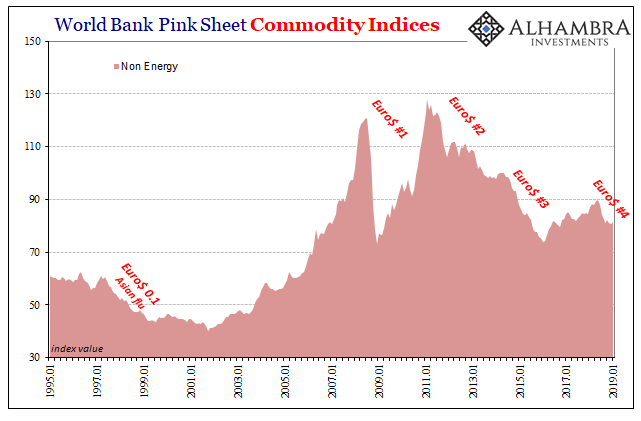

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018.

The last time they had fallen by that much it was May 2016.

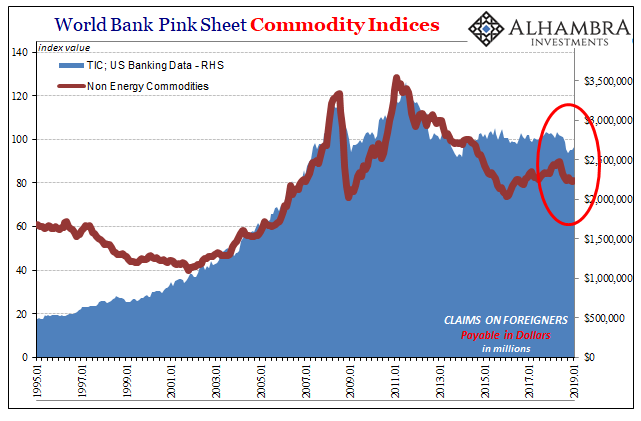

Commodities are one key intersection between money and real economy. Both are forward looking. Physical as well as monetary imbalances play off each other, performing checks on assumptions; are virtual money deficiencies “real” in the sense that perceptions about forward fundamental supply and demand are confirming?

They don’t always have to agree even over the intermediate term. Periods of divergence can be just as informative. In the eurodollar sense, Reflation #3 begun in the latter half of 2016 was uninspiring. For the banks within it outside of Goldman Sachs and perhaps Deutsche Bank, they were overall uninspired.

Yet, commodity prices seemed to be quite enthusiastic about economic opportunities under what would later be called globally synchronized growth. That narrative, nothing more than a marketing slogan, seemed to have more of an effect in these markets compared to the monetary system. Odd, to say the least.

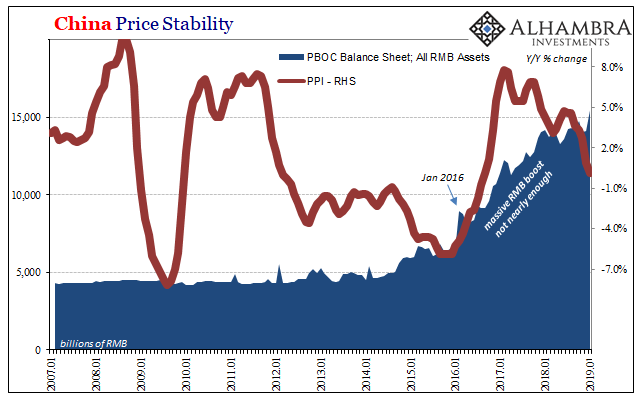

More and more it seems a head fake, one centered, I believe, on China and RMB. The eurodollar world stumbled out of Euro$ #3 and never really regained much momentum. That meant the Chinese system would not recuperate much of its lost monetary base – “dollars” in the form of foreign reserves.

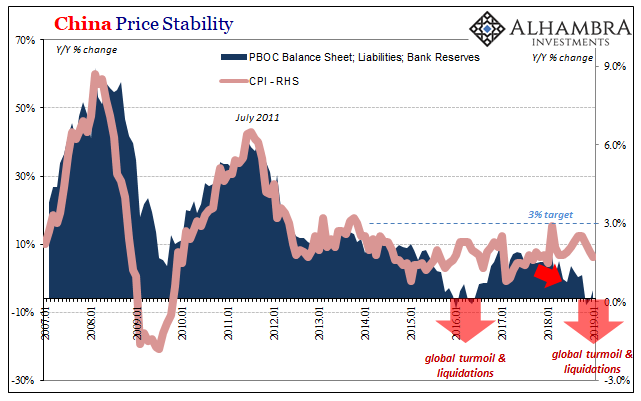

There was a conscious decision at the outset of 2016 whereby the PBOC would fill in the gap by printing RMB through its own discretionary balance sheet activities. Forex assets might still fall, and they did, but Chinese money wouldn’t as the balance tipped more toward “unbacked” RMB.

