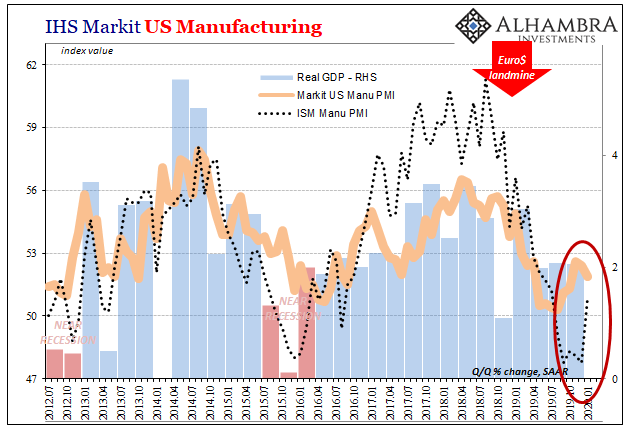

The ISM’s Manufacturing PMI rebounded sharply in January 2020, according to preliminary assessments. December’s figure was revised upward to 47.8 from 47.2, which had been a decade low, and that’s only where it began. The first estimate for the twenties exploded out of contraction, or what’s associated with the idea, to reach 50.8. It was the highest since last July, the first out of the last six to be above 50.

The index for new orders was also up sharply, jumping to 52.0 in January from 47.6 in December. Within it, the index for new export orders gained 6 points to 53.3. And those were nothing compared to the overall production sub-index, very nearly rising a jaw-dropping 10 points just in this one month (54.3 in January from 44.8 in December).

Monthly PMI data is noisy by nature, but this is taking it to an extreme. To add to the stunning volatility, the ISM took down the initial release and issued a cryptic statement about revising some parts and completing annual adjustments to seasonal factors before putting the same numbers right back out there.

The comments from industry representatives included within the press release pretty well sum up the situation:

Business has picked up considerably. Many of our suppliers are working at or above full capacity. [Computer & Electronic Products]

Small signs of increased global demand in the chemical segment. [Chemical Products]

So far so good. Followed by:

Continued signs of slowdown in manufacturing. [Transportation Equipment]

Our customer slowdown has not reached the bottom. [Petroleum & Coal Products]

The annual holiday slowdown was slightly more significant compared to the previous three years, heightening concerns over the 2020 first-quarter forecast. [Electrical Equipment, Appliances & Components]

And one more for good measure (machinery, capital goods):

The lack of faith in the economy seems to be why we cannot sell capital projects.

These are the comments that the Institute chose for publication with its superb January headline, almost as if the editor responsible for the selections is a bit incredulous, too. One or two like these isn’t unusual in any given month, but the latter are not the kinds of comments you would associate in any way with a massive +10-point turnaround in overall production (and +4.4 in new orders).

That’s why trends matter more than monthly estimates.

Perhaps the ISM’s index is merely catching up to what IHS Markit’s similar measure had been doing. This other one jumped up late in 2019 but has been fading over the last several months. From a low of 50.3 in August to 52.6 by November, down to 51.9 for January 2020’s final estimate.

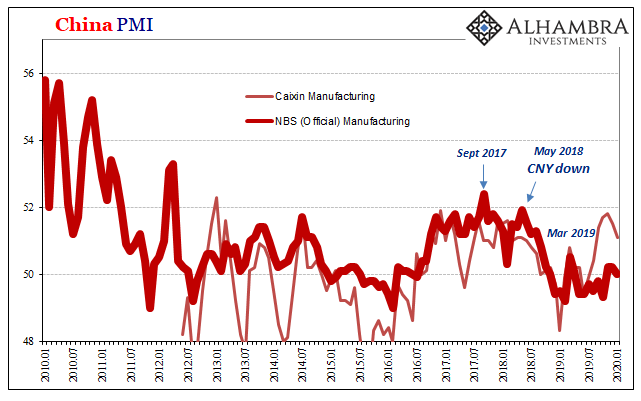

Markit’s version more closely resembled the one from China which had been suggesting a year-end sugar high as some proportion of manufacturing activity may have been moved up to beat the new tariffs.

