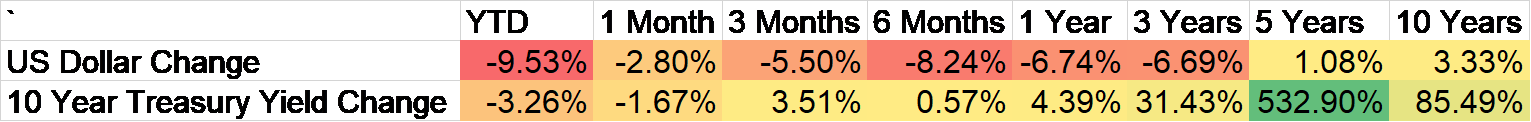

Oil jumped 7.5% last Friday in the wake of the Israeli attack on Iran but the reaction in most other markets was surprisingly muted. The dollar, which normally catches a bid in these situations, was up just 0.27% and US Treasuries actually sold off on the news. Gold was the preferred safe haven this time, up 1.4% on the week. Year-to-date gold is up 30.8% and it isn’t even the best performing precious metal. That would be platinum, up 35.2% on the year although gold is up nearly 50% in the last year. Silver has also gotten into the act this year, up 25.7%. The dollar, on the other hand, is down 9.5% YTD and 6.7% over the last year and even geopolitical turmoil couldn’t change that trend.

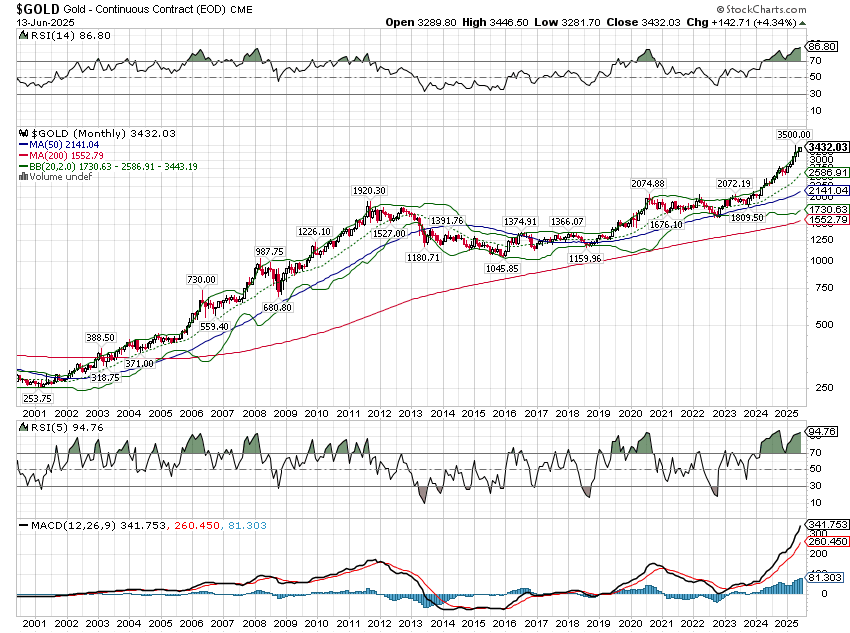

The rise in the price of gold isn’t new, of course. Gold has been in a long bull market that traces back to 2001 as the dot com boom was starting to unwind and the dollar was in the process of peaking after its big 1990s run. From $255 in early 2001, gold ran up in a near straight line – pausing only for the 2008 financial crisis – until peaking in the fall of 2011 at $1920. After a five-year bear market that cut the price in half, gold continued its climb, from $1045 right at the beginning of 2016 to Friday’s close at $3432 with nearly 60% of that move coming in just the last 18 months.

