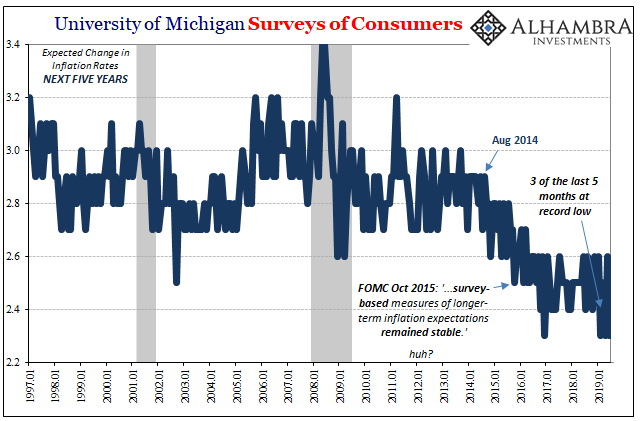

For the third time in the last five months, inflation expectations have matched record lows. To hear officials and Economists talk, you’d think they were at or nearing record highs. The unemployment rate, after all, is at a 50-year low point which by mainstream reckoning should mean the cusp of an epic wage-driven breakout.

According to the University of Michigan’s Surveys of Consumers, it’s just not there. In fact, it’s never been there. Like bond yields, there has only been conspicuous lack of any evidence to back up the claim the labor market is tight. The entire LABOR SHORTAGE!!! (which has curiously disappeared this year) was based on cherry picked anecdotes and never anything more.

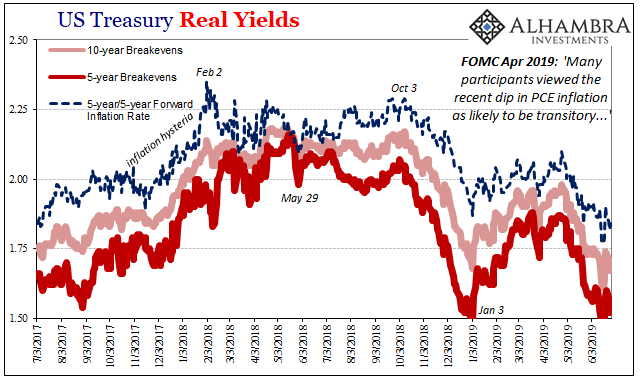

Even if you don’t particularly care for consumer surveys, there’s the same consensus from market-based views. The TIPS market, where getting inflation wrong can really, really cost you, there was a total absence of concern about an inflationary breakout, too.

Nowadays, the focus is entirely the other way. Once more, consumers and the bond market agree – Economists have no idea what’s going on in the economy.

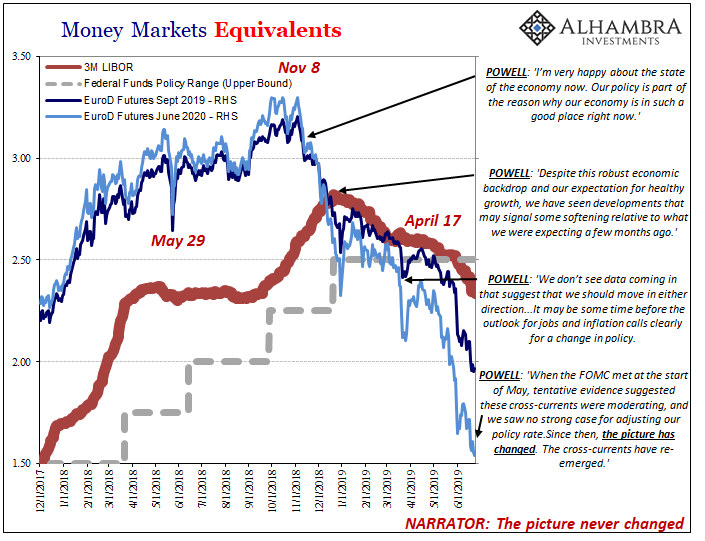

In April, the FOMC trying to make some semblance of an argument for a second half rebound, once more used the word “transitory.” While they did so, market expectations were already low and preparing to dip even further.

