The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied.

That’s not quite how this central bank quandary is being characterized, of course. It’s that R* stuff again, how in the orthodox view interest rates cannot be normalized for unspecified reasons which mysteriously all showed up at once around 2008.

The crux of Powell’s remarks is an extra special reminder of just how unserious these people are. And they come at an extra special time, markets flushing up to a series of rate cuts that the current Fed Chairman in Chicago admitted is already on the table.

Those were the specific remarks everyone focused upon – and those are what I’ll deal with here. As for the underlying, the monetary policy review, and what the Federal Reserve plans on doing, I spend my entire column at RealClearMarkets tomorrow unpacking this lunacy. That might be putting it mildly, given current events.

I’d like first to say a word about recent developments involving trade negotiations and other matters. We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.

In short: the economy is booming and would stay that way if not for Trump, tariffs, and trade wars. Fair enough to point the finger back at the White House given how the President and his advisors have publicly fitted Jay Powell for his scapegoat costume (rate hikes).

But while they are blaming each other, both proceed from false assumptions. The first one, obviously, is that the economy is otherwise booming. There just isn’t any evidence for that, especially as that view relies solely on the unemployment rate which isn’t so popular and compelling of late.

The second part is either trade wars or rate hikes to explain the current run of weakness. It’s a soft patch that already US officials have admitted, as they now start to prepare the system for rate cuts which were an unthinkable turn of events not that long ago. They’ve done so by claiming these are like 1998, some good insurance just in case – and nothing more.

Here, we’ll pick apart the trade blame game. Put very simply, economic weakness predates all of it, and goes much farther than a few hundred billion in penalties. Even Economists right now are having a hard time making the numbers work in their DSGE models. It just doesn’t add up, the relatively small bump in costs that are showing up in what sure looks like a global downturn if not recession.

And they have every reason in the world to blame trade wars; if not them, then 2018 has to be rewritten in so many places around the world which raises all the same uncomfortable questions. Better to have handy a plausible sounding explanation like subprime mortgages for the freight train barreling at them through the inverted bond curve’s dark tunnel.

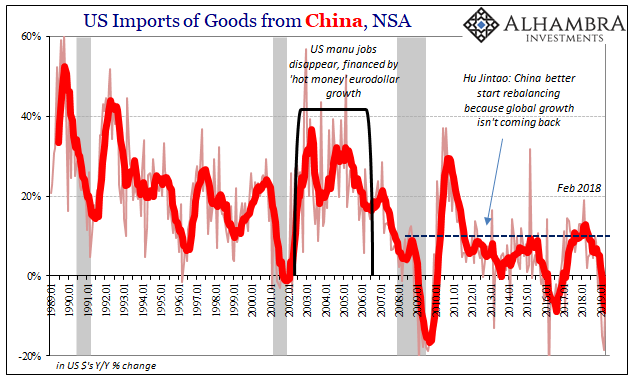

The latest update from the Census Bureau on US trade for the month of April 2019 shows just what I mean. There’s no doubt that these restrictions are in the data; imports from China, the very ground zero of the dispute, have fallen sharply since they were imposed. On average, US imports from that one country are contracting at some of the worst rates in the history of their trading regime.

While that one element is consistent with what Powell’s talking about, that’s all he has in his favor; the majority of it is not.

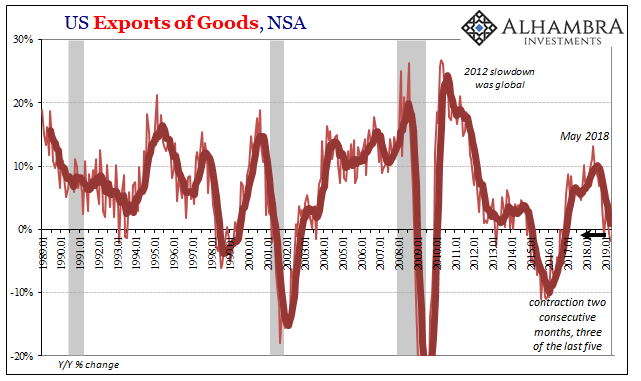

US exports to the rest of the world, for example, growth in outbound trade peaked – in May 2018. What would that have to do with tariffs on Chinese goods flowing into the US? You can only try to make a case that global economic participants were growing “uneasy” about rhetoric. Words and threats.

