In a period when weird and unusual are commonplace, it was one of the more noteworthy and interesting outliers. Late in August 2010, a media report attributed to Hong Kong’s Ming Pao news agency suggested Zhou Xiaochuan was on the run. Supposedly, the Governor for the People’s Bank of China, the country’s central bank, was defecting to the United States ahead of Communist authorities detaining him.

The report said Governor Zhou hadn’t been seen in some time. It had become known to China’s governing council that the PBOC had somehow lost $430 billion on its US$ holdings. If true, arrest would have been imminent and the least of his problems.

Chinese authorities had to be careful, though, as it was also rumored how the US Federal Reserve’s Vice Chairman Donald Kohn had blackmailed them, threatening to retaliate by disclosing 5,000 secret Swiss accounts in the name of various high government officials if they tried to apprehend the fugitive central banker.

It caused a minor sensation in the few days social media, in particular, was abuzz. Eventually, very quickly, Ming Pao disavowed the story as fraudulent, which had only been given legs when picked up by US-based Stratfor. Apparently, it sounded plausible enough to a certain few.

It’s worth remembering, therefore, because the tale underscored the nature of the global entanglements we are dealing with. This eurodollar system touches everyone. China has huge holdings of “reserves” and its actions can set off a chain of reactions. Not only are the economic and financial fates of the US and China intertwined, so are their officials.

Zhou Xiaochuan, a so-called haigui, a sort of sea turtle pun in Chinese, someone who has traveled West and then come home, was intimately familiar with American high government officials not just those in the Federal Reserve. According to one story, playing a tennis match against White House Economist Larry Summers in 2009, the pair joked that the winner would set the dollar-renminbi exchange rate (CNY).

If only either of them knew how.

If the story about the losses was true, that’s just where Zhou Xiaochuan would’ve ended up. But that’s not how these things work. What ultimately matters in the end is economic growth. The bond market really is pretty simple – leaving anyone to wonder why Economists just can’t seem to understand it.

The language barrier central banker to bonds is really about the basis for each’s perception. According to Economics, the central bank is central therefore the bond market should merely obey; the Fed sets the agenda and the curve falls right in line. That’s not how it works, therefore the unending nature of Greenspan’s “conundrum” (he of a series of one-year forwards priced out at the beginning by federal funds expectations alone).

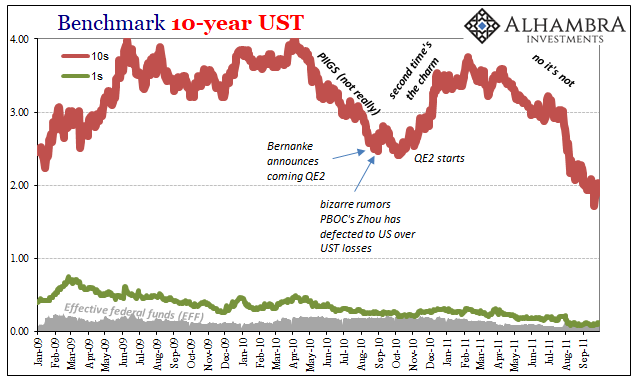

In 2010, it was just that simple. Higher nominal rates later in 2009 suggested the bond market was onboard with QE1 and ZIRP; these could work and bring about full and speedy recovery. In early 2010, presented with a series of “anomalies” in funding markets, starting with Dubai and eventually Greece, bonds turned back more skeptical. Yields fell sharply. Economists were confused.

Whether or not the Zhou story was intended as a message, or if it was just some rudimentary prank, who knows?

Either way, the bond market returned to giving Ben Bernanke the benefit of the doubt later in 2010. After QE2 was announced and then launched, yields rose sharply – reaching 3.75% (10s) in early February 2011. Then more “anomalies”, much worse in 2011 than 2010. By September 2011, just nine months after 3.75%, the yield on the benchmark 10s had plummeted by a little more than 200 bps!

Most of that plunge, importantly, happened in late July and early August – the very same time when the FOMC’s emergency calls and meetings were filled with stunned observances of increasingly desperate liquidity conditions despite more than $1.6 trillion in bank reserves created by QE’s 1 and 2.

Recovery equals higher rates; liquidity risks equal lower. Maybe these guys have no idea what they are doing, after all.

There is, however, one other wildcard, one that in very short-term periods makes the central banker smile with transitory fulfillment. The very short end of the curve plays a role here. It’s not central as in the mainstream theory, nor does it seem to last. The intermediate and long end of the curve given a little time acts independently regardless.

UST yields were open to swing wildly in 2010 and 2011 because there was no interference from the short end. As Euro$ #2 more completely developed in Spring 2011, the long end could plunge far and fast with nothing stopping it – bill rates as federal funds were all down near zero. In a sense, ZIRP kind of backfired for misunderstanding the nature of interest rates (lower rates are not good, especially over long periods of time).

