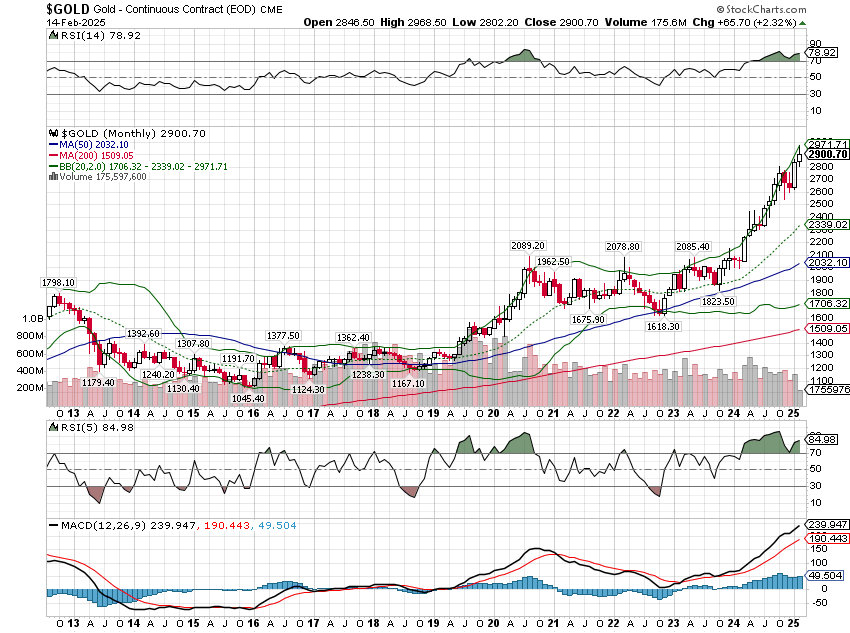

Since the beginning of the year, gold is up nearly 12% while the S&P 500 is only up a little over 4%, an outcome that is feeding a lot of narratives about it’s cause. There have been rumors about the Federal Reserve or the US Treasury buying gold because the US is preparing to devalue the dollar or maybe issue gold-back Treasuries. Treasury Secretary Bessent’s recent comment that the new sovereign wealth fund announced by the Trump administration would “monetize the asset side of the US balance sheet for the American people” is seen as confirmation that something big is afoot. There have also been numerous news articles – factual news articles – about large amounts of gold moving from London to the US, as if that is a sign of…something. There have been rumors that some of the biggest US banks are moving gold from London to the US to cover big losses on short positions. Some surmise that the BRICS nations are buying gold for their reserves so they can accelerate their alleged move away from the dollar.

