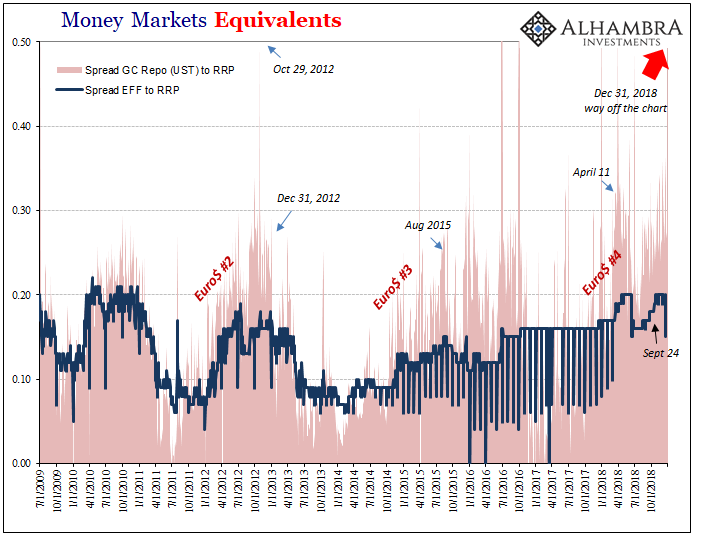

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps.

We also have to keep in mind the circumstances of that particular period. The end of 2012 was nothing like it was supposed to have been. Unless you understood what had really happened in 2011, few did, this was going to be the year of full and complete recovery.

Instead, economic data all over the world pronounced alarming weakness; a global slowdown of an “undetermined” nature. What transpired in liquidity trading merely consistent with all of that.

Ben Bernanke panicked. FOMC colleagues like Jerome Powell told him to stay the course and hold on, the US economy merely needed more time to heal itself. The repo market, on the other hand, suggested that may not have been true. Bernanke opted for repo.

Only, QE3 was announced in the middle of September 2012. The first transactions were executed under it in early October. The level of bank reserves began to rise yet the repo rate wouldn’t budge. On October 29, it exploded upward while QE3 was in full swing.

The result was QE4 in late December. Common convention assigns both those as a single program, the third, when they were anything but. QE3, the MBS purchase version, wasn’t working. Bernanke believed the system needed another which is where the UST purchases of QE4 came from months later. The repo market in between showed the futility of either.

If adding bank reserves didn’t lead to easing, how can fewer bank reserves result in tightening? If QE wasn’t E then QT isn’t T. What ended the rout in markets was the growing realizing in 2013 that the 2012 slowdown hit Europe with recession but didn’t appear to be so serious elsewhere. Asia seemed to have been spared (until 2014). The repo market wouldn’t really calm down until May 2013 (Reflation #2).

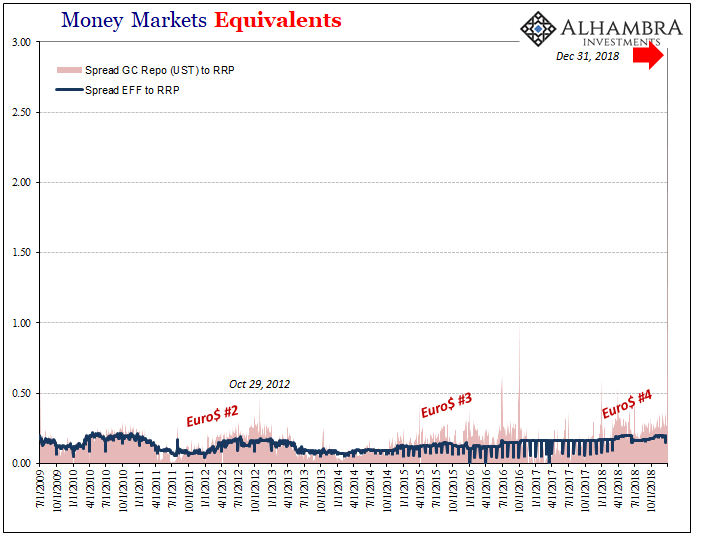

You may have heard something about repo this week to end the calendar year 2018. On the last day of trading, again the calendar bottleneck, the repo market went insane. There are several posted repo rates each pertaining to specific parts of it. The rate published by DTCC is the general collateral rate meant to be applied broadly, to give us an overview of what’s going on in the shadows.

