The British manufacturing sector pulled the English economy into contraction for the first time since 2012. Real GDP declined by 0.2% Q/Q in the second quarter of 2019, another minus sign to add to the growing global list. Goods production fell sharply, down 2.3% in Q2 from Q1. It was the biggest decline since 2009.

And it is being blamed on Brexit “uncertainty.” The most powerful forces in the entire world right now are, we are told, varying brands of the stuff. There’s Brexit, populists, and, the most widely discussed, $3 billion worth of a 10% tariff on $300 billion of Chinese goods heading to the US. They do like to cite the $300 billion figure because otherwise the “uncertainty” of trade wars might necessarily appear pretty minimal.

There’s obviously something wrong with the global trade channel and it is hitting the manufacturing sector all over the world. Those are the effects which are spilling out in all directions.

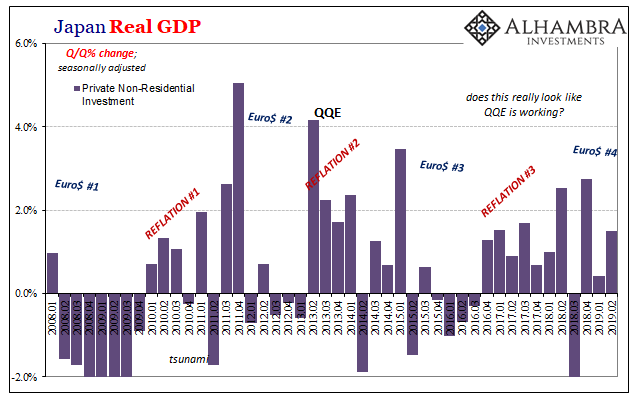

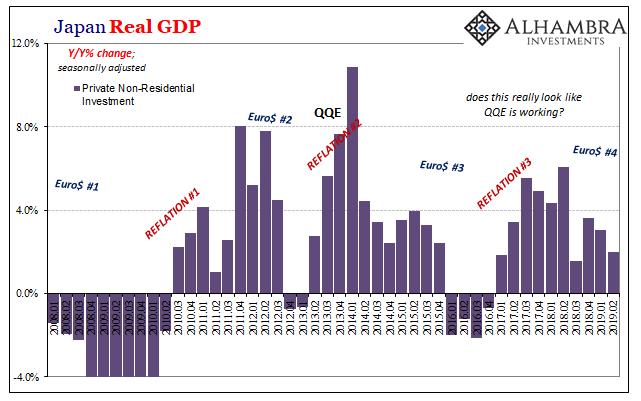

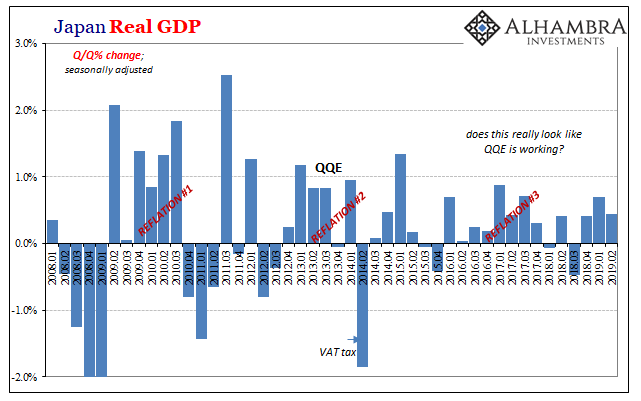

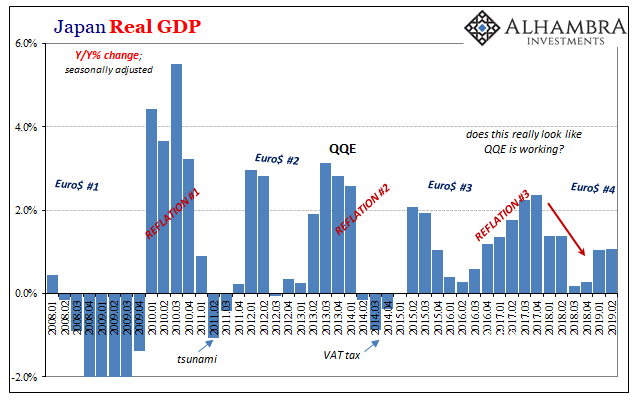

Even over in Japan where the Japanese government just reported the opposite of the UK. Whereas British GDP was weaker than expected and negative, Japanese GDP was better than expected and positive. The reason was a quarterly bump in business investment, capex well above the trend prefigured by slumping machine orders (and much less impressive when you look at it Y/Y).

One Economist tried to explain it as the economic benefit of fewer Japanese people. With what he called a “labor shortage” (do I need the all caps and exclamation points in this context?) which won’t get any better as the population shrinks, heavy industry in Japan has no choice but to invest in machinery to take the place of workers who are going to increasingly disappear.

