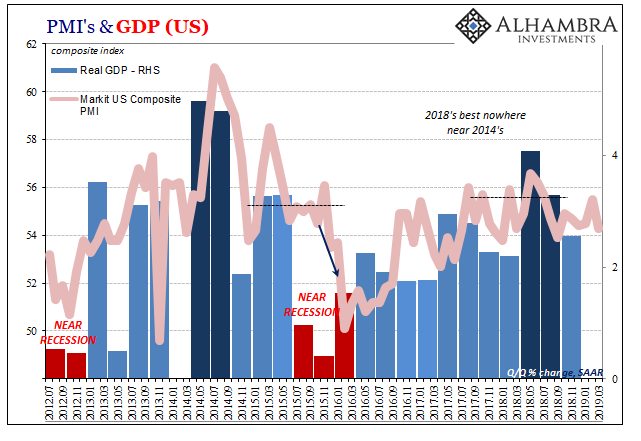

Europe is a total mess, no one can (honestly) argue otherwise. But that’s just Germany and France, right? PMI’s in those countries were a disaster. Those reported for the US weren’t really all that bad. Weaker, sure, hardly the obvious sinking especially when compared to German manufacturers.

IHS Markit’s flash US Manufacturing Index for March 2019 was 52.5. This was the lowest in 21 months, so some concern. Still, it was miles away from Germany’s 44.7. The US composite remains better than 54.

Is this still decoupling?

No. The global economy doesn’t move all at once, not at first. There are varying speeds and degrees of movement even well past inflection points. Europe is quite clearly experiencing a downturn with several key indications (not just PMI’s) pointing toward outright recession.

They are merely the first in line for various reasons, synchronized more closely with China than the United States. The US economy, however, is just pulling up the rear.

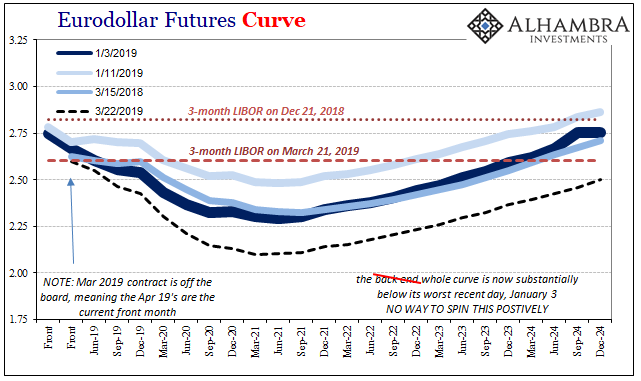

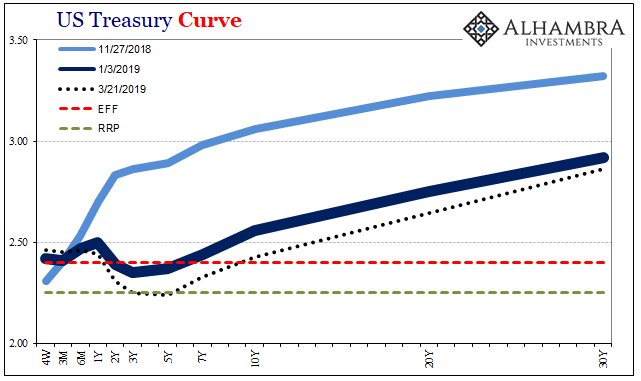

Don’t take my word for it, this is the message from bonds, eurodollar futures, and the like. Even EFF. Effective federal funds, as noted yesterday, is above IOER and now for the second day in a row. You can ignore small twists and brief turns in them, but persistent and worsening distortions are very clear signs. Escalating warnings.

While EFF remains above IOER, the entire middle section of the UST curve is under it; several maturities including the 5s are less than the Fed’s RRP “floor” today! Things are really getting screwy.

As I wrote a few weeks back:

What does it say about the state of the world when those hugely contradictory expectations [for falling LIBOR] are being fulfilled? Rate cuts, official rate cuts, may be closer than you think.

There’s a lot of big stuff going on right now.

Big things, indeed. As I asked of you before, what would make Jay Powell turn around and start cutting the federal funds corridor? Nothing good, nor something trivial. Powell has already given up on the hikes, so he’s at least partway already.

That’s what these markets are all saying. Together. Europe’s downturn today is ours tomorrow (or next month, whatever). There is no decoupling; if one stumbles we all do thanks to a monetary system that reaches into every corner and crevice. We just don’t all reach the ground at the same time nor experience the same level of agony when thudding down on it.

US markets, outside of stocks, are preparing for the thud. Grave liquidity risk everywhere. As I wrote yesterday, “Monetary breakdown to financial chaos to economic downturn.” The first and second are obvious, and in the US we are just waiting for the third.

Stay In Touch