It was framed as a good news/bad news sort of situation. For many, the entire issue of possible recession revolves around the service sector. As far as manufacturing goes, no one will argue otherwise; it’s already in trouble. But it’s a much smaller slice of overall economic activity, and unless we are talking 2008 levels of collapse there “needs” to be more on the downside for it to make a big enough difference in tipping the whole economy.

The hope rests entirely upon services. If services begin tilting too far the wrong way, then there’s no basis for avoiding a serious economic dislocation. Once manufacturing weakness begets services weakness, then the last line of defense is rate cuts. Meaning, there would be nothing left on the plus side.

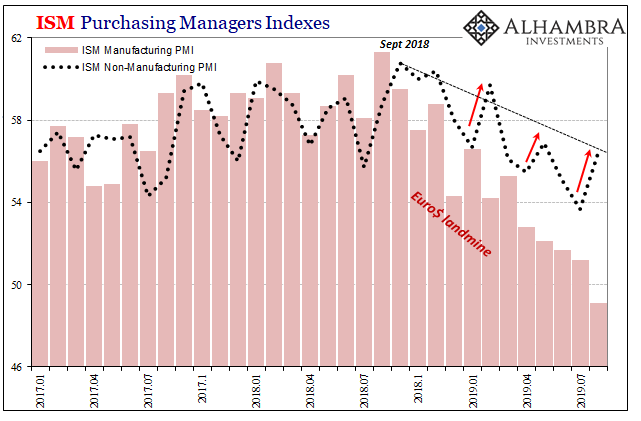

Competing forward-looking indications, the ISM Non-Manufacturing PMI and IHS Markit’s services PMI went in opposite directions for August 2019. The former provided some seeming assurance badly needed given where things stand this far into 2019. From a low of 53.7 in July, for August it rebounded to 56.4.

A gain of nearly 3 points in one month, many took it as a sign of encouragement. If that was the measure of good news, however, then that’s not good at all. The ISM does this as a regular part of its noisy calculations. It alternates almost by the month.

Earlier this year in January, for example, the index fell from 58.0 in December to 56.7. And then for February it rebounded sharply and blew past December to come in at 59.7. Green shoots, apparently. Only to fall further in March and April than in January.

In other words, when you factor the regular saw-tooth pattern to the monthly volatility for the index, the ISM isn’t necessarily looking very good at all. There is as yet no reason to believe August’s rebound was actually a rebound. There is still every reason to suspect the ISM’s two PMI’s are actually confirming each other – even though the manufacturing number is way ahead on the downside (falling below 50 for last month).

Both of those are materially lower in 2019, the downward trend intact.

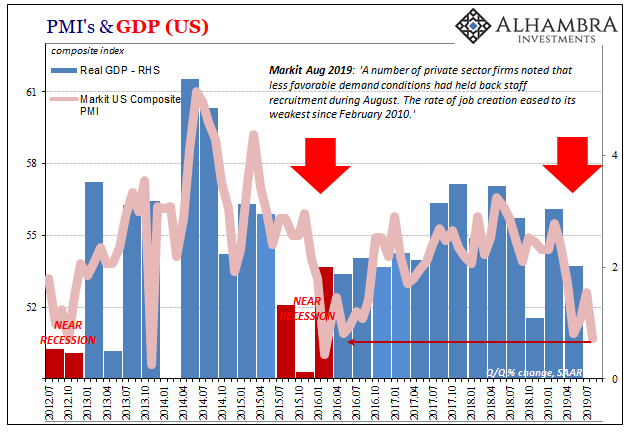

Markit’s PMI, on the other hand, was straightforward. I’ll let the press release speak for itself:

The slowdown in output was driven by only a marginal upturn in new business, the least marked since early-2016. Moreover, foreign client demand decreased. Subsequently, firms expanded workforce numbers only fractionally and the level of business optimism sank to a fresh series low.

It’s that last one which should grab your attention. According to Markit’s view of where things stand – in the services sector – businesses have never been this pessimistic. As a result, unlike the noisy ISM, this other non-manufacturing indicator dropped sharply in August from July. It had been 53.0 and has now fallen to 50.7 (down from the “flash” estimate of 50.9).

As for the composite PMI, it therefore fell to a new multi-year low of 50.7, down a touch from the flash August estimate of 50.9.

It doesn’t appear as if the services segment in the US is holding up very well at all – even including the ISM’s jumpy August in that view. The broader economy has slowed significantly since late last year (landmine). What that ultimately means remains an open question.

To that end, it’s not looking so good outside the US which is where a lot of this weakness is coming from. The idea of “overseas turmoil” has returned even if the specific term hasn’t been reused this time around.

While “trade wars” and tariffs are being blamed, JP Morgan’s Global Composite PMI, produced in association with IHS Market, dispels the notion in its data even if still referencing the geopolitics behind protectionism trying to interpret it. This index like a lot of overseas data began its descent way back in the early months of 2018 – when the dollar turned around and started wrecking things.

Again, I’ll let the press release do the talking:

Global economic growth remained lacklustre in August, with signs that more weakness may be on the cards. Output rose at one of the slowest rates over the past three years, as new order intakes expanded at the joint-weakest pace since late-2012. Business optimism about the year ahead dropped to its lowest since future activity data were first tracked in July 2012.

The text then added that, “The slowdown was mainly centred on the global service sector.” As with US services, JP Morgan’s global survey picks up on the same theme. These are, after all, broad gauges of sentiment. For both to register the lowest levels of optimism in each’s series, while being non-specific and more intangible it is still a worrisome indication and one more importantly that is forward-looking.

Already discouraged service providers is a profound difference from the idea that services will make up for and offset inarguably troubled manufacturing.

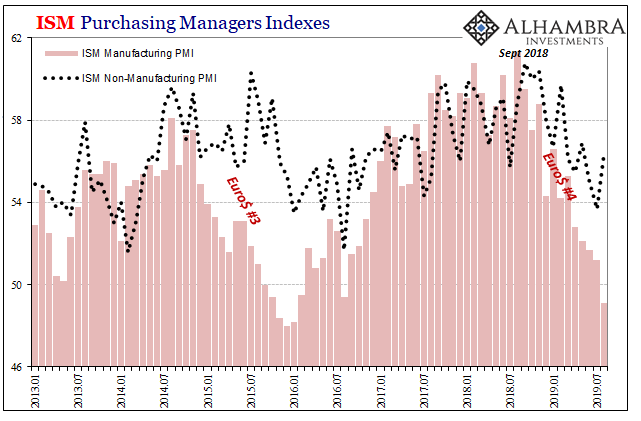

There is even here a lot of evidence of the latter being unusually weak (as in, output levels already in Euro$ #4 equaling or nearly equal to the worst parts of Euro$ #3) and how that weakness is still in the beginning stages. It doesn’t quite add up to the same sort of good news when taking the ISM number in pure isolation.

Stay In Touch