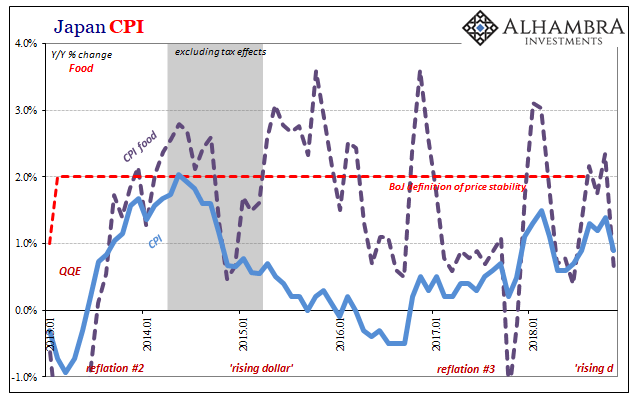

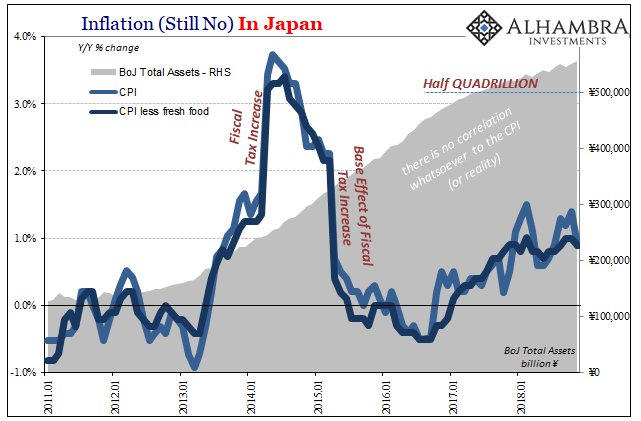

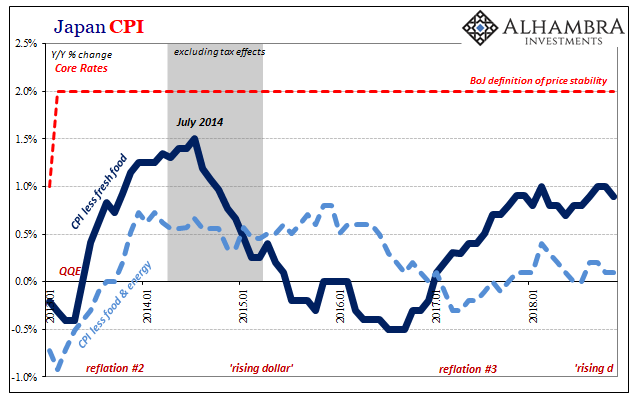

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

In yesterday’s article the topic in the East was China. Today, the US CPI confirmed the oily nature of US or European inflation. And in Japan, the Japanese CPI reinforces the role of Eastern food prices.

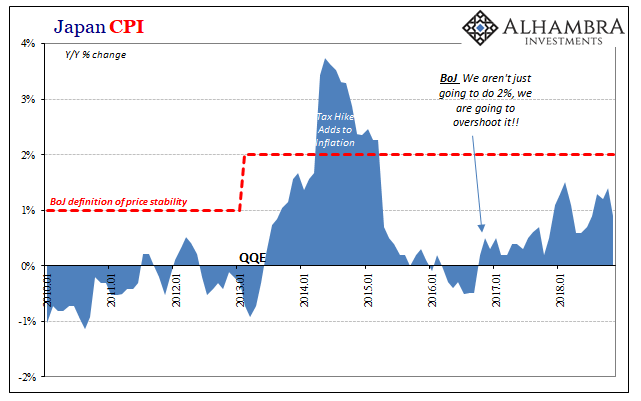

These had spiked up earlier in 2018 which resulted in simultaneous hardship (even more) for the Japanese people and premature celebrations by Economists who don’t factor household conditions into their models. In the orthodox, central banking world higher inflation is to be welcomed even if only because it (seems to) takes the pressure off.

Bank of Japan Governor Haruhiko Kuroda could hardly contain himself – until food prices decelerated sharply at mid-year. Dreams of hitting the 2% target evaporated as vegetables stopped becoming expensive so quickly.

The second time, accompanying bad weather, even officials were subdued in their reaction. As fast as volatile food prices spike, it all disappeared just as the last one did this time in November.

It left headline inflation, the CPI up just 0.9% year-over-year in November 2018, no closer to the official target despite closing in on ¥600 trillion in BoJ assets.

But the game rolls ever onward anyway. When the BoJ runs out of financial assets to purchase so as to create inert, useless bank reserves perhaps it can start buying up parcels of ocean water or clouds that pass over Japan in the sky. The results will be exactly the same.

