The easy answer for “muted” inflation is consumers. Forget the unemployment rate debate. Let’s assume that labor markets are tight. Workers are scarce and companies have to compete, and pay up, to secure labor. Input costs are rising.

That doesn’t necessarily guarantee an accelerating CPI or PCE Deflator. There is a final step in the Fed’s recovery process. Those labor-driven costs should then be passed along to consumers. That’s the only part which eventually is supposed to show up in the inflation numbers. The last piece of the puzzle.

What if companies find that they can’t pass along labor costs? Even if labor markets are tight, no CPI. The question to ask at that point is, why can’t they?

You have to start to wonder what would be going on if this is the case. The inflation estimates all say that price pressures remain muted. The unemployment rate is still less than 4%. Something has to give.

And that’s just where we begin.

The Personal Income and Spending estimates for the month of March 2019 not only continue to defy the mainstream inflation narrative, something else is up. Income growth has suddenly fallen off. When the calendar flipped to 2019, it’s as if the labor market was stung, and stunned, by “something.”

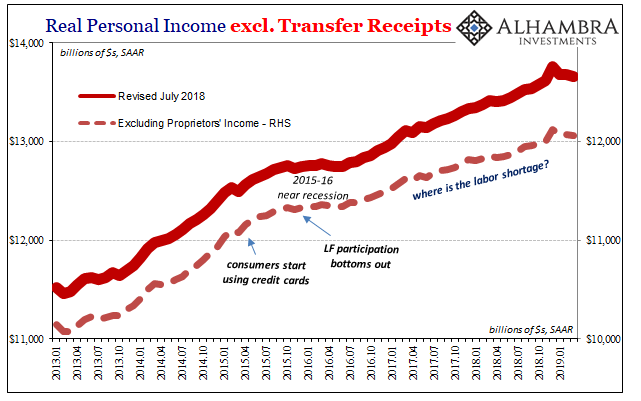

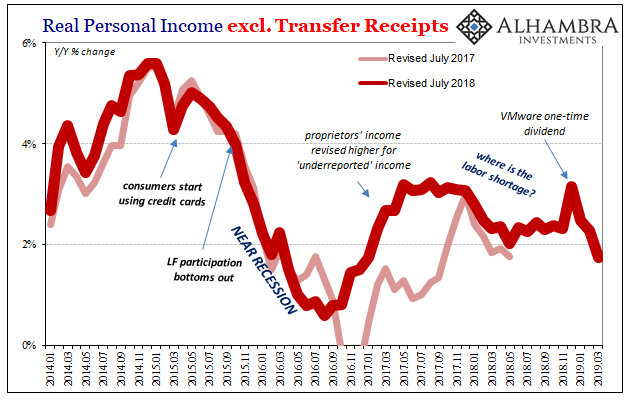

Real Personal Income excluding Transfer Receipts is one of the few data series the NBER business cycle dating committee relies upon to (unreliably) date the business cycle. A sustained, multi-month slump in this series is unusual and only shows up during periods of clear economic weakness. Typically, that’s recession. Nothing has been typical the last decade or so.

As you can see above, Euro$ #3 produced a noticeable dent in the data. Consistent with a severe if unappreciated form of downturn, the US wasn’t immune from “overseas turmoil.” That it showed up in Real Personal Income excluding Transfer Receipts demonstrates the severity of the event.

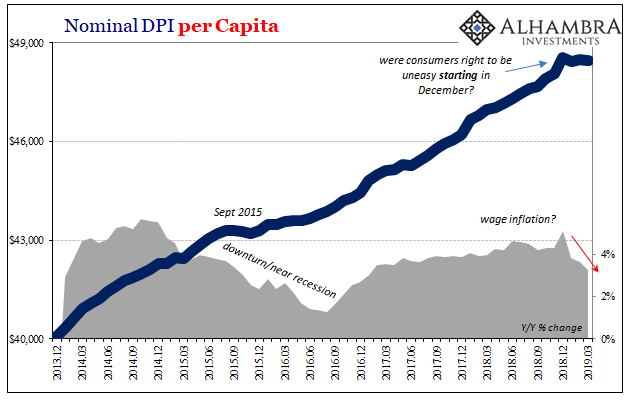

We first have to take note of last December’s distortion, though. There could be some lingering aftereffects, some statistical payback, so to speak, from a one-time dividend payment at the end of 2018. While that is a small possibility, the more likely explanation is the one people won’t want to hear.

Income growth appears to be falling way behind the pre-December pace, which wasn’t really all that robust to begin with (no indication of wage pressures). Year-over-year, the series was up just 1.8% in March 2019, far too much like late 2015.

It’s only a few months, so no definitive conclusions can yet be drawn. The suggestion, however, is that something substantial might have changed in the labor market, therefore the overall economy. If it did strike a landmine during that October to December window, we would expect the labor market to show it at somewhat of a lag. One quarter of the way through 2019, more weakness materializes and in the most vital spot.

The problem, at least so far as the data shows, is income itself and not necessarily the “real” part of these income series. Nominal income growth is coming down, meaning that businesses are slowing down hiring workers or what they pay for them (or both). It’s not the first sign of labor market weakness we’ve noted, but it is the first indication that any downturn is becoming so serious.

Nominal DPI per Capita rose just 3.23% year-over-year in March. That’s more like the downturn raging in September 2015 than the reflation optimism of September 2017 when inflation hysteria, driven by expectations for an economic boom, were really getting going.

This might suggest an answer to the core inflation rate’s drop the last few months. If businesses regardless of the unemployment rate feel they can’t pass along price increases for whatever reasons to consumers without sacrificing sales, that would show up as a slowing inflation rate. And if consumers as workers are increasingly wary of the labor market and overall economy, regardless of the unemployment rate, they would become more price conscious making it more difficult for businesses to raise prices.

Does now three months of alarming income data scare the Fed into Larry Kudlow’s rate cut camp? The more important question is whether that would even matter. I doubt that it would.

More and more the data keeps lining up anyway in the direction of rate cuts, voluntary, pre-emptive, whatever. Ever since the middle of last year, the markets, those that really matter, have increasingly priced just that scenario.

And over those many months officials had first dismissed those warnings as the rantings of “mispriced” markets, and then dismissed them again as “transitory” factors that will clear up on their own given only enough time. Yet, the data continues to point toward something far more substantial. A constantly growing threat that even after these many months still looms over the horizon.

Missing on inflation is serious enough already by failing to corroborate what was supposed to have been a boom. The income data is much more significant still. It is far less about yesterday and far more about tomorrow. We aren’t there yet, more data left to come in, but tomorrow keeps looking worse and worse.

If it has hit income, that’s a big key. Given this crucial data, we are left only with some version of downturn. Whether you want to or not, you have to begin thinking about the r-word.

Stay In Touch