Tucked away in a quiet little corner of the BIS publication library, a study was published in the organization’s September 2015 Quarterly Review. One of the biggest mysteries of that time was Chinese “capital flight.” It was breathtaking, and it would only get worse. What was really going on?

Many if not most mainstream stories focused on capital restrictions. There were plenty of published anecdotes about how wealthy Chinese billionaires were, by hook or by crook, trying to get their money out of the country while they still could.

Here’s one such story published early in 2017:

Analysts said that despite tighter scrutiny, the outflows were likely to remain strong for years to come, with companies and individuals looking for better investment opportunities while safeguarding their money against a weakening Chinese economy and a falling yuan currency.

It was a sexy narrative, to be sure. And it never came close to the numbers involved. These ran into the hundreds of billions, and quarter after quarter. There’s not that many billionaires in all of the world. Corporate treasuries would have to be totally emptied.

For the scale involved, there was only ever one realistic suspect.

Robert McCauley and Chang Shu from the BIS took a more deliberate, and intelligent, stab at it. Updating their figures in March 2016, the authors wrote:

Persistent private capital outflows from China since June 2014 have led to two different narratives. One tells a story of investors selling mainland assets en masse; the other of Chinese firms paying down their dollar debt. Our analysis favours the second view, but also points to what both narratives miss – the shrinkage of offshore renminbi deposits. [emphasis added]

Their numbers were persuasive. In the third quarter of 2015 alone, $175 billion in cross-border balances just up and vanished.

Using their database of reported estimates, they started with about $12 billion in official RMB reserves which were shifted offshore (a net outflow using this accounting basis).

This left $163 billion in private flows. Of that, $34 billion was due to China’s corporate sector reducing its foreign debt liabilities. Primarily denominated in US$’s, it counts as a capital outflow, too.

Another $7 billion was attributed to direct foreign currency loans. Firms inside China reported fewer of them with banks also inside China. It was therefore assumed, given the way the global monetary system works (dollar short), any change in foreign currency balances between China’s corporate sector and its banking sector will lead to the same change between China’s banking sector and the external financial sector (eurodollar market); China’s banks merely the middleman or redistributor from source to end user.

About half of the private total decline, $80 billion, was due to banks located outside China reducing their RMB balances inside China. Also booked as an outflow, the BIS researchers, however, regarded this as being “associated with depreciation in the renminbi/dollar rate.” They don’t say why because everyone’s been told and taught financial agents hate currency volatility for its own sake.

It still leaves tens of billions during Q3 2015 unaccounted for; about a quarter of the private total.

The lack of demand for onshore RMB can be for other more prominent reasons. In the same way foreign central banks and governments build up a dollar buffer within FRBNY’s foreign repo pool, funds going in the other direction require the same thing. What I mean is, for all those trillions of eurodollars which ended up inside China there was always an RMB buffer for net cross-border payments, too.

The more dollars going in, the more RMB held as reserve.

On the other hand, if you expect less payment activity going into and out of China you don’t need as much of an RMB buffer. And if you expect that case because of, say, a dollar shortage then the foreign repo pool and these private RMB buffers are going to be moving in opposite directions; less of the latter, more of the former.

The world increases their dollar buffer (dollar shortage) at the same time they reduce their RMB buffer (inside China, booked as a “capital outflow”). In this case CNY DOWN = BAD does apply; just not specifically because of CNY falling in terms of volatility or “devaluation”, rather because of what’s motivating the currency to move in the first place.

Dollar shortage, or the concept even of dollar destruction. This isn’t the same as de-dollarization.

In the “capital outflow” story(ies) no matter how you originate them, money has left China, sure, but then it has to go somewhere else. In the eurodollar story, dollars disappear from China (or anywhere else) because banks shrink their liability structure in response to, as well as the cause of, the facts behind CNY DOWN.

The dollars are destroyed, in essence. It’s not an outflow so much as a negative redistribution.

