‘Unexpected’ Lumbering Prices

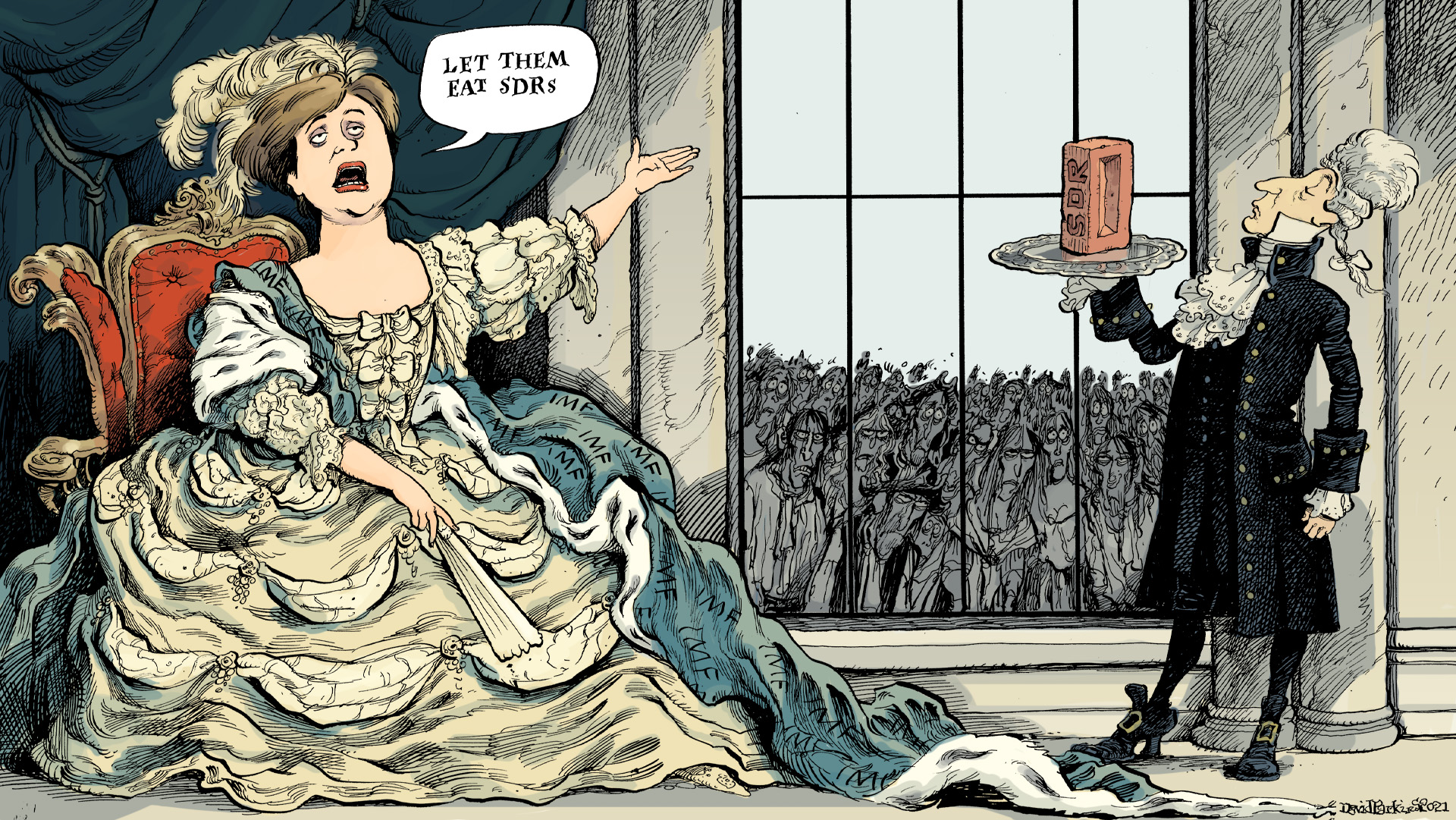

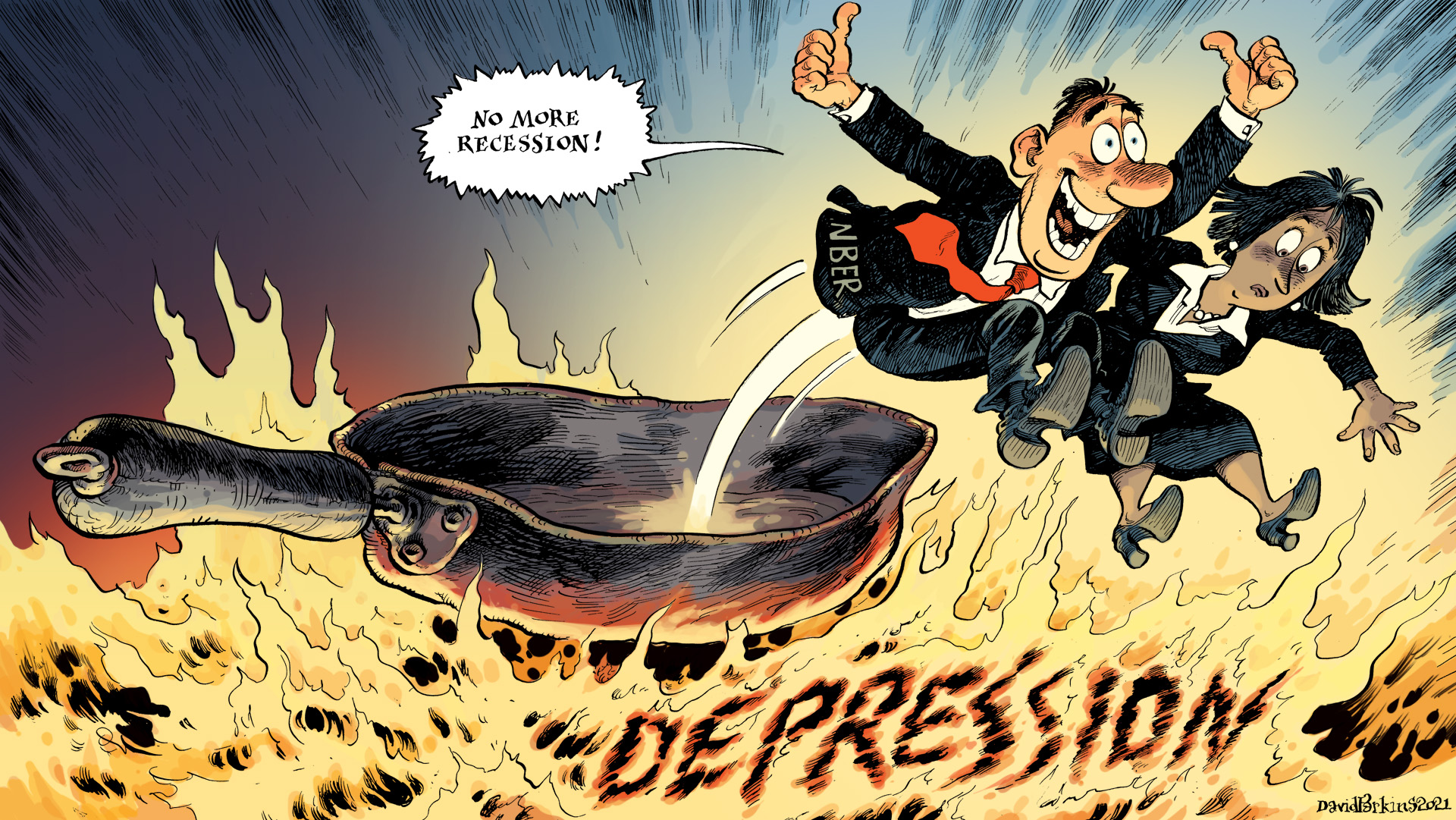

Inflation is monetary, meaning that “real” inflation – a broad-based and sustained accelerating trend in consumer prices – is a part of the not-real financial realm. If reckless authorities print too much money, then the solution, for anyone rationally seeking protection, is to rotate out of the financial and into the real. The logic is unassailable: too much money, high [...]

Stay In Touch