If, at the beginning of the year, anyone had predicted what actually happened in the first half of 2025, they would have been ridiculed and dismissed as delusional. If you were told that…

- Between January and April, the average US tariff rate will rise from 2.5% to 27%

- Among the Trump administration’s first moves on trade will be to impose tariffs on Mexico, Canada, and China over fentanyl trafficking and border control. The tariffs on Mexico and Canada will be higher (25%) than those on China (10%).

- The Trump administration will impose “reciprocal tariffs” so widespread they’ll include uninhabited islands, at rates not seen since the Great Depression, ranging from 10% (baseline) to 50% (Lesotho). Six countries will escape tariffs including Cuba, Belarus, North Korea, and Russia. Even countries running trade deficits with the US will face tariff barriers

- The reciprocal tariffs will last for exactly one week before being paused for 90 days to negotiate

- Tariffs on China will fluctuate wildly, rising to as high as 145% before settling back to 55%

- Steel and aluminum tariffs will be initially imposed at 25% but will double in June. The UK may or may not get an exception but no other country will

- Tariffs of 25% will be imposed on autos and auto parts

- President Trump will talk seriously about the US taking control of Greenland and the Panama Canal and making Canada a US state

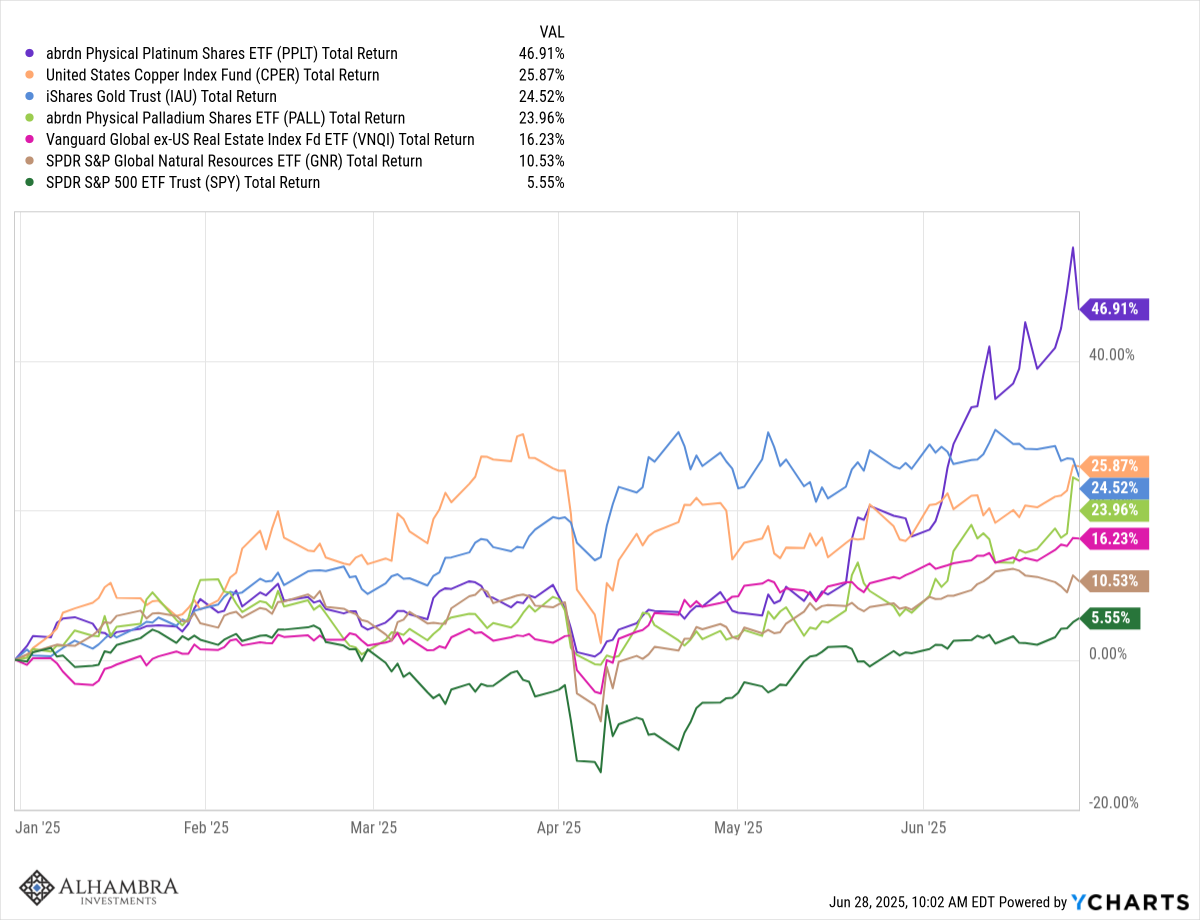

- Gold will rise nearly 25% but won’t be the best performing precious metal

- Israel and the US will bomb Iran

- The Ukraine/Russia war will continue unabated and Europe will make emergency plans to significantly raise defense spending to 5% of GDP

- The Trump administration will stop almost all immigration, threaten to deport all foreign students, strip birthright citizenship, and deport some undocumented immigrants to a prison in El Salvador

- The federal government will assume control of US Steel in a partnership with Nippon Steel

