It’s difficult a lot of times to easily and succinctly describe what’s going on inside a monetary system that; 1. Spans the entire world, easily jumping across if not erasing geographical boundaries; 2. Is located in the shadows, leaving us with no direct data or statistics; 3. Often works in a dizzying array of complexities. I have to believe that even a competent and talented writer would have a lot of trouble with this eurodollar thing.

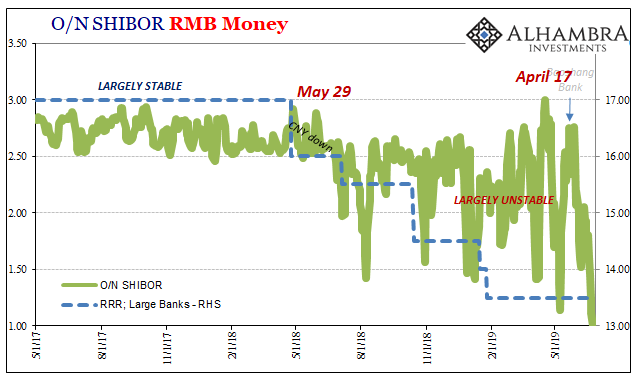

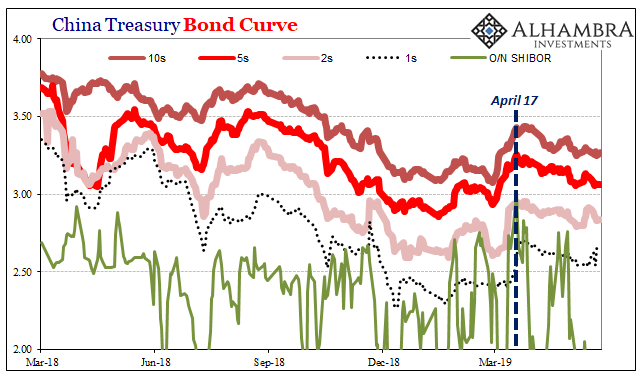

The short version is really just this: funding markets are increasingly afraid of something. In looking around and surveying the landscape, I have to believe this something is the potential for a global collateral bottleneck. That’s why, I think, China’s markets are linking up in eurodollar terms, too. April 17 is a new and worse May 29.

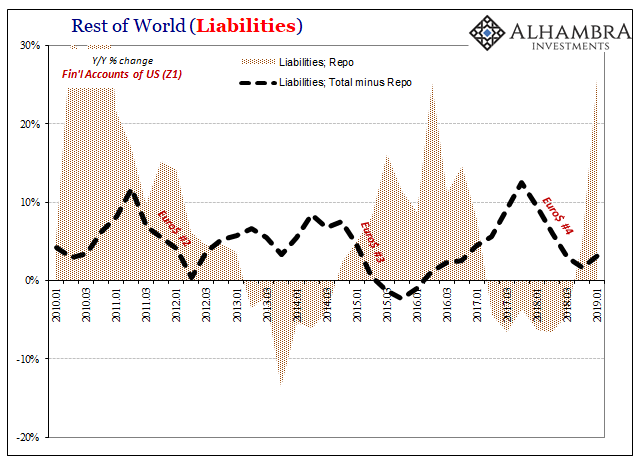

For a lot of the world, in US$ terms, the repo market is all that’s left. As I wrote last week:

What we observe here, as well as other data, is how the repo market is the last line of liquidity defense in the offshore world. It has become the lender-of-last-resort because the central bank cannot be counted on for what used to be its primary use (raising the question, are central banks, in fact, useless? This isn’t just a rhetorical flourish on my part, it is a legitimate doubt.) This was the major evidence of 2008, reinforced a second time, echoing Bernanke’s bewilderment about transmission, in 2011.

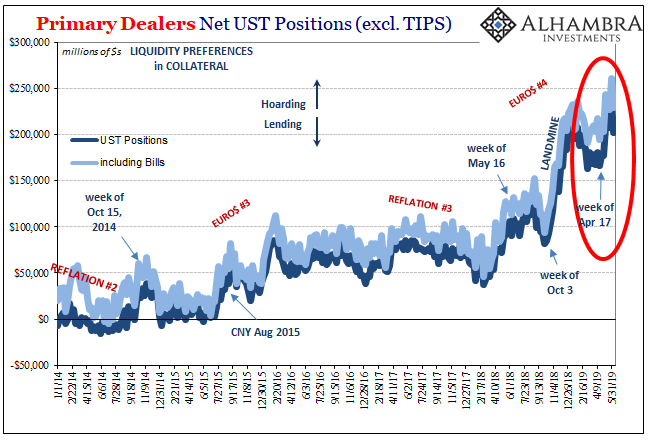

Therefore, if anyone inside that system really starts to question collateral terms, haircuts and whatnot, we’ve seen through history how it plays out. You better have UST’s on hand, or Chinese governments, else you risk becoming Bear Stearns (or Baoshang, not that this one is comparable in systemic importance).

