Officials in China seem to be taking a page out of Mario Draghi’s playbook. Before Europe was pushed to the bring of recession, the President of Europe’s central bank would downplay any weakness in the European economy. In 2018 especially, Draghi frequently referred to 2017 as if it was something special. No cause for concern, he reassured, any softening was just the Continent slowing down from really awesome growth.

With the ECB restarting QE last month, he hasn’t used that reference in some time.

Li Keqiang is China’s Premier; one of them, anyway. He was also in the running with Xi Jinping to replace Hu Jintao in 2012, which probably makes him the country’s premier Premier. According to rumors, he has been more outspoken about the China’s economic performance of late. It may be that is why, breaking with tradition, no 4th Plenary Session has yet been held.

Following the usual pattern, it would’ve been completed in October 2018.

At the end of last month, the Chinese Communists finally announced that it has been scheduled for the coming October, though no date has yet been given. But if Li is spoiling for a fight with Xi, the former’s recent comments suggest more compliance than disagreement.

Interviewed by Russian media earlier today, Li was quoted as saying:

For China to maintain growth of 6 percent or more is very difficult against the current backdrop of a complicated international situation and a relatively high base, and this rate is at the forefront of the world’s leading economies.

Publicly making excuses for the visible lack of growth is not something you would expect from an entrenching rival and critic. Like Draghi, Li is trying to say that China is merely slowing from really awesome (a relatively high base).

It would have been an opportunity to make his dissatisfaction known. Then again, the ruling Chinese elite tend to keep things inhouse. Maybe Li remains unsatisfied and is biding his time. Or, maybe Xi has brought him around to his way of thinking; that China without growth puts all the Communists on notice and into the same category as far as a potentially unruly public may be concerned.

There’s a time and place for dissent and disagreement. Dangerous economic grounds may not be it.

One thing that is for sure, the 4th Plenary Session will have its work cut out for it. The latest data from China for the month of August was uniformly awful. Even some observers are starting to see that it’s not trade wars which is dimming the government’s prospects in more ways than one.

“China’s economy is undergoing a cyclical economic downturn driven almost entirely by domestic factors. The key drivers of the slowdown are tight financial conditions, thanks to a recent financial derisking campaign, and weak local government investment,” said Andrew Polk, the co-founder of economic consultancy Trivium China, in a recent testimony to the US-China Economic and Security Review Commission.

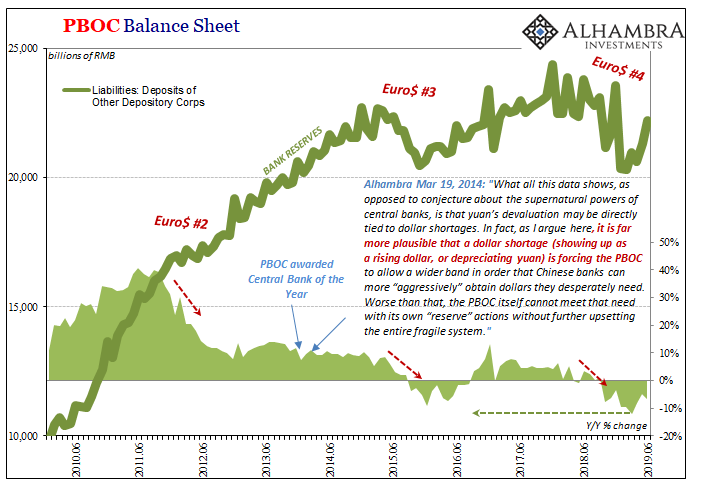

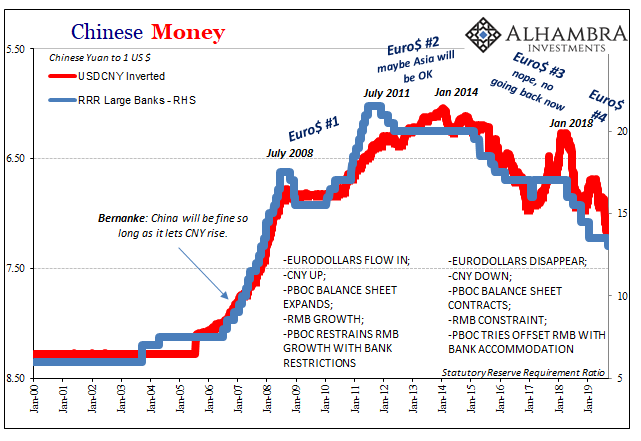

Monetary tightening only looks like intentional policy because the Western public (and the Chinese public, for that matter) has been conditioned to believe that everything taking place in China’s massive financial system must be a product of official intent. Since the PBOC is described as near omniscient and has been granted the kind of extraordinary power by the authoritarian state Western central bankers can only dream about, we are told there is nothing it cannot accomplish, nor is there any problem which would stand in its way.