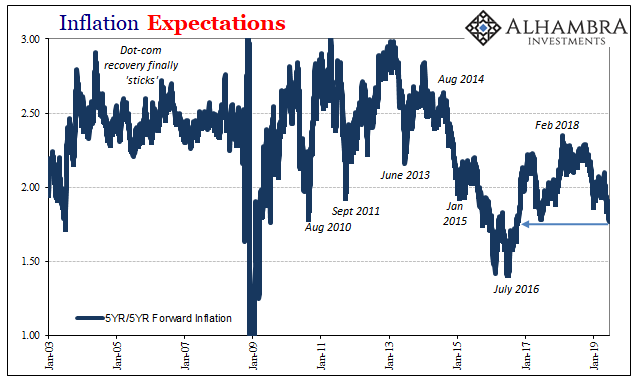

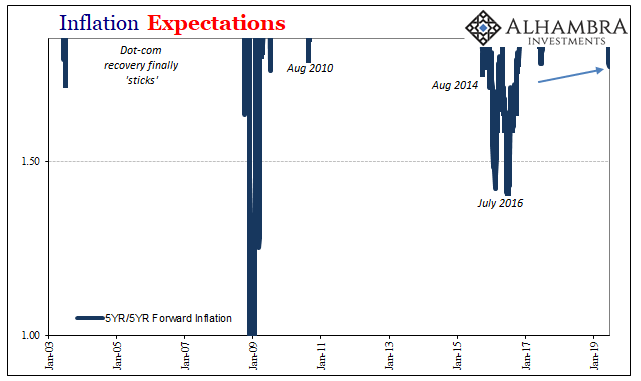

The 5-year/5-year forward inflation rate, a market measure of “anchored” inflation expectations, recently dropped to the lowest level in more than two and a half years. The market is saying that inflation expectations are now less than they were in January 2015 (oil crash) or September 2011 (second global crisis).

How bad is this? Inflation expectations have rarely been lower than they are right now. This includes market as well as survey-based measures, a broad consensus that the labor market view derived from the unemployment rate isn’t just flawed it is entirely misleading.

It always was, which is why it is no surprise to find another month without the promised inflationary breakout in the inflation numbers themselves. Those promises were never really honest analysis, and never the actual consensus outside of econometrics and the few who never leave their models.

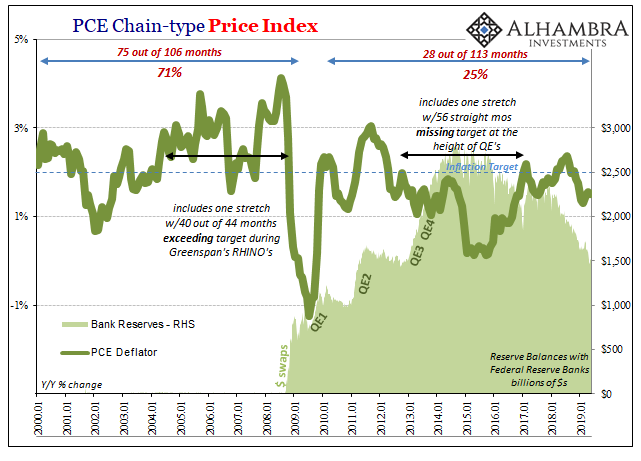

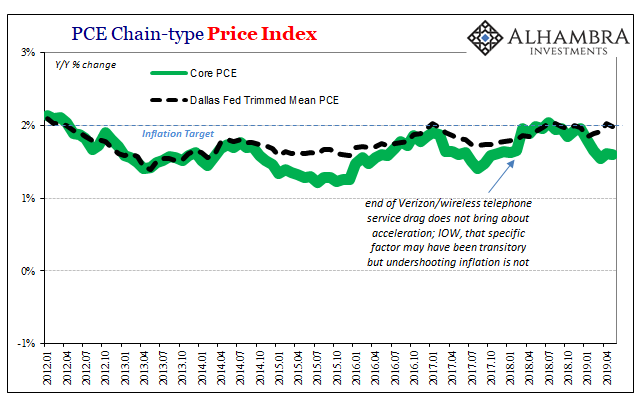

The PCE Deflator increased just 1.52% year-over-year in the month of May 2019. That’s now five straight months below target. However one may think of the series, it is undershooting all over again. Had the economic trends as the mainstream described them in 2017 been true, it would have represented a paradigm shift out of the post-2008 funk; an actual end to the Great “Recession” at long last.

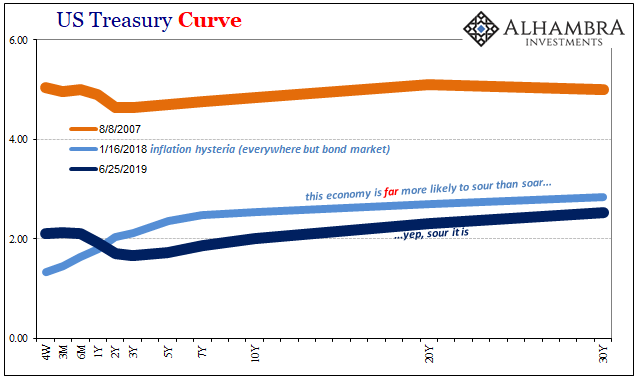

The bond curves disagreed all along, saying loudly there was little chance for it. Outside of oil prices, there was never any inflationary pressures because the economy hadn’t changed at all. It simply went into reflationary mode, like before, and now once again it’s back into being monetarily squeezed (dollar shortage).

Even the core PCE Deflator has dropped in a manner consistent with past Euro$ episodes. Today without Verizon to blame, at 1.60% growth in May it is uncomfortably close to the prevailing levels of 2015 and 2016 rather than a new ascent far and away above the monetary policy target.

The second half rebound, or even the rate-cuts-are-insurance view, both are predicated on the same mistaken interpretation. The labor market is strong; therefore the economy will easily transit this soft patch, or at least do so with a minor boost from Jay Powell.

The inflation numbers instead make plain the labor market was never strong, and both consumers and bond investors are considering only a growing downside on the economy. One that other parts of the bond market confirm is just getting started.

Stay In Touch