It is the post-crisis intersection between a chronic problem – the repo system never did replace the MBS portion scrubbed out of use – and the potential for an acute flareup. The world is already short of collateral, thus how far can the system be stretched before being pushed beyond the current limits?

I think that’s what’s producing a nastier Euro$ #4. There is deep suspicion that this one might be really testing the limits. It’s a very real liquidity risk that I believe is being expressed in a lot of different places. As of right now, this means huge demand for the best collateral as well as the inevitable rate cuts the Fed will opt for not knowing what else to do.

The evidence for this theory is presented by market data as well as how the behavior of these markets isn’t conforming to the mainstream explanations. It has to be this something otherwise Powell wouldn’t be on the verge of panicking.

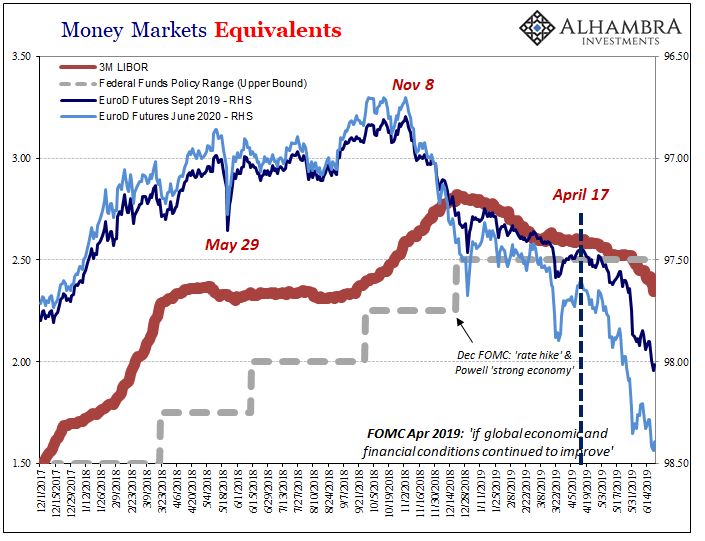

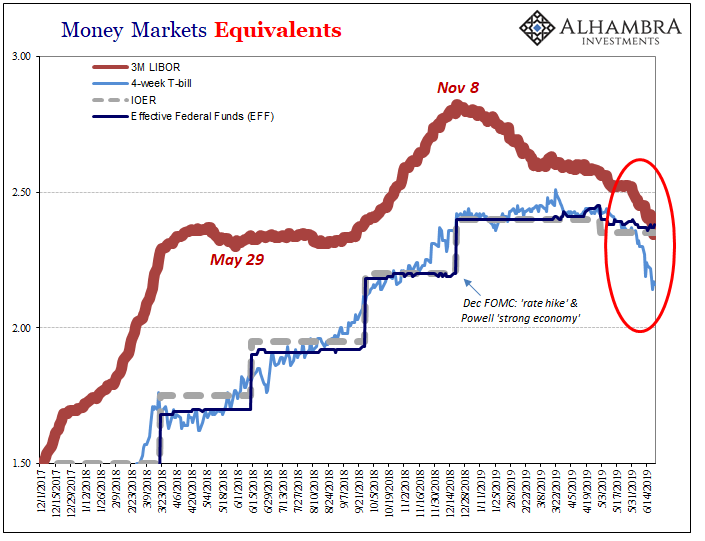

Take, for example, federal funds. Officials have tried to explain away the tendency of the effective rate to stray upward as a consequence of money alternatives. As noted last week, basically the flood of T-bills in the aftermath of tax reform meant the increased supply pushed up repo rates, LIBOR, and above all bill yields. With these higher alternates, the federal funds rate (EFF) had nowhere else to go except to be pulled up toward them.

But now, all those equivalent rates are falling – some dramatically. Three-month LIBOR, for instance, on Friday fixed at a shade less than 2.35%. It’s now less than EFF, less even than IOER. The 4-week bill is at 2.12%, having spent some days underneath 2.10%. Even the benchmark 10-year bond is flirting with the 2.00%.

And yet, on Friday EFF was still right there at 2.38%, up one bps from Thursday and a 3 bps positive spread to IOER despite the drop in equivalents. With these other interest rates going down, why isn’t federal funds falling and normalizing?

Because it was never those things. Rather:

Thus, we have the answer for federal funds, too. When everything else is exhausted, the sparest of spare liquidity suddenly becomes highly demanded; the last ripples of illiquidity emanating from deeper inside the shadow money world of offshore eurodollars.

T-bills suggest demand for collateral, LIBOR rate cuts, and EFF still the over-demand for the sparest of spare liquidity. It was always this something else.

The funding markets are thinking this through, about the potential cascade of consequences should it all tip too far in the wrong direction. EFF says the system remains pointed in the wrong direction.

China’s problems relatedly don’t help.

Since it’s not (ever) what Jay Powell says, we are left with a much shorter list of suspects. At the top of my list, a collateral chain implosion and therefore the very real potential for a global bottleneck in repo. With no other lender-of-last-resort available, it’s a huge difference to begin with.

Stay In Touch