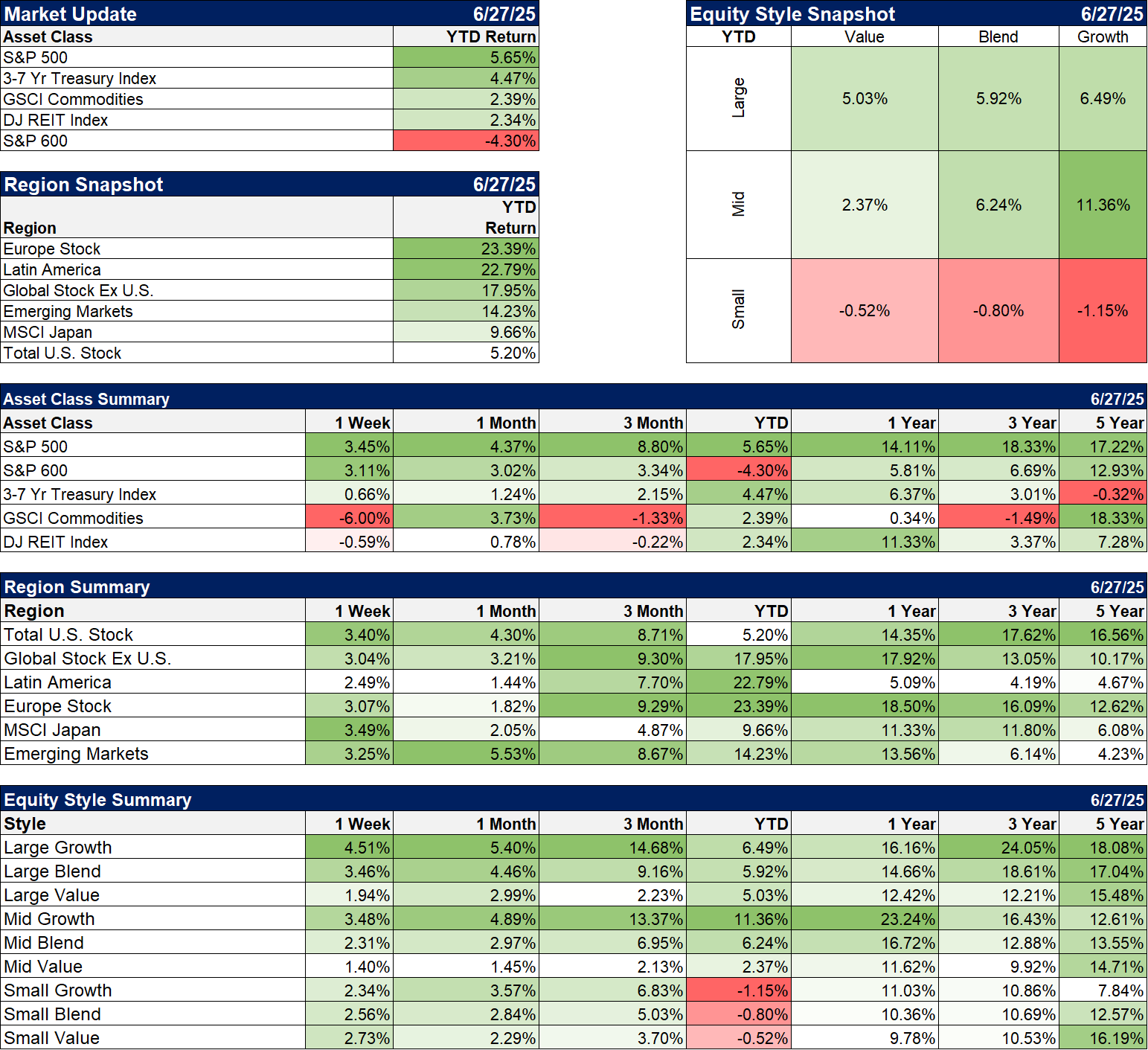

…would you conclude that despite all this the S&P 500 would end the quarter up over 5%? Would you expect non-US stock markets to outperform the US by a wide margin? And that the US dollar, despite widespread expectations of a rise due to tariffs, would instead fall over 10%? No, of course you wouldn’t. This is exactly why predictions, even if right, are useless. Even if you had known all that was to happen in the first half of 2025 you would have still likely gotten the market response wrong. I know I would have.

I am not as prone to the prediction racket as most of the investment world but I did say, before the election, that the worst possible outcome would be a one party sweep. That is so in every election because the victorious party takes it as a mandate to do “big things” which take time and a lot of campaign contributions. The result is massive uncertainty which makes it hard to do business. Well, we got a one party sweep and boy do we have uncertainty, so I guess I got that right. What good did it do me? Knowing uncertainty is coming doesn’t mean you know what form it will take or how it will affect the markets.

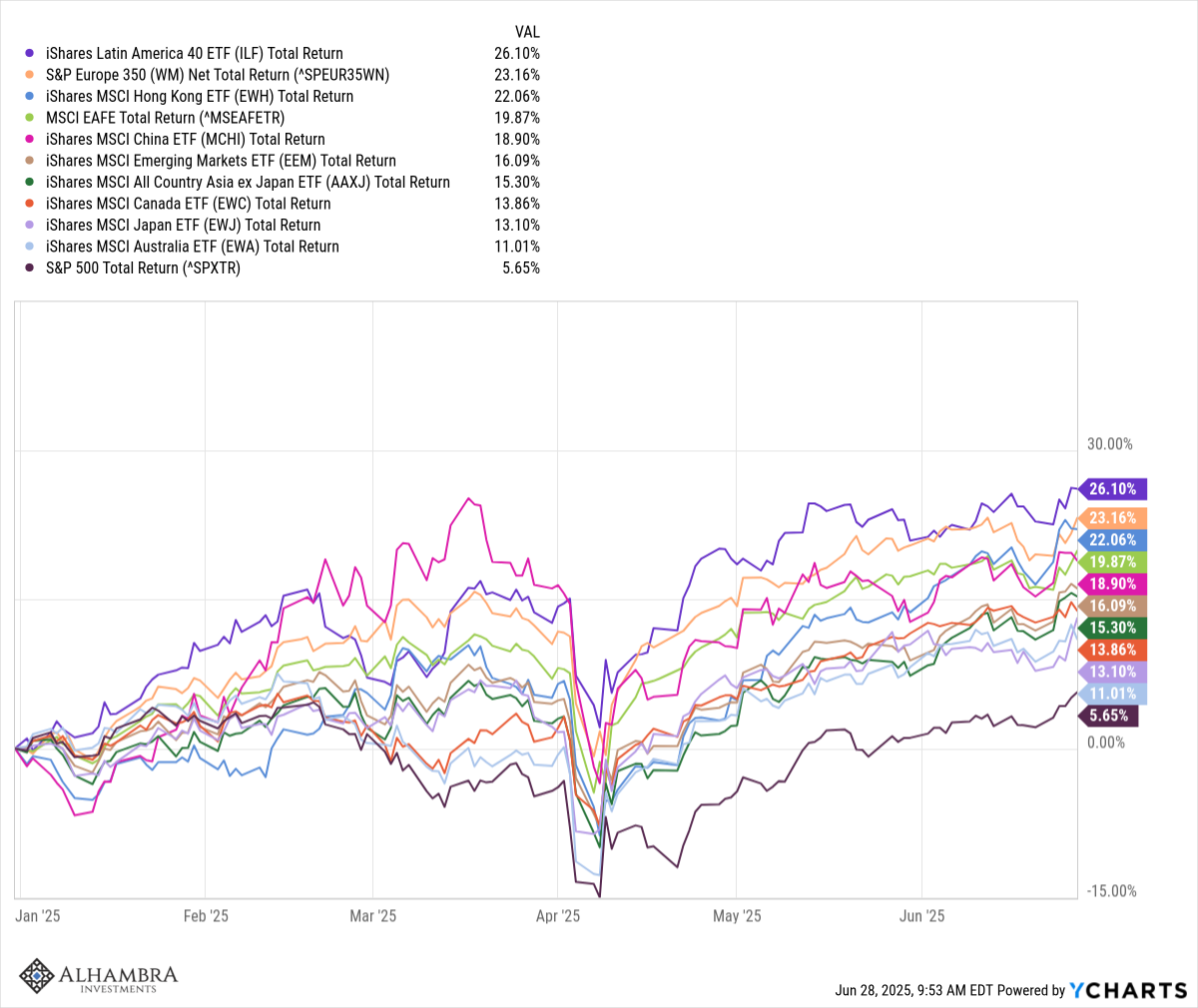

As I said, almost every stock market has outperformed the US this year. The chart below shows some of the major averages with Latin America leading the way, up about 26% vs 5.7% for the S&P 500.

