It is ironic that the setting for his speech was London. The UK, of course, never gave up the pound in favor of adopting the euro. Still, as the years drag on the biggest menace to Europe’s common currency isn’t a profligate Greek government nor the unfavorable productivity of Club Med. The euro may not disappear all at once, but it is in danger of withering.

In the land of future Brexit, Mario Draghi promised in the hot summer of 2012 to do whatever it took to save his currency. Had he actually been successful, would there have been a Brexit? Would Italian and Dutch populists be entrenched where they are? Would Germany have been poised to follow the same path?

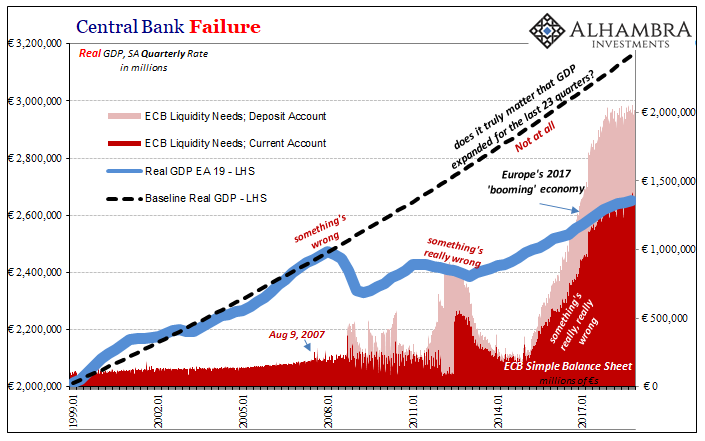

It was not supposed to be about bringing the borrowing costs of PIIGS governments down. That was his immediate concern, sure, and it was the method behind his madness, but Step 2 was actual, meaningful recovery. Changing the dynamic of Europe’s credit situation was intended to create sufficient space so that rock-solid economic growth could be returned to the entire landscape.

To the extent that the size of these sovereign premia hamper the functioning of the monetary policy transmission channel, they come within our mandate.

Did anyone imagine on July 26, 2012, Draghi’s ECB would be committing to even more “stimulus” and “accommodation” seven years later? Of course they didn’t.

“Believe me, it will be enough,” he claimed. By enough, did he mean unlimited by time?

As usual with everything central banks do, or claim that they will do in the future, the plan was celebrated far and wide. It was cheered when at first Draghi made his promise lacking any specifics, and then it was cheered again in September 2012 when specifics were finally released.

One market commentator quoted in the Wall Street Journal echoed what many were thinking/hoping about what a few months later were called OMT’s.

We had a solid rally going into this, and Draghi has ticked every box in terms of relatively bullish expectations. The ECB said it will do whatever it takes. This is putting meat on those bones.

And then came NIRP, QE, and several more years that supposedly led to globally synchronized growth. Finally, in 2018 after six years, the exit.

The ECB’s official statement released at today’s meeting was everything you’d expect, unless you still expect an exit. Short on facts and substance, a lot like Draghi’s promise made almost exactly seven years earlier. Draghi is, it seems, still promising.

The Governing Council also underlined the need for a highly accommodative stance of monetary policy for a prolonged period of time, as inflation rates, both realised and projected, have been persistently below levels that are in line with its aim.

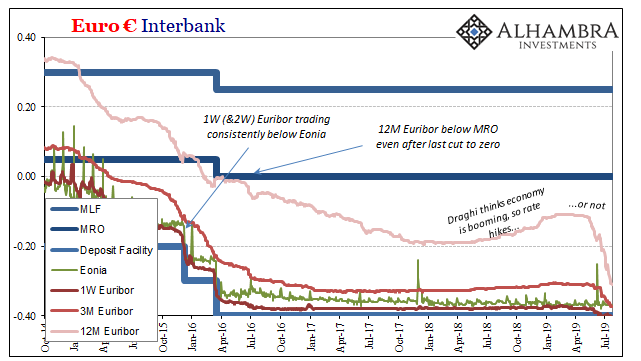

Is any policy “highly accommodative” if it is needed “for a prolonged period of time.” The Governing Council means September 2019 moving forward, the time which more rate cuts (with the MRO midpoint already at zero, and the Deposit Rate “floor” still -40 bps) will be undertaken and will be almost certainly augmented by a restart to QE (with tiered penalties on future reserves!)

