I see it as reality intruding. The myth of the Fed continues to linger in the popular media, the mainstream press will dutiful parrot the idea that rate cuts and an end to QT are “highly accommodative.” The FOMC told them yesterday what to write and say:

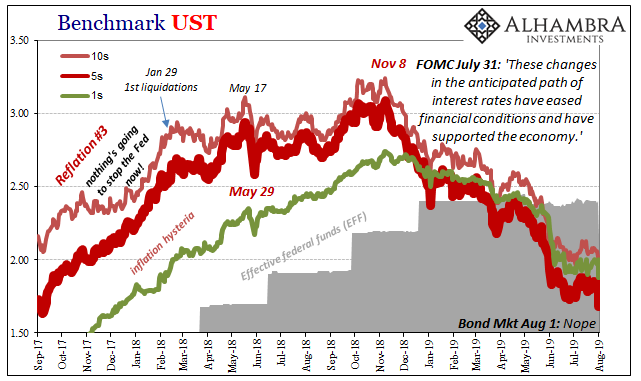

These changes in the anticipated path of interest rates have eased financial conditions and have supported the economy.

For about half an hour yesterday, that’s how it looked. Yields jumped somewhat and eurodollar futures prices dropped more. As far as getting reflation restarted, it was never more than a tiny flicker.

Today the hammer dropped. Sure, Jay Powell, you can say that the rate cut and a higher terminal level for bank reserves “have eased financial conditions and supported the economy” but no one is buying it. Not even stocks.

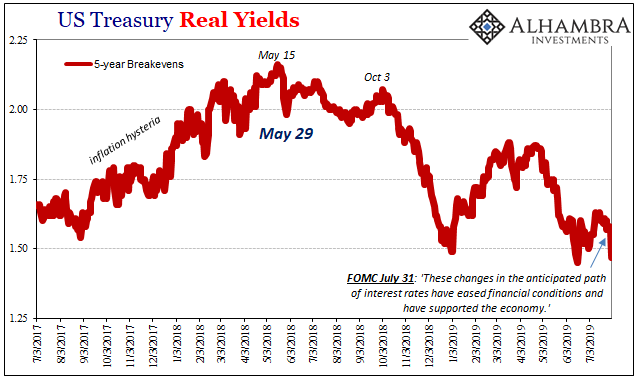

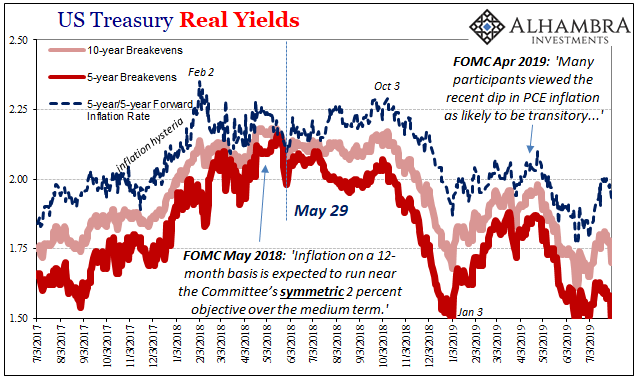

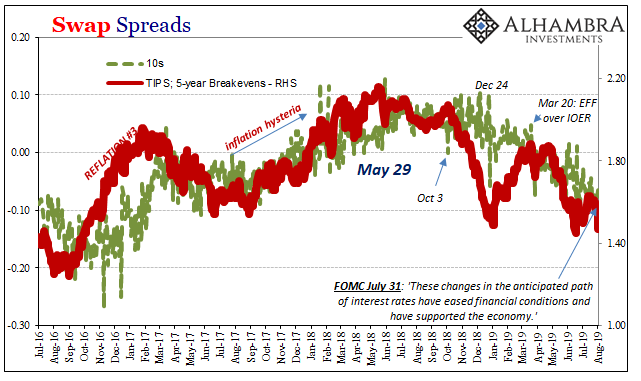

Taking the first part first; the 10-year UST yield closed below 1.90% for the first time since early November 2016. Inflation expectations dropped – by a lot. For a monetary policy regime that absolutely depends upon managing inflation expectations (the intended audience for the puppet show), the reaction in the TIPS market was devastating. The 5-year inflation breakeven, a measure of intermediate-term inflation expectations, fell a sharp 9 bps in today’s trading.