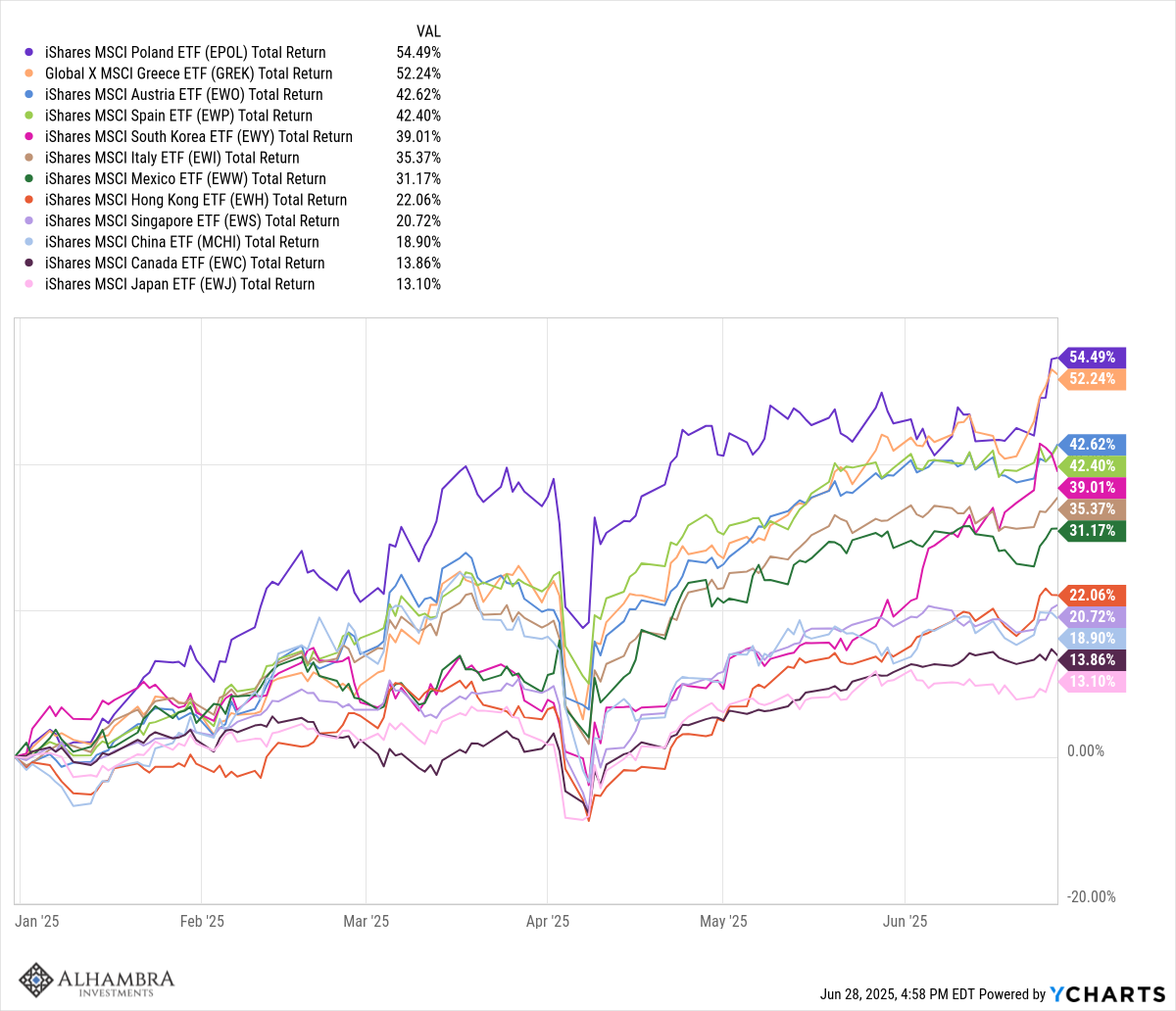

Within some of the indexes listed above, there were individual countries that rang up much bigger returns. In Europe, Poland, Austria, Greece, Spain, Sweden, and Italy all put up big numbers. In Asia, South Korea, Singapore, Japan, China, and Hong Kong all performed significantly better than the US. In Latin America it was Mexico, Colombia, Brazil, Chile, and Peru leading the way. Over the last 15 years or so, it has been detrimental to your returns to invest anywhere outside the US and even more specifically, outside US large cap growth stocks. This year, at least so far, that has been turned upside down; investing in the US was detrimental.

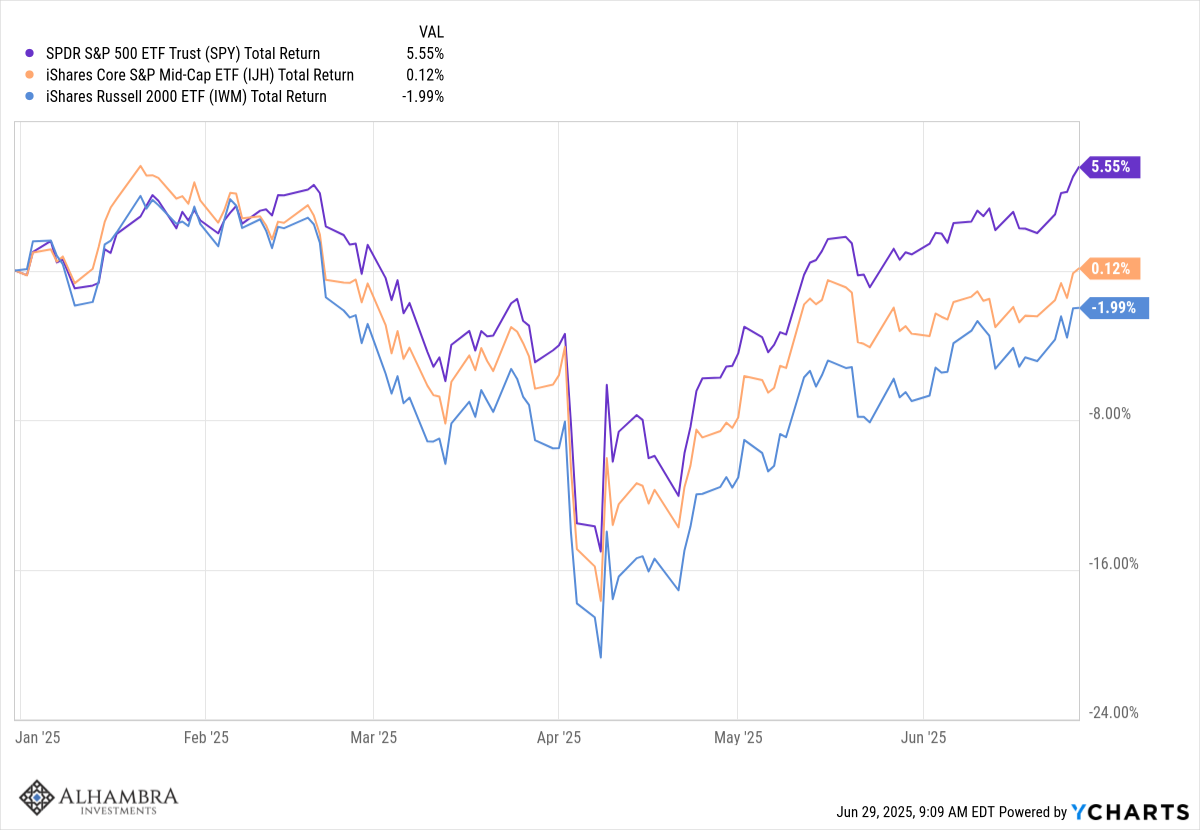

Size mattered in the first half of the year as small and midcap stocks lagged the S&P 500.

