The European slump had been a combination of several transitory factors. At least that’s what they had kept saying. ECB officials and staff Economists didn’t use that specific word, so far that’s the exclusive domain of the Federal Reserve. Regardless of semantics, the message was clear: the 2018 economy ended on a sour note but that was nothing to be worried about, soon to be forgotten.

In January 2019, various private Economists pitched in. One working for JP Morgan, Greg Fuzesi, estimated that the low level of water in the Rhine and other waterways was responsible for taking 0.7 percentage points away from 2018 German GDP.

The implication was clear – in theory. Dissipating also “temporary shocks in the auto and pharmaceutical industries” along with a little more rain and Germany would be right back at its familiar place as the engine of Europe’s accelerating, inflationary breakout.

Except:

Fuzesi notes that not all of Germany’s weakness can be explained by such one-off events, and the cause of the rest is a “puzzle.”

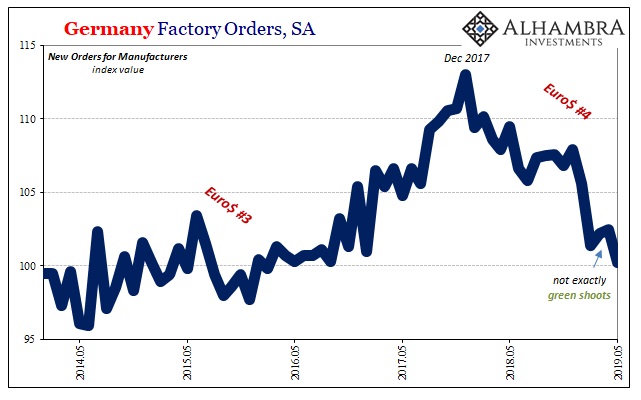

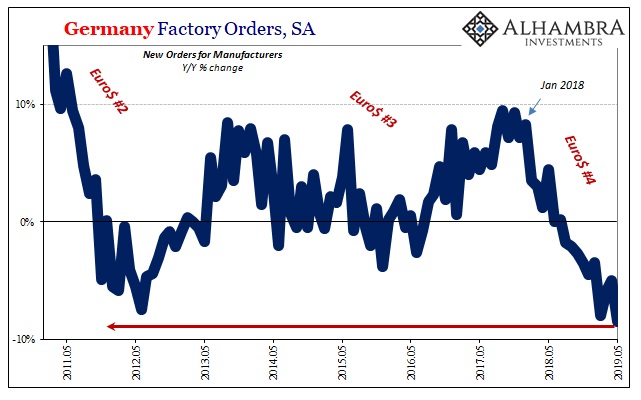

To end 2018 on such a worrisome note, German factory orders in December had been 4% less than they were in December 2017. It was the largest decline since 2012 – the last time all of Europe, Germany included, had been subjected to an official recession declaration. A quick turnaround wasn’t just desirable.

If not rainfall and emissions tests, then Germany and therefore all of Europe would be in for some serious trouble. Hopefully, then, not the “puzzle.”

According to estimates released today, the German factory sector is still shrinking. Updating data through the month of May 2019, DeStatis believes new orders in that month were nearly 9% less than they were in May 2018. Rather than get any better, factory orders are accelerating on the downside.

May’s decline was the largest since September 2009. Given that the contraction in them began last August, with the downturn starting last January, nearly a year and a half ago, the words “temporary” or “transitory” just don’t apply.

Nor does the word “puzzle.”

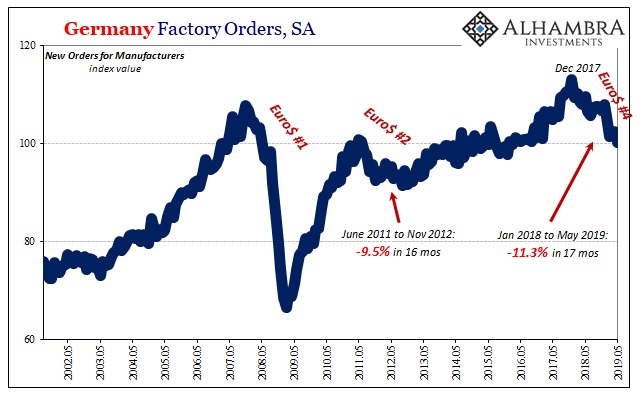

From June 2011 to November 2012, factory orders slid for sixteen months, falling by a total of around 9.5%. Going back to the very start of 2018, factory orders are lower (seasonally adjusted) for now seventeen months and counting. The overall decline so far reaching more than 11% in total. Already worse than what was an outright recession before.

Seven years ago, Economists wouldn’t have cited a puzzle for the European economy’s shocking recession. They did claim it was “unexpected”, of course, but once it happened they all pinned the thing on Greece (and Club Med, or PIIGS). There isn’t an obvious Greek problem today, thus either rainfall or a puzzle.

