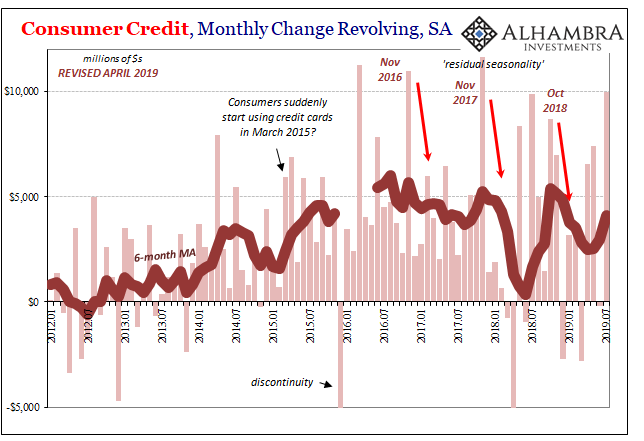

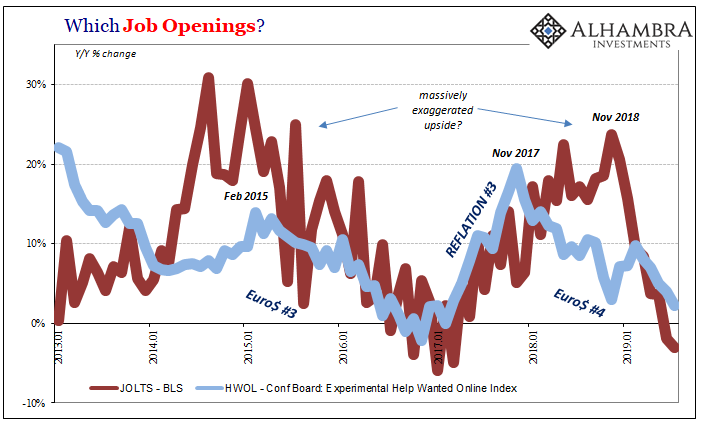

The Federal Reserve reported yesterday that revolving consumer credit in the US rose by a seasonally adjusted $10 billion in the month of July 2019. That was the largest single monthly increase since November 2017. Given how the latter month was related to “residual seasonality”, meaning Americans spending perhaps more than they wanted for the Christmas holiday, and the middle of summer is not, it raises some questions about what’s going on at the margins of the labor market.

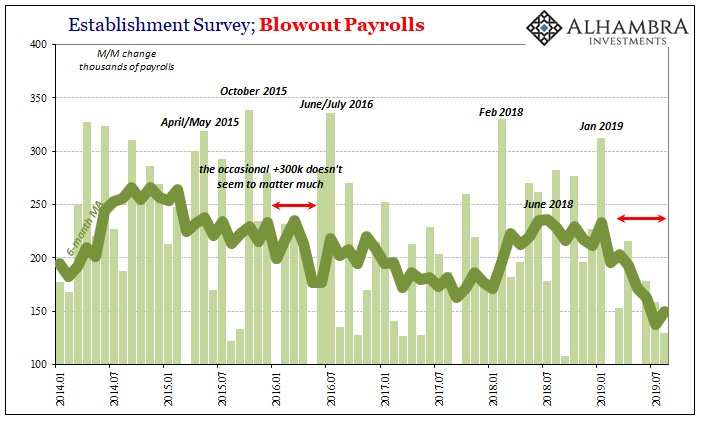

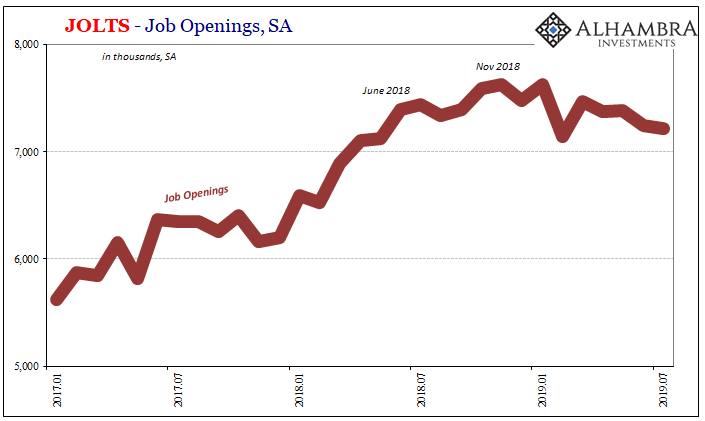

As noted for some time, everything now hinges upon the employment and related data. What the Fed will do, how the public will see the economy, it will all come down to which way the BLS numbers trend. And I don’t mean the unemployment rate.