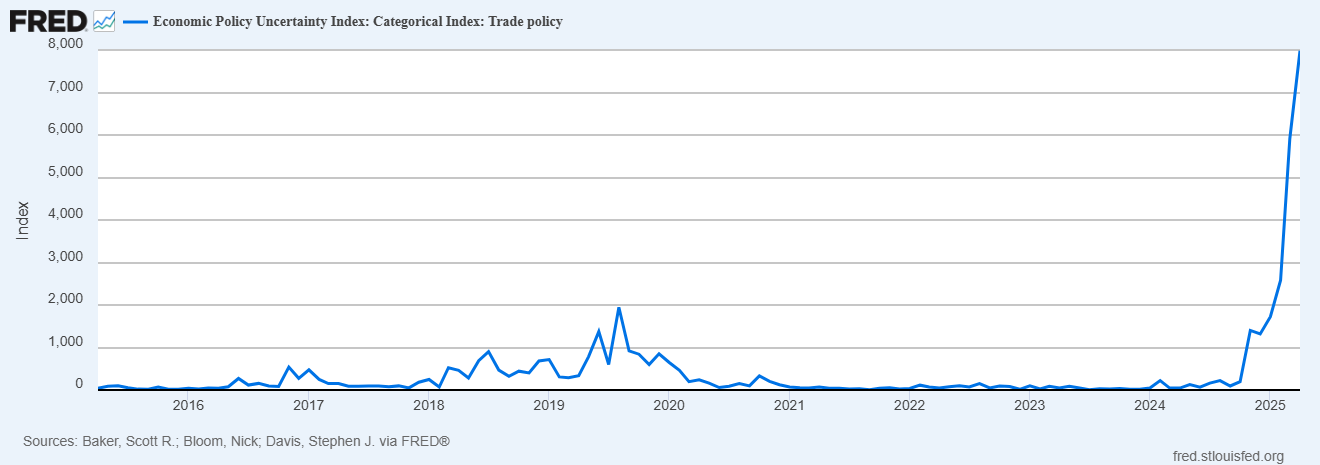

What’s driving the rise in the price of precious metals? In short, gold prices are driven by uncertainty, which of course has not been in short supply of late. As I said above, more than half of the rise in gold since 2016 has come in just the last 18 months during which political uncertainty rose to new heights. The election year generated a lot of uncertainty with Biden dropping out of the race last summer and Trump facing a plethora of attempts to keep him off the ballot. The election of Trump did not, however, relieve the uncertainty but rather amped it up to a new level. The President started talking about tariffs and a host of other provocative policies almost as soon as the polls closed and the votes were counted. Gold didn’t do much in November and December last year but it started to move higher as we rang in the New Year and it has barely looked back since. Economic policy uncertainty has been the main source of concern but the influence of geopolitical events is growing.

The uncertainty around tariffs appears to have had an impact on gold prices although correlation does not always imply causation. Gold is up since the beginning of the year but it also spiked the week of the “reciprocal” tariff announcement and is now up nearly 14% since that day in early April. The “deal” with China last week – which did nothing more than return things to the status quo ante from before the reciprocal tariff announcement – did nothing to relieve the uncertainty. Gold was up every day last week; the Israel/Iran fighting didn’t so much raise uncertainty as just confirm it continues unabated. At this point, I think most investors are just numb to all the changes in trade policy and assume that if something is resolved, it will quickly be replaced by some new threat from the Oval Office.

If you look at the price of gold from 2018 to today, a pretty clear pattern emerges. In his first term, President Trump concentrated on his tax cuts at the beginning, only moving to the tariff agenda later in 2018. For that first part of his term, gold did almost nothing, trading at about $1225 on election day (2016) and still trading there 2 years later in 2018, which is when he pivoted to trade. In January, he imposed tariffs on solar panels and washing machines. In March, he placed tariffs on steel and aluminum from various countries, extending it in June to cover the EU, Canada, and Mexico. He also set and then escalated tariffs on China in 2018. Throughout the year, other countries were laying their tariffs in response. Trump ended up paying farmers about $12 billion in subsidies after China aimed retaliatory tariffs at soybeans.

There was more turmoil in 2019 as steel and aluminum tariffs were lifted on Canada and Mexico in May but in June tariffs were threatened on all products from Mexico at 5%, increasing to 10% in July and another 5% every month for three months until Mexico stopped the flow of illegal immigrants to the US, the first time he added immigration as a condition of trade policy. Trade uncertainty hit an all-time high (data back to the early 1980s) in August of 2019.