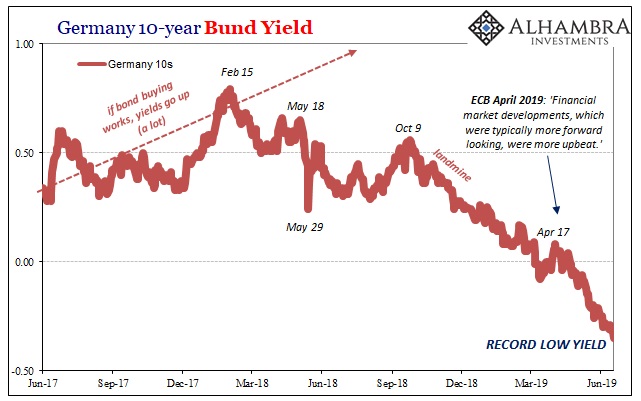

If, however, 2011-12 had less to do with southern sovereign debt, and was instead due to much the same thing as what Europe (and the rest of the world) is confronting today, then we are left to first worry about how this time is already much worse than that time – with bond yields and curves telling us there’s still a lot more of this to come.

A slow-motion train wreck is still a train wreck. Whether it ever gets categorized as a “recession” by officials is immaterial.

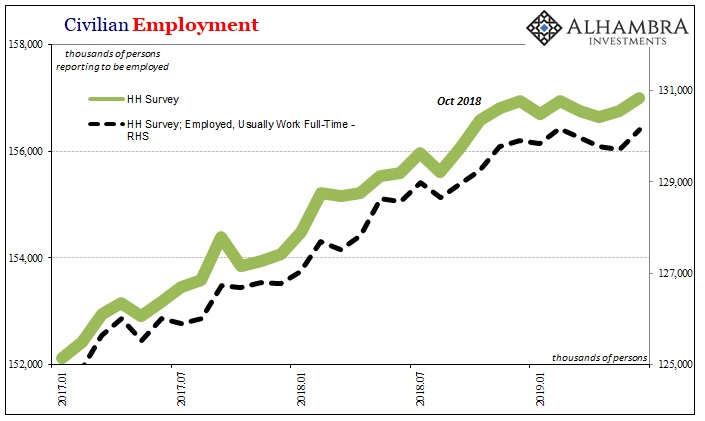

All throughout last year, it should be noted, the US jobs report remained elevated at least compared with 2017’s. These were characterized as representing a strong American labor market for the world economy to latch onto. At the very least, the US system would be left immune to “overseas turmoil.”

And yet, the global economy throughout 2018 continued to grow weaker as did, as we see now, the US economy and labor market.

In other words, Germany’s manufacturing problems were forward looking in a way the US payroll figures absolutely were not. This year, it is the latter which are moving in the former’s direction rather than the other way around. The Germany factory estimates have been telling us which way this thing is going, the US labor data confirming it that way later on (including the numbers today).

Though still a puzzle for them as to why, even the Economists are finally giving up on transitory; not that they have any choice in the matter.

German factory orders slumped in May in the latest sign that global trade uncertainty is turning Europe’s temporary slowdown into a more serious downturn…

ING said the report “wraps up a week to forget,” and JPMorgan now predicts that Germany may have contracted in the second quarter. If that happens, it would be the third time in a year that Europe’s largest economy posted no growth at all.

For now, the American payroll report is being talked about as if it offsets or contradicts this clear German gloom. Given recent history, however, it is much more likely that no one will remember the June payroll numbers.

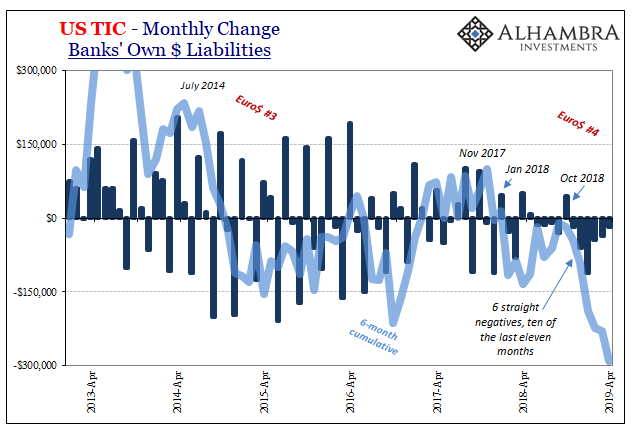

Things are pointing down, and both data points (Germany’s factories and the US jobs market) actually are in agreement. The only difference, what last year was called “decoupling”, is timing. The Germans are leading the way, and unfortunately that suggests a very real probability Euro$ #4 is nastier than either #3 or, in Europe even, #2.

Rather than rainfall or a trade truce, being able to solve the puzzle is the only thing which could prevent those comparisons. And time is running out; not just in Germany, but everywhere.

Stay In Touch