Stocks have rebounded over the last three weeks from the initial shock of the “liberation day” tariffs announced on April 8th. The S&P 500 is now down just 2.5% since the close on the day of the announcement (they were announced after the market close). There have been some changes to the initial tariff levels but even the reduced levels seem like a big change from the status quo ante. 10% tariffs on the entire world plus the “fentanyl” tariffs on Canada and Mexico (25% for non-USMCA compliant goods and 10% on energy and potash) plus whatever the latest level is for China (145% but not for some things) plus 25% tariffs on all imported cars plus whatever else I’ve missed, adds up to a pretty steep cost to the global economy. Or at least it would be if all these tariffs stayed in place for any length of time.

I do not have a working crystal ball so I have no idea what will become of all these import taxes, the ones we’ve imposed on ourselves and the ones other countries have imposed on themselves in retaliation. I don’t know how many trade deals the Trump administration can negotiate and sign in the next 2 1/2 months. I don’t know if the new deals will be better than the old deals we had in place before that Rose Garden ceremony. We had free trade agreements with 20 countries before President Trump decided to tear them up: Australia, Bahrain, Canada, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Israel, Jordan, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Singapore and South Korea. I do not know all the details of those agreements but I find it hard to believe that all those countries were cheating on their trade deals with us. It seems to me that President Trump could make some pretty positive headlines next week by merely announcing that we will abide by our previous free trade agreements.

Could we end up with better trade deals after all this? Could we see a free trade deal with India or Japan or the EU? What about China? Our relationship with China is strained by more than just the recent round of tariffs which amount to an embargo in all but name. We have restricted China’s access to high end chips thinking that would prevent them from gaining a technological edge but the emergence of Deep Seek would seem to indicate the effort has been for naught. Did our restrictions actually accelerate China’s technological development? Maybe. If so, do the restrictions still make sense? Can we get China to focus more on domestic demand to relieve the pressure on the US and the rest of the world from their flood of exports?

The tension between the US and China does seem to have lessened in recent days with President Trump approving some exceptions and China (quietly) doing the same for some US products. I wonder too what the actual tariffs are on Mexico and Canada if they only apply to non-USMCA goods. How much of the trade between the three countries fits that category? Can we reach an agreement with the EU if the Trump administration continues to mischaracterize their VAT as a non-tariff barrier to trade? Will negotiations between the US and the EU include any talks about Greenland?

Given all these questions – known unknowns – and all the ones I haven’t asked here – unknown unknowns – do you really think you can predict the future course of the global economy? The stock market? Interest rates? I can’t imagine anyone answering those questions in the affirmative. Even in the best of times, it is hard to predict the market or economy a year in advance; I’d say it’s impossible because of those unknown unknowns – black swans do exist. And these are not, by any stretch of the imagination, the best of times. The uncertainty about future economic policy is off the charts and the geopolitical situation is far from comforting.