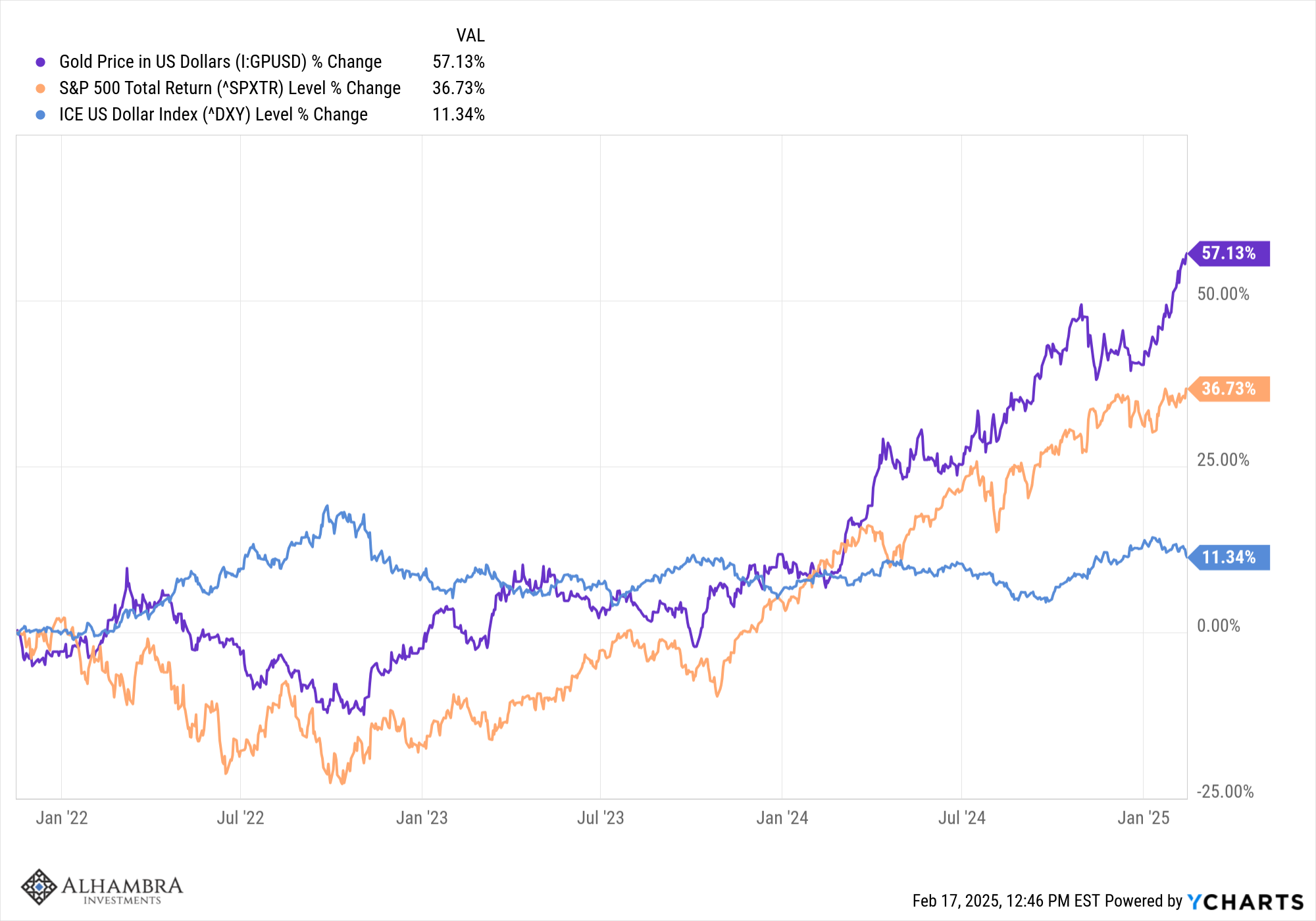

The rise of gold during a time of a strong dollar and a relatively strong economy is certainly odd. Usually gold rises when real interest rates and the dollar are falling but that hasn’t been the case recently. Since mid-November 2021, the 5-year TIPS yield has risen from -1.9% to today’s +1.75% and it was over 2.5% as recently as October of 2023. The dollar index is up over 11% since then and real GDP has grown at a 2.3% annual pace. The rise in real yields is a sign of rising real growth expectations and the rise of the dollar reflects the better prospects of the US economy compared to the rest of the world. Both of those markets anticipated the above trend growth of the US economy since 2022. And yet, gold is up 57% during that time, beating the S&P 500 by a wide margin.

So, why is gold rising? First, let’s address the rumors. The answer to the question why is gold moving from London to the US is a name – Donald Trump. The President has spent a good portion of his short period of time back in office threatening the world with tariffs and since he hasn’t mentioned any exceptions, traders are assuming that gold will be tariffed like any other good crossing the US border. The result is a rush to move gold from London to NY to avoid any future tariffs and that rush in turn has created an arbitrage opportunity. Gold in London trades at a discount to the near term futures contract in NY. Traders can buy bullion in London, deliver it to NY and lock in the price differential – assuming they can get it there in time. The increased demand has pushed delivery times out which has in turn raised the lease rate to borrow gold. None of this has anything to do with a shortage of gold or devaluing the dollar or the BRICS nations accelerating their move away from the dollar. There is no plot afoot. It’s an artificial situation created by the uncertainty of the Trump administration’s potential policies.