Note: Alhambra and/or its clients own shares of the midcap ETF, IJH.

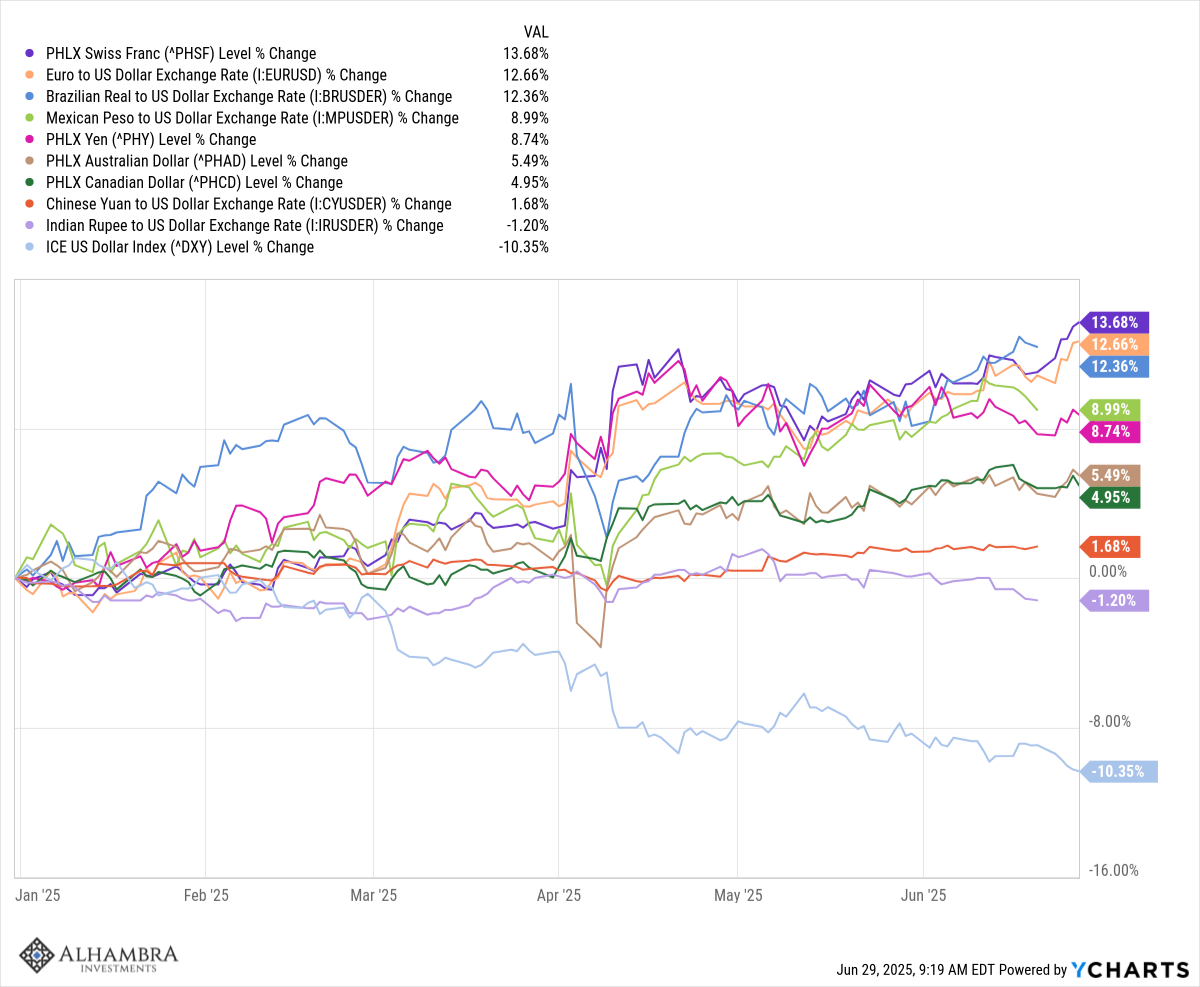

Some individual commodities produced great returns, beating stocks by a wide margin, but with crude oil down on the year, the commodity indexes were up about 2% (depending on what index or ETF you use). Natural resource stocks also beat the S&P 500 and international real estate had a great first half. This is what we expect from a weak dollar environment and while I expect to see a bounce in the dollar sometime soon – sentiment is very negative – the longer term probably includes a weaker dollar.

