In February 2015, IHS Markit thought that the US manufacturing sector might be slowing quite against every expectation. Its final PMI reading for the month of January was 53.9, down quite a bit from highs registered in the middle of 2014. Some of those fears seemed put to rest the following month when the flash reading for February 2015 rebounded to 54.3. That was subsequently revised upward early that March, for a final 55.1.

Economists were, of course, thrilled. What slowdown, they asked. Janet Yellen was right, this was all oil gluts and transitory speedbumps as the US economic risks were closer to dangerous overheating and inflation than any sort of renewed slump.

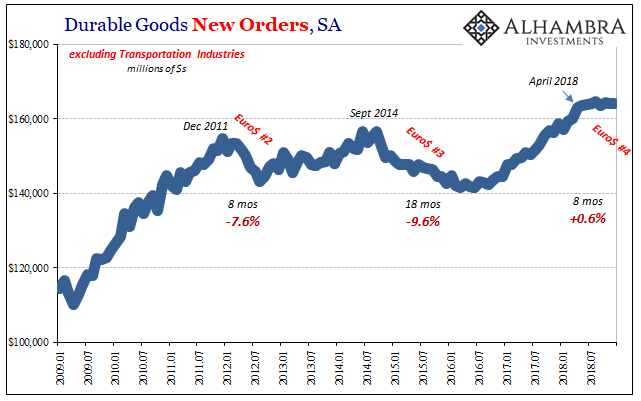

None of that was true. By February 2015, the domestic manufacturing sector was already many months into a protracted recession. Depending upon the specific statistic, while the overall economy may have just barely missed an official peak declaration (from the NBER) American industry would go under for an extended period lasting in some places as long as two years.

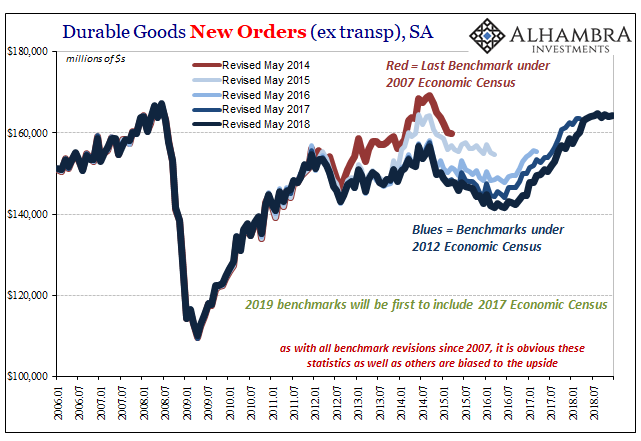

The exact duration and more so its depth wouldn’t be fully revealed until years later. Most people might remember Markit’s 55.1; I have no doubt they’ve never seen a single story written about the four-times revised benchmark for durable goods or Industrial Production.

What becomes painfully obvious is how upward biased these statistics can be. There is no nefarious intent here, just the misapplication of the Great “Moderation.” This kind of data was created and built upon assumptions that economies face only a binary option – either recession or growth. If it isn’t the former then it must be the latter.

High frequency data is therefore predisposed toward one direction or the other. Changing from one to the next is relatively easy, meaning safe, when the NBER makes a declaration. The numbers are revised out of trend-cycle growth and into trend-cycle contraction relatively quickly. Without any official cover, the result is what you see above – very tardy recognition of downturns.

The end product, more than anything, is confusion.

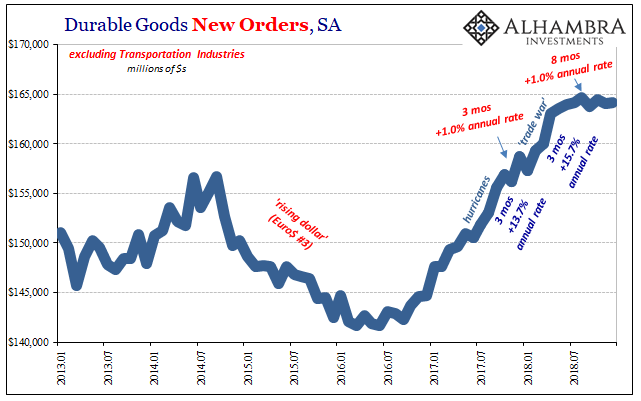

This discussion has become relevant again for reasons beyond evaluating those specific episodes in the past. As you can see above, the durable goods series is now suggesting something of a quandary again. Over the last eight months, including the latest update for January 2019, released yesterday, there’s been no growth at all in new orders (or shipments).

Eight months precludes transitory factors, or the noise that accompanies monthly variations. It isn’t growth and it isn’t recession – at least not according to the current benchmarks. Whatever it might be revised to in the future, as I suspect it will be, even as it is right now there is clearly something up with US manufacturing.

Markit’s latest US manufacturing PMI, the flash for February 2019, suggests something like that interpretation. The index declined to 53.7 which was a 17-month low. On the surface, it seems more consistent with a slowdown rather than something worse. Unlike the Census Bureau, these PMI’s don’t undergo deep benchmark re-evaluations which is how US economic observers can still find a 55 in manufacturing for February 2015 when in fact the manufacturing sector was already months into substantial and sustained reverse.

Even as they are, the Census Bureau’s estimates for durable goods (and capital goods) propose that something changed last year; so obvious it sticks out on every chart. Under the mainstream unemployment rate view, this was a shift in the wrong direction. The timing is also auspicious, too, given what happened around April and May (29).

However, it doesn’t tell us any more than that. Not yet, anyway.

Stay In Touch