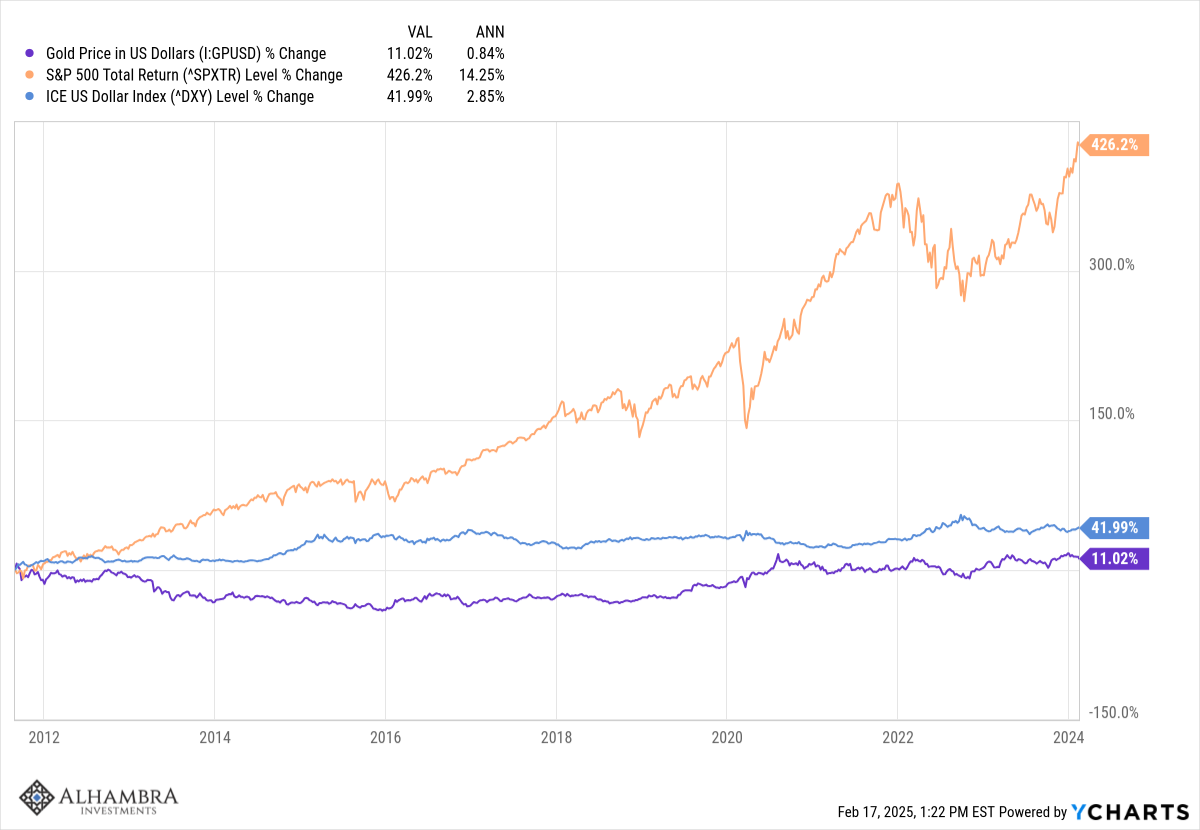

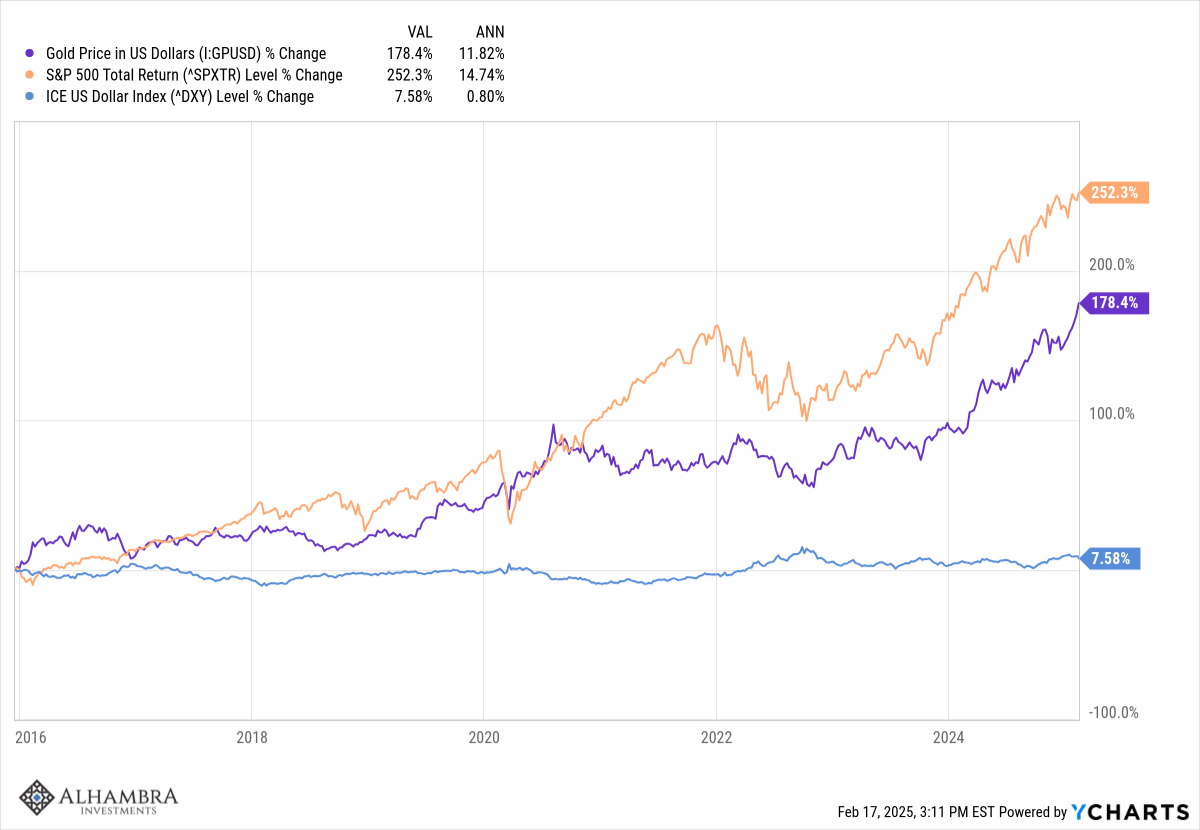

Gold in the 21st century has mostly performed as one would expect, rising when the dollar was weak and falling when it wasn’t. From 2002 to 2011, the dollar fell nearly 37% while gold rose almost 550% and stocks rose a mere 27%. Over the next nearly 13 years, until February of last year, the dollar rose 42% while gold rose less than 1% per year and stocks rose over 14%/year. A strong dollar generally means a strong economy which in turn means strong corporate profits which translates into higher stock prices. Why put your money in gold when there are better investment opportunities available?

A rise in the price of gold is generally associated with a reduction in economic growth expectations and if we measure from the peak in real interest rates, we can see that this time isn’t different. The 5-year TIPS yield peaked in October of 2023, just over 2.5% and by September of 2024 had fallen to 1.4%. Gold rose about 40% during that time which is consistent with the fall in growth expectations. From the Fed’s first rate cut in September through the election and two more rate cuts, growth expectations stabilized and gold fell slightly into the end of the year. Since the start of the year, 5-year TIPS yields have fallen again from a bit over 2% down to the present 1.75% (growth expectations falling) and, guess what, gold has risen strongly. What hasn’t happened, the dog that hasn’t barked if you will, is that the dollar hasn’t fallen. That’s the anomaly everyone ought to be focused on. You don’t need any conspiracy theories about gold moving from London to NY to explain the movement in the price of gold.