At the beginning of 2018, when President Trump started to enact his trade agenda, gold was $1203 and by August 2019 it had risen to $1554, a rise of 29%. Coincidence? Well, the uncertainty surely isn’t since we know who drove the tariff agenda in Trump’s first term. That would be the same person driving it today – President Trump and creating uncertainty is his preferred negotiating tactic.

In this second term, Trump has tried to move his tariff and fiscal agenda at the same time but all that has done is increase the uncertainty relative to the first term (as you can see above). And what has gold done? It’s up from $2624 to $3432, a rise of 30.8% which nearly matches the rise during the tariff tinkering in his first term.

When Biden was elected in late 2020, gold was about $1775 and at the end of 2023 it was around $2000, a rise of about 13%. It started to rise in October of 2023 and has had only three minor down months since then. There was uncertainty during Biden’s term too but it did not rise to the level of Trump. And just to be clear, I’m not saying Biden was a better President, just that Trump adds a large dollop of uncertainty you didn’t have with Biden – or any other President in my lifetime. Markets can adjust to just about any policy but uncertainty means, essentially, no policy and that is hard for investors to ignore. It is the uncertainty that causes problems – and the rise in the price of gold.

Gold has also taken on more institutional importance over the last few years as central banks – China being the largest but not the only one – have been accumulating bullion. In fact, gold has overtaken the Euro as the second largest reserve asset behind the dollar, partially due to accumulation and partially from appreciation. Central banks now hold nearly as much gold as they did in the 1960s when the world was still on the Bretton Woods monetary system with the US dollar pegged to gold at $35/ounce. This accumulation was driven by uncertainty of a different kind. From January 2006 to January 2022, central bank gold purchases totaled less than 20 tonnes a month. By contrast, from February 2022 to January 2025, they bought over 80 tonnes a month. What changed in February of 2022?

Russia invaded Ukraine on February 24th, 2022 and the G-7, led by the US, froze $280 billion in Russian assets (most of which was in Euros in Brussels). There has been mounting fear that other countries would pull away from the dollar in the wake of the Russian seizure and while the dollar remains the world’s reserve currency, other countries are taking action to diversify their holdings. The common link between the Russian war and the trade wars is what always drives gold prices – uncertainty and the fear it engenders.

Gold has gotten so expensive that some traditional gold buyers are starting to turn to platinum as an alternative. China’s imports of platinum hit a 12-month high in April as demand rises for jewelry and investment. A client who recently visited India said he was bombarded by advertisements to buy platinum while there. Sentiment about precious metals is obviously buoyant and so the contrarian in me wonders if some of the issues causing uncertainty might be resolved, but I must admit I don’t see much prospect of that anytime soon. If I’m right about that, if Trump continues to be Trump, then this probably isn’t the time to sell all your precious metals. If you maintain a strategic allocation to gold, as we do, you might consider rebalancing though, since your allocation has likely grown relative to the rest of your portfolio.

So far the uncertainty around tariffs – and other policies – hasn’t much affected markets other than precious metals and the dollar, which are obviously related. Stocks are near their highs and interest rates remain well behaved showing little change in growth and inflation expectations. Gold – and the weak dollar right now – are both warning signs even if the rest of the market hasn’t gotten the memo yet. Investors who are parking their capital in an inert metal are more interested in preserving capital – and purchasing power – than investing in the future. A weak dollar is an indication that foreign investors may be rethinking their commitment to US assets. Neither of those developments is positive for long-term growth and the longer the uncertainty goes on the worse the damage. There seems to be a consensus developing that all this trade turmoil be all behind us by next year. I don’t buy it. Think of how much power is embedded in the authority to impose tariffs unilaterally, on anything you want (court rulings pending) and ask yourself: Can the President resist using that power? We all know the answer to that don’t we?

Diversify, diversify, diversify.