That’s one way to reckon stimulus.

Or, maybe, Q2 is just an aberration. With Japan’s looming VAT tax hike (and 2014’s debacle still fresh in the Japanese mind), there’s bound to be some noisiness in the short run leading up to the levy.

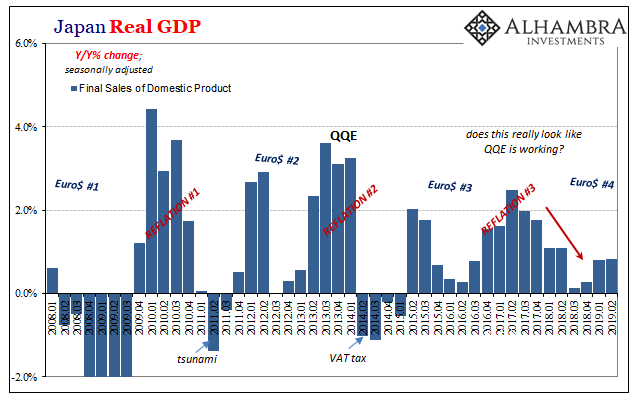

Otherwise, apart from business investment things don’t look so good. Real GDP in the second quarter was up 0.44% from the first. That’s down from 0.7% (revised) in that prior quarter, and not really that much different from the first nine months of 2018 which saw two negative quarters out of three. Lackluster to begin with in 2017, what do you call a step down from that?

If you are a central banker or write in mainstream publications, you marvel at these strong numbers.

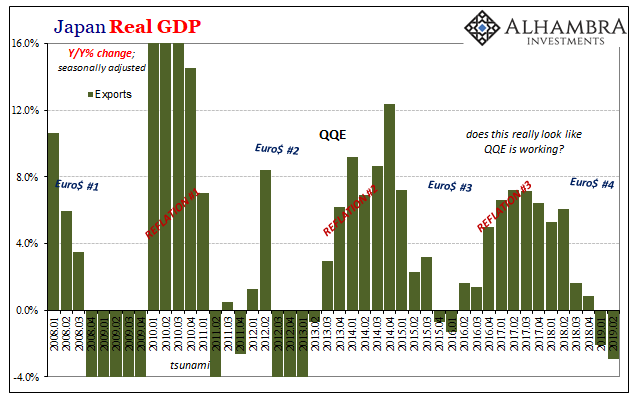

Household spending and final sales continue to be subdued however you want to characterize them in relative terms. But because they aren’t falling off a cliff, Japan’s economy is being characterized as resilient and therefore that is the strong part – it isn’t worse…at the moment. It is facing serious external headwinds (demonstrated by the export numbers) and managing to stay somewhat afloat.

Or is it?

It may be that Japan’s economy is simply weakening just not all at once, at least not yet. This year has seen something of a weird new phenomenon, a sort of recession impatience. Either get on with it, or it can’t be happening.

Like the UK figure, what you see instead is pretty thorough downside risk which remains all throughout these numbers – only beginning with exports and manufacturing. It is a lack of actual strength which continues to persist even if Japan’s economy hasn’t yet collapsed into full-blown contraction.

