“Our freedom of choice in a competitive society rests on the fact that, if one person refuses to satisfy our wishes, we can turn to another. But if we face a monopolist we are at his absolute mercy. And an authority directing the whole economic system of the country would be the most powerful monopolist conceivable…it would have complete power to decide what we are to be given and on what terms. It would not only decide what commodities and services were to be available and in what quantities; it would be able to direct their distributions between persons to any degree it liked.”

― Friedrich August von Hayek, The Road to Serfdom

After weeks of negotiating, the Trump administration announced a trade deal with the UK last week. Well, not exactly a deal but the outlines of a deal. Well, okay, not so much an outline as a sketch, a few points of agreement on agriculture, a deal to buy some Boeing jets and an agreement to keep negotiating a slew of other details. Oh, and my wife’s mild addiction to Branston Pickle is going to cost 10% more. In other words, it was an update on the negotiations that have been ongoing since the first Trump administration and the 10% tariffs Trump imposed on April 2nd didn’t change anything of substance although it might produce a rounding error’s worth of revenue for the US government. What we really found out is that the 10% tariff level is likely a floor, although countries that have a trade surplus with the US can probably expect a higher number. During the campaign, President Trump promised 60% tariffs on China and 10% tariffs on the rest of the world and that may be where we’re headed. Why didn’t he just do that and forgo all this drama? That question answers itself.

