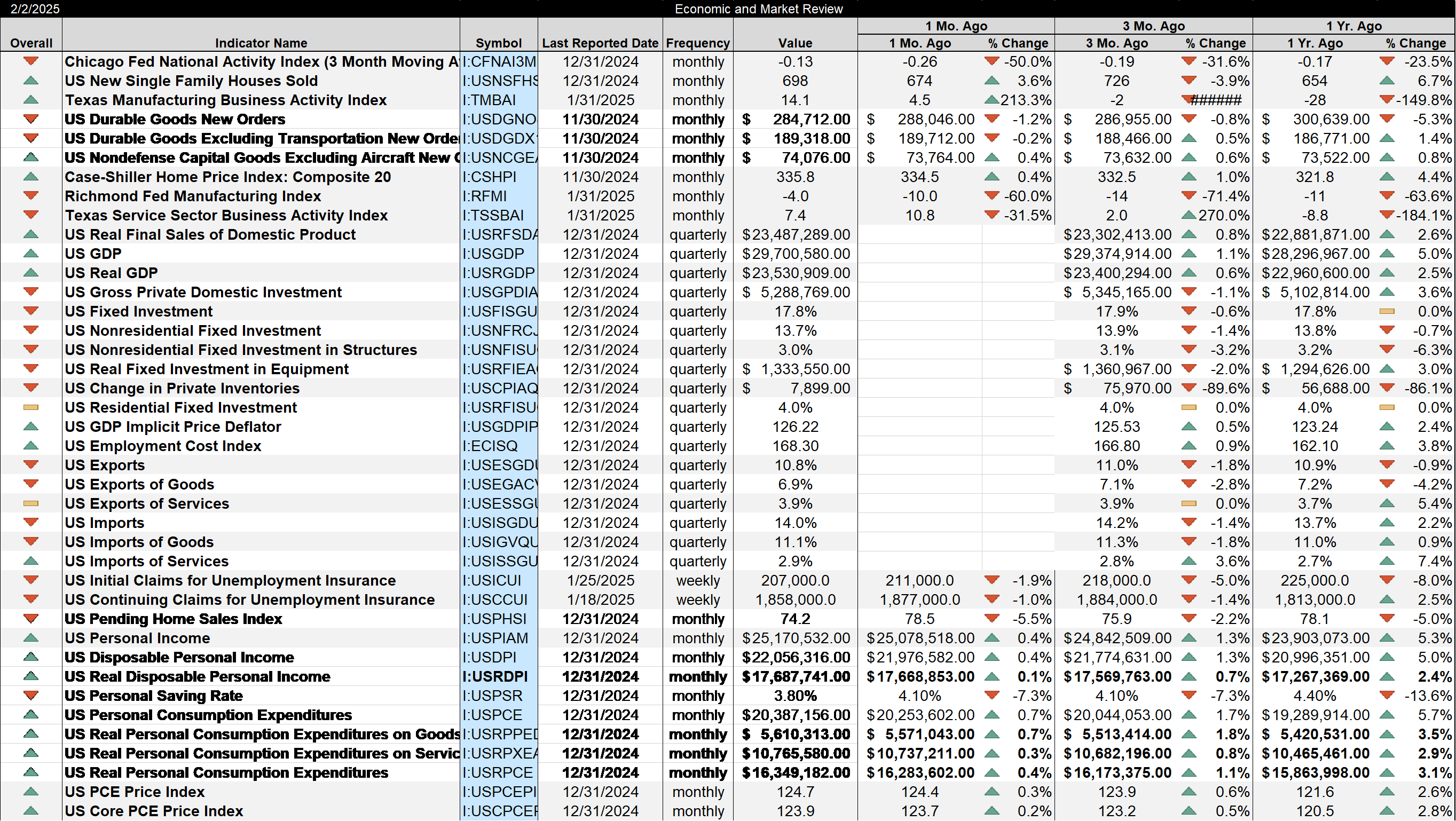

You should note that these indexes were last updated on January 6th and it is likely they have risen more since then. The uncertainty surrounding Trump’s future policies is already affecting the economy and that can be seen in the economic statistics such as the trade report last week. Our goods trade balance worsened from -$103.5 billion in November to -$122.1 billion in December as imports surged 3.9% while exports fell 4.5%. Whether you see that as a positive or a negative, it is most likely a result of individuals and companies rushing to secure goods before the tariffs hit. We can see a similar effect in a range of other reports even though they only cover December. It is unlikely that this behavior moderated in January with President Trump talking openly about imposing the tariffs on Canada, Mexico, and China on February 1. The question is what happens after this effect wears off and the prices of some imported goods start to rise in February and beyond?

What we know right now is that the economy is still performing pretty well or was as of the end of the year. GDP growth for the fourth quarter was reported last week as up 0.6% from the previous quarter (2.3% annualized) while the year-over-year change came in at 2.5%. Nominal GDP grew by 5%, meaning that inflation was 2.5% on a year-over-year basis using the GDP price deflator. An equal split between real growth and inflation is certainly not terrible but it sure isn’t great either. What it is, is just about the average since 1970 of 2.7%. But it is well below the averages of the 80s (3.1% and includes 2 bad recessions) and 90s (3.2% and includes the first Gulf War and 1990 recession). We appear to run the risk of repeating the period following the financial crisis of 2008; growth in the 2010s averaged just 2.2%. Still, that doesn’t seem like an emergency that warrants the shock therapy of imposing tariffs on our three largest trading partners. Our slower growth likely has more to do with our debt/GDP ratio than trade. Ironically, the two are related although tariffs only address the symptom, not the cause. Any policies that tend to reduce the deficit might be looked upon favorably by the market at this juncture. I am skeptical of the DOGE operation but government efficiency probably shouldn’t be an oxymoron so maybe some good will come of it. My point is that it is probably too soon to judge overall economic policy just yet.

As for the future, it will unfold as it does – without our foreknowledge. The problem with the future is that it is so often impervious to reason and logic and getting it wrong can be quite dear. Investors are best advised, especially with an impulsive executive such as Trump, to react rather than try to anticipate and only reluctantly then. The President has said that these tariffs can be reduced or eliminated if Canada and Mexico meet his expectations, although he has been vague about what might do the trick. What’s true today may not be true tomorrow.

