I haven’t written a formal asset allocation update since November so this one will be a little bit of catch-up for non-clients as we did make some minor changes in early January.

On January 7th we shifted our bond allocation somewhat to reduce duration. Continuing to hold longer-dated bonds at that point essentially meant betting on a recession and I was and am not prepared to do that. Selling bonds changed our risk allocation to 50% Risk, 10% Cash, 40% Bonds for a moderate risk investor. Today I am making further changes that will reduce the cash position:

When I wrote my last full asset allocation update on November 19th the S&P 500 was at 2690.73. Today it stands at 2774.88, a difference of just over 3%. If that was all the information you had, if you didn’t know what happened in December, how would you feel about the market? Worried? That seems a little ridiculous when the change since then is just 3% and it is to the better. What does that say about the near panic we saw on Christmas Eve? Was the fear warranted? Does the correction (or bear market if you prefer) in the 4th quarter have any bearing on where things go from here? Has anything changed since then that is significant?

The most remarkable thing about this economic expansion that started way back in 2009 is its consistency. Some might argue it is a consistency marked by mediocrity and there is considerable truth in that characterization. There are a veritable plethora of economic statistics I could cite that underscore that point. From income to consumption to investment, the rate of growth this cycle has been below what we’ve come to expect over the last few decades. It has been described as the “new normal” or “secular stagnation” and no one seems to have a clue how to get out of it.

The efforts to do so have not, so far at least, produced the desired results. The Fed’s endless monetary manipulations have amounted to not much more than a lot of hand waving and shouting. The global monetary system moved on some time ago from anything over which the Fed has control. The supply of and demand for money – whatever that really is – and what changes that balance is unfathomable in today’s globally interconnected markets. Changes in central bank policies can shift global capital flows creating booms and busts that have unintended and unanticipated consequences. The Fed – and the other major central banks – has a lot less control than they or the average stock punter believes.

Fiscal policy has been equally ineffective. The Obama administration tried spending our way out of the doldrums along with restructuring the health care system to little positive effect. Can you think of even one thing, one policy the Obama administration championed over the course of their eight years in office that had an unarguably positive impact on economic growth? I can’t either. President Trump has tried the supply-side Keynesian approach rather than the demand-side, but a lasting impact is hard to discern at this point.

The other major Trump initiative has been to renegotiate our trade agreements with the rest of the world. The results so far are, ahem, underwhelming. There have been two quarters of growth during the Trump administration where the annualized rate was over 3%, both of them in 2018. It may be the trade negotiations that managed to get growth above 3% briefly but not in a way that is sustainable or desirable. Quite simply, companies – and I’m sure some individuals – bought today what they might have bought tomorrow out of fear of higher tariffs. I don’t know the extent of such activity but we know from past experience that expected tax hikes pull forward demand. And there is always a slump after the higher tax is imposed. In this case, there probably will be even if an agreement with China is reached.

No matter what gets thrown at this economy – quantitative easing and tightening, cash for clunkers, Obamacare, corporate tax cuts, Brexit, Europe falling apart, China slowing, trade negotiations – it keeps growing at 2%. It has been slower and faster in this expansion but never for very long. One gets the notion that maybe policymakers – Democrats and Republicans – have been concentrating on the wrong things. (You should imagine a derisive snort here)

For investors though, the reasons for the economic malaise and its cure are not all that important. In fact, I’d suggest that concentrating on causes and potential policy responses might make you a worse investor rather than a better one. All of us have political biases, preferred outcomes based on our beliefs about how the world works, but we have to invest based on the world we have, not the one we’d like or the one we fear. Markets will tell us when policy is likely to produce bad outcomes and we can adjust our portfolios based on the collective wisdom of the crowd rather than the hubris of our own beliefs.

The correction in the fourth quarter looks today like an overreaction by equity markets. Whether it was based on fear of a Fed mistake or rising protectionism or a global economic slowdown or whatever other bogeyman you can think of, stock investors succumbed to their fears and sold. The reaction in other markets – particularly bond markets – was more subdued and measured. The new year has brought a recovery in stocks and some interesting developments in other markets but so far nothing has moved outside the ranges that have defined the markets and the economy for most of the last five years.