That isn’t to say that the rise in the price of gold over the longer term isn’t something to worry about. In late 2015, gold was trading for a little over $1000 and today it is nearly $3000. The dollar has been largely stable over that time and TIPS yields have risen modestly – growth expectations have risen. So, if the US economy is doing so well, if AI promises a future of increased productivity, why is an inert metal that produces no cash flow and has limited uses performing so well? It is a bit of a conundrum, no doubt, and I think one of the most important questions facing investors today. The gold market appears to be anticipating a future where dollars buy less – maybe considerably less – than today.

We own gold and have almost since the day I started this firm. We always own some gold because we know that bad outcomes for stocks and bonds are often good outcomes for gold – but we can’t predict when those bad times will arrive. In other words, gold is a hedge, a hedge that has paid off handsomely recently. That and all the attention gold has gotten recently, along with a near record long speculative position in gold futures, has me thinking it might be time to think about cashing in some of our gains. One place to look for an alternative is in other commodities. With the exception of the COVID period, gold is more expensive relative to crude oil than it has been in at least 40 years (remember when crude oil traded below $0 during COVID?). It has never been this expensive relative to platinum and palladium and is also more expensive relative to copper than it has been since the mid-80s (again, with the exception of COVID when copper fell under $2).

Lastly, I’d just ask this question: Do you know anyone who is bearish on the dollar? Anyone who doesn’t just know that tariffs mean the dollar has to go up? Me either.