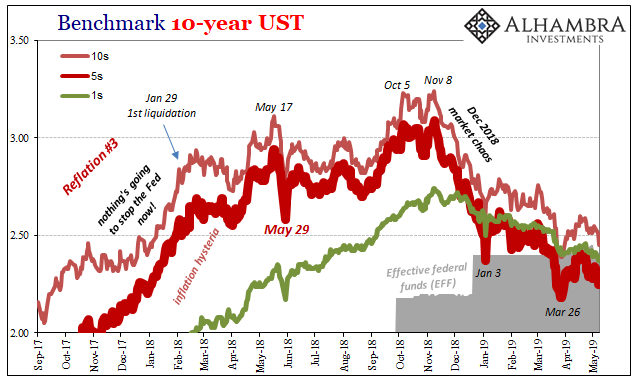

It’s much different in 2018 and 2019. Faced with rising illiquidity, bond yields have fallen but nowhere near the way they did when ZIRP was involved. The short-end is in the way today.

For how long, though?

The 5-year UST broke below federal funds back in January and then straddled the short end for weeks before finally punching through the barrier in March. With the exception of April 16 trading, the 5s have yielded less than federal funds ever since.

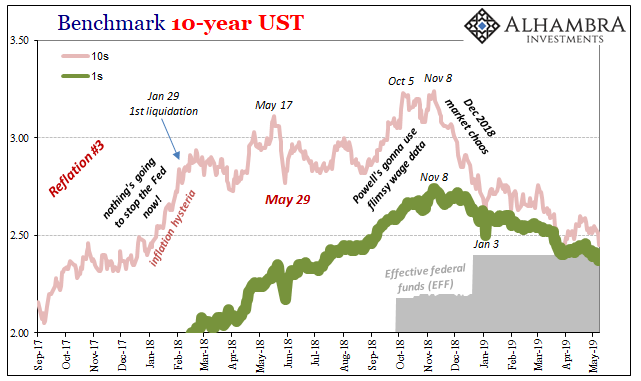

If I was Jay Powell, though, I’d be even more concerned about the 52-week bill. There’s more short-end stuff in that one than independence of the long end. As such, its behavior going back to November 8 is a slap in the face of the FOMC. A new sort of conundrum, if you will.

Fed officials are now trying to say “transitory”; as in, there was a soft patch, a growth scare back there at the end of 2018. That’s now over and to make sure, Powell and his gang of Economists have pledged they will not raise rates again perhaps this year. But, as you can see above, the 52-week bill (1s) isn’t buying it.

Starting late last month, and continuing throughout May so far, the yield on the 1s has also broken beneath EFF. That’s a bigger deal for Powell because as a more short-end rate we’re talking more purely about money alternatives here. The potential for rate cuts grows even louder. This perhaps more than even eurodollar futures is a bad sign for how 2019 is being price out one-third of the way through it.

Going back to November 8, the 1s have been very steady in their reversal; before November 8, hawks and rate hikes. Maybe not agreeing with why Powell was doing what he wanted, at least signaling that Powell would continue raising the federal funds levers anyway.

Now, with the 1s firmly below EFF this has escalated beyond the simple Fed “pause” scenario. Again, rate cuts are being considered a more probable setting in the most important market in the world – uninterrupted by the noise of FOMC officials projecting calm and confidence.

Why November 8?

One reason may have been the FOMC. That was a meeting date and the statement the Committee released contained only one change, but it was a noteworthy one. In its prior statement for the immediately prior meeting, the text said business fixed investment had “grown strongly.” This was rewritten on November 8 to “moderated from its rapid pace earlier in the year.” It was the first indication that the growing weakness was filtering into the heretofore unbreakable official narrative.

More than that, though, China. On November 7, that country’s foreign exchange manager reported some pretty substantial declines in forex. No, Governor Zhou, who had since retired earlier in 2018, didn’t screw them up. Instead, as I wrote:

The dollar shortage, or eurodollar squeeze, however you wish to call it, is growing more disruptive not less (where’s federal funds lately?) We can see the results of the disorder scattered all across the globe. Nothing is more consistent with the sudden struggles in the European economy of late as China’s declining foreign reserve balances.

A day later, Chinese authorities in the Banking and Insurance Regulatory Commission published a highly unusual directive:

On the surface, it sounds like very little, the usual Communist infatuation with top-down economic targets. But at this moment, the implication taken together with everything else suggests an almost bailout. Monetary tightness combined with possible further economic weakness could push China’s corporate sector into the abyss and it appears Chinese officials at the top are really worried about it.

Put it all together: monetary tightness globally picked up in China (loss of forex) leading to more than economic uncertainty (corporate risk) in the country that may have already impacted the same way (business investment) in a US economy that was supposed to have been impenetrably booming. Two months later, there are no hawks left.

Recovery equals higher rates; liquidity risks equal lower. It’s nowhere near as clean as 2011, but the short end is becoming less of a barrier to the long end the further we get in 2019.

Contrary to the media, and the stock market post-Christmas Eve, those risks have been more and more validated by incoming global data. And now the 52-week bill is substantially beneath federal funds itself contravening three technical adjustments to IOER.

All this stuff is related, and pretty darn consistent. The difficulty lies in trying to translate everything from the view of central banks being central. Maybe that was the entire point behind August 2010’s bizarre Zhou rumor, to perpetuate the myth that these guys and their big numbers sure seem to matter so much. They really don’t, however. Take a look at the 52-week bill.

Stay In Touch