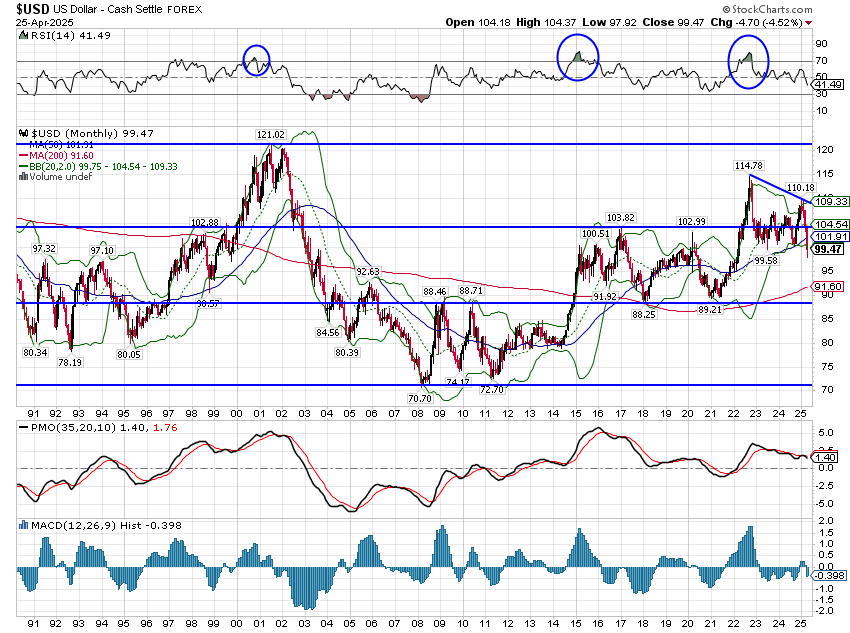

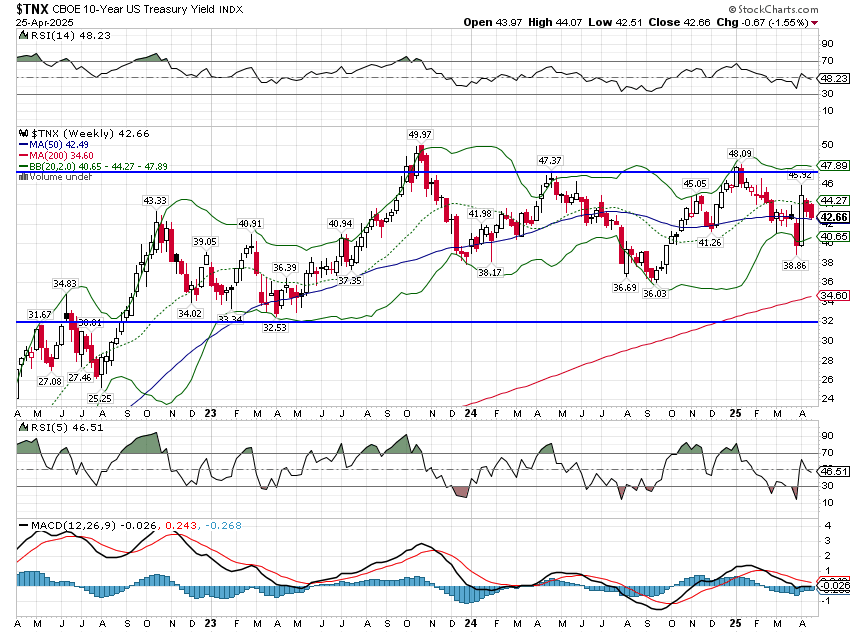

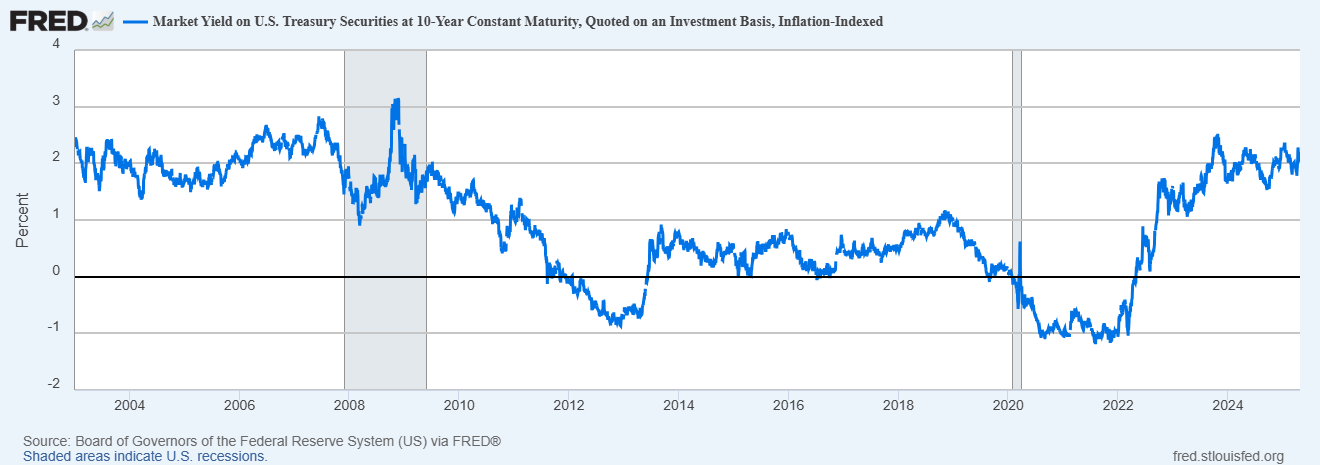

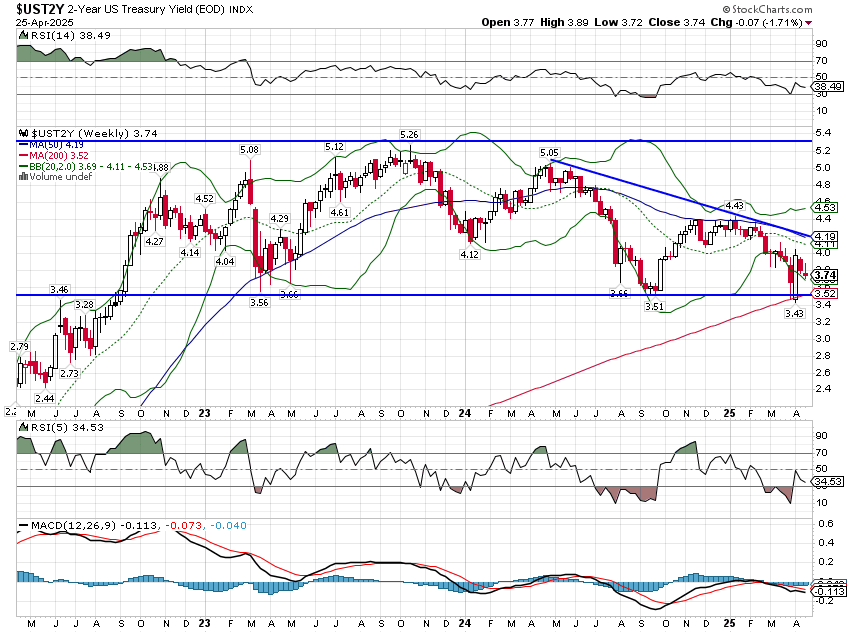

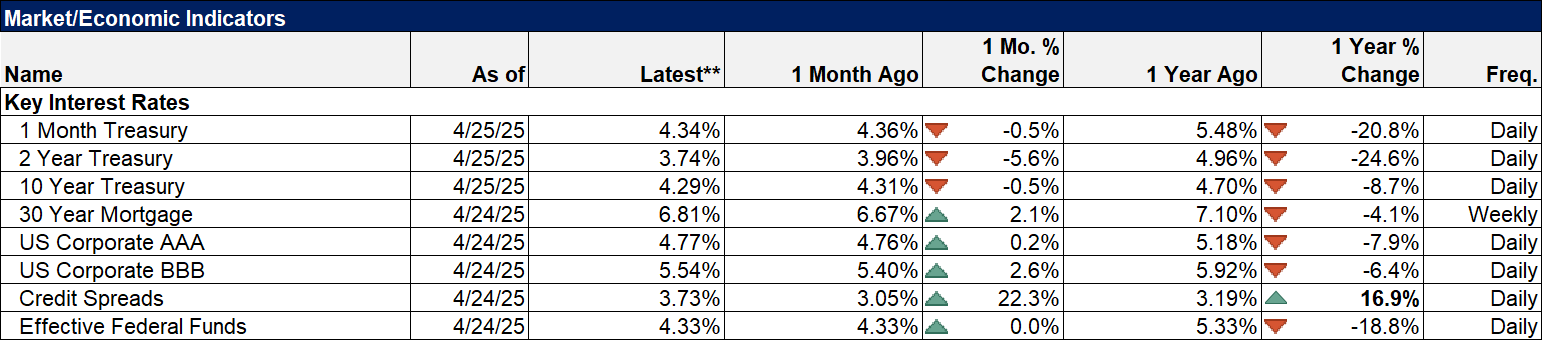

So, what do we do? We look to markets to capture the wisdom of the crowd and right now, believe it or not, there hasn’t been much change in the market based outlook. The 10-year Treasury note yield is essentially unchanged since election day. The 2-year yield is down about 50 basis points but essentially unchanged since late September of last year. 10-year TIPS yields are also unchanged since election day and have barely moved since September of 2023. Stocks are down about 4% (S&P 500) since election day but that small a move tells us almost nothing. Yes, there has been some volatility recently and the S&P 500 did trade down 20% – intraday – from its recent high, but that’s normal too; corrections like this happen about every 18 months or so.