Joe Calhoun

Environment

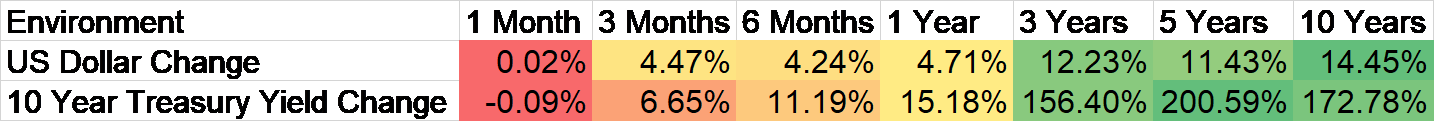

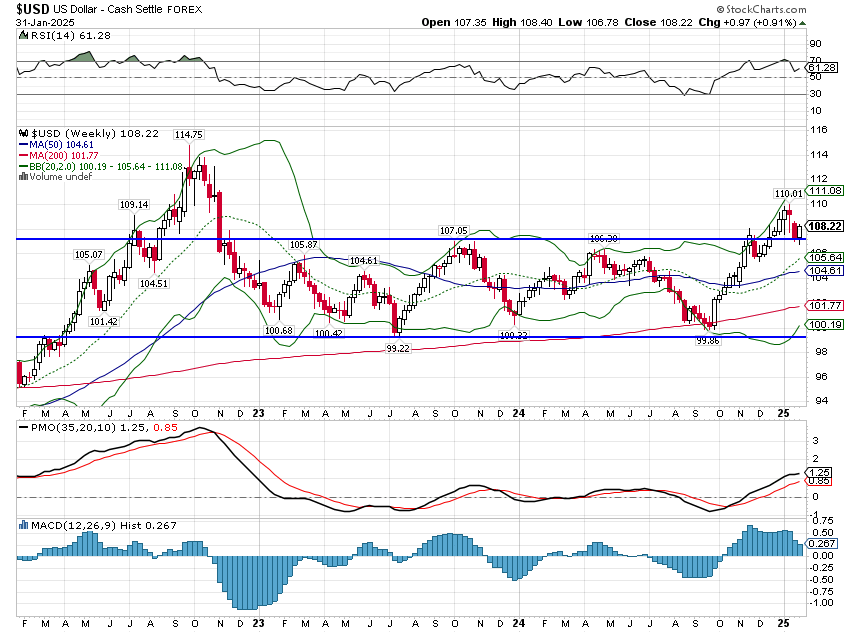

The dollar was up 0.9% last week, a pretty steady rise throughout the week as the tariffs grew closer. Theoretically the dollar should rise on the imposition of tariffs, and that is what is widely expected, but we don’t know how much of the tariff hit was already priced in. I wouldn’t be surprised if the buck actually fell this week but I’m far from sure about that. Right now the dollar index is right atop the previous break out point around 107. If I knew nothing about the dollar except this chart, I’d be looking for a further move up so if it falls next week that would be, I think, a major departure from expectations. One thing I’ll say for Trump – he does keep things interesting.

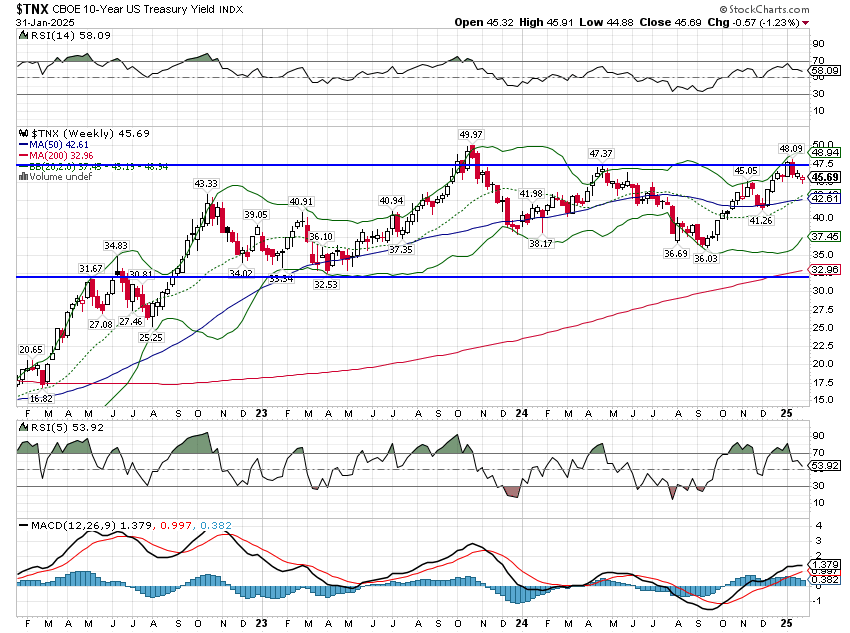

Interest rates were down slightly on the week so if the market is anticipating a growth slowdown due to tariffs it isn’t discernible in the markets. The 10-year Treasury yield remains in the channel it has been in for most of the time since late 2022.

The environment right now is marked by a short-term uptrend in the dollar and a continuation of no trend in rates. I suppose you could say rates are also in a very short-term uptrend but that’s a stretch since it hasn’t broken out of the old range. With Nominal GDP up 5% year-over-year the current rate is about where it should be. The 10-year rate tracks the year-over-year change in NGDP pretty closely and they have always converged so the current rate just below that would seem to indicate some expectation by the market of growth slowing. But it is so scant as to be meaningless.