Note: Alhambra and/or its clients own shares of PPLT, IAU and PALL

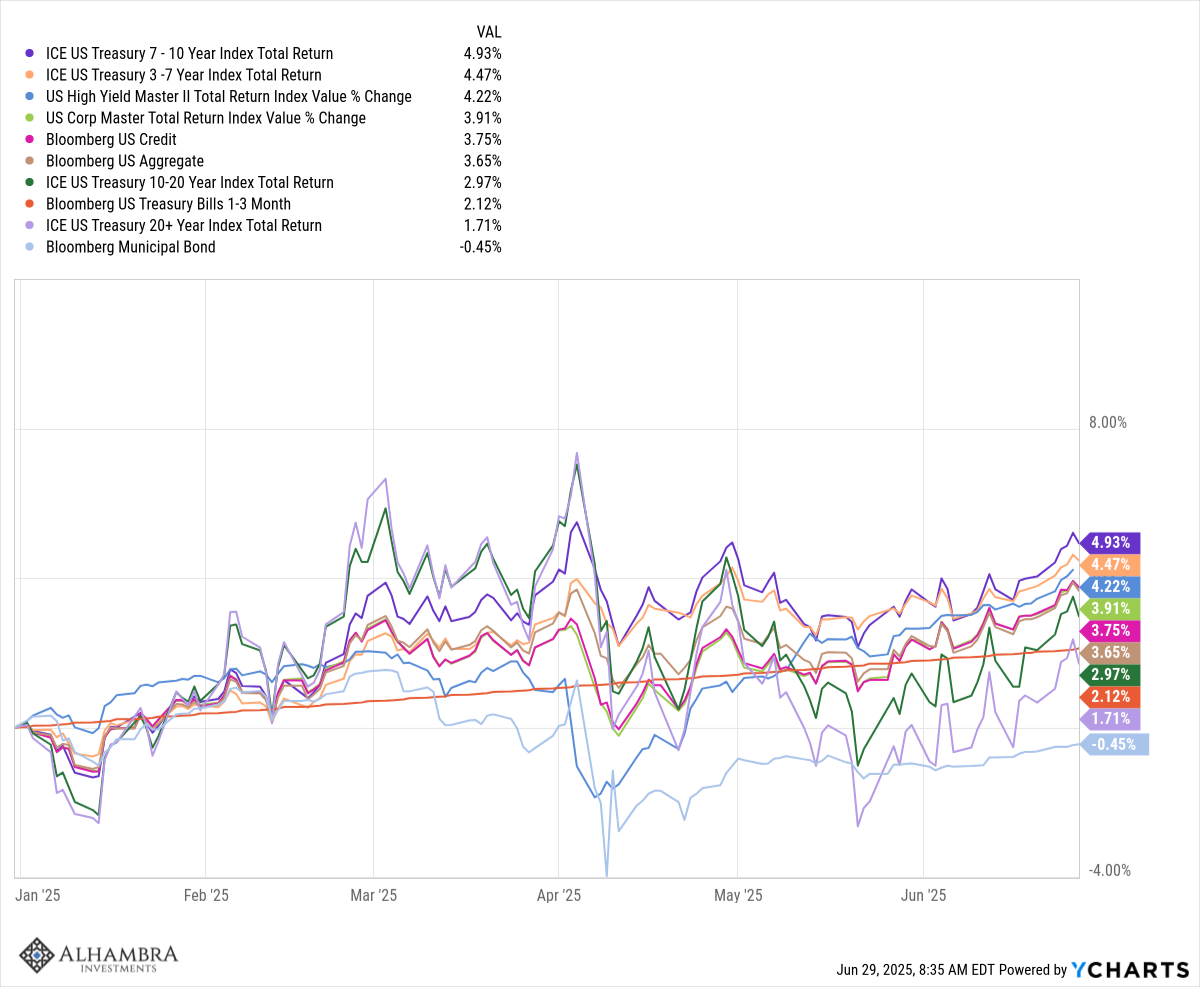

Bonds produced positive returns across the entire yield curve with intermediate-term bonds leading the way, while very short and very long-term Treasuries lagged. Corporate bonds rose too but not as much as Treasuries; the extra risk was not rewarded. Bucking the trend were muni bonds, which fell fractionally in the first half. Concerns about potential tax changes and increased supply were the likely culprits.

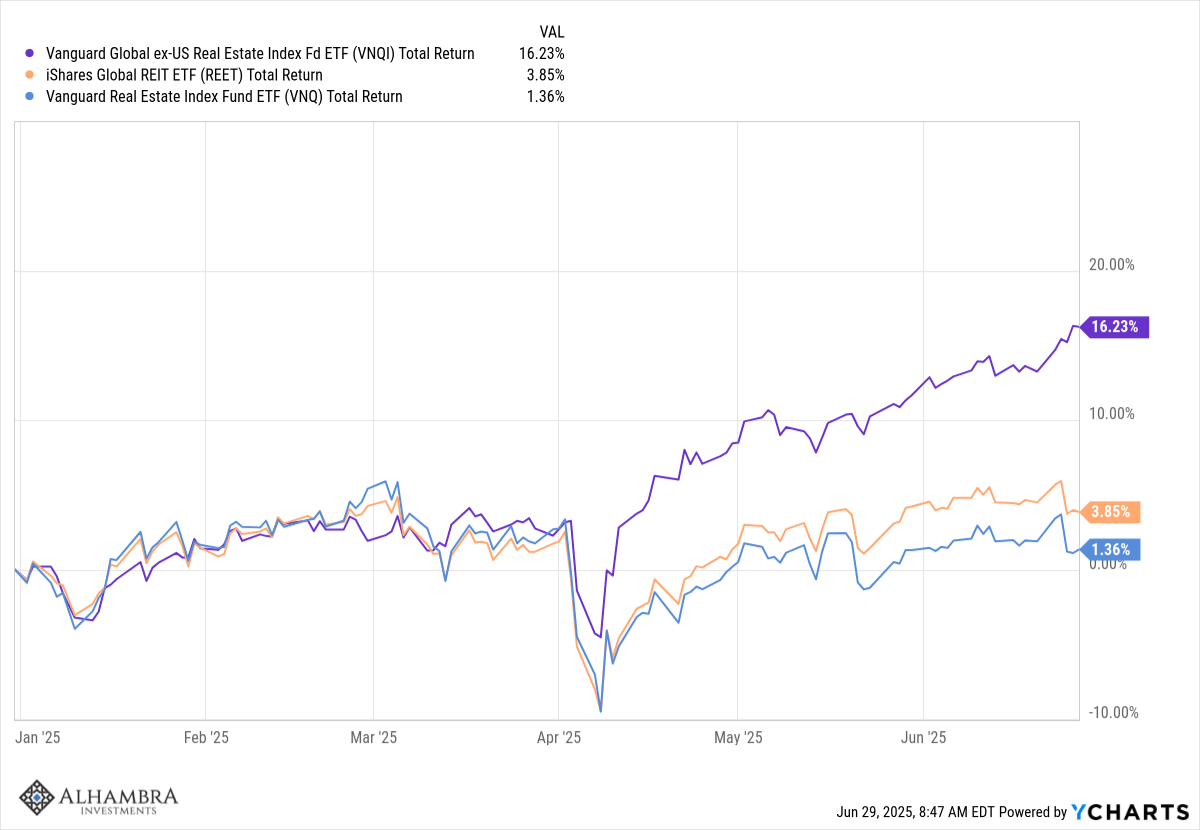

Real estate returns were positive but US REITs lagged the rest of the world by a wide margin. International real estate is catching up after badly underperforming the US over the last 5 years. Most of the difference in performance is from changes in the value of the dollar.