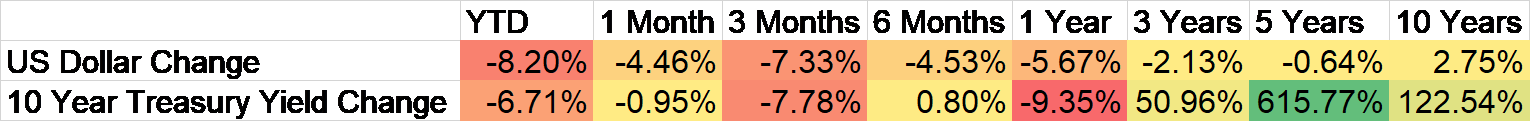

The one variable we watch closely that has changed and may hold some significance is the value of the dollar but even that is a pretty modest move since the election, with the dollar index down about 4%. I do think it may hold more significance though because that small move down represents a 5-year low. The dollar has been strong for a long time and a change in trend would be significant.

The changes in the markets since the election don’t warrant a change in your investment stance, at least not yet. If the dollar really is changing its trend to down, there will be some big tactical moves to make in coming months such as increasing your non-US equity exposure. Trend changes in major currencies don’t happen very often; trends are usually measured in years, not months or weeks. In my career, which now stretches to over 30 years, there have been three major changes in the dollar trend:

- The bull market that ran from 1995 to 2002

- The bear market that ran from 2002 to 2008

- The bull market that started in 2011 and appears to be ending now

Each of those periods produced unique winners and losers.

- The dollar bull markets pulled capital into the US and raised asset valuations to extremes. The dot com boom of the late 90s and the tech/AI boom of today may not be the same but they aren’t that different either. The dollar bull periods also generally produced low inflation and relatively high growth. US stocks outperformed international stocks in both periods but the more recent one has been more extreme. Commodities and other hard assets generally performed poorly although gold has performed well in recent years even with a strong dollar.

- The dollar bear market saw non-US stocks outperform by a wide margin and reduced US asset valuations. Hard assets (gold, commodities and real estate) outperformed and inflation was more of a worry.

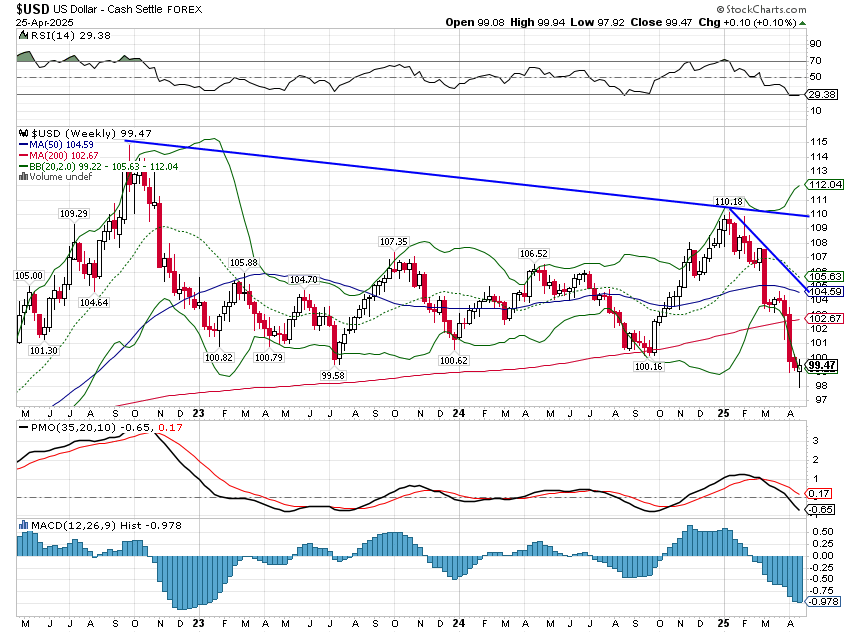

If we are indeed entering a weak dollar period, it won’t be exactly like the one we had in the first part of this century, but it will likely be very similar. I don’t think we’re quite at the point yet where a big tactical shift is warranted but we are getting close. The dollar has been in a two-year topping process which is almost exactly what it took the last time it topped. The index hit 119 in October of 2000, 121 in July of 2001 and 120.5 in January of 2002 before finally succumbing to gravity. Over the next 6 years, it fell 41% before hitting bottom in March of 2008 at 70.7. Will it fall that far this time? If it does it will have a big impact on the global economy that likely lasts for years; you don’t need to rush but changes like this only happen a few times in your investing career. You can’t afford to miss it.