Environment

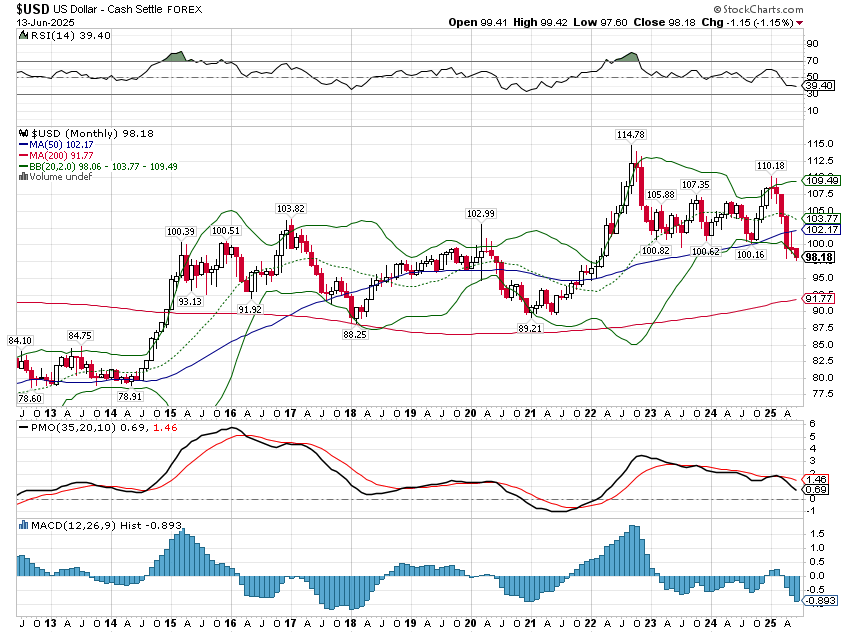

The dollar closed the week down 1% and only managed to rally by 0.25% on Friday after the Israeli attack on Iran. That is pretty feeble for the so-called safe haven currency. The buck also set a new intraday low for this short-term downtrend, falling to 97.60 at one point. That is just a little below the previous low of 97.92 set in April. That was also the lowest reading since March of 2022. The dollar is no higher today than it was in 2015 so I think we can do away with the idea that the dollar is in an uptrend, a bull market. I still don’t think you can call this anything more than a short-term downtrend though and one that is likely to see some upside fairly soon. The overwhelmingly bearish sentiment on the dollar seems unlikely to be right in the short term so as I said last week, expect a rally of some sort.

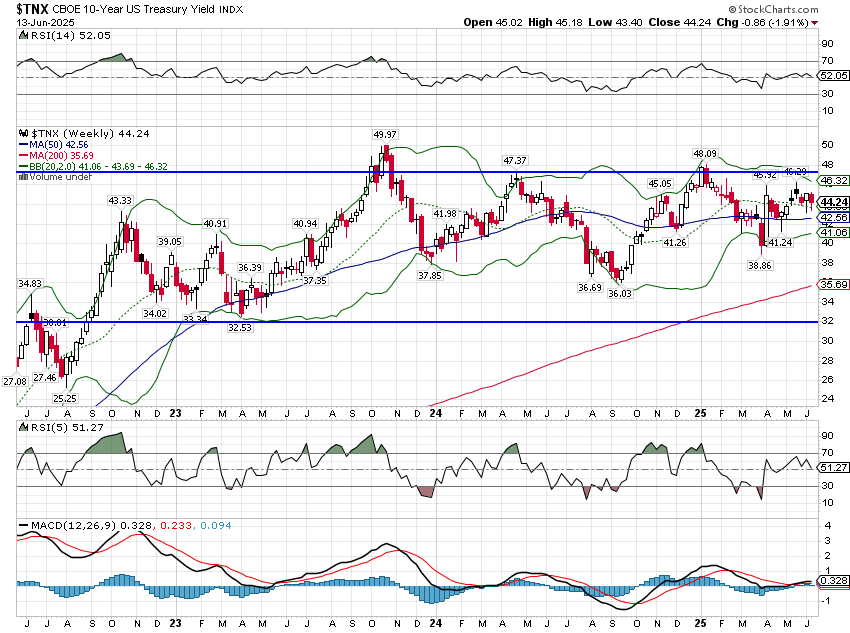

Bonds also didn’t do the expected thing Friday with rates rising about 7 basis points. Usually we expect to see bonds rally as a safe haven in these situations. The 10-year Treasury yield continues to trade near the top of its nearly 3-year range. There is nothing to be deduced from that except stability in the economic outlook.