If the dollar stays strong (because of tariffs), rates will be the dominant factor in future market returns. If rates fall, interest rate-sensitive and defensive plays lead. If rates are rising, you want more offense on the field. Very different outcomes depending on rates. And the potential outcomes multiply if the dollar instead falls. That’s why tactical adjustments are hard.

Markets

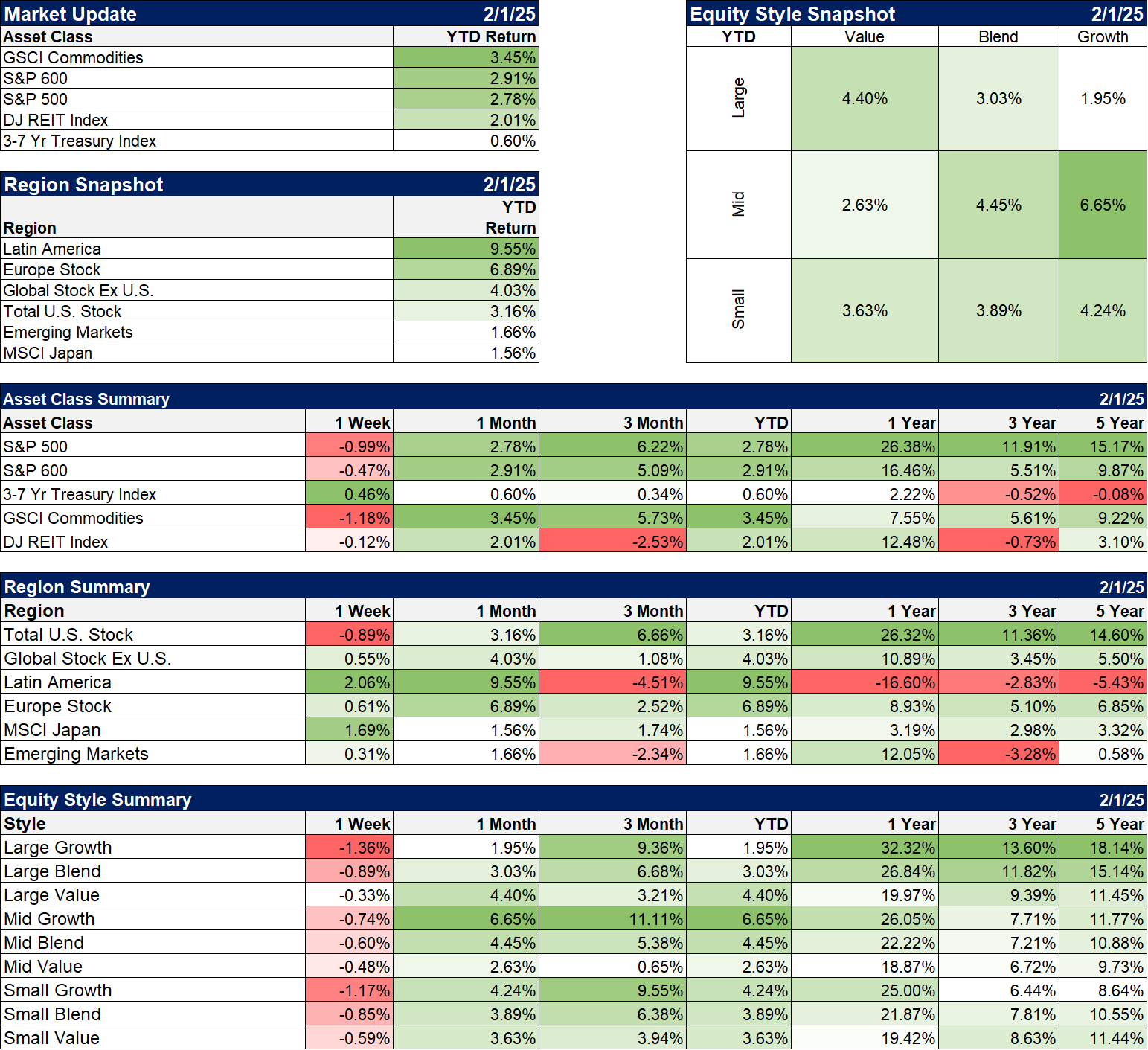

Of the major asset classes we use in our base multi-asset portfolio, only intermediate treasuries and gold (not shown below) managed a gain. Non-US stocks were mostly up on the week with Latin America and Japan leading (we have a small allocation to international in our tactical portfolios). Latin America had a good month but the stocks in that index are down over the last five years. BTW, the Latin American index is dominated by Brazil (61.2%) and Mexico (24.6%) while the most interesting place on the southern continent – Argentina – isn’t even in the index.

Growth stocks fared poorly last week and Large cap growth is lagging YTD. Large and midcap growth have outperformed value over the last 1, 3, and 5 years but small cap value is leading over the last 3 and 5 years.