Joe Calhoun

Environment

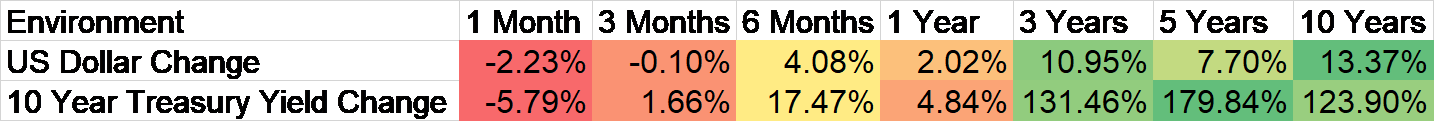

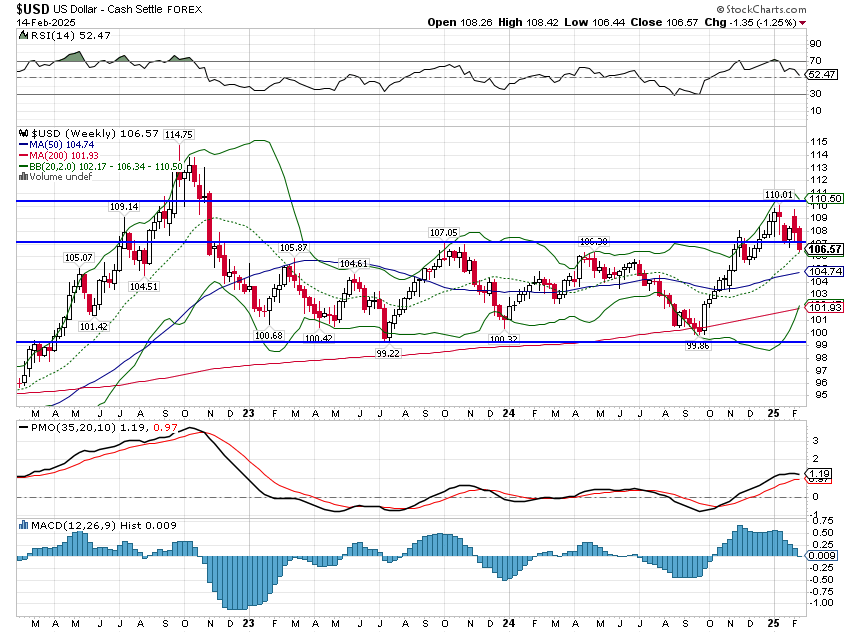

The dollar is back in the old range again, down 1.25% last week. That may have had to do with the reciprocal tariff announcement which turned out to be more of an announcement about a future announcement. In other words, nothing really happened yet except the signing of a memo directing people in the administration to look into the idea. Pffft. If I were a trader, I’d be looking at getting short the buck since no one seems to have the guts to actually bet against it right now. Everyone is afraid that someday Trump won’t be bluffing or negotiating or whatever he’s really doing and when that day comes the dollar will soar. Maybe but with everyone expecting that I have my doubts. The market generally acts to frustrate the maximum number of people and right now that would be the longs.

Gold also had a good week, up over 2% but that chart is just screaming for a top. Straight up moves aren’t generally sustainable so, at a minimum, I’d expect some consolidation.

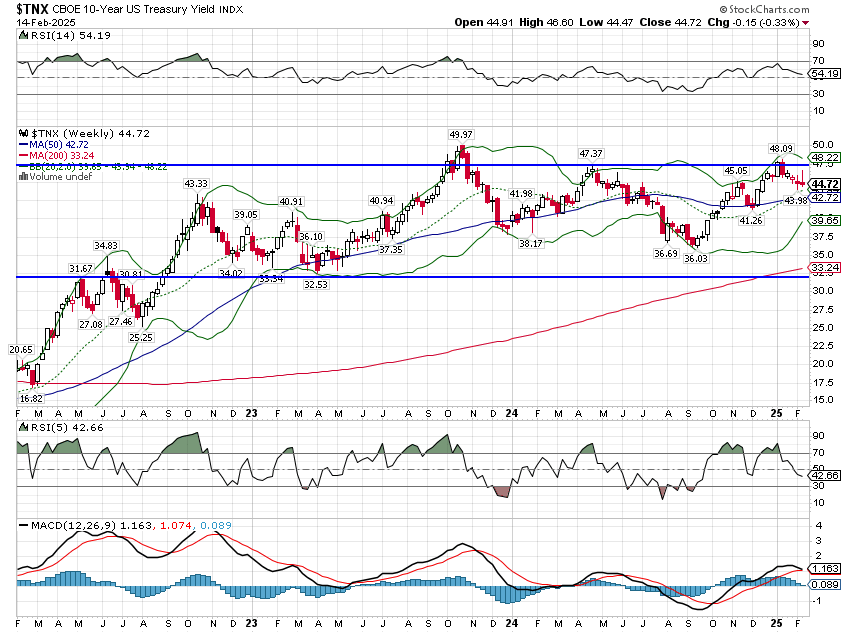

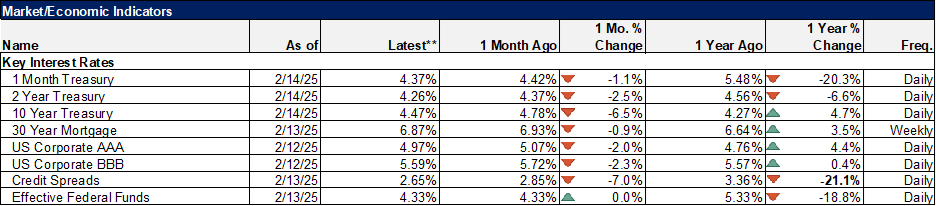

Interest rates were also down last week despite some hot inflation reports. The market seemed to put more emphasis on the weak retail sales report Friday. I don’t know that I’d read too much into that since it was really, really cold in January and every other indicator of consumption is still pretty strong. Having said that, given what is going on with DOGE, we’re probably going to start seeing jobless claims rise in coming weeks and that could definitely weigh on the consumer. The 10-year rate is still in the range it has been in for over 2 years; a trip to the bottom of that range would be interesting but not exactly a surprise.