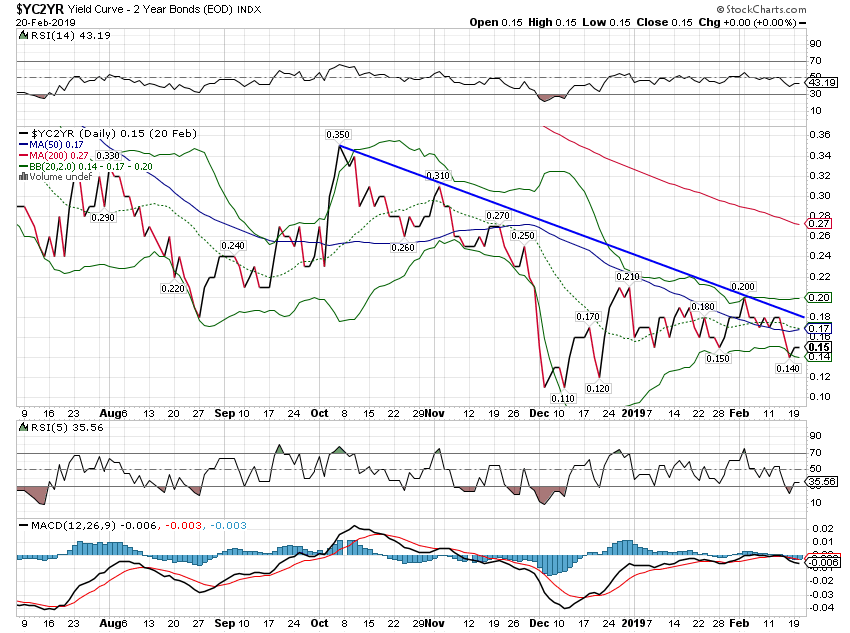

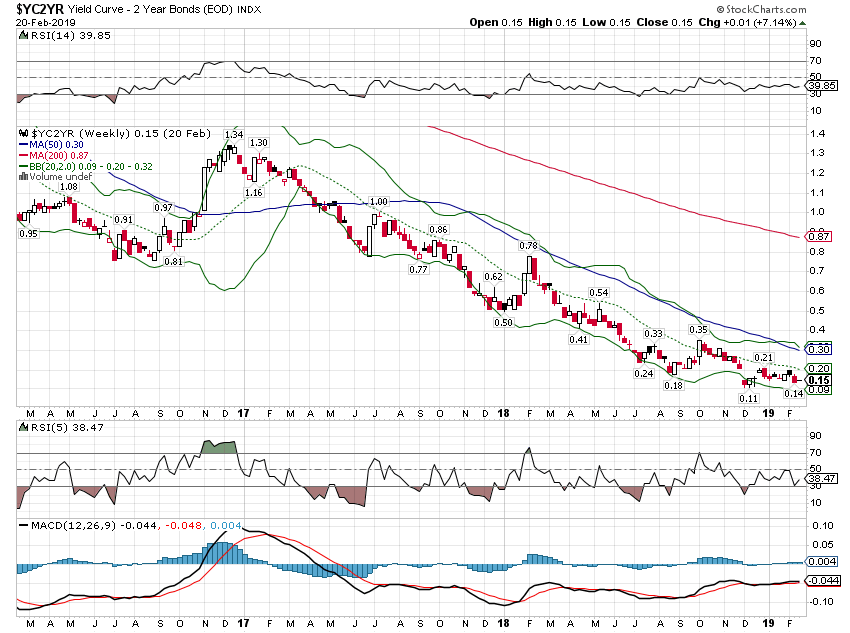

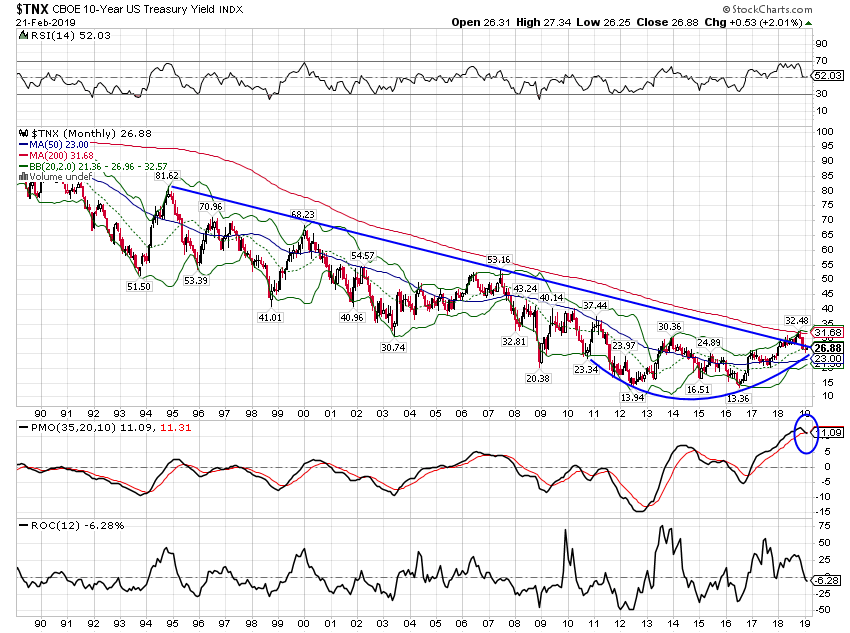

Yield Curve/Rates

The yield curve continues to flatten, down about 10 basis points since the November update. This is normal for the yield curve as we move through the business cycle. The curve has steepened a bit since its nadir in December at 11 basis points but it is minor and means nothing at this point. The recession warning sign will be when short term rates start falling rapidly, anticipating an imminent Fed rate cut; the curve will steepen rapidly. As my colleague, Jeff Snider, has pointed out recently, there are markets pricing in some probability of a rate cut in the next year. But for now, the probability is not high enough to affect the traditional yield curve shown here.

A longer term view shows how insignificant the recent moves were.