Note: Alhambra and/or its clients own shares of VNQ, VNQI and REET

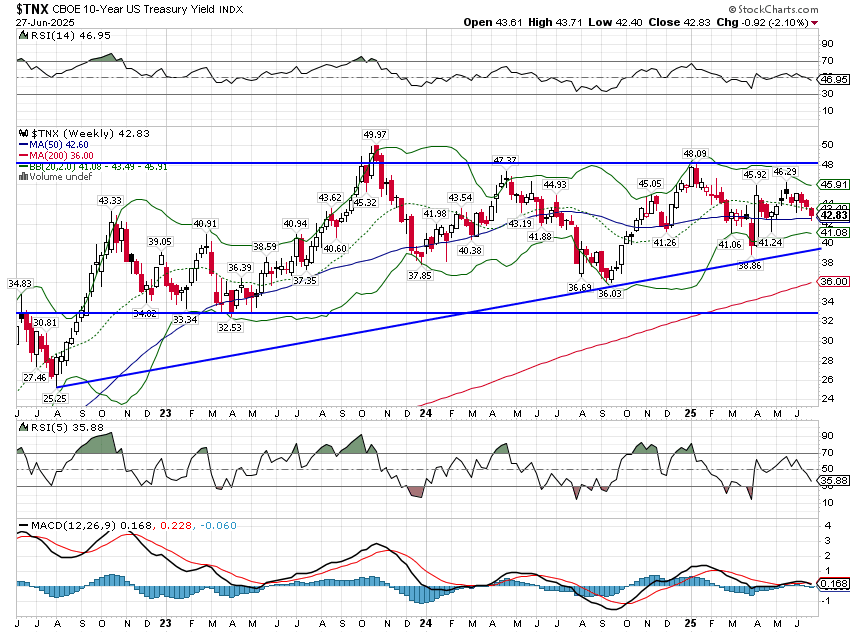

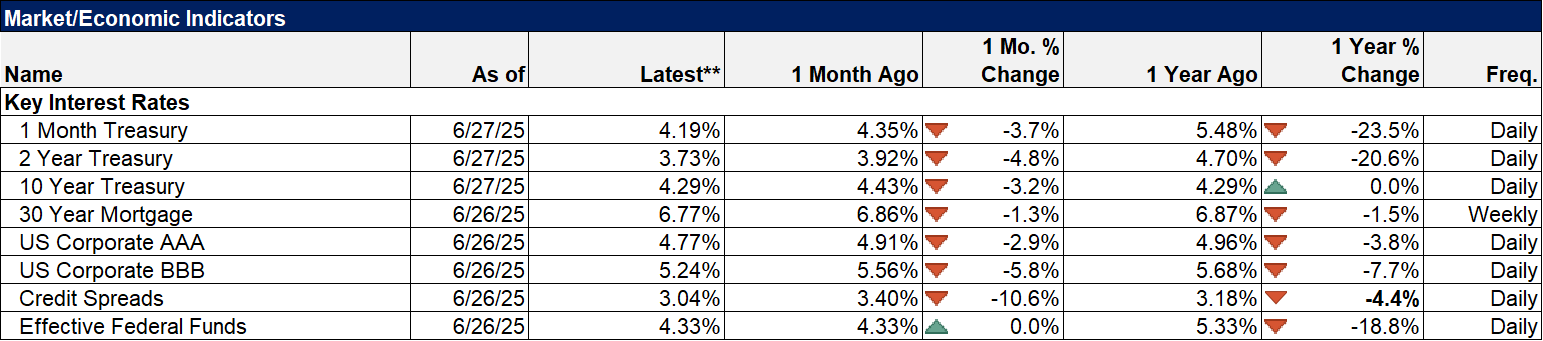

I see no reason to believe the second half of this year will be any easier to predict than the first half. President Trump is going to continue to be unpredictable because that’s who he is and how he operates. The only thing predictable about President Trump is that he will be unpredictable and so you should expect the uncertainty to continue for the next 3+ years. One would expect that to have a negative impact on the economy but despite all the first half turmoil, a market-based view of the economic outlook has changed very little. Interest rates are still in the same range they’ve been in for almost 3 years. Real interest rates and inflation expectations are little changed.

The only two significant changes have been in the value of the dollar and in expectations for corporate earnings. Before the election last November, Q1 2025 S&P 500 earnings were expected to rise to $64.45 (from $54.63 in the same quarter of 2024). Instead, earnings for Q1 clocked in at $57.52, a drop of 10% versus the prior expectation and only up a little over 5% from the same quarter in 2024. Earnings estimates for all of 2025 were $277.68 before the election and today stand at $255.68, an 8% reduction in expectations. Full year earnings growth has fallen from almost 17% to less than 10%. While the Fed and other economists are worried that tariffs will raise consumer prices, analysts believe that a big portion of the tariffs will be absorbed by corporate American’s bottom line. And since they get their clues through guidance from the companies they cover, that means the companies expect to eat some of the cost too.

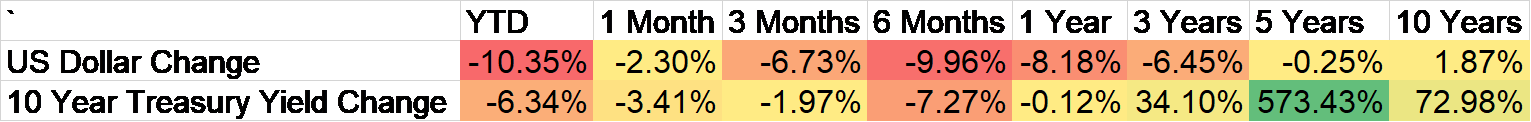

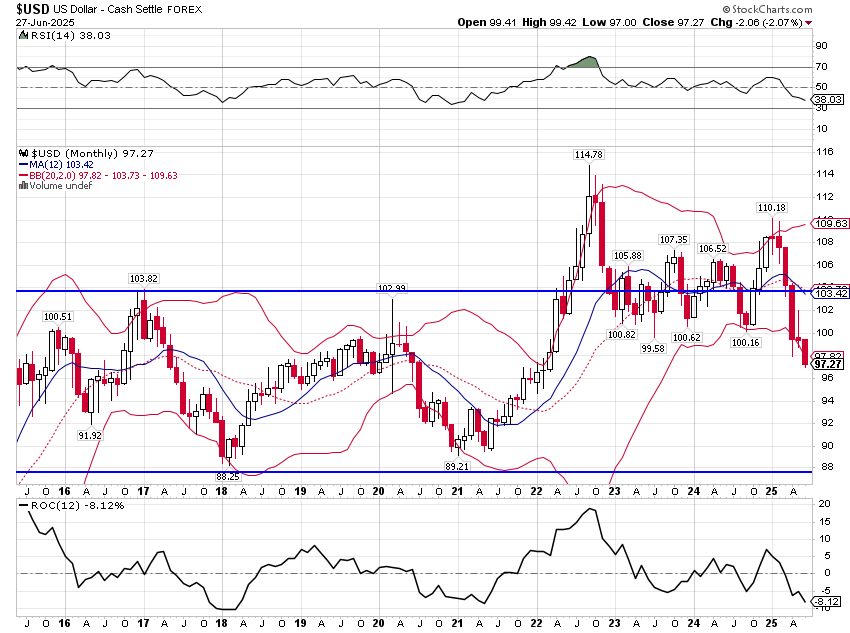

The overwhelming consensus coming into the new Trump term was the the dollar would rise due to tariffs. The textbook view is that when tariffs are imposed on a country, their currency will fall to offset the impact of the tariffs. This is why the President’s economic team kept insisting that other countries would absorb the cost of the tariffs. If the price of those foreign goods stays constant in local currency terms they become cheaper in dollars so there is no hit to US importers. What they didn’t say is that if that happened the impact on the trade deficit, the thing they are supposedly trying to “fix”, would be nil as well. Unfortunately, contrary to the textbook and the Trump trade team, foreigners aren’t stupid or meek. The dollar fell over 10% in the first six months of the year which is the main reason we saw all those non-US markets outperform. While I expect a bounce in the dollar soon – sentiment is very negative – the trend is down until proven different.

While we can’t predict the future, we can ask questions and there are plenty for investors to ask about the balance of this year.

- What will happen on July 9th when the reciprocal tariff pause ends? The Trump team keeps telling us that deals are imminent but so far the reality is that we have little to show for the last 3 months of negotiation. There is a preliminary agreement with the UK and some kind of agreement with China on rare earth metals that doesn’t seem to have changed anything. Ford announced recently that they have had to shut down some production over the last month due to a lack of rare earth magnets.

- What will be the fate of the budget bill? How will taxes and spending change?

- What exceptions to tariffs will be allowed? Will Apple, for instance, continue to escape tariffs on iPhone production? Will the administration follow through with tariffs on semiconductors that would hit every electronic product not made in the US – which is basically all of them?

- Will the Iran sanctions be lifted or reduced? If so, how will that impact global oil supply?

- Will deportations have an impact on food production and prices?

- Will the tariffs be declared unconstitutional or illegal under the IEEPA? How would that change what products and countries are subject to tariffs?