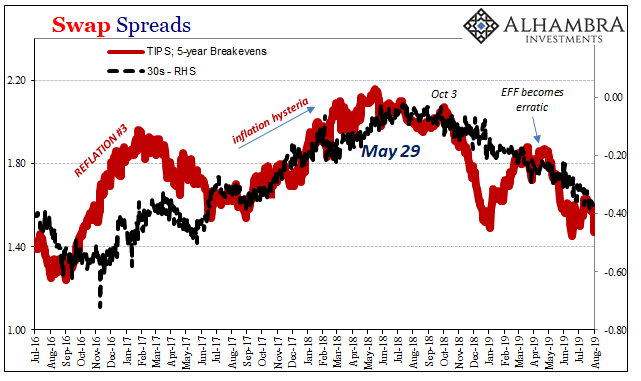

If financial conditions are being aided and eased, there isn’t any market corroboration. As noted earlier in the week, the rate cut (and QT debacle) is not the first “easing” in terms of inflation expectations these sharp monetary theorists have engaged. Going back to early May 2018, just weeks before May 29, the FOMC has been talking up inflation and accommodation as “needed.”

What started out as implicit has become fully explicit. It isn’t taking.

Throughout the whole progression, the direction more or less has been the same. Nothing goes in a straight line (except swap spreads once they get going), but the change in paradigm after May 29 shows up in obvious fashion in inflation expectations as well as nominal yields (and curve shape). It’s a runaway freight train at this moment.

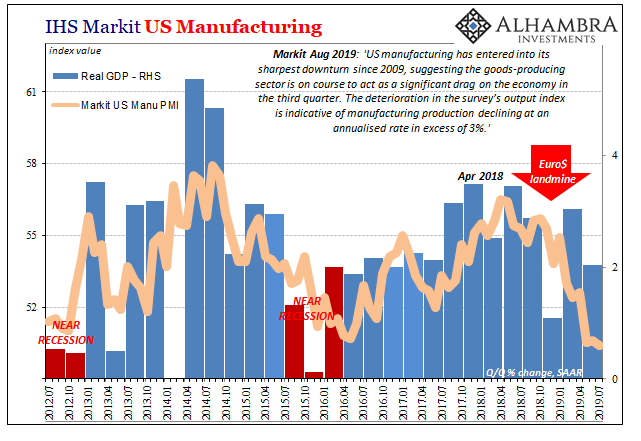

Despite the statements about a strong or very strong economy, the real economy has instead followed in the same way as the bond market – especially after the landmine at the end of last year.

Today, more PMI data suggesting the slowdown – not imminent crash – continues to deepen. Therefore, the downside risks keep building and as the trajectory persists. It dispels the notion of “transitory” factors, another angle working against whatever the Fed does or intends to.

First up, IHS Markit. The index for July was actually upgraded fractionally from the flash reading. And yet:

US manufacturing has entered into its sharpest downturn since 2009, suggesting the goods-producing sector is on course to act as a significant drag on the economy in the third quarter. The deterioration in the survey’s output index is indicative of manufacturing production declining at an annualised rate in excess of 3%.

As noted yesterday, these kinds of PMI results suggest the “sharpest downturn since 2009” is still in its beginning stages. This, too, goes along with the behavior of the bond market unimpressed by a one-and-done (or even a series of rate cuts).

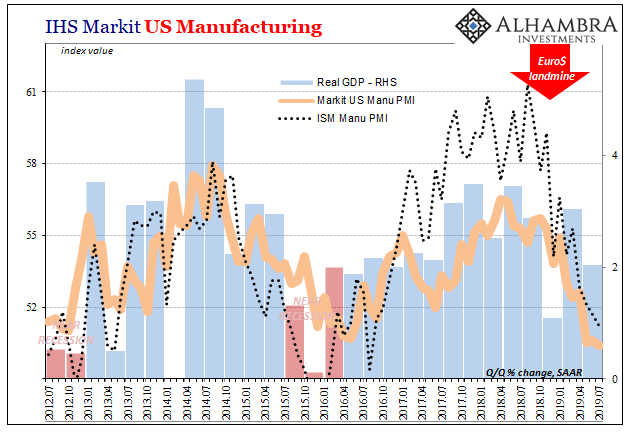

The ISM Manufacturing Index fell to 51.2 in July. That’s the lowest since August 2016, further confirming at least the marginal direction for the overall economy. It’s also a significant difference because during globally synchronized growth this index was one of the very few data series which had suggested there was something different about 2017.

Unlike Markit’s version, the ISM implied things might really have been cooking back then. And it stayed that way throughout much of 2018, too, even as questions and uncertainty gathered. Unlike GDP (or anything else apart from the unemployment rate), this PMI made it seem like Reflation #3 was something special, over and above 2014 and Reflation #2.

Whether that was actually true is now a moot point – and that’s the point. However “good” it might have been in 2018, the ISM is consistent with everything else in 2019. Impervious to the Fed’s inflation management regime, the second part of the FOMC statement (“supported the economy”) is also more and more at odds with the data (not just PMI’s).

It’s not really a surprise why just one day after its rate cut the Fed failed to find any takers.

Stay In Touch