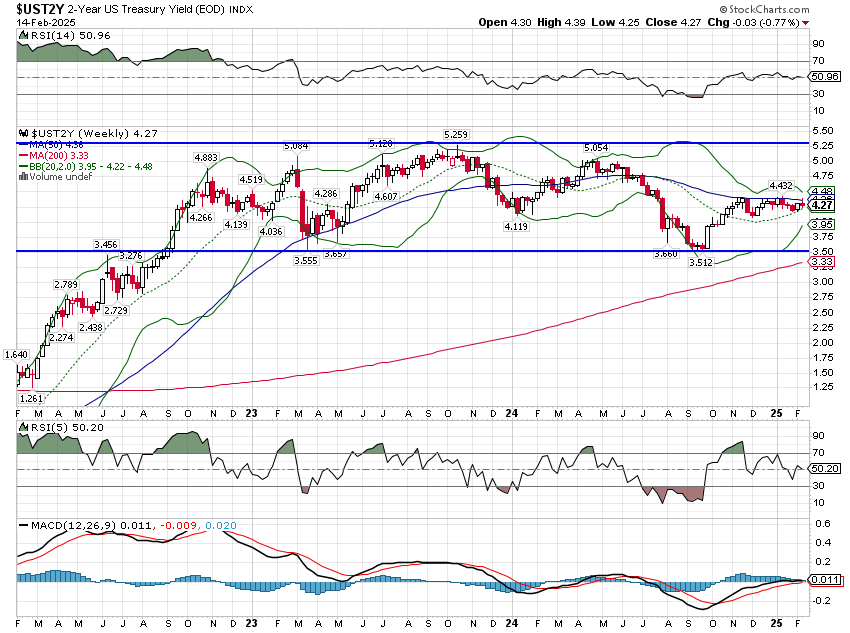

Short-term rates were down last week too but a little less than long-term rates; the yield curve flattened. That is not, just in case you’ve forgotten, a positive sign for growth.