Commodities even China’s economy seemed revived by the prospects. It was anticipated to be the biggest decoupling attempt yet; if the eurodollar world wouldn’t completely heal itself, then the PBOC might just go its own way for the first time ever. Perhaps this is what brought European banks a little way back into the eurodollar world for the first time in many, many years.

China’s monetary officials, it seemed, had stolen a page from Mario Draghi; to do whatever it took.

But like the narrative of globally synchronized growth, it was much too grand in the collective imagination. The process was stifled from the very beginning by a mess of constraints, not the least of which China’s never-solved dollar deficiency. They could make use of Hong Kong and thereby make a conduit for Europe’s small generosity, it still wasn’t a permanent solution.

The PBOC could make money growth positive with this new RMB, but not by all that much.

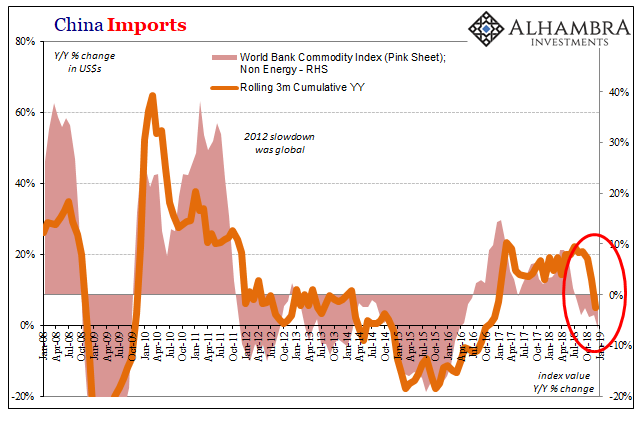

Like the US, at some point the boom had to actually boom. Figurative booms are nice and all to write about in the mainstream media, but commodity investors out on a limb are going to have to see some real flows at some point. RMB or not, China’s economy had to take off before patience ran out. Really take off.

Even in the best months of 2017, monetary constraints were all-too-visible no matter how far CNY kept rising. The best magic tricks are those where you don’t immediately recognize the illusion.

For all that RMB put into practice, the dollar drag was just too much to overcome. These two competing viewpoints finally converged at the end of 2017. Coming together in 2018, they made last year an increasing mess.

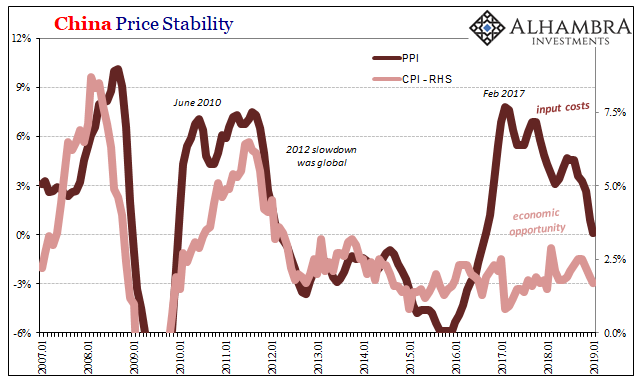

China’s National Bureau of Statistics (NBS) reports today that consumer price inflation slowed yet again in January 2019. The CPI gained just 1.7% year-over-year last month compared to a 1.9% growth rate the month before and as much as 2.5% back in October 2018.

But that was all food price inflation, not the sort of labor shortage, healthy economy stuff Economists keep anticipating. This wouldn’t be the expected result of effective, determined RMB printing.

It is in producer prices that we see most clearly the difference between RMB hope and eurodollar reality. China’s PPI unlike its CPI surged while the PBOC’s MLF was doing a brisk RMB business with China’s big banks. Commodity investors merely presumed this was the key to a global rebound.

RMB is just not enough by itself, certainly nowhere near the monetary capacity to steer the global economy let alone forcing it to overcome its near constant eurodollar drag. The NBS also reports today that factory gate prices, China’s PPI, was basically flat in January barely positive at +0.1%.

With commodity prices still sinking even modestly (by recent historical standards) input prices are going to be contracting at some point, too. As a forward leaning indication predicated on commodities, it seems that money and physical economies are back together again for the first time in several years. That’s the bad news. There is only bad news.

There was a whole lot that was wrong with globally synchronized growth. The RMB head fake, though, is right at the very top of that list. People wanted very badly for it to be true, so they made it true. Something was different, they said, and it was. Only, what was different wasn’t the right thing to be different.

Every poker player knows that once you’ve tipped your hand the game is lost. Having gone down the RMB route, and having showed how little it achieved, now what?

Stay In Touch