Markets

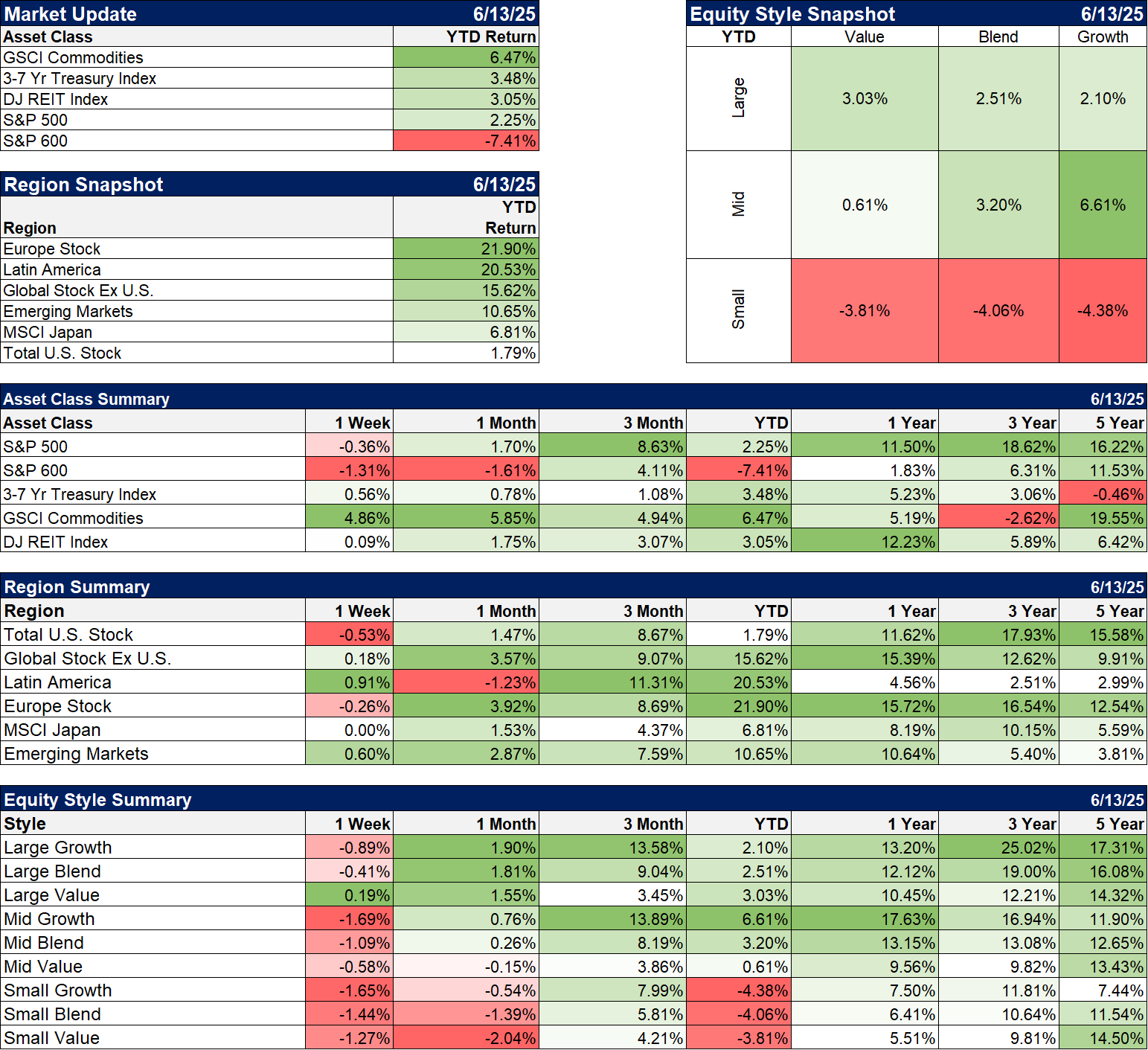

Commodities were the best performing asset class last week as crude oil rose by 13.3%, heating oil 11.8%, and gasoline 7.5%. Platinum had another good week, up 3.1%, but Palladium gave up some of the previous week’s gains, down 2.7% on the week.