Environment

After trading briefly under 98, the US dollar index rebounded and managed to close positive on the week by 0.1%. Considering the rebound in stocks, that is a pretty feeble response for the buck and I think demonstrates how negative the sentiment is for US assets. It does not appear that foreigners were participating in the US stock rebound. My guess – and that’s all it is – is that they were using the rebound as an opportunity to further reduce their US exposure. Whatever the truth the downtrend in the dollar remains intact but a further rebound should be expected and would not change that picture. A rally up to the 103-104 area would be normal and wouldn’t change a thing. If you are considering a swap to more non-US equity exposure, that would likely provide a good entry point (or exit point depending on your point of view).

The longer-term view of the dollar provides us with a potential guide to where the dollar is ultimately headed. The dollar has traded in a range since the early 90s with three distinct zones. The upper zones and the lower zones are generally where bad things happen so falling back into the middle zone isn’t necessarily a bad thing. But it does have obvious consequences for asset returns that are very different than the environment we’ve lived in for the last 11 years or so when the dollar entered its latest strong period. In the period from 2002 to mid-2008 – when the dollar hit its low for the last downtrend cycle – gold rose 232% while the GSCI commodity index rose 274%. That period also saw big outperformance by foreign stocks with the EAFE index up 107% to its high in late 2007 vs just 35% for the S&P 500. Emerging market stocks rose 267% during the same time frame. European stocks rose 145%, energy stocks rose 250% while tech stocks were flat. Materials stocks rose 124% while US consumer discretionary stocks rose only 3%. The Euro rose from 85 to 160 versus the dollar. Will that happen again? Probably not in exactly that way but if the dollar falls that far again, it will likely be similar.

Given all the turmoil of the new administration and its grand plan to reorder the global trading system, it is quite amazing that things have been so stable. The 10-year Treasury yield is down modestly since the beginning of the year and remains firmly in the range it’s been in since late 2022. As incredible as it sounds, the outlook for economic growth hasn’t actually changed all that much. Of course, that could change rapidly but at least for now things are pretty stable:

10-year TIPS yields have also been stable so there hasn’t been a big change in the market based expectations for inflation and that means real growth expectations haven’t changed much either. The real 10-year yield is well above what prevailed during the weak growth period that started in 2010 and back to where it was prior to the financial crisis of 2008. Again, that could change quickly but it hasn’t yet.

On the other hand, the 2-year Treasury note yield is in a short-term downtrend which reflects expectations for Fed rate cuts later in the year. That could mean the market is anticipating some near-term economic weakness but even if that’s what it is, it isn’t a large markdown.