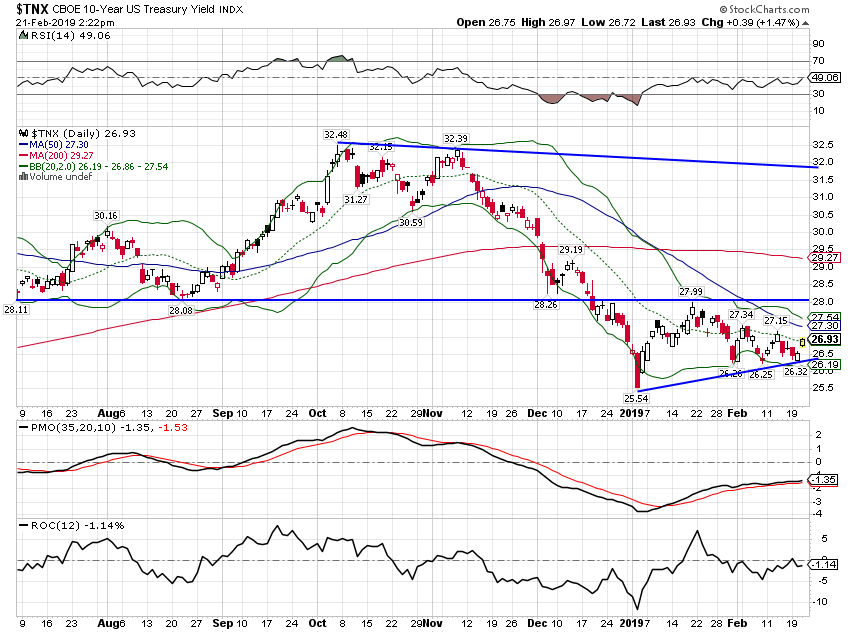

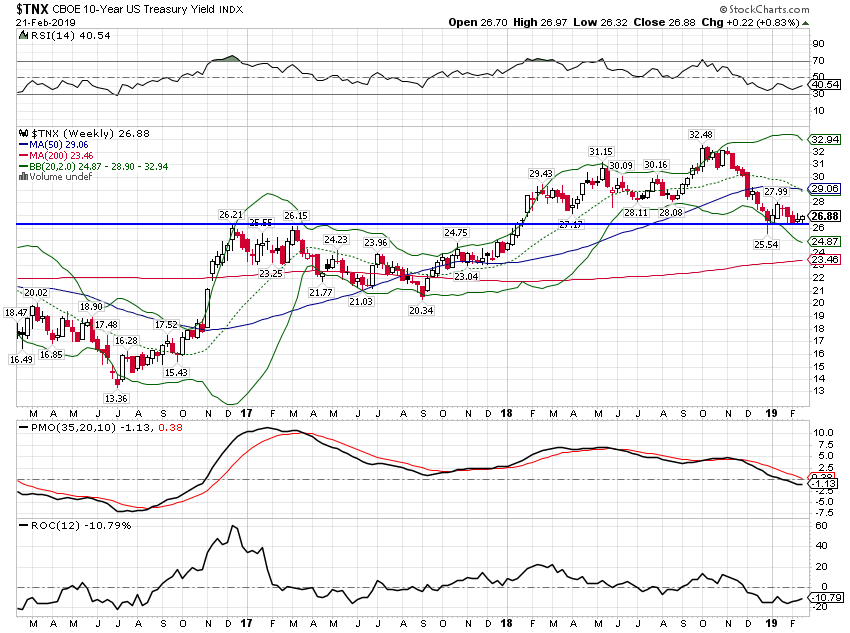

The curve flattened because the 10 year Treasury yield moved down more than the 2 year Treasury yield. The 10 year yield has stopped falling recently and is slightly higher since the beginning of the year. There are some hints in other markets that rates might head higher from here. More on that down below.

To get a sense of how stable things have been, rates today are essentially unchanged during President Trump’s entire time in office.

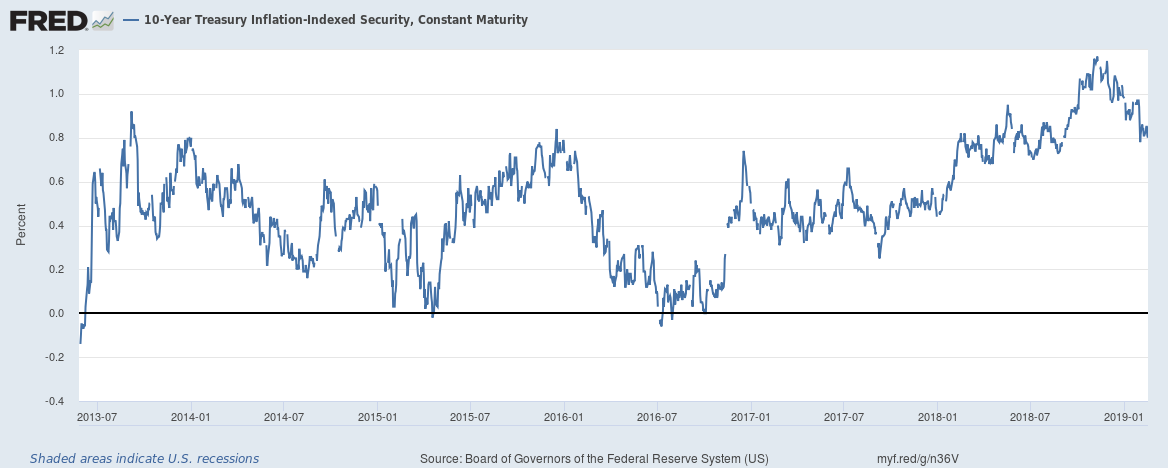

Real interest rates, as measured by the 10 year TIPS yield, finally followed nominal rates lower. Real growth expectations have fallen modestly since the November update. Still, real rates are basically no different today than they were way back in mid-2013. Inflation expectations have fluctuated more than real growth expectations.

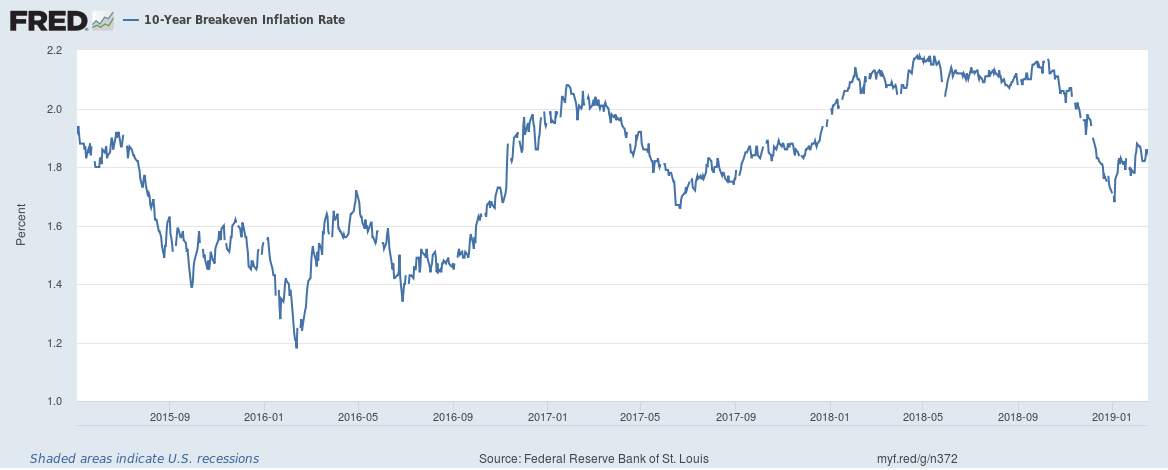

Like everything else though, inflation expectations are not much changed over the last few years. Expected inflation is about the same today as in 2015.

Credit spreads widened with the stock selloff last year but with no recession confirmation from the yield curve, it didn’t really mean much. Credit spreads are basically coincident with the stock market, widening during corrections and narrowing during rallies, as we’ve seen recently. Spreads are still a little wider than their nadir so I’m keeping an eye on this. But for a recession call, I’ll need some confirmation from another indicator such as the yield curve.