Bonds and REITs also managed small gains for the week and Latin America was up nearly 1%. If commodities continue in their bull trend that should be positive for Latin Americans stocks as the region is heavily reliant on resources.

Large value also managed a small gain last week and is now leading growth YTD.

Small cap stocks are still down YTD despite the big rally off the April lows.

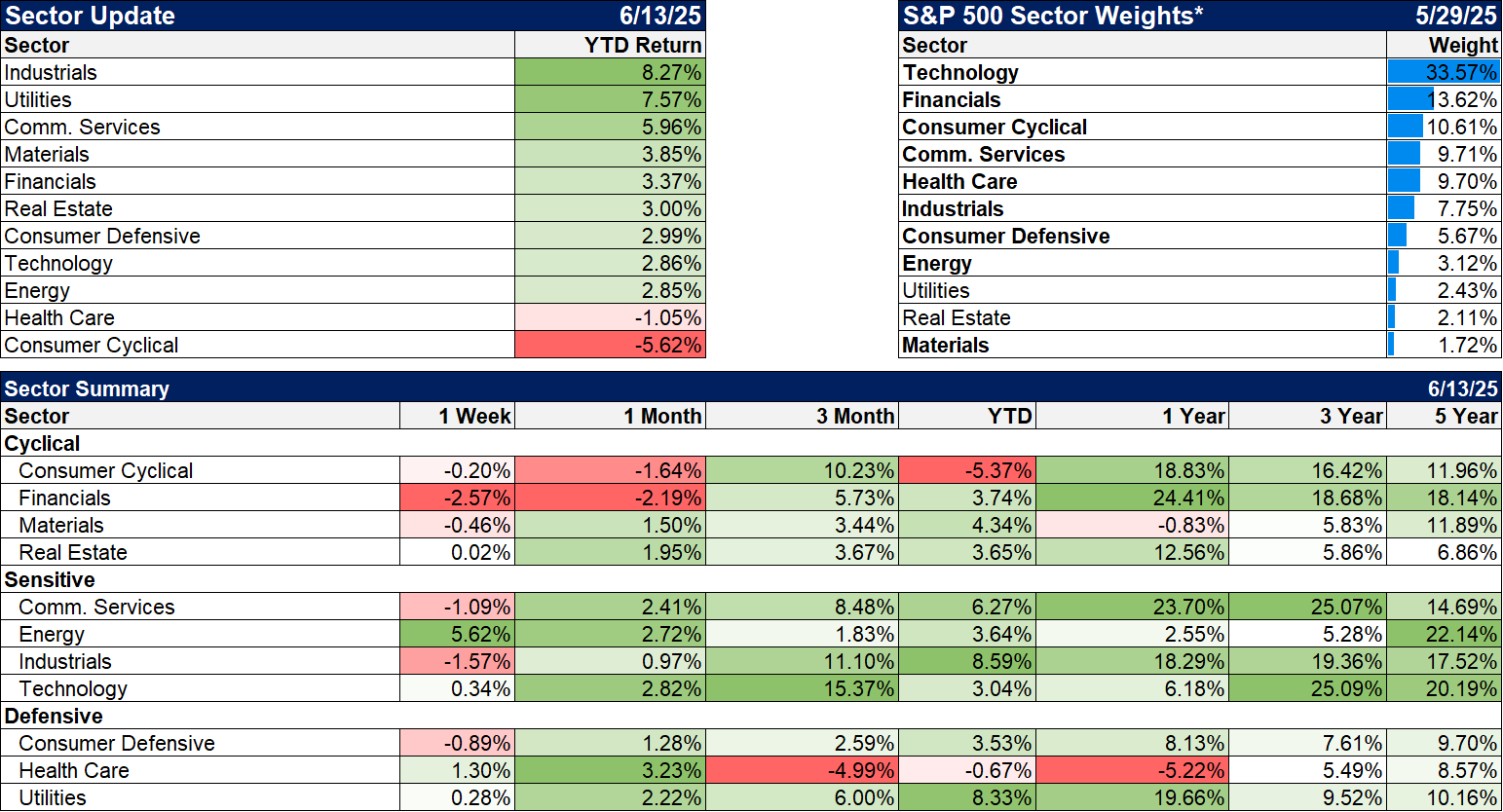

Sectors

Not surprisingly, the best performing sector last week was energy, up 5.6% on the back of higher crude prices. While I am positive on energy stocks, history shows that geopolitical events like this are usually short lived.