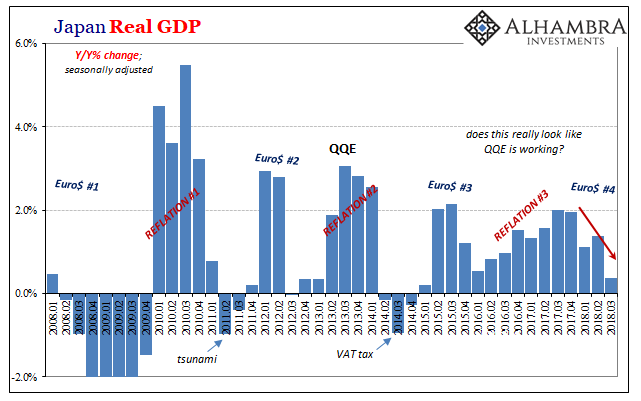

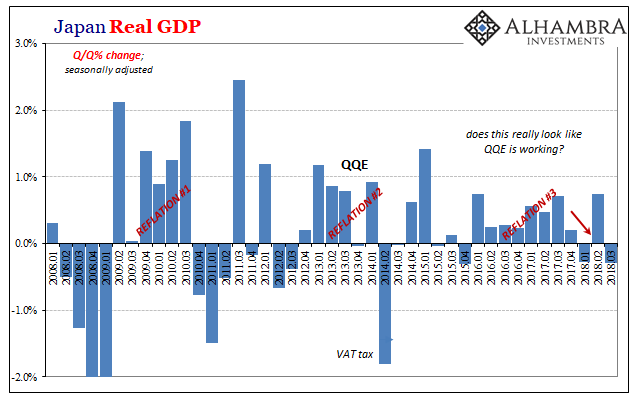

If there are detectible rhythms in the Japanese economy they don’t originate in Kuroda’s office conferences. In 2017, there was some general improvement in it, which is why BoJ officials were so quick to crown their perceived success over inflation early on last year.

Like the CPI, however, that economic improvement largely disappeared. This became much clearer as the calendar wore on, explaining also why in the second CPI spike the reaction to it was so much more, dare I write, muted.

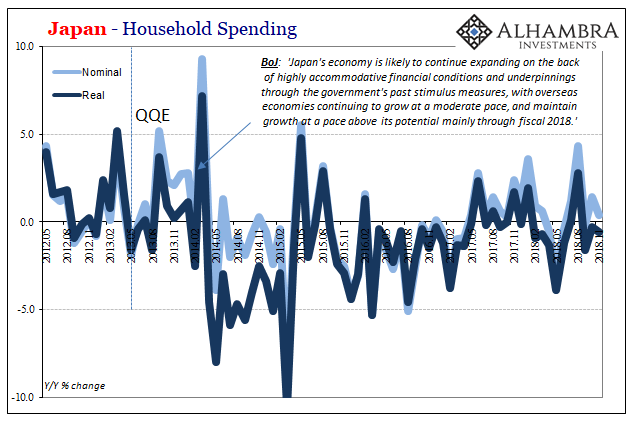

We’ve seen these rhythms repeated all over the world; 2017 somewhat better; 2018 back down circling the drain again. In terms of household spending and income, the inflections are the same as they have been globally. Japanese money and the money that drives the margins of the global economy does not originate with the Bank of Japan.

The eurodollar system turned the wrong way in 2018 (starting in 2017) and the consequences are written all over something like Japan Household Spending and Income. In 2017, under Reflation #3, household spending averaged -0.3% as contraction remained under the effects of the prior downturn. In the last six months of that year plus January 2018 (in what more and more appears the final month of that reflation trend), the average was +0.7% which isn’t much but for Japan it seemed huge.

For all of 2018 through November, -0.5%; with spending contracting in each of the past three months and positive in only two of the past ten. Japan’s economy is right back down to where it wasn’t supposed to return. With GDP negative in two out of 2018’s three quarters, the economic turn isn’t one limited to just beleaguered Japanese households.

I can’t decide which one is the worse case; in Japan, at least, the Japanese people don’t seem all that bothered by almost three decades of inept policy. It has led to a sort of political stability only bordering on insanity. It’s as if Japan has put itself into a deep freeze hibernation and they are perfectly willing to be OK with the sleep.

These results being replicated elsewhere have moved the whole world the other way, though. Rather than chilling the globe’s various populations, the lack of growth has heated up serious political and social instability. Brexit, Trump, Bernie, Bolsinaro, AOC, Itexit, Emperor Xi, these had all followed the 2015-16 downturn.

In the one sense that’s good; it could lead to the way out, a wake-up call or opening that maybe somewhere someone finally “gets it” that the economy is broken because central bankers don’t know their jobs (a fact made more obvious by the ridiculous overhyping of 2017). That would be a far more preferable scenario than Japan’s three lost decades. One is more than enough already.

Then again, if history has taught humans anything it is that you can’t control fire. It has a way of breaking free and consuming. In mathematics, chaos theory, it is the unpredictability of complex systems that can be hugely upset by the smallest little nothing (spark) when that system reaches a critical state. That’s the real danger of Euro$ #4 globally, another downturn that unleashes wildly unpredictable backlashes.

Kuroda doesn’t have to worry about that. We might. Japan’s economy gives us insight, short run and long run, into the economic possibilities ahead. Its political situation does not.

Stay In Touch