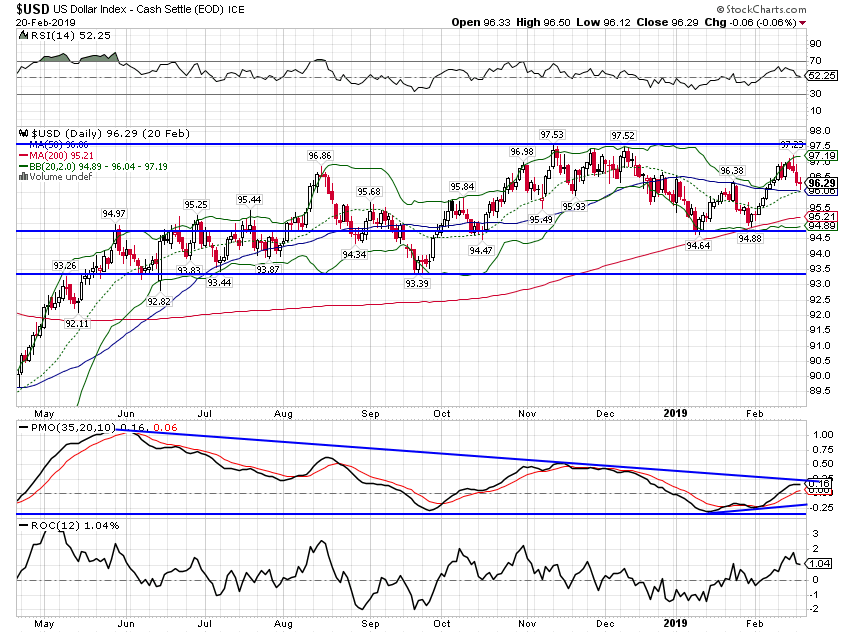

The dollar has been steady to down a bit since November. With global economic data seemingly quite a bit weaker than the US, it is somewhat surprising the dollar hasn’t gained more. Or maybe, more accurately, it is surprising the Euro hasn’t weakened further given the economic data coming from the continent.

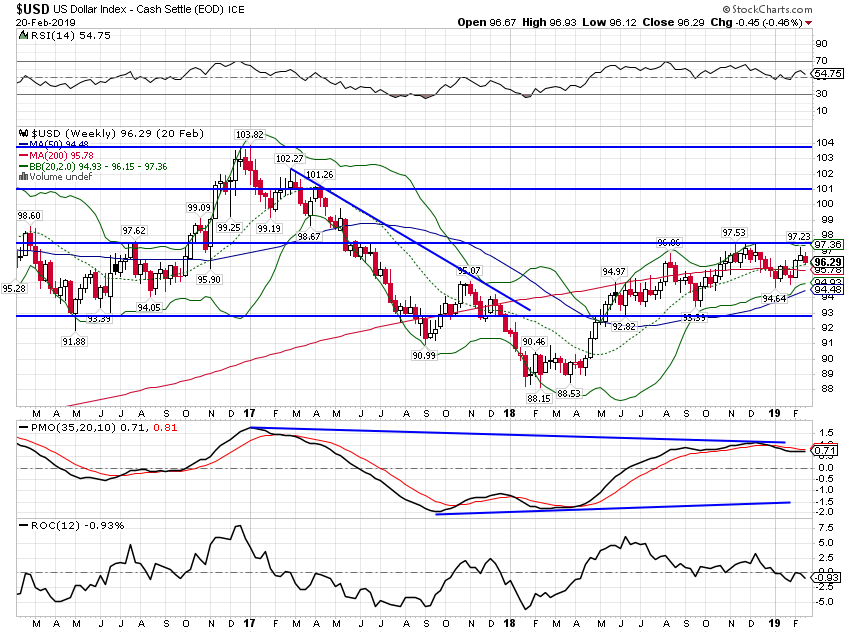

Weekly momentum continues to point to lower prices for the dollar index.

As I’ve said many times, I don’t try to predict the future but I do try to interpret what the market is saying. The lack of strength in the dollar seems to be pointing to an equalization of growth expectations between the US and the rest of the world. Obviously that could happen one of two ways. Either the US weakens or the rest of the world strengthens. Consensus is firmly in the former camp. A trade deal might not really amount to much in the big picture but it could flip the market narrative about global growth.

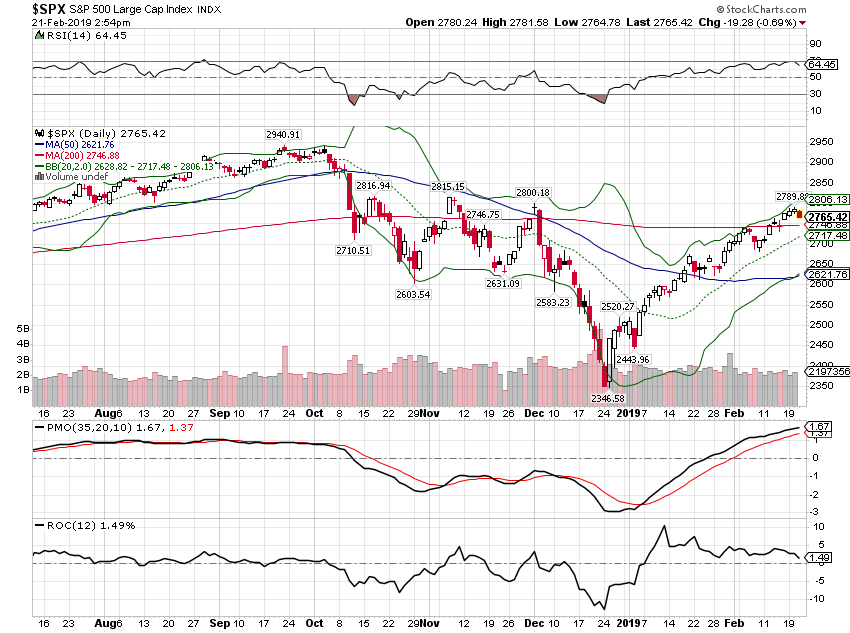

In the November update I labeled the stock market rebound from the October lows a “dead cat bounce” that was expected to fail. And it did, spectacularly, in December. But since then the market has made a nice recovery back to the 200 day MA.