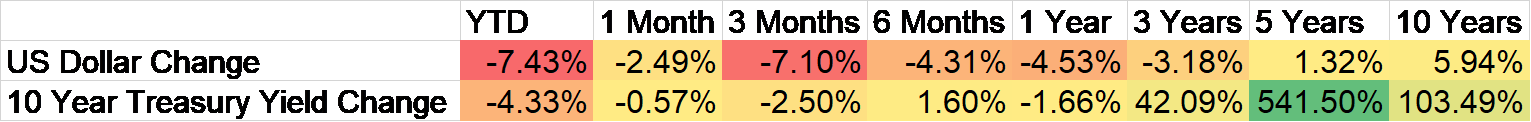

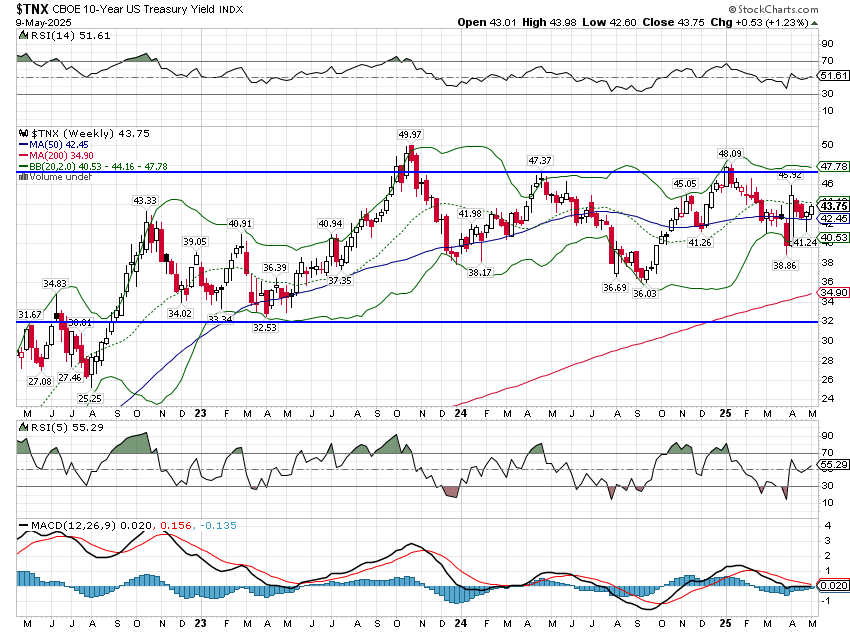

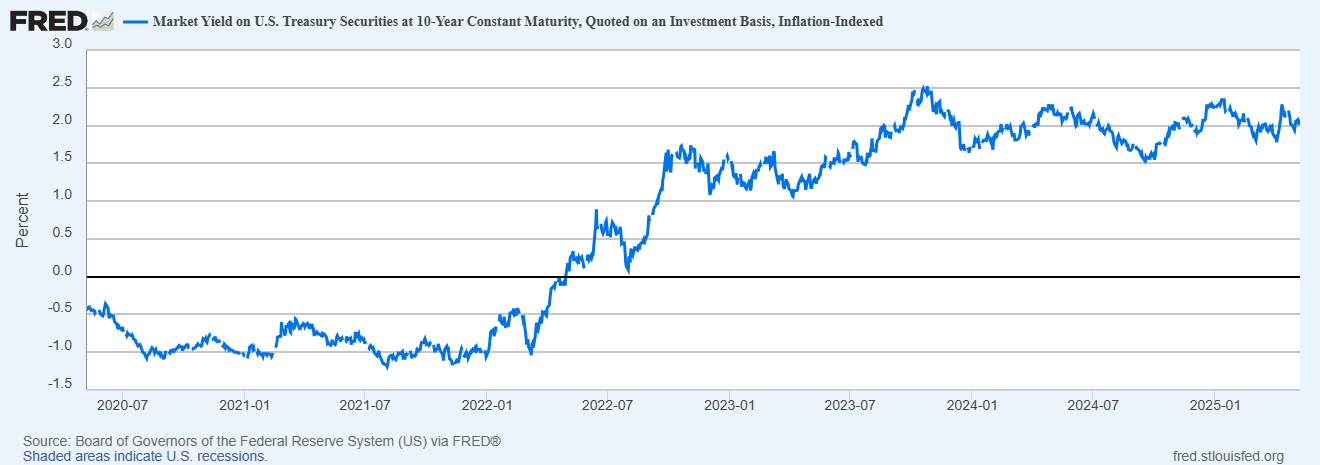

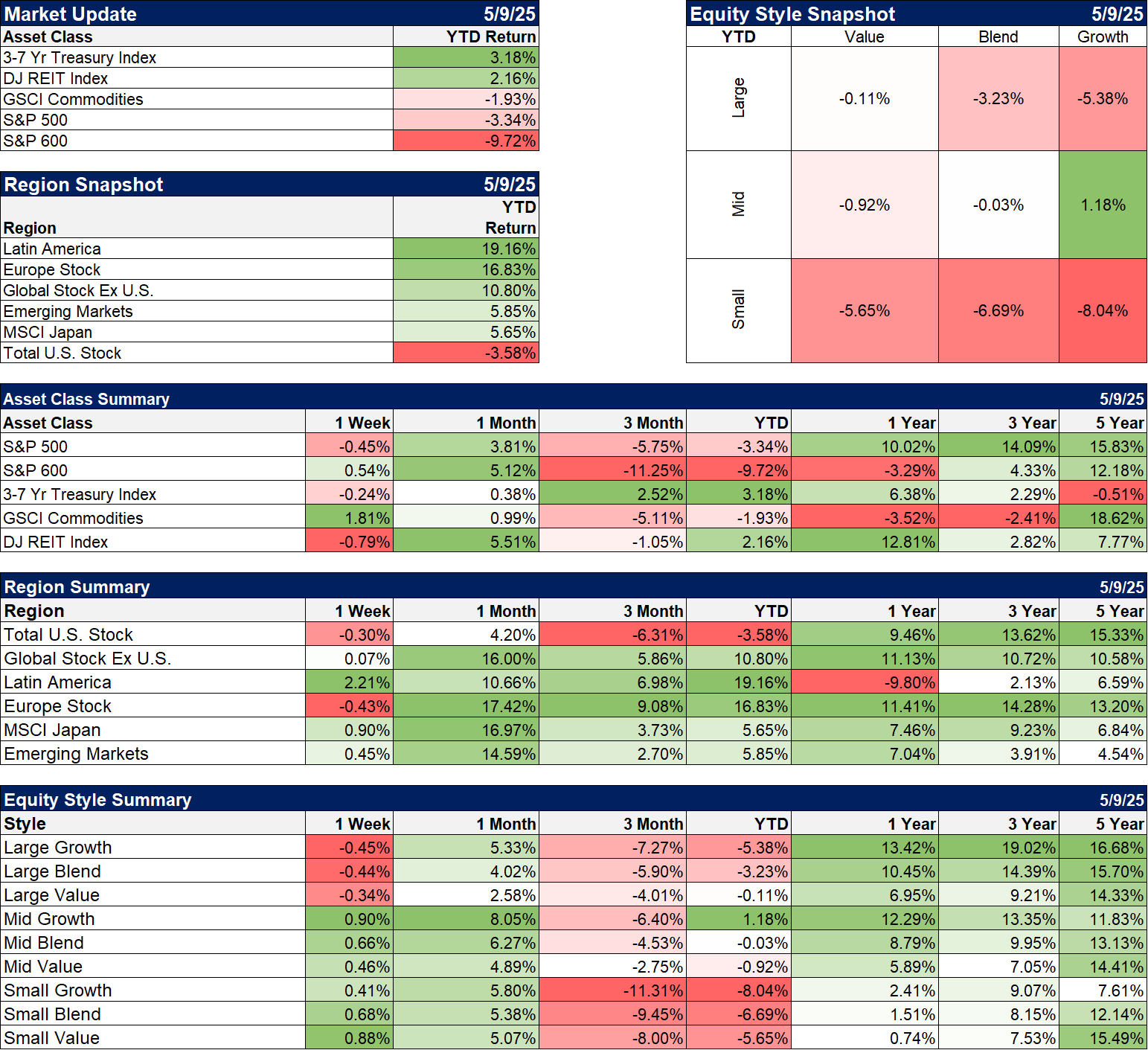

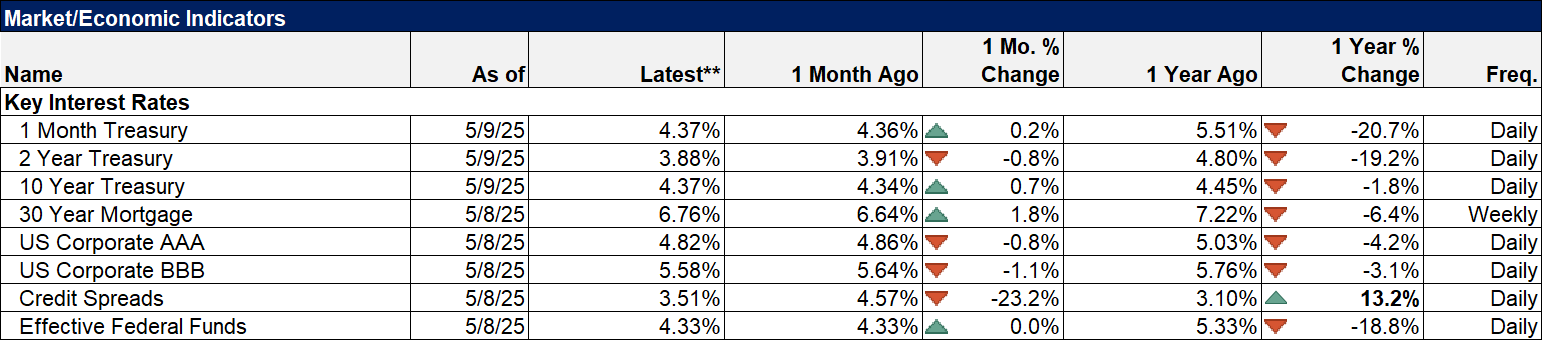

Maybe all this is just noise anyway. That’s what the market seems to be saying with essentially no change in the market-based economic indicators I watch. Despite all this drama and bluster about the US getting ripped off by other countries in trade, interest rates, nominal and real, are essentially unchanged since before the election. The 10-year Treasury yield closed at 4.29% on November 5th and today it stands at 4.37%. The 10-year TIPS yield closed at 1.99% on election day and today stands at 2.08%. 10-year inflation breakevens stood at 2.27% on election day and are 2.29% today. Credit spreads, a measure of stress in the corporate bond market, have widened modestly but are no higher today than they were last September. The S&P 500 is down 0.33%, small and midcap stocks are down about 5% and the NASDAQ is up 0.71%. I don’t know how anyone could gain much insight from such small movements.