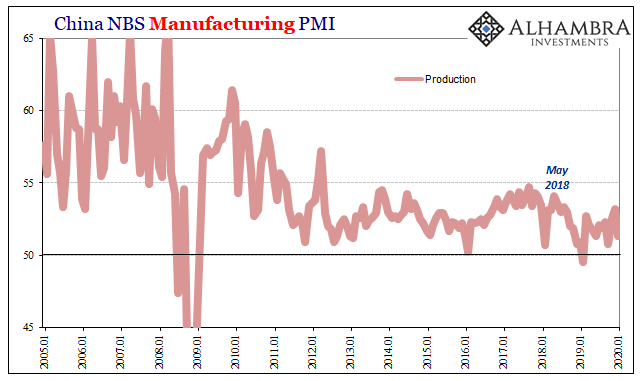

According to China’s National Bureau of Statistics (NBS), the official manufacturing PMI dropped back to 50 again in January 2020 after the final two months of 2019 at 50.2. The production sub-index had been 53.2 in December, the highest since August 2018, only to fall sharply down to 51.3 in January which was back among the lowest in the PMI’s history.

Caixin’s survey of smaller and mid-sized manufacturers is suggesting the same late year artificiality, to an even greater degree. From a low of 49.4 last June, this index had surged to as high as 51.8 in November, but now is falling backward again down to 51.1 in the latest number for January.

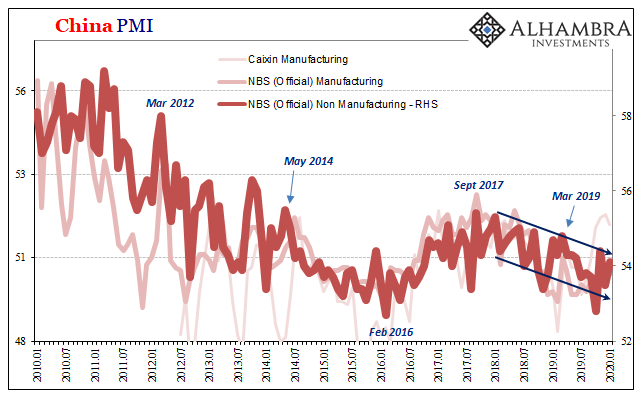

On the other side of China’s economy, the NBS said its services PMI rose to 54.1 from 53.5 – which, like the ISM today, when it was released late last week caused more than a few to question how that might be. After all, the coronavirus.

Even if the outbreak proves to be overblown (and I have no idea if it will be, or if this one will turn out to be more than SARS or the H1N1 outbreaks), it’s hard to fathom how in the initial stages where it already has been a serious disruption, at least when comparing January 2020 to December 2019, China’s services sector could have accelerated. It has led to the usual questions about the government’s involvement in the statistics.

With regard to the non-manufacturing PMI, I think people have been misinterpreting the monthly result giving the positive monthly change more than it deserves. Yes, it was up in January from December; however, that number still remains more importantly inside the downward trend which began late in 2018.

In other words, the index in January 2020 is down from 54.4 in November 2019, was 54.7 in January 2019, 55.3 in January 2018 – and 53.5 in January 2016.

What everyone wants to know is, has the global economy hit bottom? Did Euro$ #4 get overturned by trade deals and rate cuts? Unfortunately, PMI’s are the wrong tool for this job. Even though this is precisely why they were originally created, they really only add value for analysis where their trends are concerned and can be defined.

Maybe the next few months will show it, but for now there aren’t any trend-breakers here.

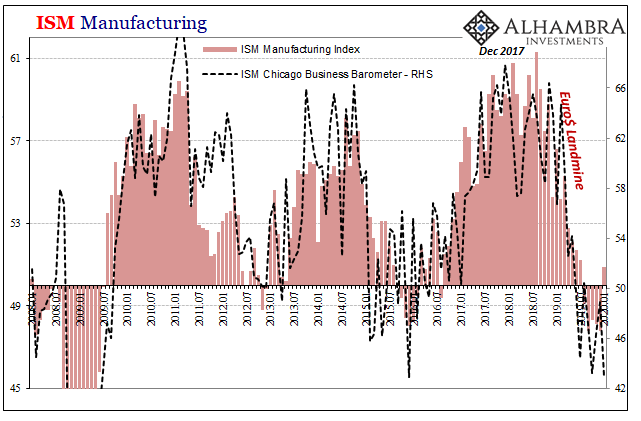

On a monthly, high frequency basis, PMI’s are decidedly noisy. Some months much more than others. Just look at the ISM’s manufacturing PMI versus its Chicago Business Barometer.

Stay In Touch