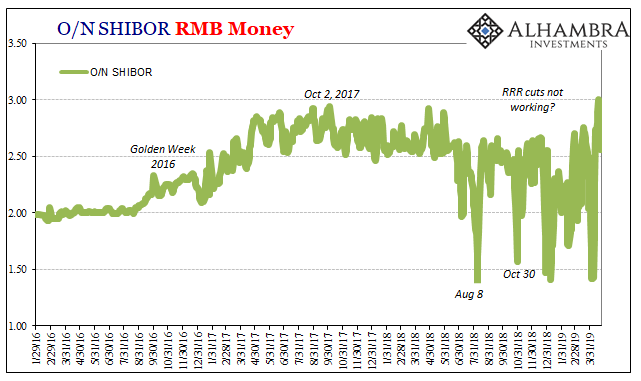

A little less than three weeks ago, the overnight unsecured money market rate for Chinese renminbi (RMB), SHIBOR, had fallen sharply to 1.417%. This was among the lowest in history, though it has been happening more frequently since last summer. That sounds like a good thing, only the low rates don’t ever last.

Instead, over the next eight market sessions O/N SHIBOR skyrocketed to just about 3%. Fixed at 2.998% last week on the 17th, it was the highest in four years going all the way back to the eventful month of April 2015.

This kind of volatility especially at the shortest maturity suggests limited and temporary capacity for spare liquidity. It is the result of a titanic struggle to maintain control. The PBOC has had better success at term, but perceptions about the shortest maturity heavily color how participants act. If you think there’s a good chance you might need liquidity in a pinch, and this is what you see for overnight funding, it’s a little like volunteering for a game of Russian roulette.

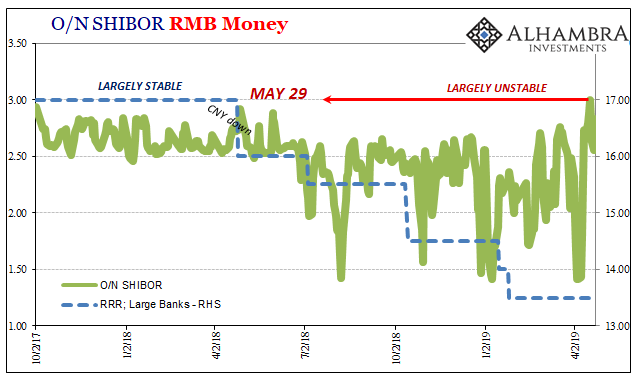

On the one side, the RRR’s. China’s central bank has cut the reserve requirement five times over the last year. Authorities intend for Chinese banks to use more of their previously locked up reserves.

The reason is because the PBOC is supplying less of them, the opposing side. A lot less. It is an attempted transition from central bank-derived liquidity to more bank-derived. It isn’t going all that well, as you can see above. Some days, it looks awesome; others, not nearly so much. In the end, the volatility overrides those days when rates are exceptionally low.