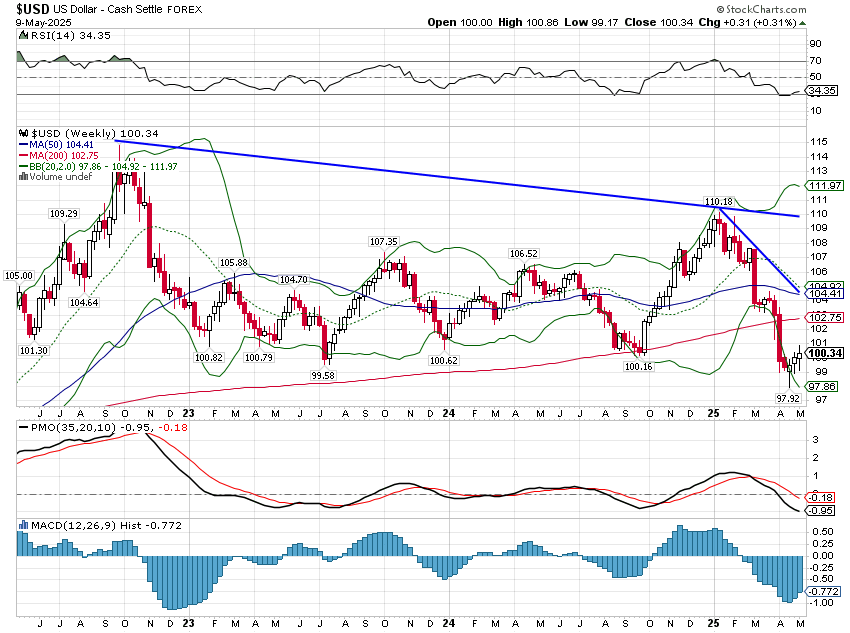

The dollar has gotten a lot of attention – even from me – because it has fallen 8.4% from its high on January 10th, but if you measure from election day it is only down 3.4%, which isn’t meaningless but not all that dramatic either. The drop in the dollar is, in my opinion, mostly about rising growth expectations outside the US, particularly in Europe. Changes in the dollar are driven by changes in relative growth expectations between the US and the rest of the world and since US growth expectations haven’t changed (see above), the drop must be from a shift in foreign growth expectations. If anything I think we can credit President Trump for that as he has forced Europe to take more responsibility for its own defense. I can’t say I’m thrilled with how it was accomplished but Germany and the EU are now promising to spend a couple trillion Euros on defense and infrastructure over the next five years. Fiscal profligacy has its limits but it does impact the private sector, with deficits feeding almost directly into the corporate bottom line. And, as a whole, the EU debt situation is a lot better than the US so they have room for fiscal expansion.

We also haven’t seen any significant impact on US corporate earnings yet. Q1 earnings have been much better than expected, up 13.4% year-over-year according to Factset, up from the 7.1% estimate at the end of the quarter. Margins are up to 12.4% from 12.04% in Q4 24 and the highest since the record set in 2021. The percentage of companies offering negative guidance for future earnings, at 55%, is less than the 5-year and 10-year average. Of course, there are a lot of companies that aren’t offering guidance at all due to uncertainty around future tariff rates so that could change during the quarter as more trade progress is announced. Earnings estimates for 2025 are down just 2% since the end of Q1 and the 2026 estimate is down 2.1%. Again, maybe all this changes in the coming weeks and months but for now, the turmoil of the tariff rollout isn’t having much effect.

Having said all that, I don’t think we can get complacent about the economy or corporate earnings. There’s a lot that isn’t known yet and everyone is so focused on the short term I don’t think anyone has started to factor in the long-term consequences of this new economic environment. What are the investment and growth implications of a weak dollar? What are the consequences of the President setting tariff rates based on how he feels today? Just last Friday he posted on social media that “80% tariff on China seems right!” before the onset of negotiations with the Middle Kingdom. Is President Trump’s gut going to set prices for everything we import to the US? When the CEO of Mattel last week said they might move some of their toy production out of China but not back to the US, President Trump threatened them saying:

Okay, let Mattel go, we’ll put a 100 percent tariff on his toys, and he won’t sell one toy in the United States, and that’s their biggest market.

Are toys a national security emergency? If they aren’t – and I don’t see how they possibly could be – from where does President Trump derive the authority to “put a tariff on his toys” and prevent Mattel from selling “one toy” in the United States? Do we really want one man deciding how companies and entire industries are going to operate? Are we really going to allow the President to decide what we can buy and from whom? When he eased some of the auto tariffs a couple of weeks ago, he said at a rally later that day that he gave the auto companies “a little bit of a break”:

We gave them a little time before we slaughter them if they don’t do this. They took in parts from all over the world. I don’t want that. I want them to make their parts here.