Healthcare, technology, real estate, and utilities also managed small gains last week.

Economy/Market Indicators

Economy/Economic Data

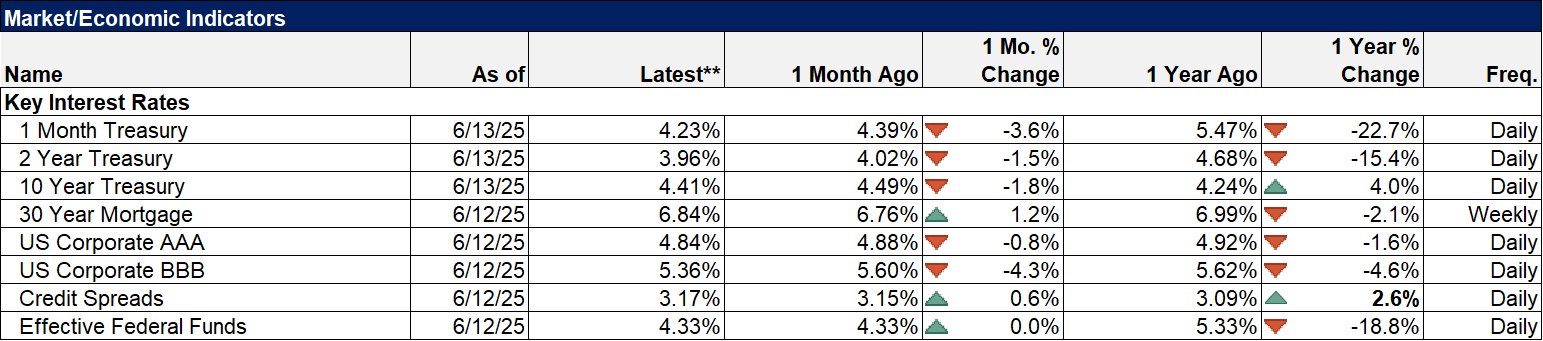

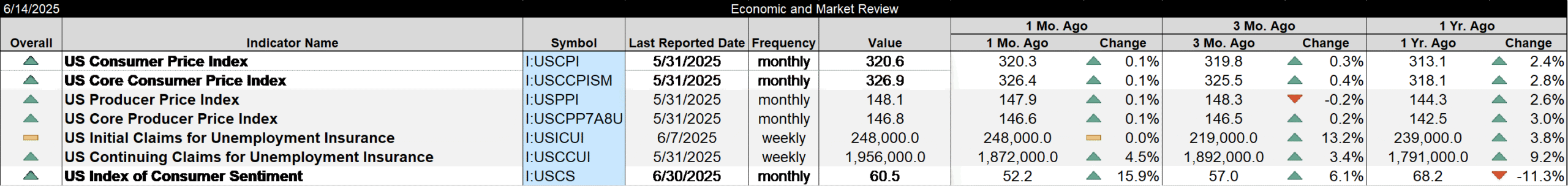

- Consumer prices rose less than expected in May, up 0.1% vs expectations for 0.2%. It was actually slightly less than that – 0.08086 – before rounding. Year over year change was 2.4%, nearing the Fed’s target of 2%.

- Core consumer prices also rose less than expected, up 0.1% vs expectations for 0.2%. This one was a little higher at 0.12989 before rounding. Year over year change was 2.8%.

- Producer prices, headline and core, both rose a less than expected 0.1% in May.

- Weekly jobless claims were unchanged from the previous week at 248k. The trend does seem to have turned up thought with claims up from 205k the first week of January.

- The U of Michigan consumer sentiment reading rose to 60.5 but that is still well below the long term average of 85. Readings this low are generally associated with recession but the all time low was in 2022 at 50 and we avoided recession then.

Stay In Touch