Therefore, the dichotomy of interpretations: has the Japanese economy accelerated in the first half of this year after a bad second half of last year? Or are these not unusual fluctuations around a still weakening trend?

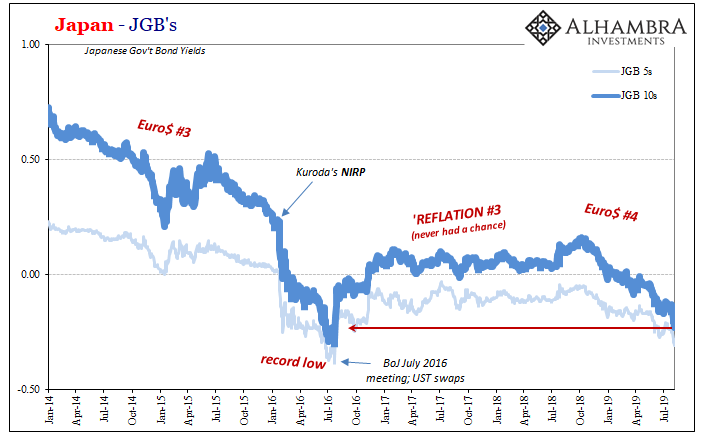

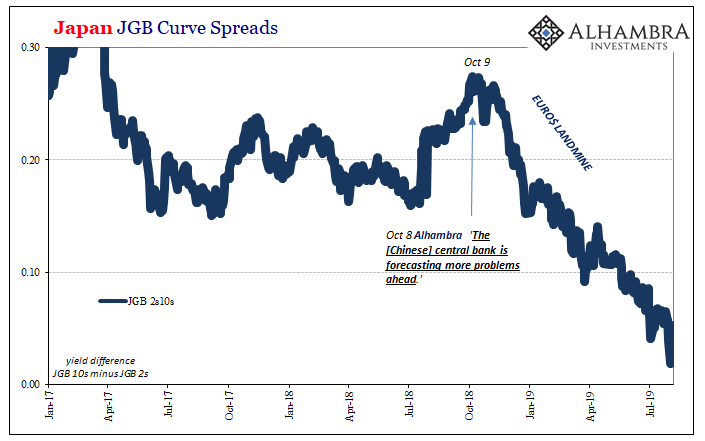

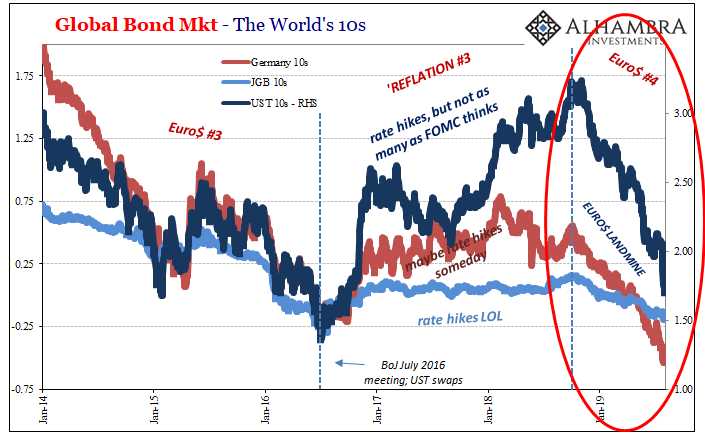

Economists say it is the former, the end of “transitory” factors and Japan emerging from them a little bit at a time. But what does the bond market say?

Despite the better-than-expected Q2 GDP estimates, yields were actually lower on the day and further into the range near record lows. The problem isn’t that the Japanese economy still presents downside risks, it is more so that the whole global economy does altogether. It’s not Japan or the UK take your pick; it is all of the Japanese figures plus the UK’s which add up to a much weaker global picture.

There is a distinct lack of strength which despite the lack of hitting a wall or falling off a cliff increases the chances of doing those very things. There’s a whole lot of unappreciated lumpiness in a truly global slump.

Stay In Touch