- Will AI adoption accelerate and improve productivity? Will it be fast enough to offset the hit to growth from reduced immigration?

- Will inflation continue to fall back toward the Fed’s target? If so, will the Fed cut rates and if so, how many times before the end of the year? If not, will Trump try to fire Jerome Powell?

- Will recent signs of economic weakness spread?

With all that uncertainty – and that is far from a comprehensive list – it is more critical than ever to have an investment strategy in place that you can continue to execute through the drama that is the Trump show. There will be tactical opportunities but the only real cure for uncertainty is diversification. For most of the last 15 years diversification has been a mistake – prudence devalued – as US growth stocks dominated returns. If the first half of this year is any indication of the future, those days are over.

Joe Calhoun

Environment

The dollar downtrend accelerated last week amid increasing talk of rate cuts to come in the second half. The support around 100 has been broken decisively and there is little support until the bottom of this range near the 90 level. It won’t go there in a straight line but as I said after the election, Presidents always get the dollar they want. Trump wants a weak one and he’s getting it.

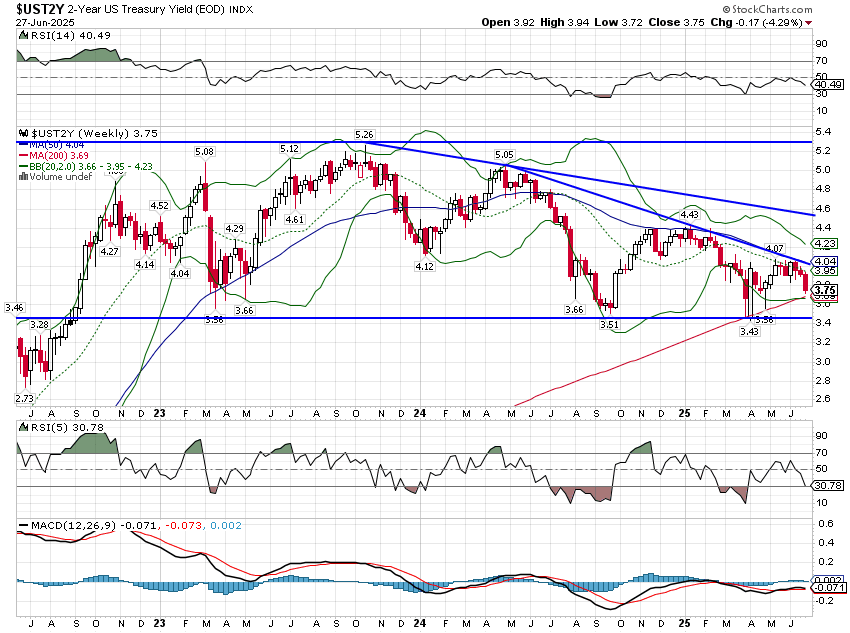

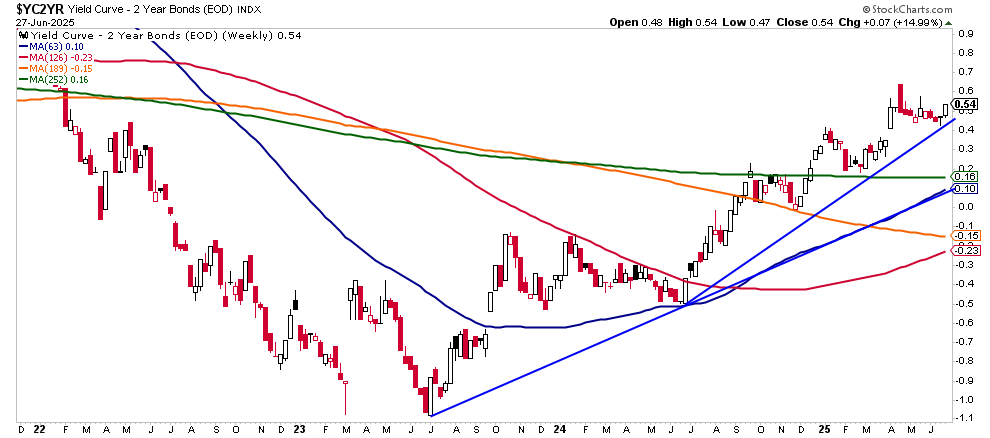

Interest rates were down a little last week but the 10-year Treasury rate remains in the same range it’s been in for almost 3 years. There is, however, a gently rising uptrend here that may be telling us something that we need to keep an eye on. Since the beginning of the year the yield curve has been steepening because short rates are falling faster than long-term rates (50 bps vs 29 bps) which is normally a precursor to recession. But if that uptrend in long rates continues while short rates fall, that would be more an indication of stagflation, weak economic growth, and rising inflation. For now, the message from rates is that growth and inflation expectations are both falling.

Markets

There was a big snapback in LC growth in Q2 but it still wasn’t enough to raise the S&P 500 return for the quarter above non-US markets. The S&P 500 rose 8.8% in the quarter but Global ex-US was up 9.3%. Europe also rose 9.3%. Sentiment is, however, getting pretty bullish on international stocks so a pullback of some sort, even if just relative to US, seems likely in the short term. Longer term the relative performance will mostly be determined by the course of the dollar.

Small cap stocks were up in the 2nd quarter but are still down on the year.

REITs and commodities were down slightly in the quarter and their track record over the last three years is pretty abysmal. But commodities are the best performing of these asset classes over the last 5 years. Gold, which isn’t shown below, has gotten a lot of attention the last few years because it has outperformed stocks but over the last 5 years general commodities have actually performed better. The difference is that the general commodity indexes made all of their gains in the first two years of the five-year period, rising 162% from June 2020 to June 2022, a result of Russia’s invasion of Ukraine. The performance since June ’22 is actually negative (-12.3%) while gold has risen nearly 76%. That’s why we hold both general commodities and gold in our portfolios and treat them separately. We didn’t make anything on the general commodities position the last 3 years but gold more than made up for that. Diversification works.

Contrarians – or investors as I call them – take note of the things that performed the worst over the last 5 years: REITs, bonds, Latin America, Japan, and Emerging markets.