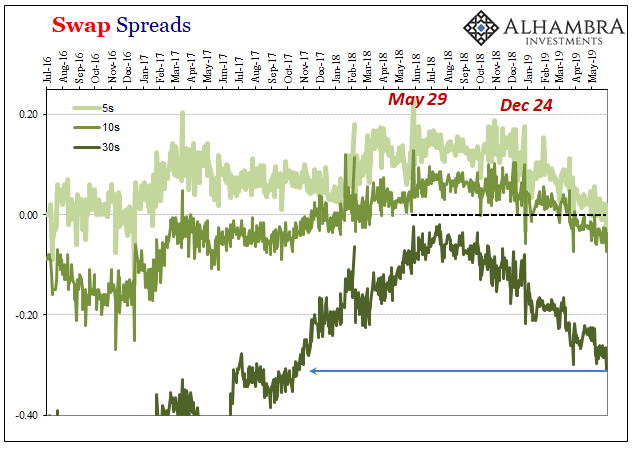

On the other hand, watching money, liquidity, and markets we know all about April and May 2018. Especially May 29. A serious dollar shortage even a serious (and so far enduring) dislocation in funding regimes and redistribution, one that would easily account for the sudden downturn in difficulties of foreigners trying to buy US goods.

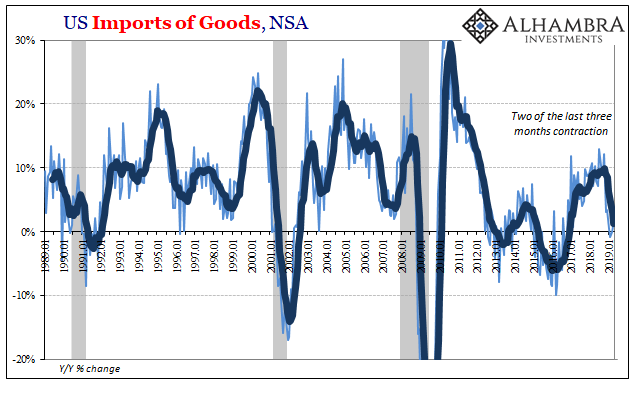

A specific downturn in overall US demand (imports) also would have little to do with these government impositions. It also predates them and there is no trade war answer as to why a booming economy wouldn’t be making up the difference everywhere else.

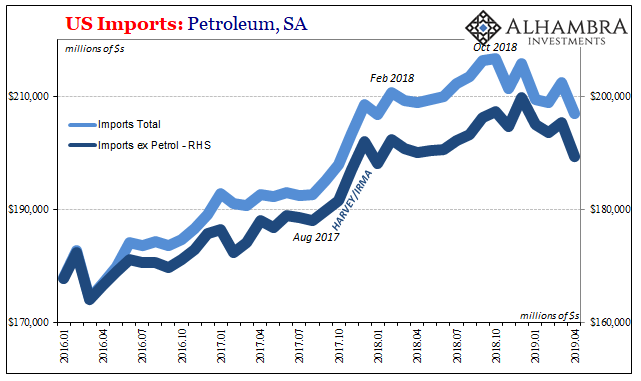

The numbers and the timing, none of it adds up – especially if you are purposefully factoring the unemployment rate which has suggested a roaring condition for domestic demand. Instead, that demand has near fallen off a cliff:

Import growth has been soft going back to last February! And now it has contracted, seasonally-adjusted, dating back to that landmine somewhere in the October to December window.

The latest data suggested an unusually sharp decline in import activity into the US in April 2019 – despite a rebound in oil prices and therefore oil imports. It was the second such bad month of the four reported so far for this year. A pattern is emerging, one more consistent with possible recessionary conditions than a booming economy pushed mildly astray by a few billion in directed tariffs.

The import data in particular, a pretty good proxy of US demand, this is the kind of trajectory that backs what I wrote earlier with regard to the unemployment rate:

The inverted curves, especially now plummeting bill yields, these say to Powell you don’t yet know just how wrong you were to have depended upon that one suspect number.

You are about to find out, though. Maybe as soon as tomorrow’s payroll report?

These are serious and very well-established longstanding economic issues, being talked about and persuaded by wholly unserious people. Trade wars aren’t one of them, except in the narrow sense they provide the current regime with their badly needed subprime mortgage distraction.

Stay In Touch