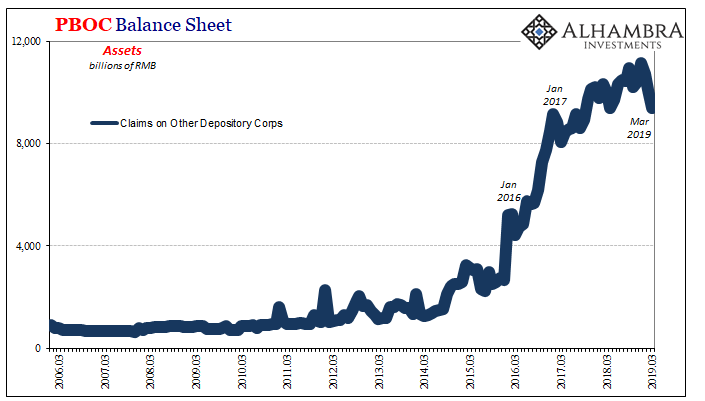

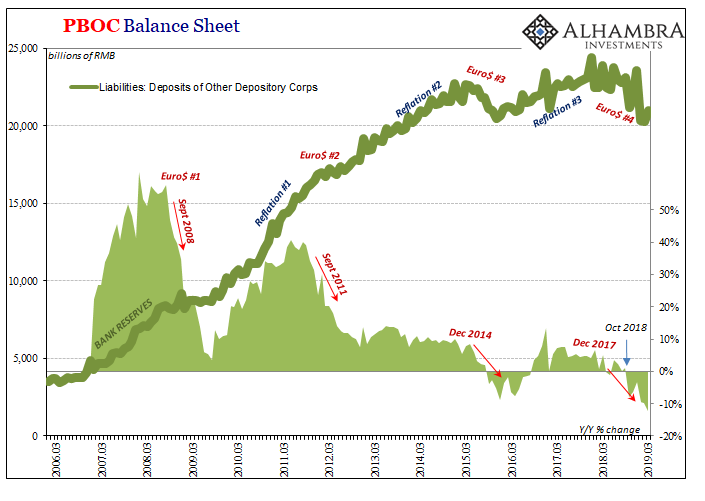

In March, according to the latest figures from the PBOC, the central bank wound down an enormous amount of program liquidity. These are things like the MLF and SLF, bank windows that beginning in 2016 formed the basis of China’s panicky response to Euro$ #3. That monetary “stimulus” ended up with a bloated RMB portion of its balance sheet for clearly nowhere near enough economic gain.

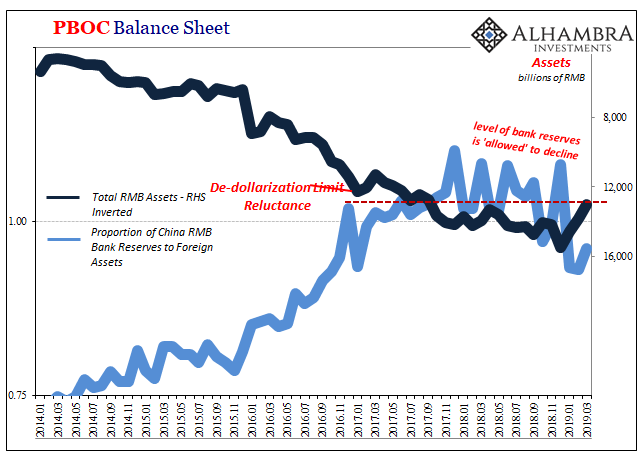

That kind of bedrock instability is what Chinese authorities are attempting to address. Ever since the end of 2016, they’ve drawn a line in the sand (shown below). Officials have shown that they will not further de-dollarize because they believe it is a huge negative for CNY. Everything rests upon the stability of CNY; a lesson derived, I think, from China’s view of 1990’s Japan and Russia.

What that means is painfully simple. If the PBOC will not “print” RMB liquidity, then the only other way for its balance sheet to expand, and therefore internal RMB, is via foreign reserves. Either a friendly, helpful global eurodollar system or, to preserve CNY, China’s central bank must take more drastic measures on its liability (money) side.