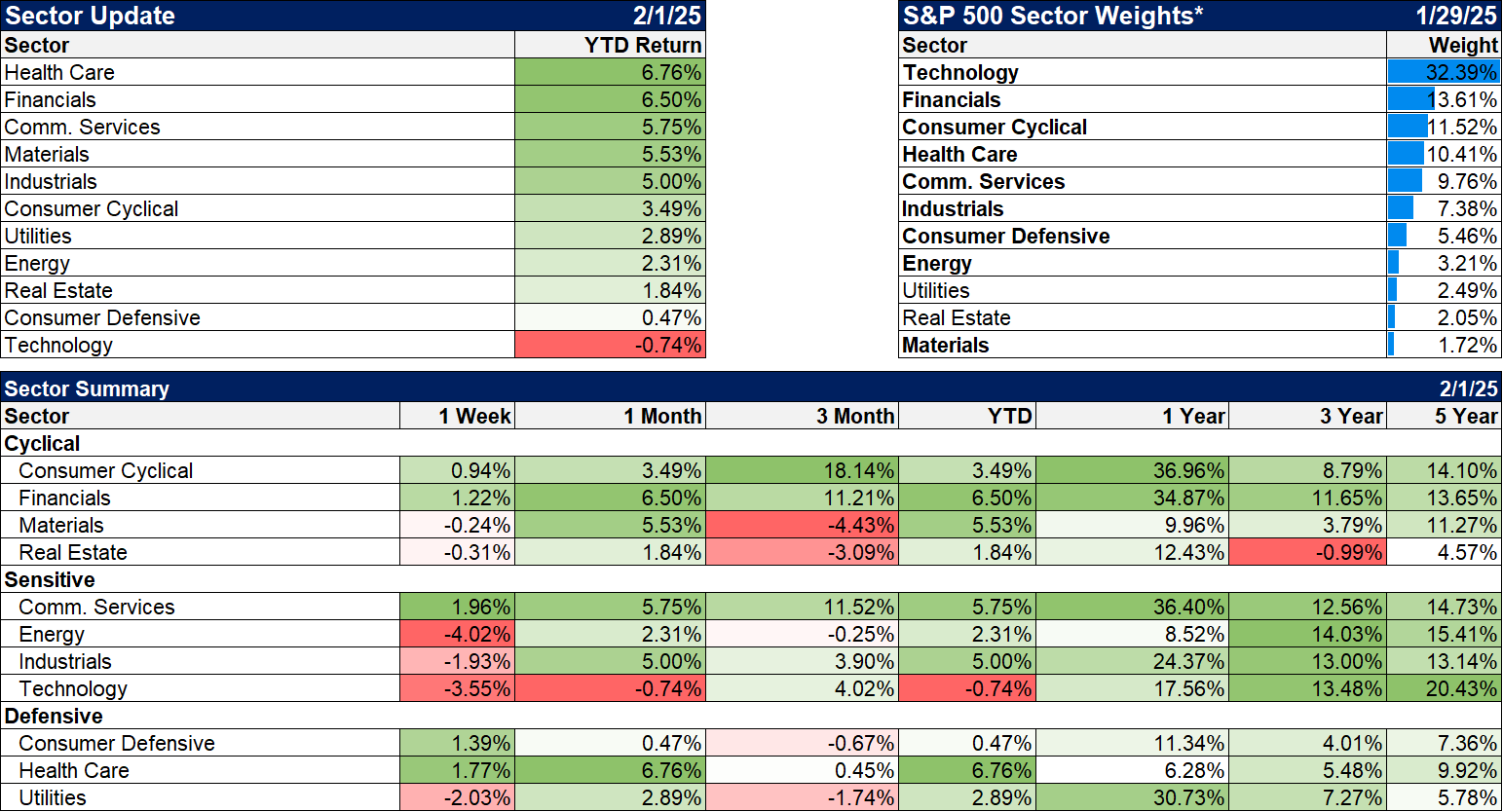

Sectors

On a sector basis, I often look at the laggards for potential investments. Right now Consumer defensive, Real Estate, and healthcare are the worst performers over the last 1, 3, and 5 years. Those might be good places to look for bargains.

Economy/Market Indicators

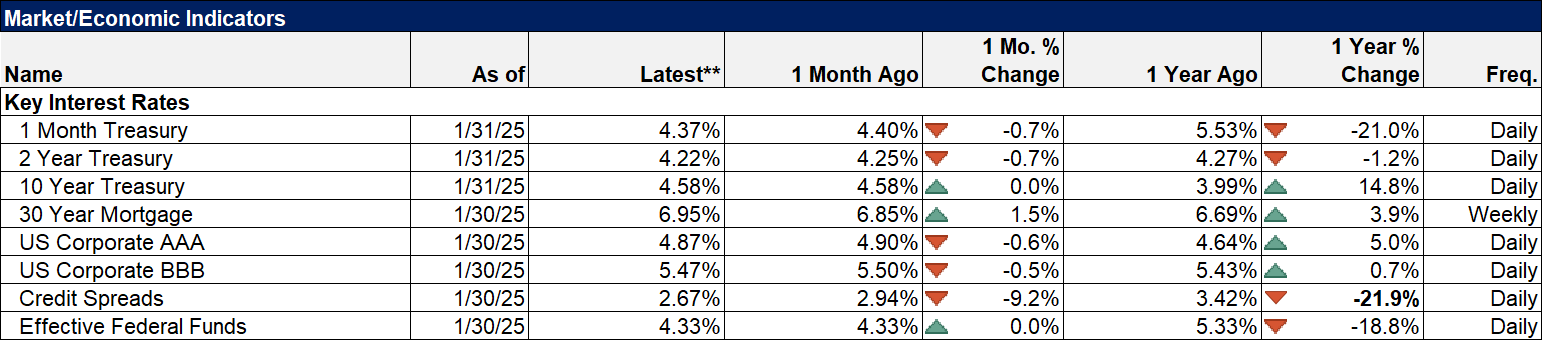

If there is anxiety in the market over potential tariffs it can’t be found here.

Economy/Economic Data

I covered a lot of this in the commentary above but a couple of things to highlight:

- The Dallas Fed manufacturing survey was positive for the second month in a row after 31 consecutive negatives

- The 3 month average of the CFNAI improved to -0.13 or just below trend growth

- Gross private domestic investment clocked in at -1.1% (annualized) in the GDP report. And it wasn’t residential investment which was flat. The bigger culprits were Fixed Equipment (-2.0%), non-residential investment in structures (-3.2%) and inventories.

Stay In Touch