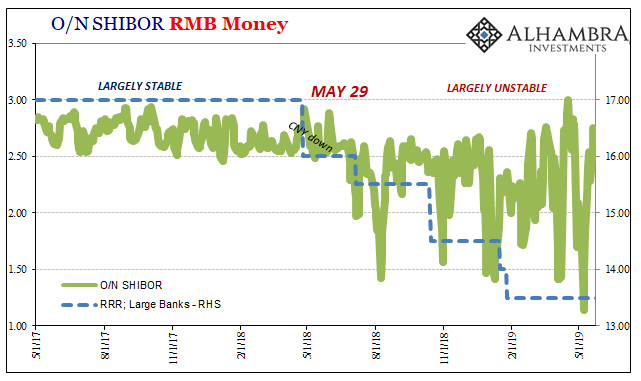

Earlier this month, the People’s Bank of China (PBOC) reduced the percentage of liquid reserves some banks are required to hold. Effective May 15, the Chinese central bank estimated that the policy change would release about RMB 280 billion into the system. This RRR discount, however, was only applied to small and medium-sized banks.

The reserve rate for large banks has been the same since late January when the PBOC allowed for two reductions (on top of three others before them). Monetary officials have been very clear about their goals. This is targeted policy aimed to boost lending rather than bubbles. The assumption, one of them anyway, is that large banks tend to release liquidity everywhere – including the infamous wealth management products and shadow banking conduits.

When the central bank acted back last October, the statement accompanying the change to RRR for large banks was very explicit:

The People’s Bank of China will continue to implement a prudent and neutral monetary policy, not to engage in floods, to reorient and control, to maintain a reasonable and sufficient liquidity, to guide the reasonable growth of monetary credit and social financing, and to create a high-quality development and supply-side structural reform. A suitable monetary and financial environment.

Take them at their word here. Their strategy is perfectly clear, therefore also the implications.

Managed decline.