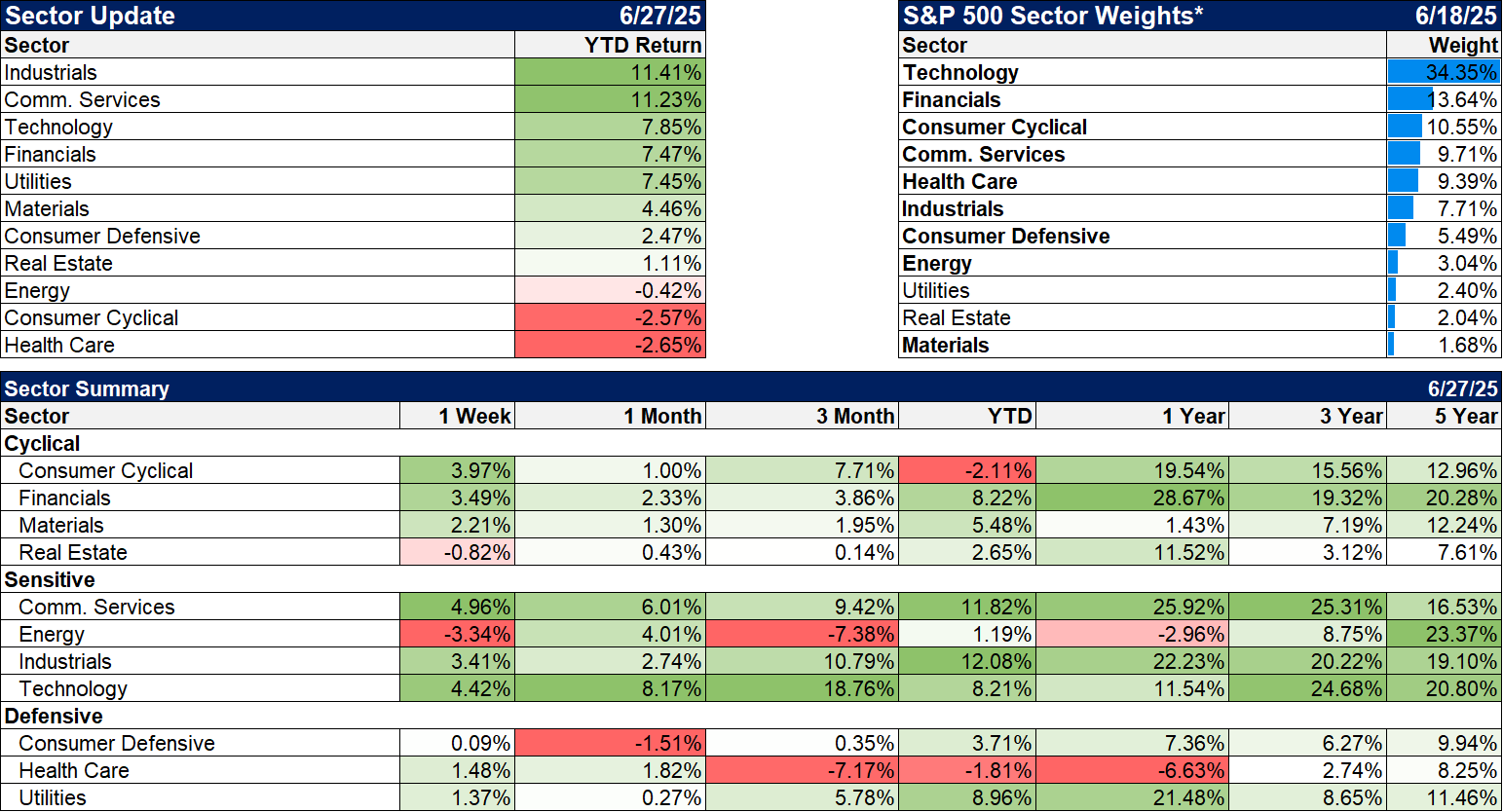

Sectors

Energy is down for the year but not as much as you might expect with crude oil down nearly 10%. Natural gas isn’t much better but is at least positive at +3.1%.

Poor performing sectors over the last 3 and 5-years are real estate and healthcare.

Economy/Market Indicators

Credit spreads are threatening to break below 3% again. There is no fear in credit. Mortgage rates are down a little over the last month but need to get closer to 6% to really have an impact on housing.

Economy/Economic Data

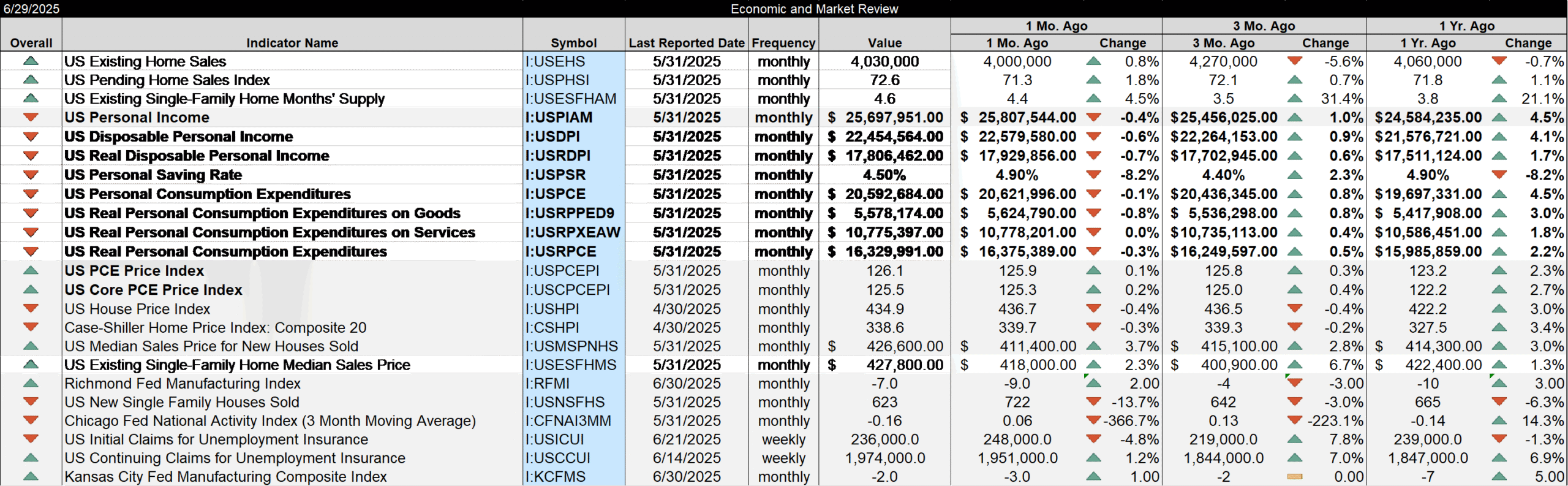

The most important data of the week was the personal income and spending report in bold below.

- Real disposable personal income was down 0.7% in May from April and is up only 1.7% year-over-year. There are some mitigating factors to consider. Social Security payments dropped month-to-month but that was due to a drop off in one-time catch up payments from the Social Security Fairness Act, explanation here. There was also a drop in farm income that was due to a drop in payments from ECAP, explanation here. However, a year ago, the year-over-year change in RDPI was 2.7% so it is trending in the wrong direction.

- Real personal consumption expenditures were down 0.3% on the month but what’s more concerning is that they are now down since December of last year. There has been a lot of ups and downs this year in goods due to front running of tariffs but like the overall number, real goods consumption is down for the year. Consumption seems to have hit a wall in the new year. I wonder why? Could it be….uncertainty?

- More concerning still is the stall in services consumption which is, at least theoretically, unaffected by tariffs. The annualized rate of real services consumption is only up $10 billion ytd. The year-over-year change is down to 1.7% when it was annualizing over 3% prior to the election.

- New home sales fell nearly 14% in May but existing home sales actually rose a little. If mortgage rates come down I suspect you’ll see a lot of pent up demand come to the fore.

- The Chicago Fed National Activity Index (3-month average) fell to -0.16, indicating growth slightly below trend. Recession is usually underway if this gets to -0.75 or worse.

Stay In Touch