How is it positive for the US economy to “slaughter” US auto companies? Is this how we’re going to run the economy now? One person deciding for every industry how they should manufacture their products, where they should get parts and raw materials? Is there no such thing as comparative advantage when it comes to the US economy? Does the President really think we have the capacity to make everything ourselves? President Trump and his economic team are apparently going to try and negotiate with every country on the planet and determine the right level of tariffs for each country and the products it exports. Does anyone really think the President’s economic advisors can accumulate enough knowledge about the global economy to set import prices for every product at the “right” level? What if they set the tariff too high and we end up with shortages? President Trump already told little girls they don’t need more than a few dolls and a couple of pencils. Is he now going to tell us how many cars or boats or pairs of shoes we can have for our money?

There are legitimate reasons for the government to be involved in the functioning of the economy. There are certainly critical products and materials that fall under the umbrella of national security that require a secure supply chain. And in some cases that may mean using tariffs in a selective way to encourage their production, although there are certainly less intrusive ways to accomplish the same thing. But it certainly does not apply to every country and product in the world. It is also true that government needs to provide a set of rules within which economic actors are allowed to operate. Even Adam Smith knew that left to their own devices, business people would collude to maximize their profits at everyone else’s expense. But there needs to be limits on government actors as well. Power, as the saying goes, corrupts and absolute power corrupts absolutely.

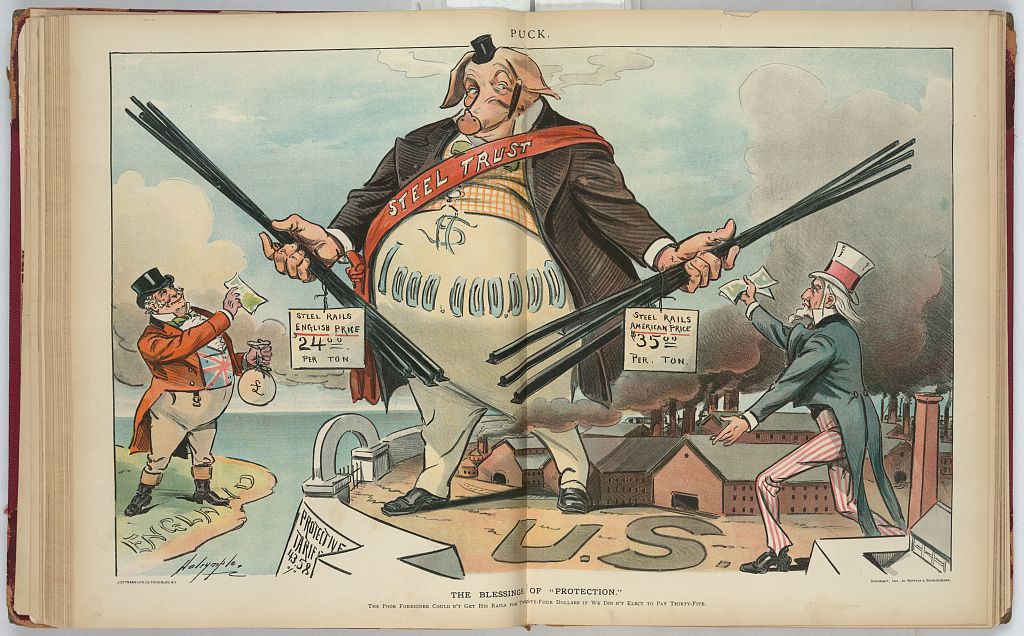

These first three months of the new Trump administration have had me thinking a lot about Friedrich Hayek’s The Road to Serfdom. In that book Hayek warns of “the danger of tyranny that inevitably results from government control of economic decision making”. He was, of course, speaking about socialism but it is hard to differentiate what is going on today from what Hayek called central economic planning. The President may mean well but he and his team cannot ever have sufficient knowledge to direct the entire economy. That’s why socialism doesn’t work. Each government intervention in the economy leads to another. A tariff over here means bailing out farmers over there or steel consumers over there. Unintended consequences are the norm, not the exception.

What are the long-term consequences of consolidating power over the economy in Washington, D.C.? We know the answer to that question. We’ve answered that question before in this country, multiple times. We know the effect tariffs have on the economy and the country because we’ve done this before. There is no reason to do it again so we can learn the same lessons we learned in the past. What we need from D.C. today is humility. A very large dose of humility.