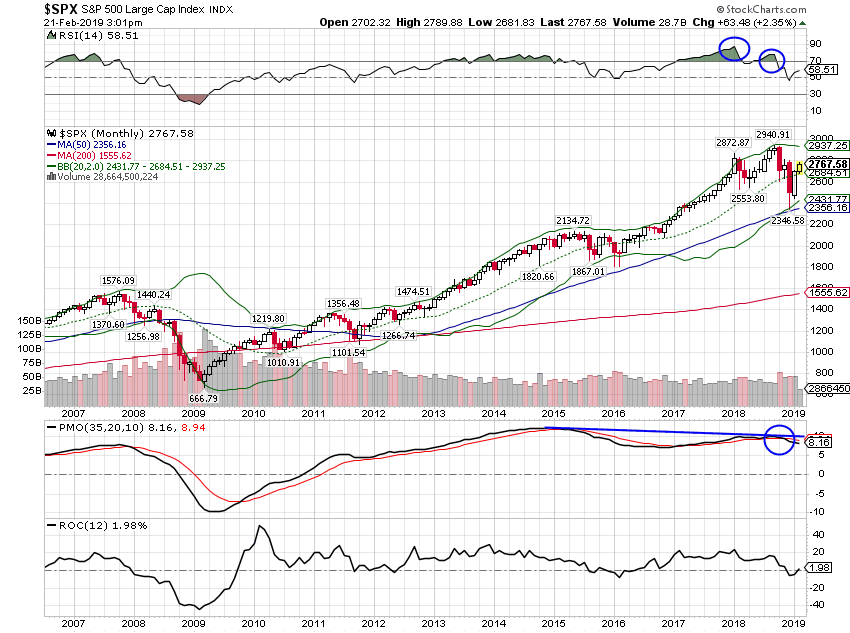

I also expected to get a sell signal from monthly momentum and we did at the end of December. My expectation was that the index would fall to the mid-2300s before finding a bottom. I’d say 2346 was close enough. But the monthly momentum sell signal is important because we don’t get these signals very often. This is just the fourth sell signal since the 1990s (mid-1999, late 2007, 2015 and now). What does that mean? Be skeptical of the rallies.

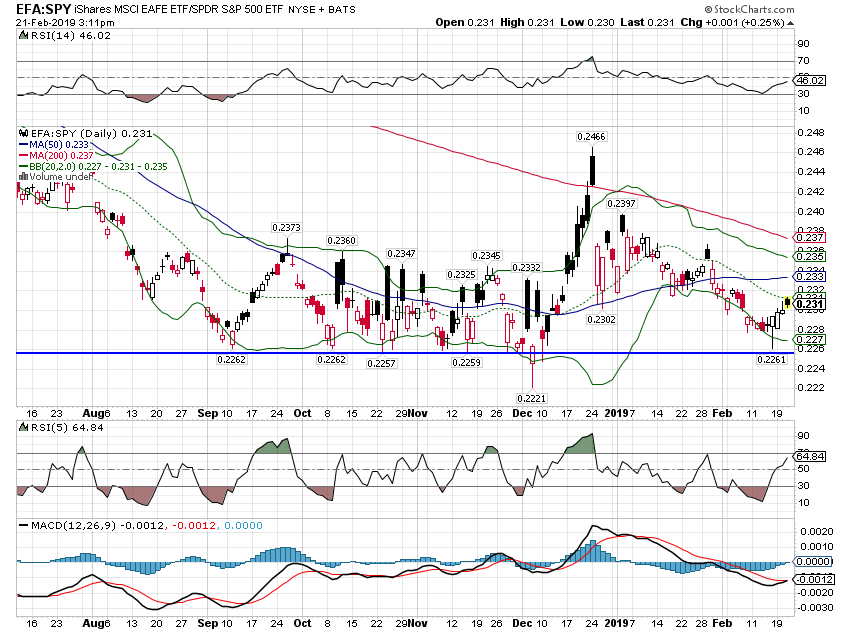

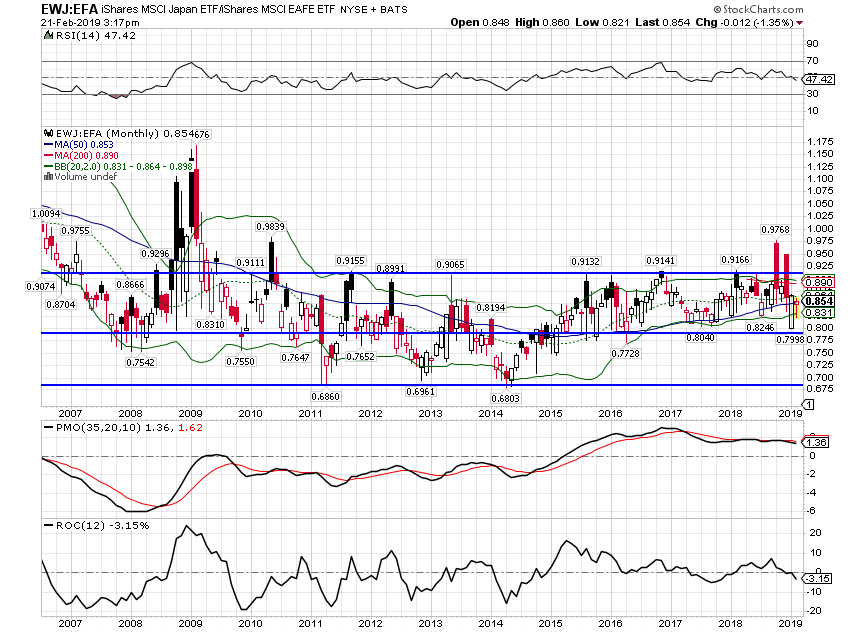

Foreign stocks outperformed by a wide margin in December but have given back a lot of that in the new year. Still, EAFE has performed in line with the S&P since September. As I’ve said many times, don’t expect foreign markets to outperform for any significant term until the dollar gets going in a downtrend.