The GC rate for UST collateral on December 31 was 5.149%, or, more appropriately, 289.9 bps above RRP. It was a fitting repo mark for a month filled with liquidity and economic warnings, the perfect way to end Jay Powell’s spoiled year.

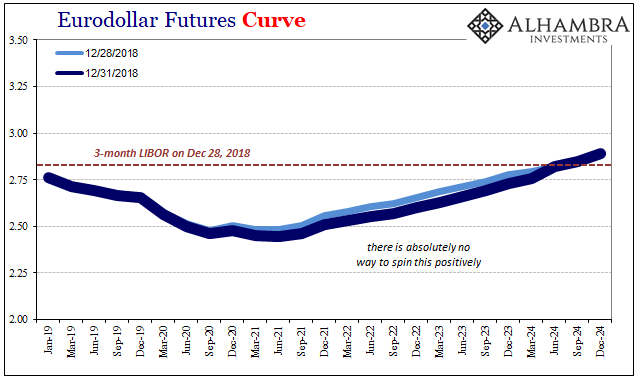

There are a number of implications starting with comparisons to October 2012. If a 53 bps spread spooked Bernanke into QE4, why wouldn’t nearly 300 bps shock Powell into something other than “strong” economy? Actually, that’s just what eurodollar futures are now trading – lower interest rates immediately ahead likely as just a first step in another round of pointless monetary policy flailing (or what they call “easing”).