Markets

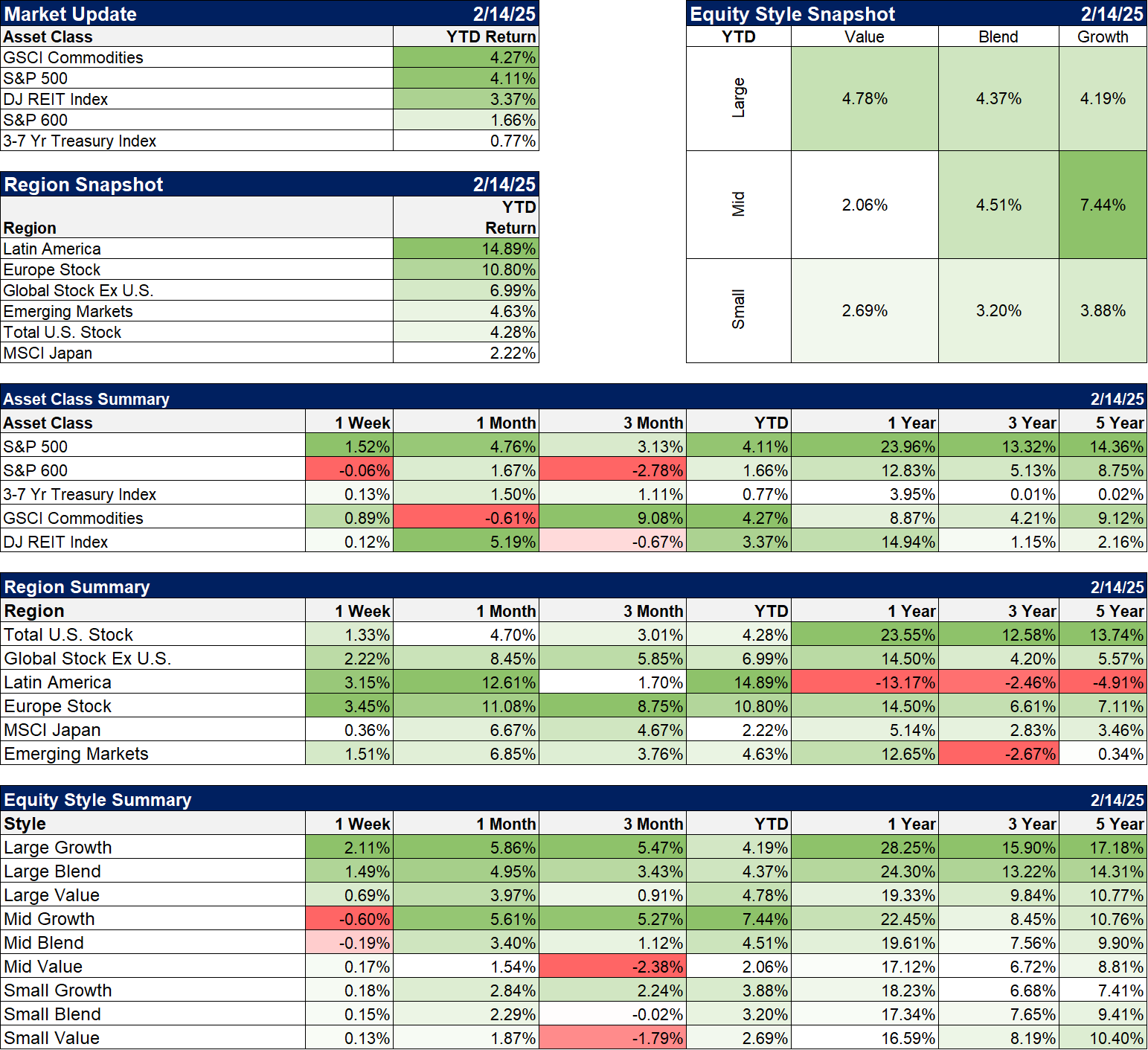

Non-US stocks outperformed again last week in what is becoming a habit. Even Emerging Markets are now outperforming the S&P 500 YTD. That is mostly due to Chinese stocks which are now strongly outperforming the S&P 500 over the last year (41% vs 23.6%). How can that be with the Chinese economy on the verge of collapse (or so I’ve heard)? Markets are not perfect but they are the best glimpse of the future you are ever going to get and Chinese stocks are seeing better times ahead, despite whatever Trump may do. Or maybe Chinese investors are hoping for a deal between Xi and Trump, the perceived probability of such having seemingly just risen with Jack Ma’s recent return to the regime’s good graces. Politics makes strange bedfellows so who knows?

Commodities and gold are both doing well YTD, but there’s a warning there too. Commodities perform well when the dollar is falling and interest rates are rising while gold does well when the dollar and interest rates are falling. The growth outlook is key. If growth turns out better than expected, commodities should outperform. If growth falls short of expectations, gold should outperform.