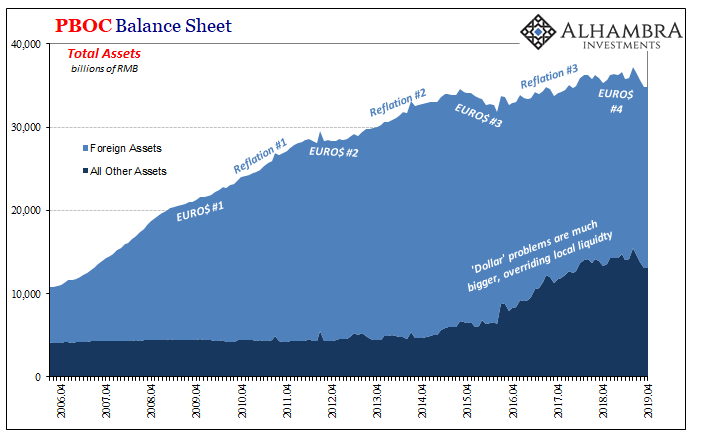

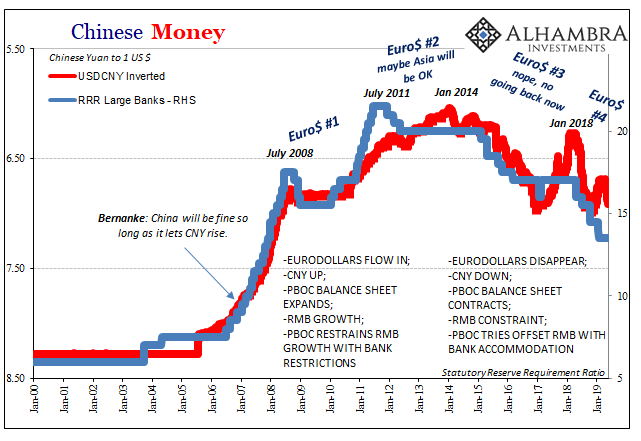

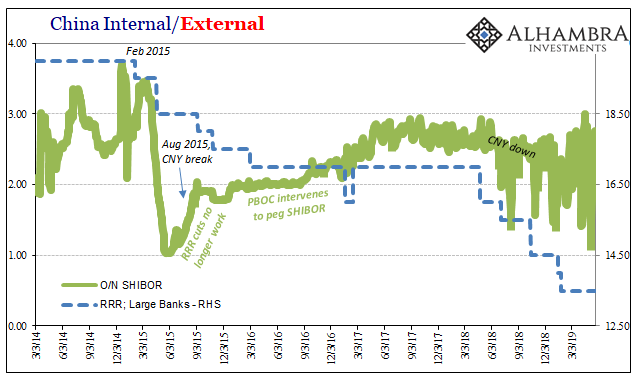

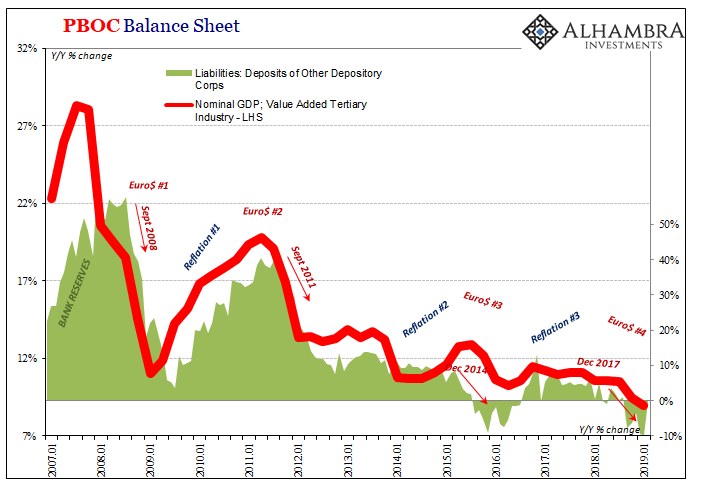

Let’s start with the top level, or topline as it is in this case of central bank accounting. China’s monetary system is built upon foreign inflows. The RMB is backed by the eurodollar system, including denominations beyond the US$. When financing isn’t easily available for the country as a whole, the PBOC’s balance sheet is constrained.

Because of that external limitation, it means the same thing on the liability or money side. Without growth in assets, there cannot be growth in liabilities. The one exception was 2016 when likely due to government pressure and fears over where Euro$ #3 was taking the country (uncontrolled decline) the PBOC was given the green light to offset dollar “outflows” with RMB printing.

We’ve covered the downside of that program before. A lot more imbalance with basically nothing gained. The result, as a matter of policy now, “not to engage in floods.” Either the dollars come back in as the eurodollar system starts to work again, or the dollars go out and the Chinese manage the decline as best they can.

When you more appropriately put it that way, it really doesn’t sound much like “stimulus.”

The best they can is a twofold least-worst case. Aside from government deposits, an exogenous factor, the liability side of the PBOC or any central bank’s balance sheet is currency and bank reserves. Unlike the US system, bank reserves actually play a large role in RMB liquidity and therefore China’s economy.

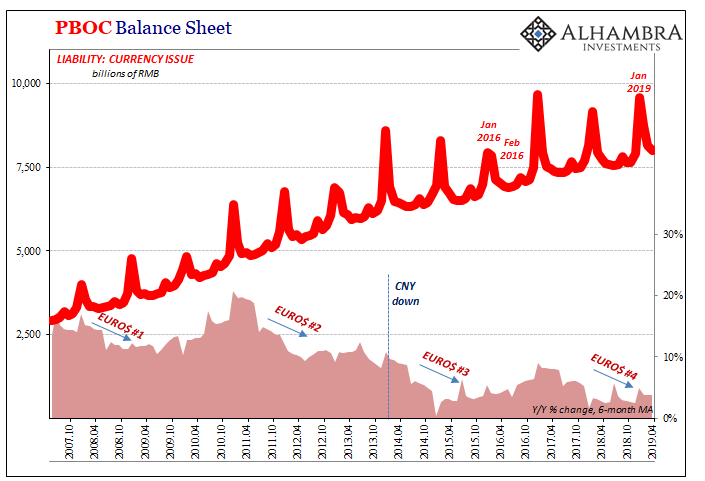

Which would be worse for it, reducing bank reserves to banks or cutting back the physical currency actually in circulation? It’s not really any question at all. Currency growth has to be prioritized. That doesn’t mean, however, it won’t suffer balance sheet reduction, too.

In fact, RMB currency growth has been squeezed practically down to nothing. Again. As of the latest balance sheet figures for April 2019, currency issue rose just 2.8% year-over-year. It’s another month below 3%, near the lowest on record. In fact, that’s been the case in almost every month (except January and February, Golden Week skews) going back to last August.