Therefore, if China’s economy is being squeezed by monetary restriction to the point of real danger, what else can it be other than a purposeful “derisking campaign?”

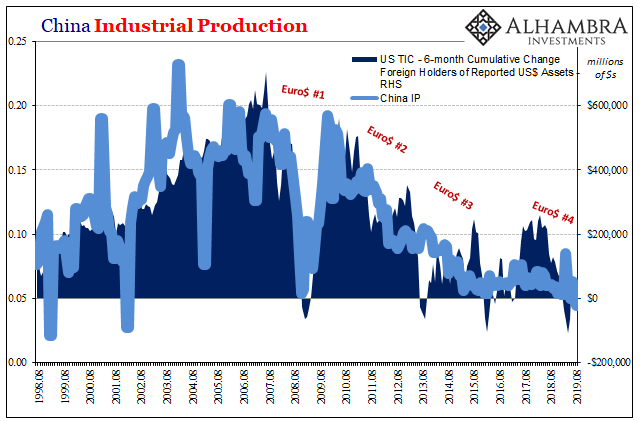

What is bigger than the PBOC and any of its policies is the eurodollar system and its own mind. China’s central bank is desperately reactive, not proactively asserting control with every statement and program. The global dollar reserve is slowly strangling the life out of the Chinese economy.

It will take some time more, but eventually it should become just as clear that there’s little anyone can do about it. Xi, Li, nor PBOC Governor Yi Gang.

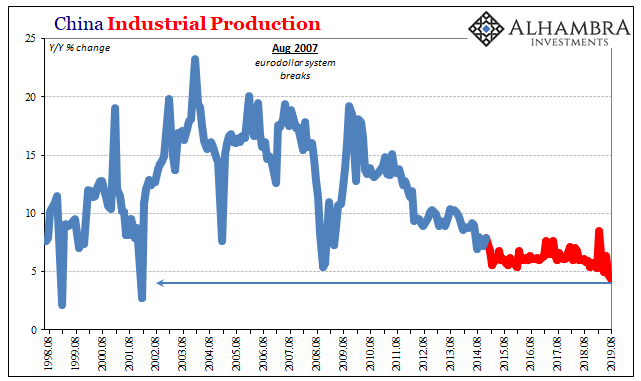

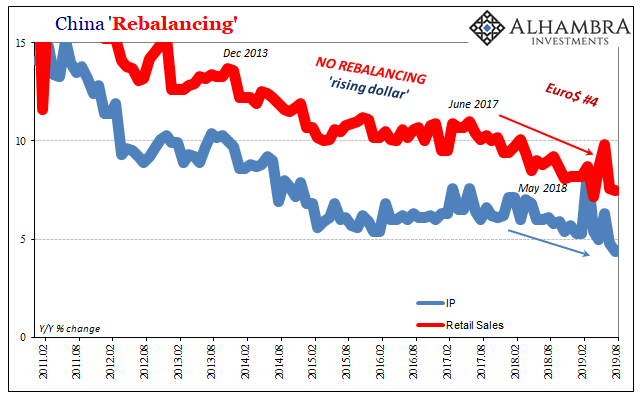

According to China’s National Bureau of Statistics, Industrial Production grew by just 4.4% year-over-year in August 2019. It is effectively another new record low. The only months worse were a couple of Februaries a very long time ago. Already in a weakened state, it is becoming clearer how China is weakening some more – an increase in deceleration (second derivative) going back to late last year (the landmine).