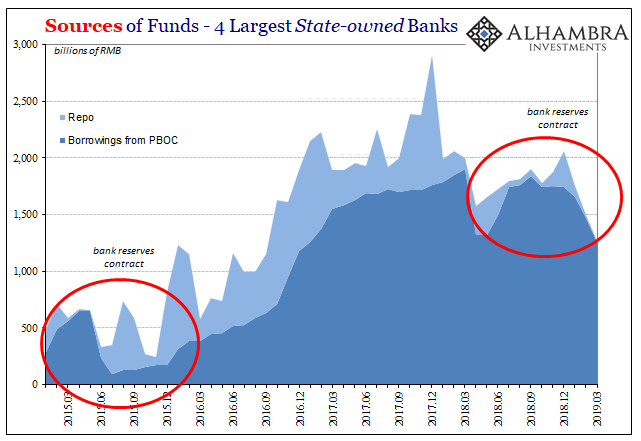

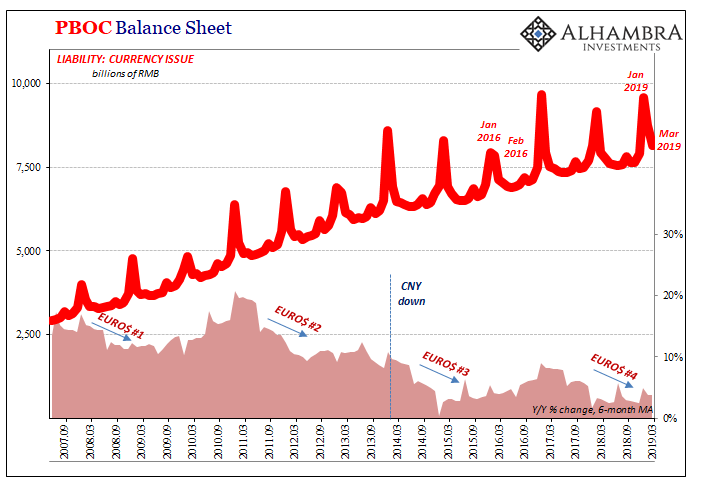

As the eurodollar system began to shift toward the unhelpful late in 2017, the choice was made for China. The level of money and currency was curtailed. This squeeze picked up around April and May 2018 as CNY plummeted, leaving the PBOC to enact RRR cuts to hopefully get ahead of reductions in central bank balances – both bank reserves and currency issued.

This internal RMB squeeze of external eurodollar origin really, really picked up in October 2018. At the time, the central bank practically warned the world what was going to happen.

Since last October, the level of Chinese bank reserves has contracted sharply. In March 2019, this was down by more than 12% from March 2018. It was the largest decline in the published records. As you may have casually noticed, declining bank reserves don’t correspond to periods of economic expanse no matter the RRR’s

In terms of currency issue, the Golden Week holidays skew comparisons even as far as March. The year-over-year change for last month was just +2.3%. As it stands, this is the third lowest growth rate for RMB currency. The two months below it were September and November last year.

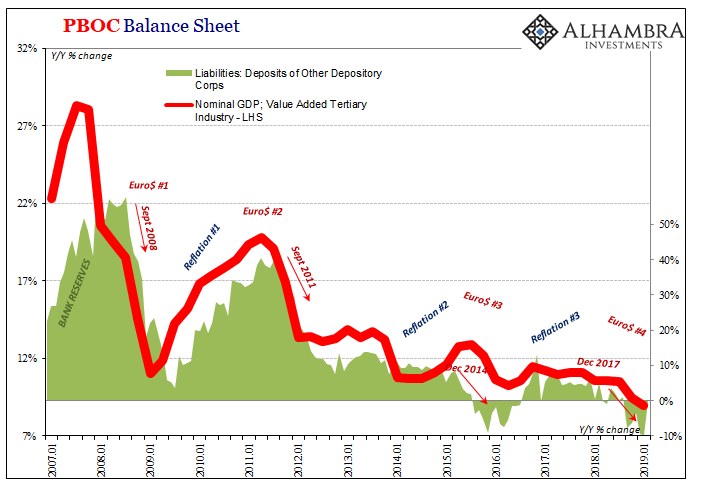

This is what I mean when I say people misunderstand the PBOC’s policies. It is a knee-jerk reaction to nothing other than a headline. The Fed “pause”, the ECB’s coming T-LTRO plus its aborted rate liftoff, and the Chinese central bank all forming this spring backbone of supposed dovishness. Green shoots everywhere.

Except, in China’s specific case that’s not the case. Chinese monetary authorities are not adding stimulating liquidity, they are at best hoping to offset the huge drain coming from their own balance sheet! This is the real monetary rebalancing behind, as noted yesterday, the country’s actual economic rebalancing.

It will be called “stimulus” anyway. Unfortunately, real market and economy participants can’t depend upon mainstream descriptions.

Stay In Touch