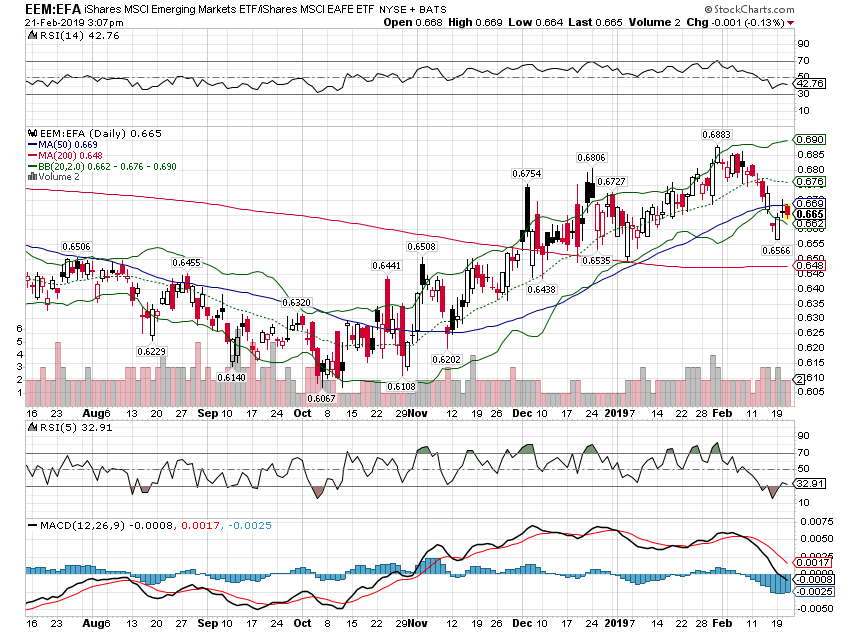

Emerging market stocks continued to outperform developed foreign markets into the new year but have pulled back some in February. I’m not changing our allocation – yet – but the long EM trade is looking a tad crowded right now so continued outperformance may be tough.

Japan has outperformed EAFE since 2014 but has recently been a wash. I still find Japan compelling and I’ll hold it as long as it at least keeps up with EAFE.

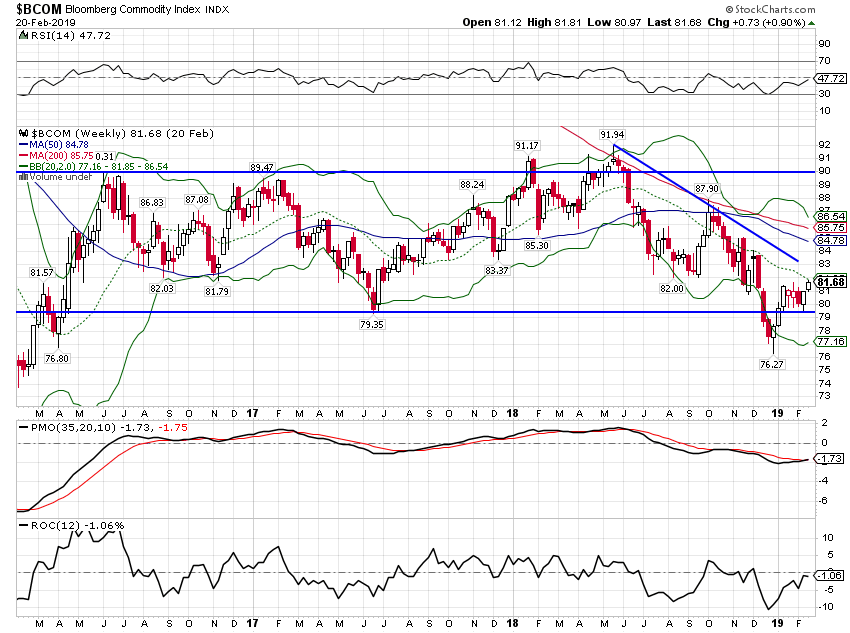

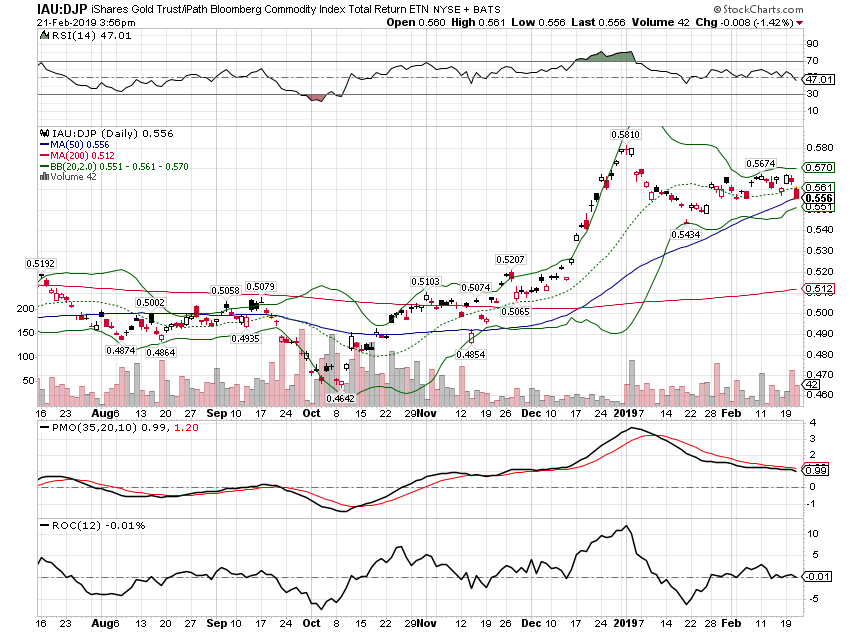

Commodities is where things get more interesting. The Bloomberg Commodity index followed stocks lower in December and have also rebounded in the new year.

But unlike stocks, long term momentum for commodities is turning higher.

