There are those which are so very clear in their disingenuousness – to the point of overdoing it and becoming obviously absurd. In the increasingly desperate rush to downplay the headlong race to rate cuts, this one’s up there:

Eurodollar futures traders, having decided that the Federal Reserve is likely to cut the fed funds target range at least twice over the next six months, are looking beyond the expected easing cycle in search of their next edge — the point at which rates will resume rising.

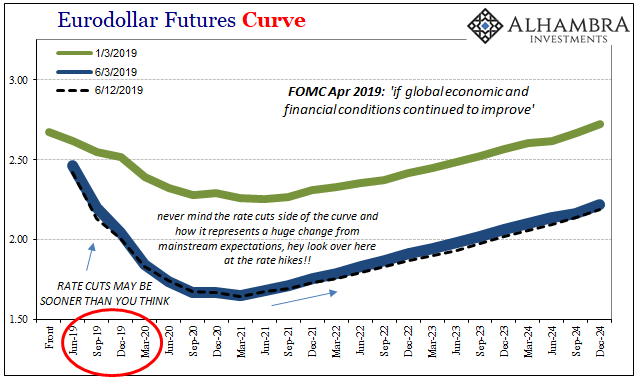

I mean, come on! Have they never once seen an inverted curve? Or do they think you, their reader, hasn’t? I’ve seen and catalogued some whoppers over the years, and this one is high up on the list of pure rationalizations.

It is, after all, a curve. Even inverted during the prelude to some of the worst times, the thing will never just slope ever downward to some NIRP-y oblivion. There’s always, always the other side of the surreal smile. In other words, no matter what, no matter when, the upside track of rates is always an included feature; nothing whatsoever abnormal about it.

And the real irony in pointing it out is that the far end of the eurodollar curve is actually sinking. That’s right, even when short rates are predicted to rise after, the market is betting on a lower and lower rebound trajectory. That’s the supposed good news? The economic and financial damage from what’s coming will be lingering for some significant length of time following.

It’s a pretty transparent attempt to make what is a very bad change seem something much less so, and using a set of instruments drawn from a market even these writers probably don’t really understand (I can confirm this in several personal instances). Take a look at the curve and if you think rate hikes is the most newsworthy feature…

The real meaningful message here is, ask yourself, what would anyone in the mainstream have thought if at this time last year they were told that rate cuts plural would be the only FOMC moves in 2019? They’d have lost their minds, that’s what. It would have seemed otherworldly, beyond impossible – even though the eurodollar futures curve inverted one year ago tomorrow, predicting over time a growing probability for this very scenario. The front end is what mattered and matters even more now.

At that very same time, it also constantly pointed toward “the point at which rates will resume rising.” As to that second part, no one really cared last year nor should they this year. Not yet, anyway. Why should they? We still don’t know what’s today just around the corner.

After all, you wouldn’t ever think much positively about slamming on the brakes and feeling good, being comforted in the knowledge that after you hit the car right in front of you, you’ll be in the ambulance getting treatment soon enough thereafter. This would be a very twisted sense of positivity.

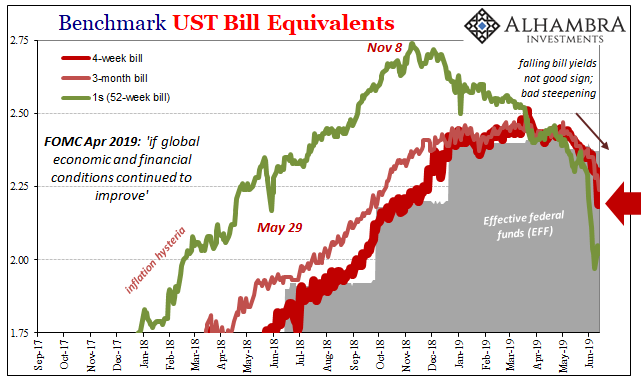

One key indication where “soon” comes in is the collected perception of bill yields. The equivalent interest rate for the 52-week instrument has already dropped precipitously consistent with the eurodollar futures. The 4-week bill has now plummeted, too, an incredible 11 bps plunge in just the last two trading sessions (including today). In 4-week territory, that’s an enormous move.

What does Jay Powell have to see in the economy that makes him propose and vote for the first one…at the end of July? And when he does, we’re supposed to pay more attention to Spring 2021?

Somehow, though, I’m guessing for all their downplaying and misdirection even the mainstream message will soon enough start reluctantly focusing in on the front part, the downward slope of the impossible, no-way-it-could-ever-happen inverted smile. Maybe some day people will start wonder why all this.

Stay In Touch