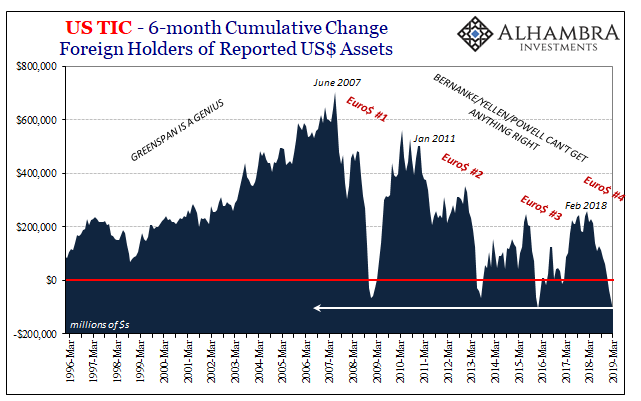

It sheds a different light on the BIS estimates, preserving still the scale of the numbers involved; therefore, a sense of just how big this problem might have been. Why was 2015-16 for EM’s and Asia in particular as bad as 2008 was in the US and Europe? Immense dollar destruction would be the answer.

And it was all a big mystery while it unfolded. We were otherwise left to figure flighty Chinese billionaires as the reason why nearly $1 trillion in reported reserves disappeared from China by the time all was said and done with Euro$ #3. It was never a credible explanation.

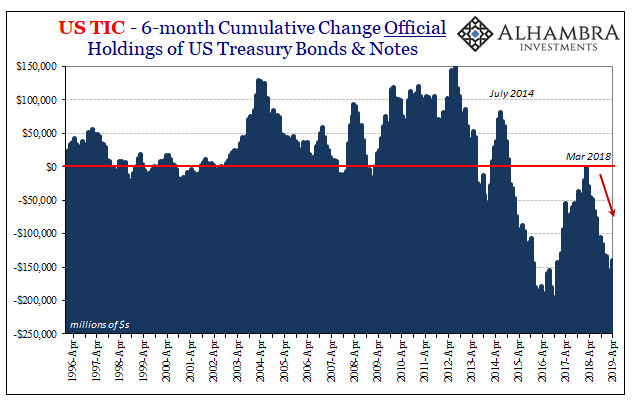

Such a global monetary desert plays out in all sorts of ways, as we are finding again during Euro$ #4.

In the minutes from the June 2019 FOMC meeting released today, the very first section is about what will effectively be QE5. I’ve written up the tortured details behind this standing repo facility before.

What is most striking about the minutes is not that the thing is in it, or how it might add up to a fifth QE attempt. Rather, the text is curiously silent as to any reason why it is being considered at all! You are left to imagine how policymakers are tinkering with their control over money market rates, including, importantly, federal funds.

But why? Why now? Especially federal funds, of all places.

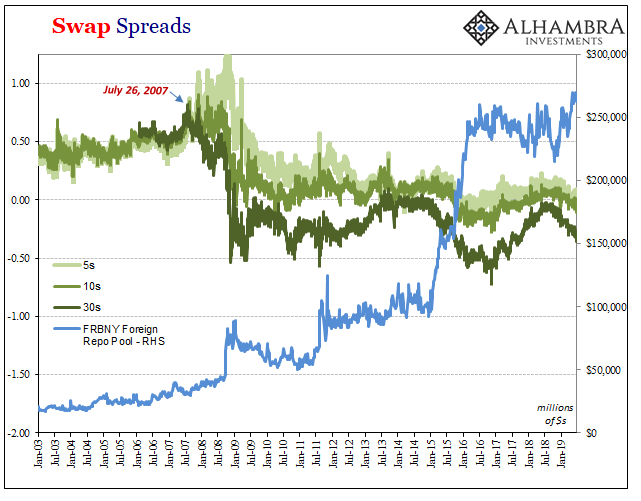

As noted yesterday, the way this system works is a lot more complicated than you’ve ever been led to believe. There’s a vast and hidden structure out there, and thus enormous potential for things just not going the way they are expected; or how they “should” according to current beliefs. It only starts with fed funds; or, more realistically, trouble in these shadows ends there.