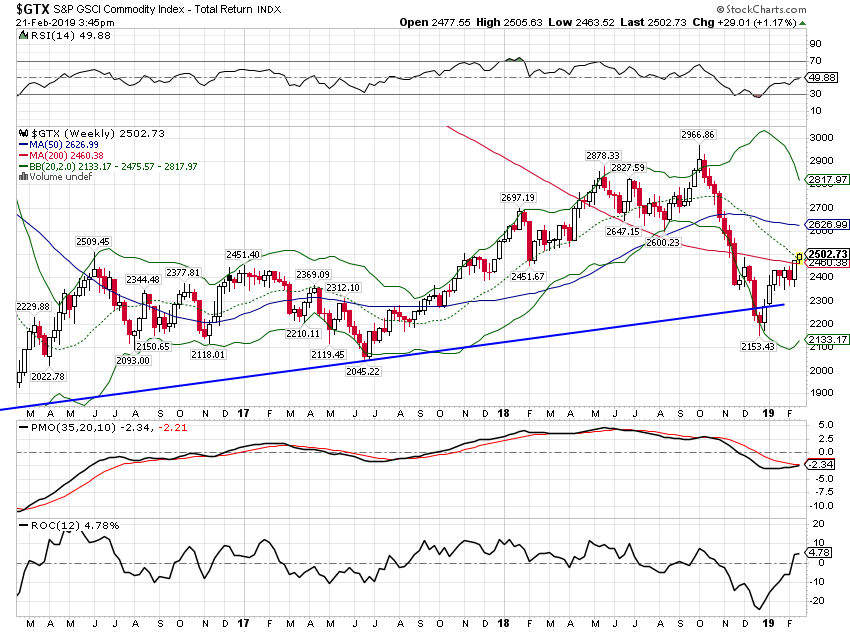

The Goldman Sachs index has also rebounded in the new year with crude oil leading the index higher.

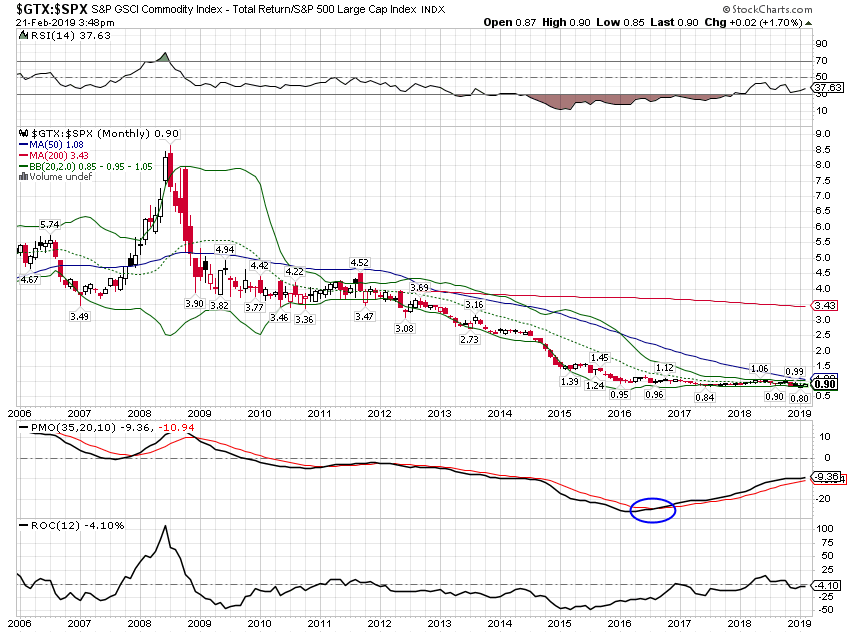

Longer term, momentum is shifting from stocks to commodities. The GSCI has underperformed stocks slightly since 2016 but has outperformed the S&P 500 since mid-2017. This is one of the reasons I keep expecting the dollar to fall; commodities tend to lead the dollar.

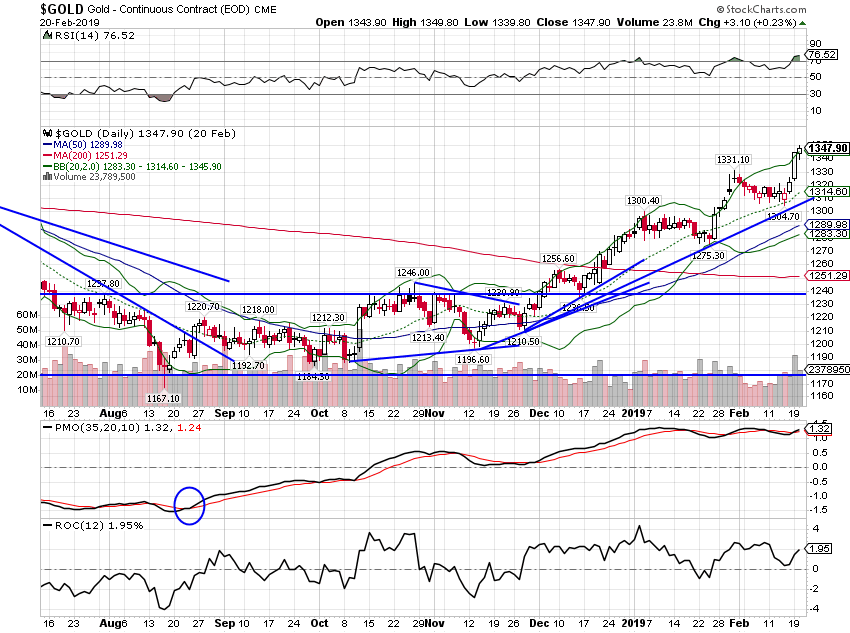

Even more interesting I think is gold. The consensus in the fourth quarter was that gold was rallying due to fear. Supposedly, investors were selling stocks and buying gold. That really doesn’t make much sense and doesn’t have much history to back it up but it seemed an adequate explanation at the time. But gold has continued to rally in the new year right along with stocks. So what’s driving it now? Not fear apparently.

Gold has also outperformed the general commodity indexes since the October lows but momentum has shifted recently.