That’s why we might look at a tertiary indication like consumer credit. Seeking to validate our interpretations of what looks to be pretty weak employment and labor figures, the rise in especially revolving credit adds just a little bit more to that view.

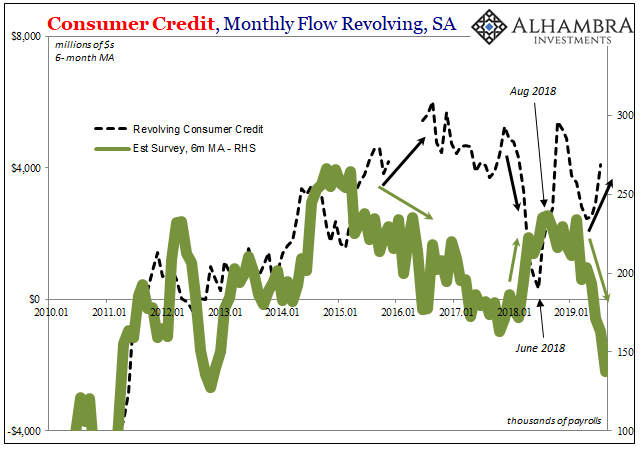

Unlike before the summer of 2007, Americans are no longer in love with their credit cards. It now appears that these are to be used only when needed, more of a last resort than a first instinct. Why do we think this way? Because there’s a pretty clear inverse correlation between job growth and revolving credit card use dating back to the labor market slowdown which began (under Euro$ #3) in early 2015.

The trends again seem to be moving in opposite directions. The revolving credit balance, in the aggregate, is seeing larger monthly gains in 2018 and 2019 at the same time the Establishment Survey reports more and more the absence of big ones in jobs.

Obviously, this doesn’t prove anything; at best, an intriguing inverse correlation that might add some useful color for analyzing the plight of American consumers.

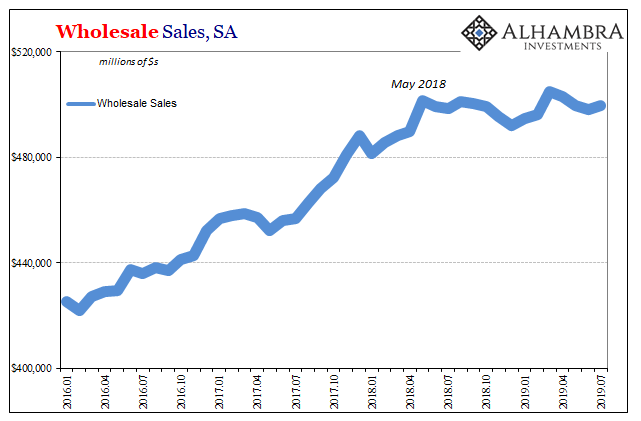

When looking at other data like retail or wholesale sales, the last couple of years (2018 and 2019, and a high residual seasonality figure in between) suggest consumers haven’t given up but they aren’t exactly holding up, either. More exhaustion than the strength let alone epic job market tightness central bankers and Economists have been talking about.