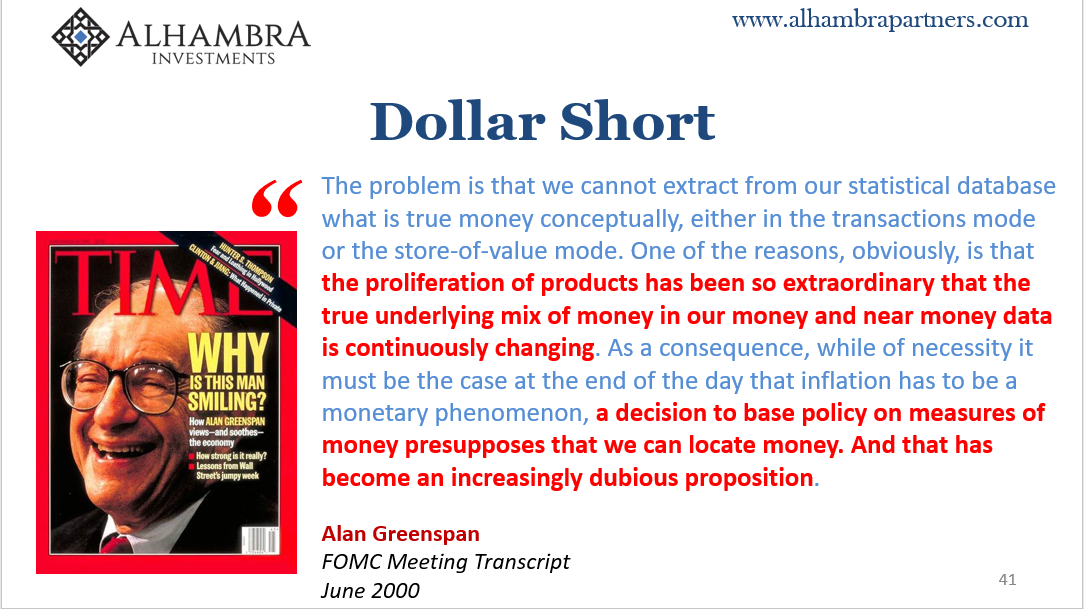

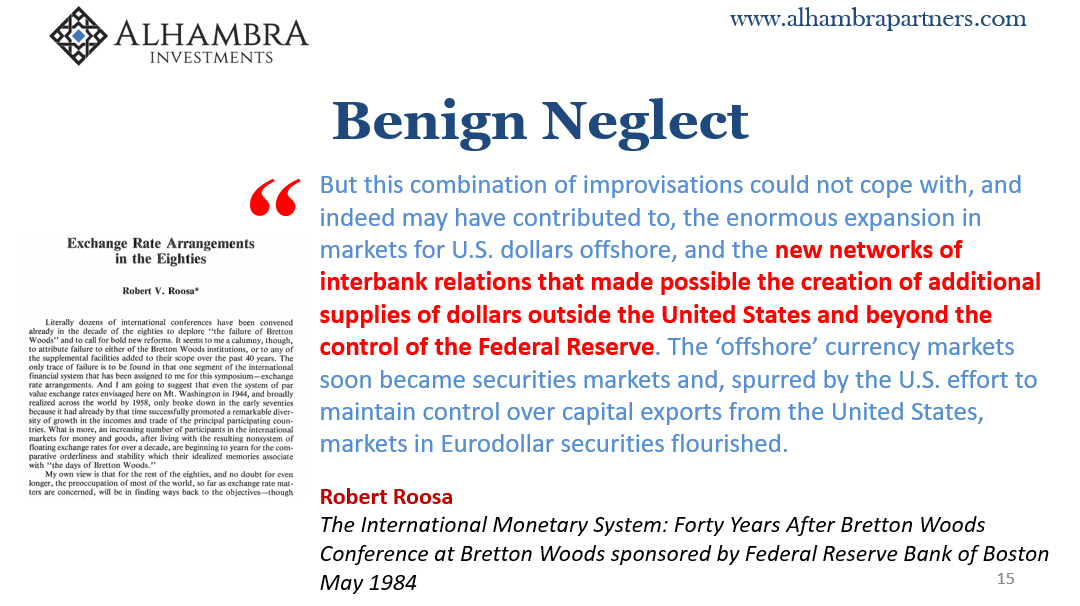

These Economists have no idea what they are doing. They just don’t. It’s really hard for some people to believe this, the legend of Greenspan and the myth of technical competence. Even the maestro admitted (many times) no central banker could define let alone measure money, and that was two decades ago.

So, logically, if you can’t define nor measure money how would you ever know if there is a monetary problem?

Furthermore, even if you did somehow start paying attention to these sorts of “anomalies” how would you know what should be done about them? You can’t just catch up on half a century of monetary evolution all at once; which explains everything you need to know about QE.

But for the sake of argument, and to illustrate an important point, my main point, let’s say bank reserves were a crucial piece of the modern liquidity dynamic. Let’s assume QT and the drawdown in reserve balances was tightening. So what?

Where’s the rest of the private system to step in and provide what the Fed no longer does? See, that’s what’s missing here, the only thing that matters. If the economy was actually robust any sort of QT would be relegated to a minor technical footnote, money dealers eager to fill the void seeing opportunity where it should be.

The end result of QT as Powell and the FOMC understand it would be a hand off from public balance sheet liquidity to privately created. It should have been seamless but even if there were a few bumps, as the BIS desperately claims, they would be bumps not market terror(s).

A GC repo fix even at end-of-year of 5.149%, 290 bps above RRP, is not a bump. QE wasn’t E, QT therefore isn’t T. The T that we did observe throughout 2018 is the absence of private money dealing (May 29 and collateral most of all), the eurodollar balance sheet capacities central bankers still haven’t bothered to consider despite the last eleven years. The last trading day was a perfect reminder.

History rhymes, especially the ominous surrender from the global economy that toward the end of 2018 was eerily similar to 2012 (and 2007 or 2014). QE or not QE, doesn’t make a difference. The end result is the same regardless. One of these days people will stop listening to central bankers and start demanding some real answers. I doubt, however, they will do so before the global economy is unnecessarily and severely damaged by monetary malfunction yet again.

After enough economic damage, they may just altogether skip asking questions.

Stay In Touch