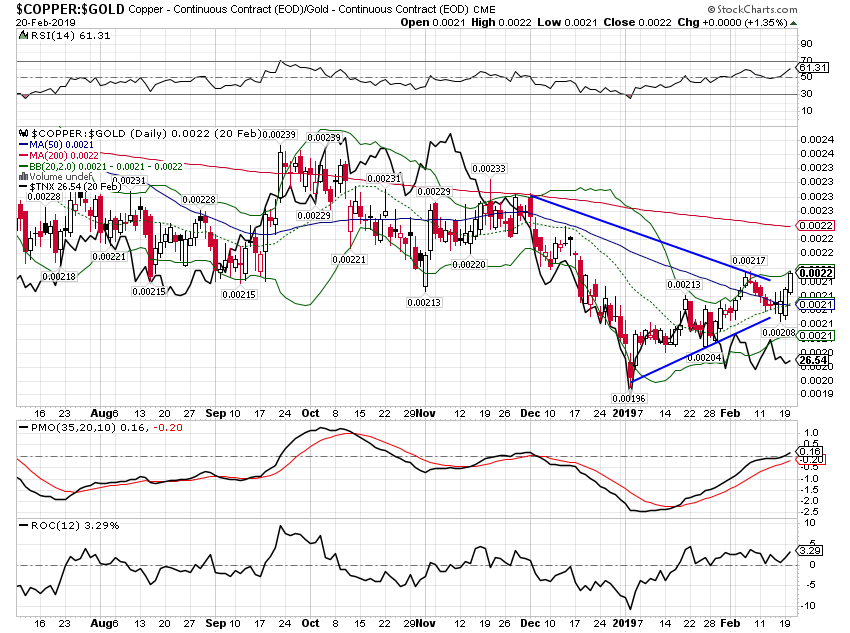

We can also see this, more clearly, in the Copper:Gold ratio which has recently turned higher. This ratio turning higher is what precipitated the move in January to reduce the duration of our bond portfolio. Bond yields are positively correlated with the ratio. More upside for bond yields seems likely in the near-term.

And very long term, bond yields appear to be making a secular shift. The last few decades it has paid to maintain a long duration portfolio and trade the short end around recession. If this secular shift is like the last one in the 1950s, your bond strategy and tactics need to change. Now you need to maintain a short/intermediate portfolio and trade the long end around recessions. The momentum reading on this long term chart though does show an extreme overbought situation. I’m not sure how that will be resolved.

Until recently there were plenty of people who would tell you that bond yields had nowhere to go but up. Curiously they rarely offered any evidence to back that up except the idea of a global synchronized expansion, a scenario that didn’t survive the fourth quarter correction. Frankly, it didn’t make much sense anyway so good riddance.

But markets do seem to be trying to tell us something right now. Maybe all that policy tinkering is finally having an impact – just not the one we were promised. Momentum shifting to commodities and bond yields trending higher, despite the recent pullback, is interesting to say the least. If the fear in the fourth quarter was about potential recession, doesn’t it seem odd that bond yields didn’t fall further? If recession was really the concern shouldn’t yields have been testing the 2 handle rather than staying near 3? And what about gold? If recession fears have faded – and stocks sure seem to indicate they have – then why hasn’t gold sold off? And what about the dollar? If Europe is so bad – and the recent data sure supports that – then why hasn’t the Euro sold off more? Remember all the talk about the Euro going to “par”?

I don’t think we can make any judgments about these things right now. Commodity markets are still in the range they’ve been in since 2016. Nominal and real bond yields are still in their respective ranges of the last few years. In short, not much has changed yet. But the things that don’t make sense are adding up so investors need to keep an open mind. If bond yields are indeed making a secular bottom that is a change with huge implications.

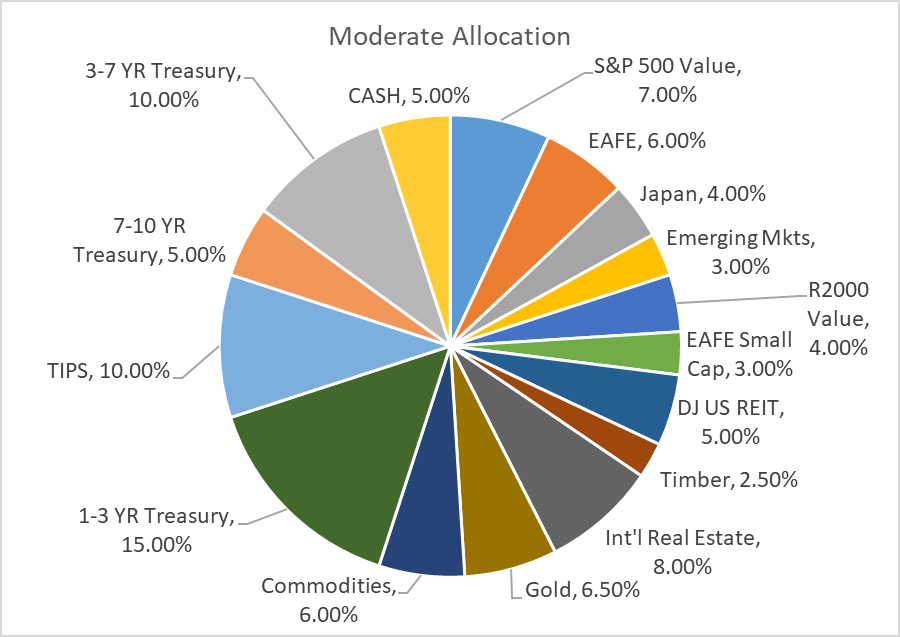

While acknowledging that we don’t have enough evidence to make big changes to the portfolio, I do think it is time to eliminate our underweight to real assets. The risk side of our portfolios are split between stocks and real assets (real estate and commodities). We have been underweight real assets for years now and I think it is time to end it. Here are the changes this month to the moderate portfolio:

- Raise Gold to 6.5% from 5%

- Raise the general commodity allocation to 6% from 5%

- Add 2.5% to CUT in the REIT allocation. CUT is a global timber ETF.

- Reduce cash to 5% from 10%

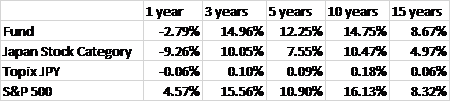

Note: We have recently shifted to an actively managed fund for our Japan stock allocation. We’ll have more to say about the fund soon so watch your inbox. In the meantime here’s some information on the fund:

The fund has had the same manager since 2006. It is fairly small at about $600 million in assets. It is concentrated, holding just 26 positions and turnover is negligible.

Here’s the overall allocation for the moderate portfolio:

Stay In Touch