The Blessings of “Protection”

Economic Environment

The dollar remains in a short-term downtrend but appears to be setting up for a countertrend rally. First resistance is around 102.5 and further resistance comes in at about 104 but so far the rebound attempt has been pretty feeble. Sentiment is pretty negative though with seemingly everyone suddenly bearish on the buck so a further rebound should be expected. Most of the real action in currencies isn’t in the majors anyway but in the smaller Asian currencies like the Taiwan dollar, Korean Won, and Singapore dollar, all up significantly against the US dollar over the last month. I think that suggests that currencies will be part of any trade negotiations and these countries are trying to get ahead of the curve. It hasn’t had much impact on the dollar index yet but it just adds to the negative tone.

I’ve seen several analysts say recently that the drop in the dollar, the recovery in US stocks, and the stability of US interest rates are not compatible, that some of these markets must be wrong. These analysts are assuming that the drop in the dollar is due to reduced growth expectations for the US economy while stocks and bonds point to continued growth at about the same rate as before the election. That could be but the dollar is an indication of the relative change in growth expectations between the US and the countries that make up the dollar index. It could be that the dollar has dropped because expectations for growth outside the US, say in Europe, have improved. Or it could be that the dollar is right and stocks and bonds are wrong. We won’t really know until some point in the future when it becomes obvious. Never reason from a price change or make assumptions about why a market has moved the way it has.

It is true though that US growth expectations, as measured by interest rates, haven’t changed much. The 10-year Treasury yield is up 8 basis points since the election and the 10-year TIPS yield is up 9. Inflation expectations have changed by all of 1 basis point. The market seems to be saying that the tariffs won’t have much, if any, impact on US economic growth or inflation. Does that mean tariffs will be much lower than feared? Or that the tariffs won’t be effective, that they’ll be evaded? Or maybe that 10% tariffs, which seems to be where we’re headed, just aren’t that disruptive? I don’t know what investors are thinking but the conclusion, right now, is pretty obvious. That could change rapidly as we get more information on tariff negotiations but right now, the economic impact of Trump is basically zero.

Markets

A very mixed week for markets with large cap stocks down a little and small/mid cap stocks up a little. Non-US stocks were up a tiny fraction as a whole but Latin America continues to outperform. For the year, diversified, multi-asset class portfolios are up a bit while the standard 60/40 stock/bond portfolio is down a bit over 1%. Hard to believe after all the volatility we’ve seen this year but US markets have basically gone nowhere. Global portfolios have done better with non-US stocks outperforming but the US takes up a large part of the global index so it isn’t a huge difference. If the dollar does indeed rally some here, that might provide an opportunity for investors to add more international exposure.