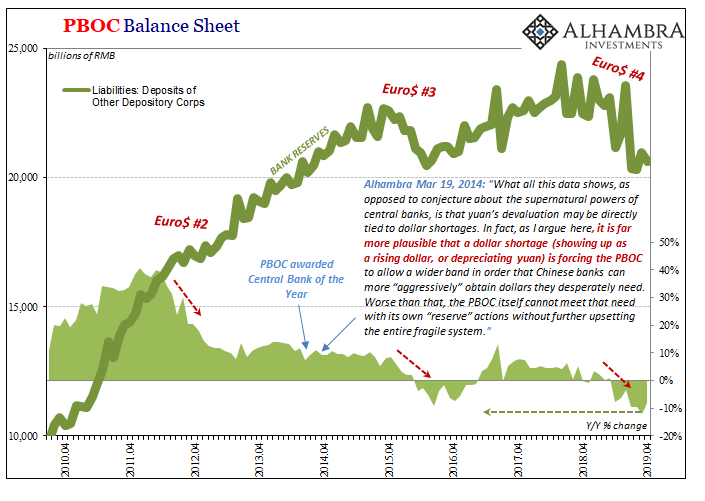

But in order to manage just that minimal growth in currency, the dollar squeeze on the asset side means something has to give. The only thing left, China’s big monetary fudge factor or plugline, is bank reserves. Therefore, in order for currency to stay positive bank reserves have now to contract by around 8-10% every month.

Following a massive 12.2% year-over-year contraction in March 2019, last month bank reserves fell by another 8.2%. The 6-month average is now also -8.2%, by far the worst in modern Chinese history. During Euro$ #3’s squeeze on China, the lowest the average had gotten was a quaint -5.6%.

Enter the RRR. It is the last line of defense, the final lifeline factor which demonstrates why the PBOC has chosen this strategy. To “pay” for even a small bit of currency growth, the central bank takes away from the overall level of bank reserves. To put some of them back, it allows China’s banks to use more of what they have at their disposal; reserves long ago locked up when monetary growth was taken for granted.

It is the equivalent of an amateur, untested acrobat walking an extreme tightrope over the whole expanse of Niagara Falls.

Back in October, the PBOC statement also said:

The liquidity of the banking system is basically stable. The monetary policy is stable and neutral, and the monetary policy orientation has not changed.

Is it stable, though? One of the more pernicious aspects of modern Economics is how people are taught to focus and even obsess about only the nominal direction of interest rates; down is good, up is bad. That can be true, but it’s much more complicated than all that.

Sometimes down is bad and more so when up and down are unpredictable. Volatility being the opposite of stability, in money markets where large positions and decisions depend upon predictability the consequences can be equally large.

Earlier this month on May 8, just a few days after the last targeted RRR was announced, but still a week before it became effective, the overnight SHIBOR rate plummeted to just 1.141% – the lowest since the rocky, low-rate summer of 2015. Four days later it was 2.4123%, a 127 bp increase in a very short period of time. The rate would gain another 33 bps to this past Monday.

Is liquidity actually stable?

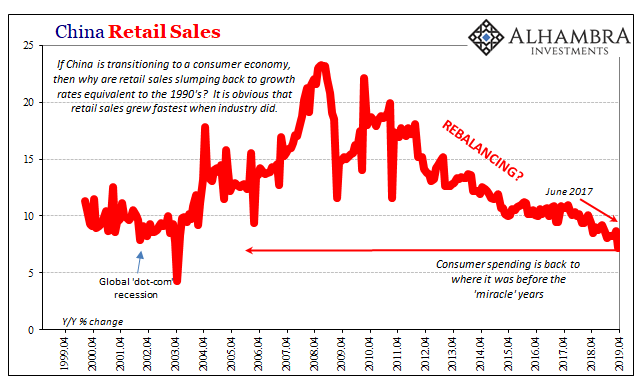

That’s only where the problems begin. Again, China’s central bankers haven’t many options. For this highly suspect and questionable liquidity, as RRR sometimes maybe offsets a continuously sharp drop in bank reserves, the system can only manage minimal currency growth. It seems too asymmetric, giving up a lot to gain very little.

It may be the best of a really bad situation, but all that does is remind us this is a really bad situation.

Managed decline actually makes it sound better than what’s really happening. A more realistic label would add scare quotes around the word in question. There is no question about the decline, nor where it originates. What is in doubt is how much and how effectively it is being managed.

“Managed” decline.

This is what they are telling you is China’s big stimulus.

China will be pumping money into their system and probably reducing interest rates, as always, in order to make up for the business they are, and will be, losing. If the Federal Reserve ever did a “match,” it would be game over, we win! In any event, China wants a deal!

— Donald J. Trump (@realDonaldTrump) May 14, 2019

Stay In Touch