I wrote:

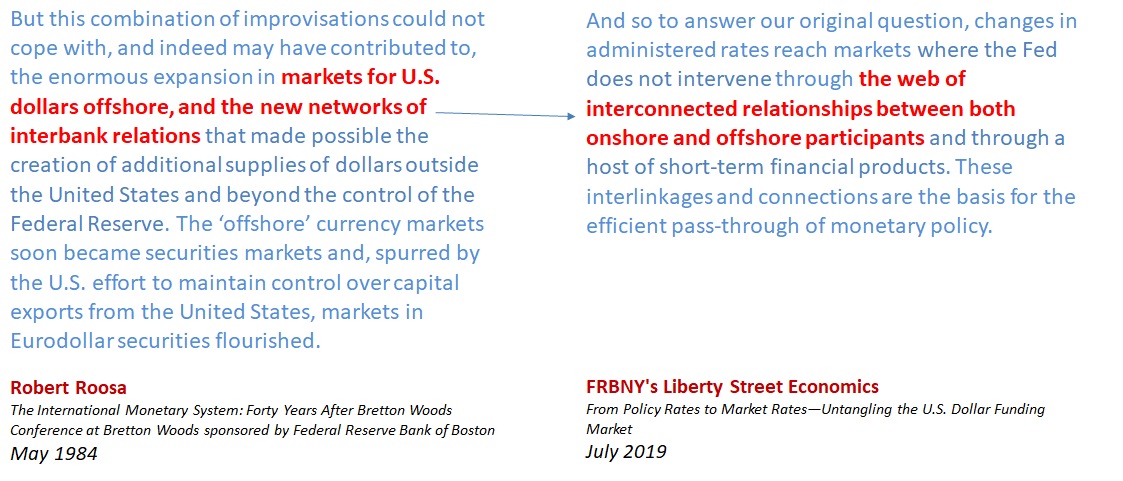

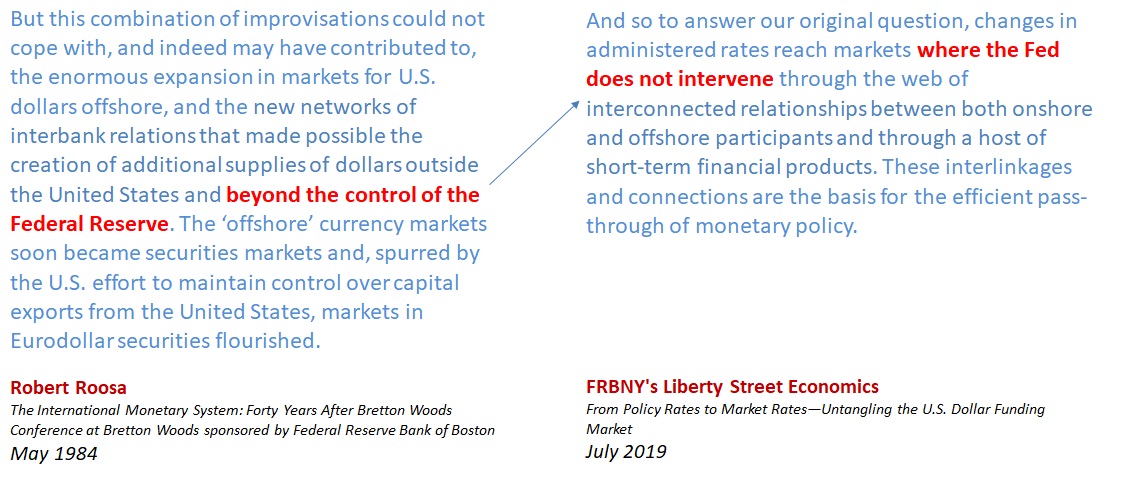

What they don’t say, what they can’t say, is that these interlinkages and connections can also be the basis for interrupting and overwhelming the pass-through of monetary policy… New York central bankers finally come out and admit offshore dollars are important, that they must play some fuzzy role in things, but don’t yet grasp just how important.

This monetary system is global in reach and scope. It may be denominated in dollars, but it is not strictly a US$ system. That leaves the US central bank expecting to be in charge of the US$ increasingly isolated and impotent; more and more on the outside of what really goes on in it.

The standing repo facility, QE5, or whatever you want to call it, this is the FOMC trying (more desperately) to come to terms with all this. After being forced to by fed funds, of all things. It is a wonder to behold.

A potentially destructive global wonder.

Stay In Touch