Markets

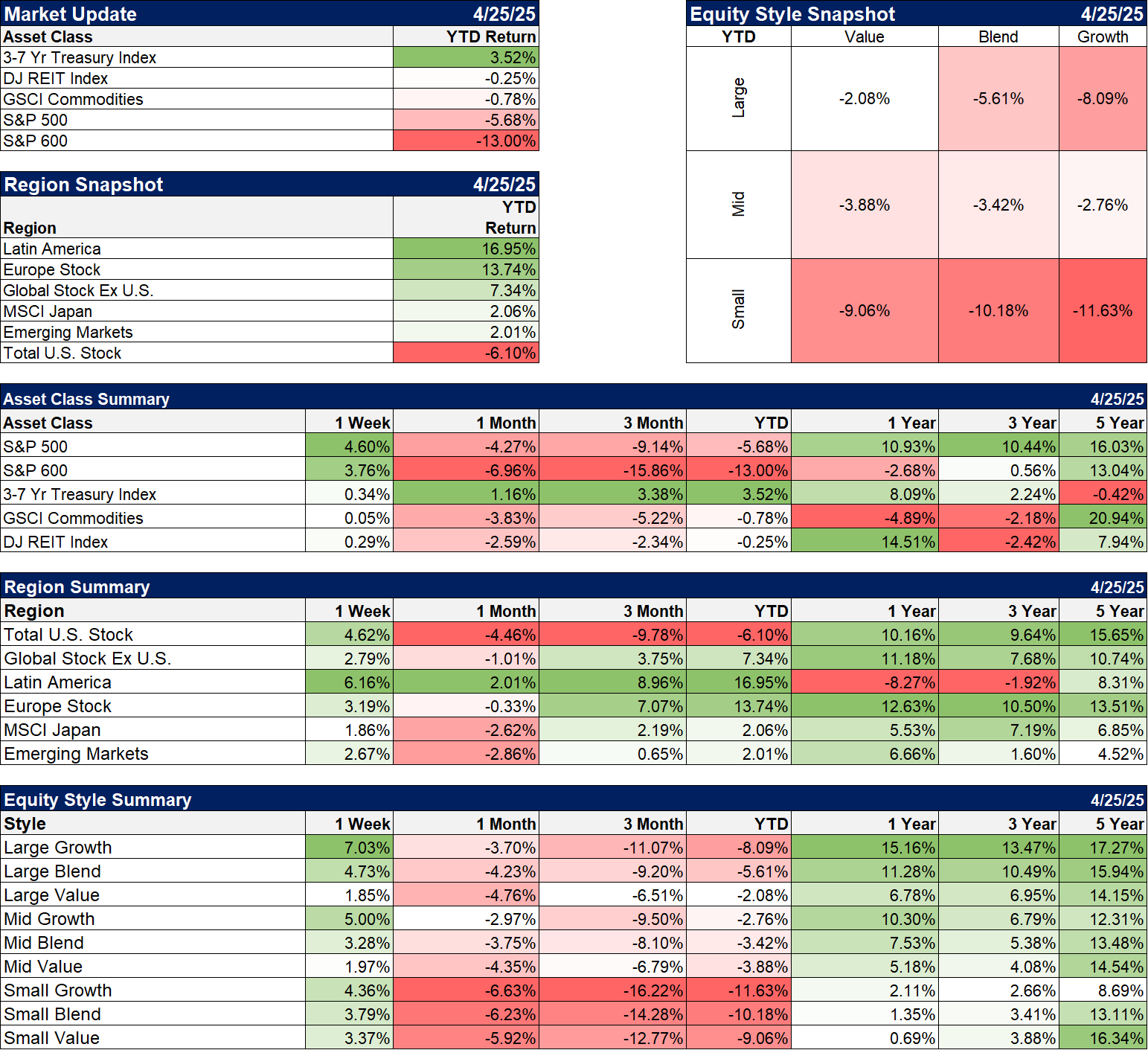

US stocks did rebound last week but it was, in some ways, a disappointing bounce. It was mostly a rebound in technology-oriented stocks and some cyclicals, both of which remain down over 10% YTD.

Growth stocks had a great week but still lag value stocks YTD. Small cap stocks continued to lag.

Foreign stocks also had a good week with Latin America up more than the US and Europe only lagging by a little. Those are the best performing regions YTD as well.