But don’t we have to question “highly accommodative stance” going back at least to 2012 if not years yet before? Another of putting it, we’ve seen enough constant “stimulus” to know what it isn’t. There’s been no accommodation nor has anything been stimulated.

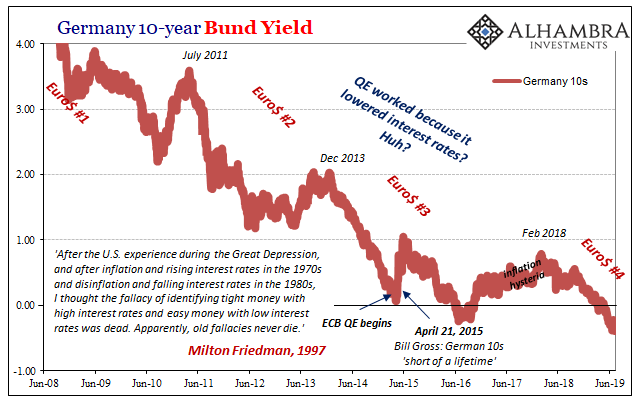

The ECB merely confuses transitory reflation between eurodollar events for burgeoning recovery. That’s why they went bonkers in 2017 over globally synchronized growth instead of heeding the bond market, especially in Germany, which can and does tell the difference. Draghi was warned by bunds not to take 2017 so seriously.

He did anyway because of emotion, almost surely because he’ll be remembered for his promise whether he delivers or not. Figuring it was his last chance, he grabbed globally synchronized growth and hyped it as much as anyone. It didn’t matter if there was any real data behind it, as he even said in January 2018:

The strong cyclical momentum, the ongoing reduction of economic slack and increasing capacity utilisation strengthen further our confidence that inflation will converge towards our inflation aim of below, but close to, 2%. At the same time, domestic price pressures remain muted overall and have yet to show convincing signs of a sustained upward trend.

Had there been “strong cyclical momentum” instead of mere global eurodollar reflation there would have been inflationary pressures evident right then. The ECB admitted there weren’t; but Draghi still believed they would show themselves because…he believed that they would show themselves.

Hardly a convincing basis, what has unfolded over the year and a half since perfectly in keeping with the official hype and misreading of the overall situation. As such, it wasn’t just bonds which were unenthused about the global recovery; euro money markets largely rejected it, too.

Quite tellingly, only the 12-month Euribor rate ever moved toward the fantasy of exit and normalization – and even then it was a mere +8 bps. European banks weren’t seeing what Draghi was seeing.

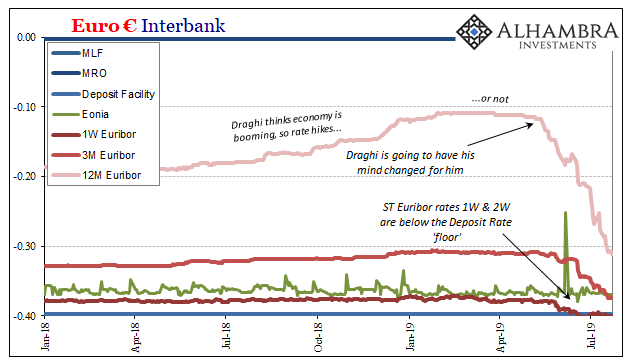

In July 2019, the ECB has even bigger problems than they thought. Euro money rates have absolutely plunged. This dive includes the 1- and 2-week Euribor maturities both fractionally fixed underneath the Deposit Rate “floor.” As noted earlier this week in another context, whether central bankers anywhere can tell what is or is not a floor is constantly in doubt.

This kind of technical proficiency should matter. It does in bonds if not in the financial media fixated on charismatic promises and showmanship.

What does this euro money market mess mean? In general terms, something changed around the end of April – for the worse. Perhaps it was the lack of green shoots especially in Germany’s economy, or maybe it was concern becoming alarm about something going on in terms of global funding conditions outside of euros.

Before the ECB ever confessed to thinking about renewed “stimulus” (in late June), European banks became a whole lot more willing to dump “liquidity” in this one market and pay the penalties (negative rates) for doing so. They’ve suddenly become very shy about doing anything else with it, no matter the growing costs.

Many people even today see these dovish turns as being overly cautious, far too pessimistic for an economic situation that may not be ideal but isn’t really all that bad. Having made his famous promise so long ago those people may not remember or have been adults when it was made, Dr. Draghi looks at the bond and euro money markets and can’t help but dread how it may not have been just the idea of recovery which suddenly disappeared.

Stay In Touch