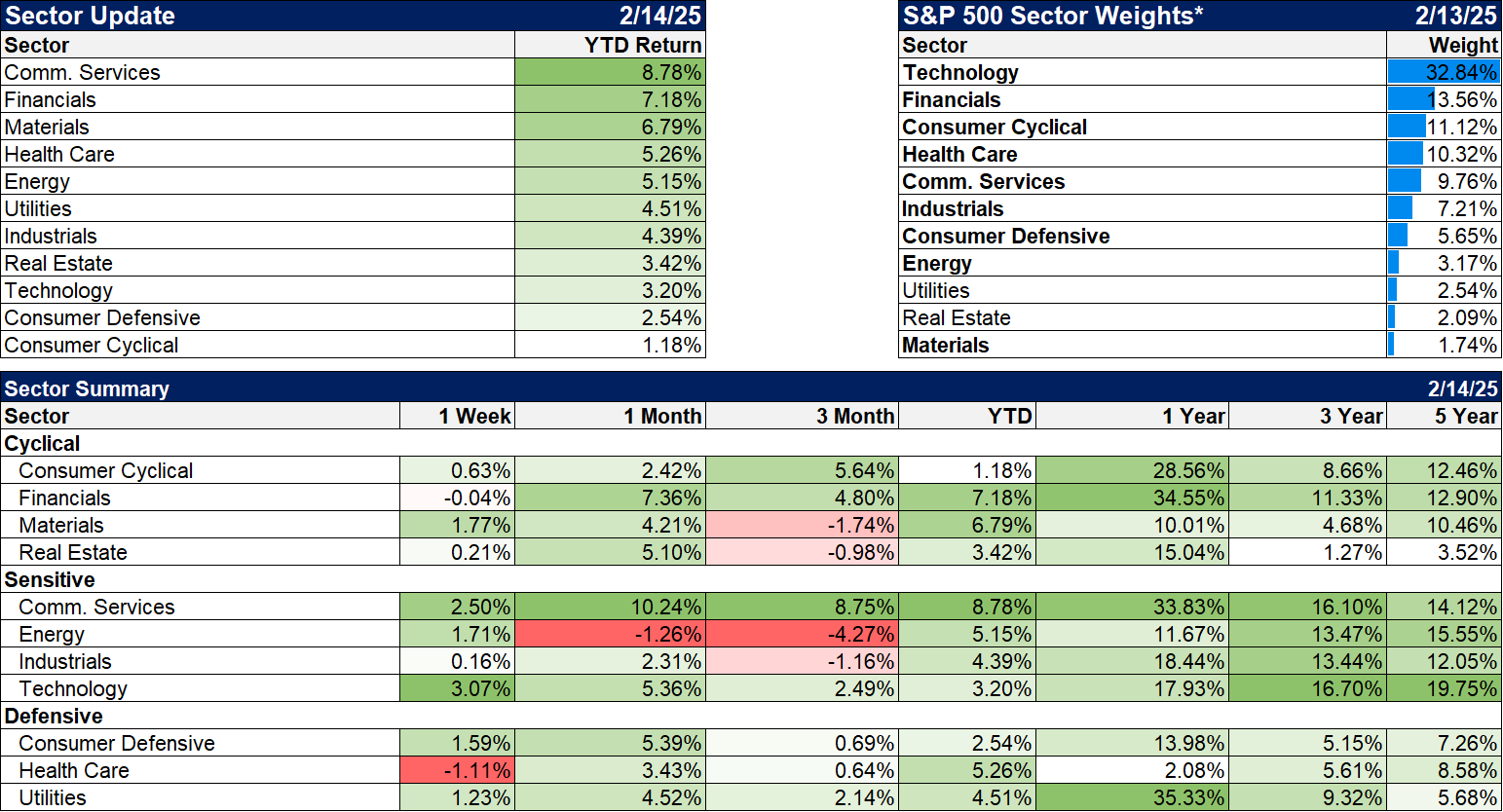

Sectors

Last week saw a continued broadening out of the rally with only 2 of 11 sectors down. Communication services continues to lead YTD, but some laggard sectors have been playing catch up this year. Materials and healthcare have both lagged over the last 3 years but are off to a good start this year. REITs are also doing better but have a long way to go and will likely require lower rates to get there.

Economy/Market Indicators

Credit spreads are falling again. Narrow spreads offer little protection against recession when low rated credits will have problems. The time to buy low-rated bonds is during recession when no one wants them. That certainly isn’t now.

Economy/Economic Data

Highlights:

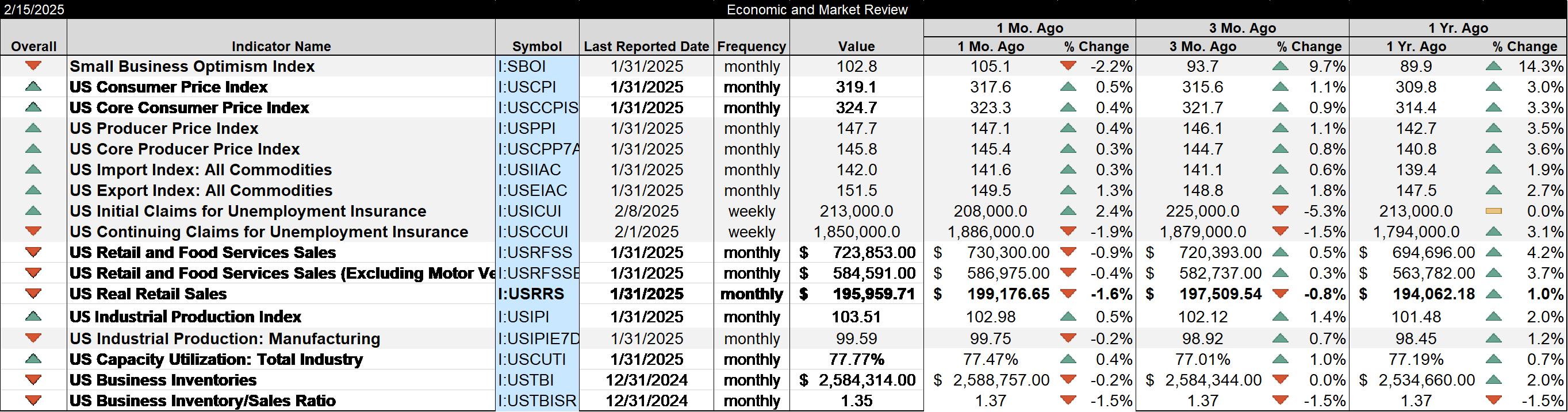

- NFIB small business survey fell but is still above the long term average. The uncertainty index rose to the third highest level ever.

- Consumer and producer prices were both up more than expected in January and the trend of the last six months is worrisome. The dip we saw last year, to rates of change near the Fed’s target, has been fully reversed. Inflation is now running around 3%; that is still in the 2-4% range where stocks perform best but going in the wrong direction.

- Retail sales were a disappointment, down 0.9%. Ex-autos was a little better (-0.4%) but still worse than expected. Some of the drop can probably be blamed on weather but we won’t know that until we see this month’s number.

- Industrial production rose but the big gain was in utility output and no that wasn’t from data centers; it was frigging cold in January. Manufacturing output was actually down 0.1%.

Stay In Touch