Sectors

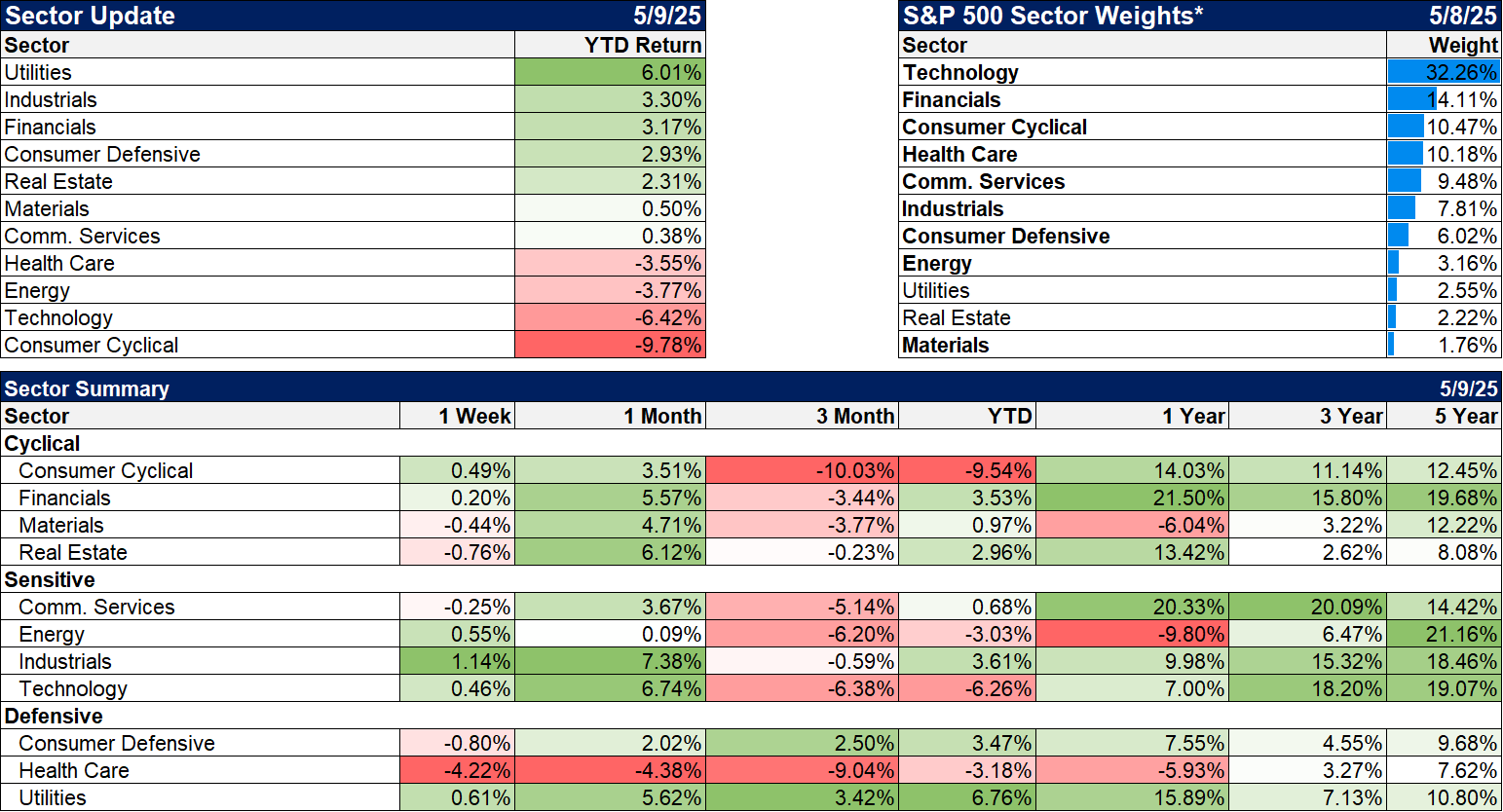

Healthcare was a big loser last week, a victim of dual threats from the government. The Trump administration has apparently been talking to Congress about capping drug prices for Medicaid (effectively) and the industry awaits details on tariffs. There are certainly better, less disruptive ways to get more pharm manufacturing in the US but this administration wields only sticks.

Economy/Market Indicators

Credit spreads continue to narrow after the recent spike. But while stocks have fully recovered, spreads have not, gaining back about half the widening seen after “liberation” day.

Economy/Economic Data

Tariffs continued to distort trade patterns in March but that isn’t exactly news. China reported April data that showed a big drop in US trade but a surge into Southeast Asia. If the data is accurate it may just be showing the transshipment of goods via countries with lower tariffs.

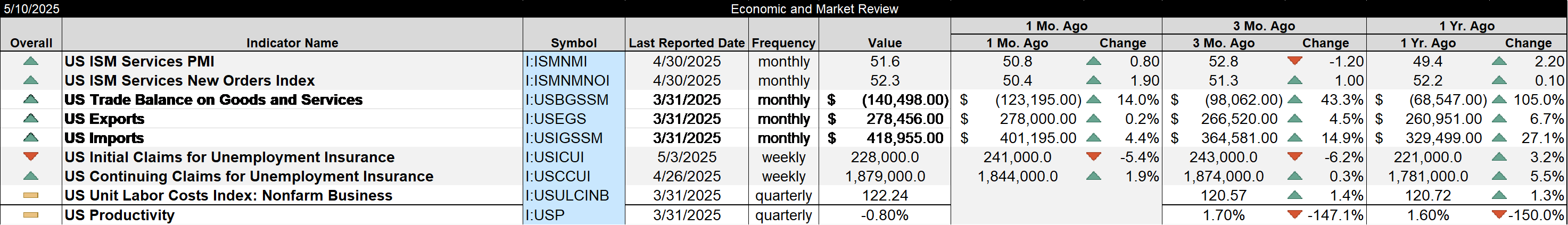

The ISM services index improved in April and from a year ago, continuing to show consumer resilience. Jobless claims fall back from the 241k jump last week; the labor market is so far undisturbed by what is going on.

Stay In Touch