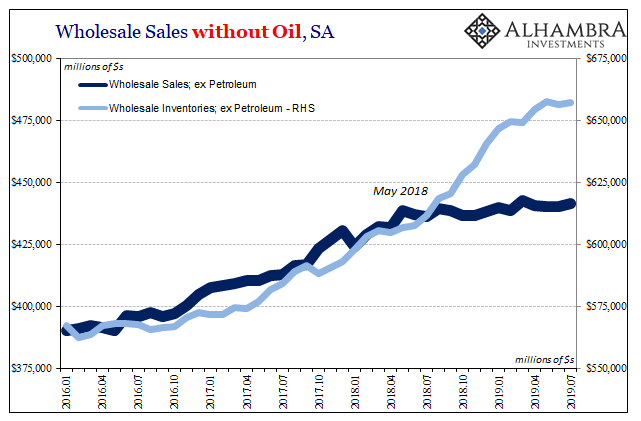

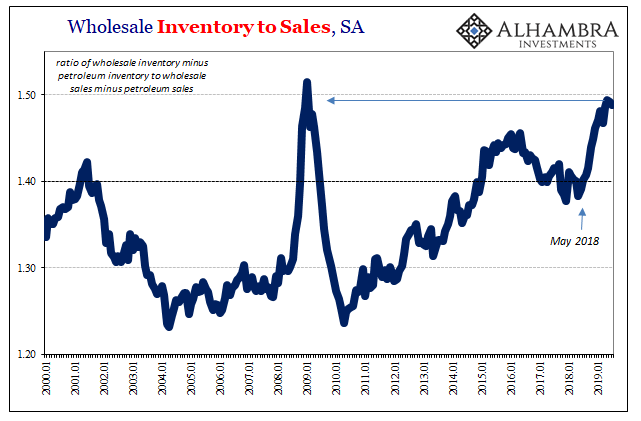

It was around May 2018 (May 29) when revolving credit climbed back up and the labor market data peaked that wholesale sales, in particular, registered what is now a more than yearlong pause (which, like durable goods, may amount to something more than a pause and more like contraction, though one that may not be fully revealed until upcoming benchmark revisions in future years).

What stands out is how this break in sales clearly diverges from wholesale inventory, which can only mean one thing – wholesalers as anyone else along the supply chain were expecting robust growth only to find there wasn’t any at all.

That interpretation fits within the paradigm of credit card usage being more “have to” than “want to.” When those at the margins have to use credit cards they are going to be more careful about it. Therefore, a change in direction at the margins which, for now, the data says was at least an inflection in overall spending on goods (confirmed by retail sales).

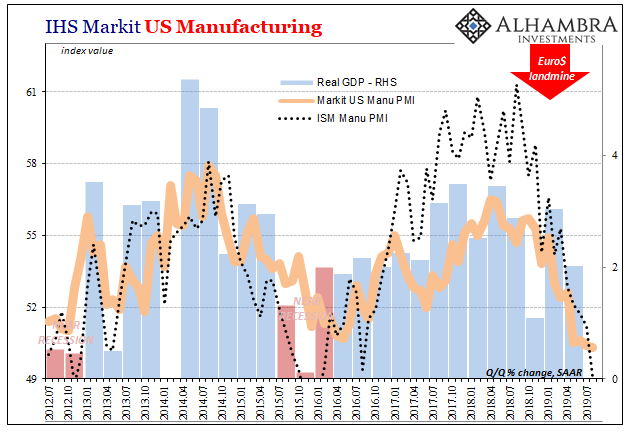

The broader economic consequences of that are what we have been seeing in places like manufacturing and now service sector PMI’s (acknowledging that a whole lot of service activity is related to the movement, management, and sale of goods).

The unanticipated (businesses and business professionals still listen to, and make their forecasts from, Jay Powell because there is apparently nowhere else to turn) buildup of inventory puts the brakes on production orders. The distance between sales and inventory was created by, as suggested in “have to” credit cards, an abrupt change in consumer spending due to perceptions of and in all likelihood the reality in the labor market.

Not strong.

And that was before getting up to speed with more recent projections nearer to where things might stand right now at this moment.

Altogether, it proposes the balance of risks are entirely on the downside which will mean all those things stated in the outset here: no way the Fed is one and done, not that it really matters in the economy, and, in what would be John Maynard Keynes’ worst nightmare, the perception of these risks increasingly acted upon by consumers as worried workers.

In fact, the rate cuts are as much intended to reassure those consumers as anything else; something they’ve been told to believe is a huge positive to cling onto (expectations policy) in the face of what can only be a lot of serious and growing negativity. Break the expectations cycle of recessions. Rate cuts don’t do anything as far as money and banking are concerned (moneyless monetary policy).

Under far different circumstances, like those Economists and central bankers have been promising for half a decade now, a determined increase in revolving credit might be interpreted far differently – as a good sign of recovery, risk taking in that vital consumer area. It is increasingly clear how this small piece of the overall situation fits instead into a much different economic puzzle.

Stay In Touch