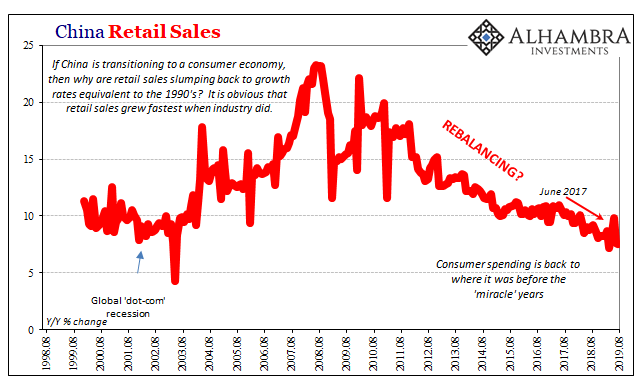

Retail Sales in China grew at just a 7.5% annual rate last month, which was the third lowest on record. That followed 7.6% growth in July. In fact, retail sales have only grown at rates less than 7.7% four times in the entire series, with three of those showing up just this year, including the past two months (July and August).

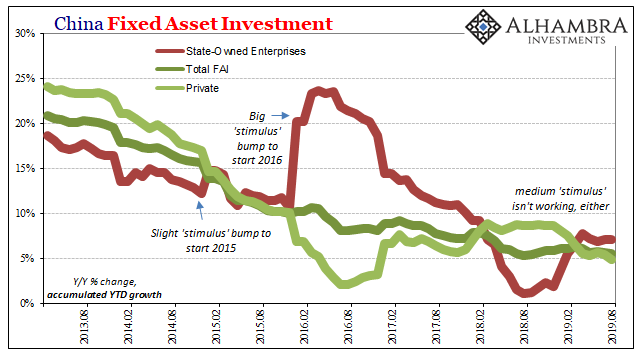

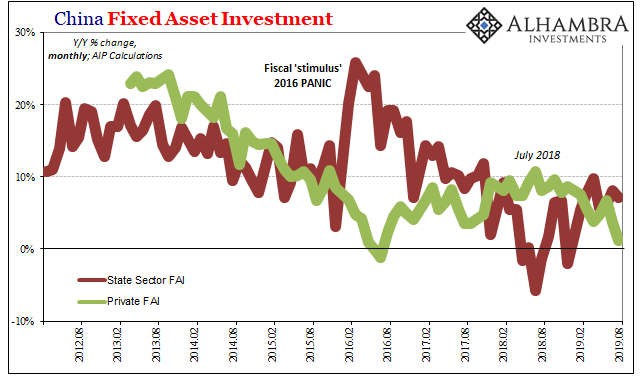

But if there was one economic account that could potentially unite any political factions among the ruling Communists, it would be Fixed Asset Investment (FAI). Specifically, Private FAI.

The NBS reports that overall, total capex spending in the January through August 2019 period was just 5.5% more than during the same months of 2018. That accumulated growth rate is the lowest since last summer – and it, too, is within reach of a record low (5.3%).

China’s authorities are doing their part – somewhat. While they haven’t yet panicked like they did at the outset of 2016, with things relatively better back then than they are now, State-owned Enterprises (SOE) are at least maintaining a steady rate of fixed investment. At 7.1% accumulated, the “stimulus” this year has been constant unlike last year in 2018.

And it’s just not working. Not only is IP at a new low and Retail Sales moving back toward one, too, Private FAI on a monthly basis (which requires a few basic calculations to convert the NBS accumulated) in August grew by just 1.1%. You have to go back to the last bottoming out of Euro$ #3 in 2016 for any other month near and below zero – and even then there were only two.

What China really needs is dollars. Desperately, which is why they’ve been opening up every possible intake channel of late. I wrote last week:

The whims of the eurodollar, its general behavior directs these worldwide cross currents. Having never recovered from what was Euro$ #3, China is heading down deeper into Euro$ #4.

To try to offset the painful monetary influence, there will be still another RRR cut next week [this week] and quite predictably Chinese authorities are extending their kindest and warmest regards to anyone with dollars who might want to invest them in the country.

The eurodollar system squeezes everything. The financial system, the political leadership, and, above all, the global economy – starting with China. I doubt it was the sort of China-First policy anyone has had in mind, but it may ultimately be the one that gets the Chinese leadership on the same page. And that’s not a good thing, this nastier number four.

Stay In Touch