Sector

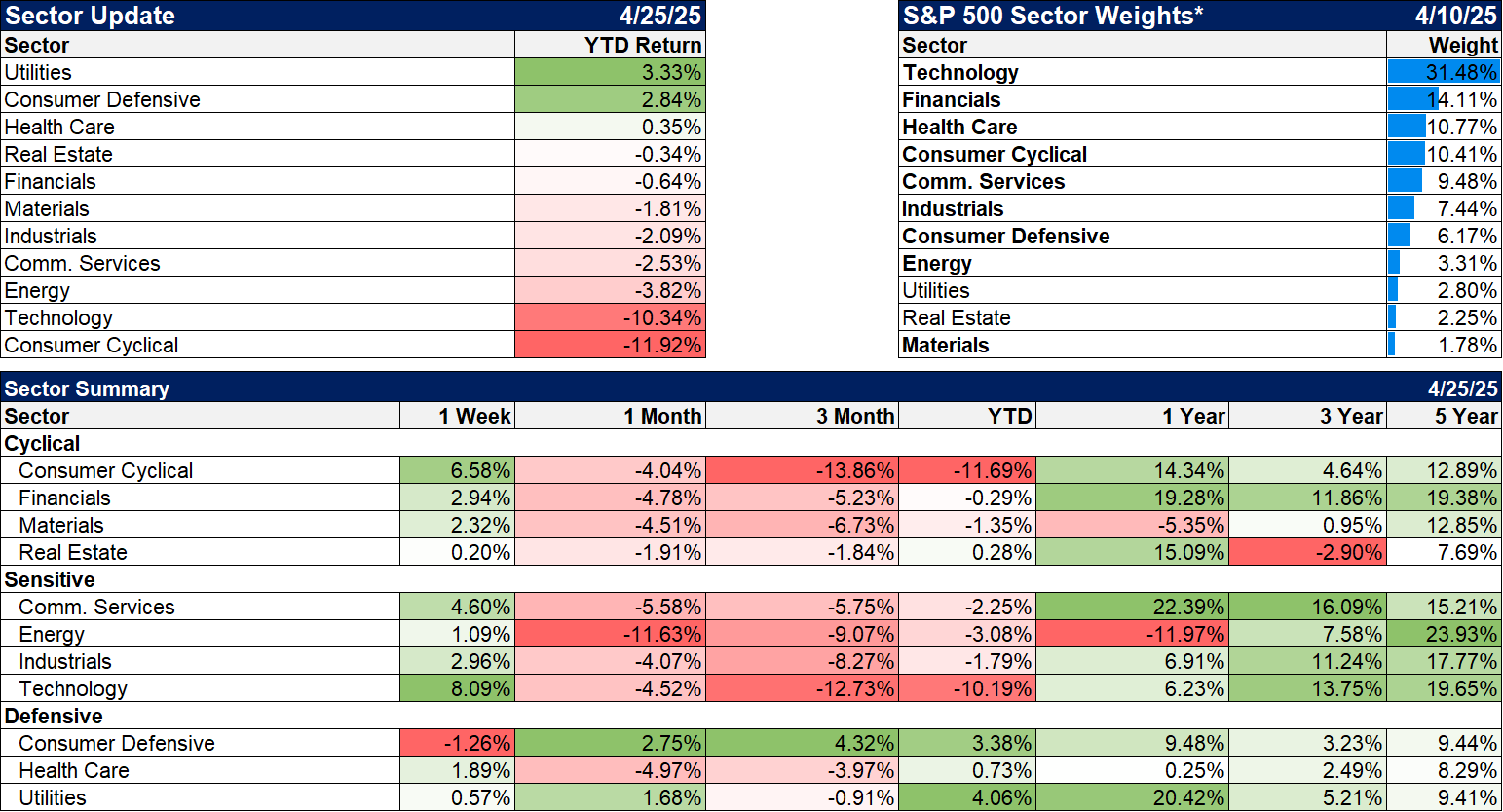

Defensive sectors continue to lead YTD although the lead over most sectors other than tech and cyclicals is fairly modest. The market may be anticipating some kind of slowdown but if so, it isn’t much.

Economy/Market Indicators

Credit spreads have narrowed over the last week and are now back under 4%. Spreads are still in a short-term uptrend though and so we remain cautious.

Economy/Economic Data

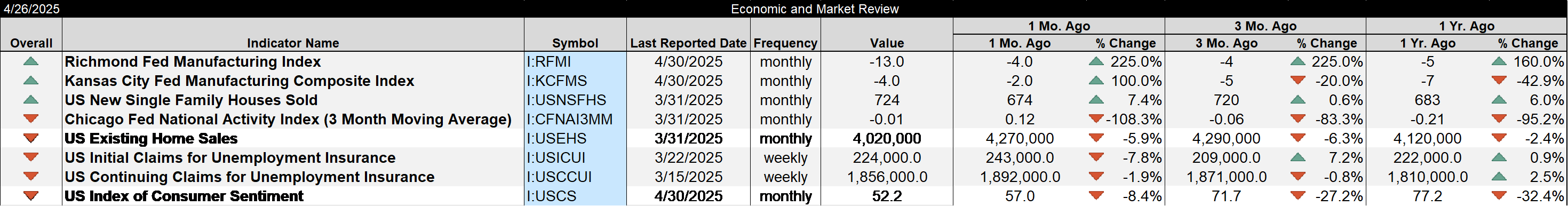

There wasn’t much in the way of data last week but it was fairly weak and distorted by the tariff chaos. Regional Fed surveys are weakening as are the S&P Global PMIs (not shown), but that is after a strengthening in the period after the election as companies ordered ahead of the anticipated tariffs. Housing remains weak but that hasn’t really changed that much from the last couple of years. Unemployment claims remain remarkably low. Consumer sentiment is in the toilet with most Americans unhappy with President Trump’s handling of the economy (among plenty of other things). Past low readings for consumer sentiment have been good buying opportunities in stocks though so don’t let it get you down too much.

Stay In Touch