Perhaps it is very fitting timing. Not quite in the manner of serendipity, more like events matching stupidity. In the annals of the absurd, central bank programs fill out most of the catalog. It is getting harder and harder to describe the level of ridiculousness, the rationalizing already bordering on the sheer lunatic.

And it all derives from just one thing.

Economists start with R*. In reality, R* or R-star is just their way of admitting the economy has never been fixed without accepting blame. Ben Bernanke didn’t announce ZIRP and QE1 by saying the recovery will be stunted because the natural interest rate is going to fall by decree of demographics.

It was the other way around! The recovery came out stunted and now afterward central bankers are claiming demographics are the reason(s). It can’t be anything else, so don’t bother investigating. When QE so thoroughly craps out, what else should we expect from this cult?

Did you know that people living longer, on the whole, is a big economic negative? Neither did I, and I suspect this would be news to not just the current inhabitants of planet Earth but very likely the vast majority of everyone else who has ever lived here. I wish I was making this up:

Williams attributed the issue to two factors: longer life spans and slower population gains that hold back productivity and thus keep the U.S and other developed economies in a low-growth pattern.

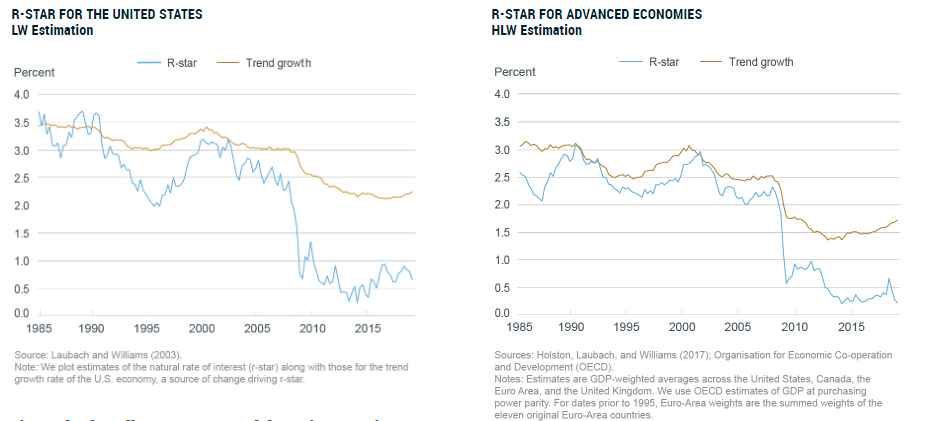

The issue he speaks of is, of course, R*. What FRBNY President John Williams doesn’t say, what he is never asked, is why R* curiously seems to have registered its steepest descent, undergoing what amounts to a paradigm shift right around 2008. Since the natural rate is not directly observable, Economists infer it from different reconstructions. The Fed’s New York branch’s estimates are as follows:

Big collapse at the very same time, we are told, central bankers were heroes courageously saving the system from an even worse fate – that worst fate being a downturn without recovery, a depression. Funny how that happened anyway.

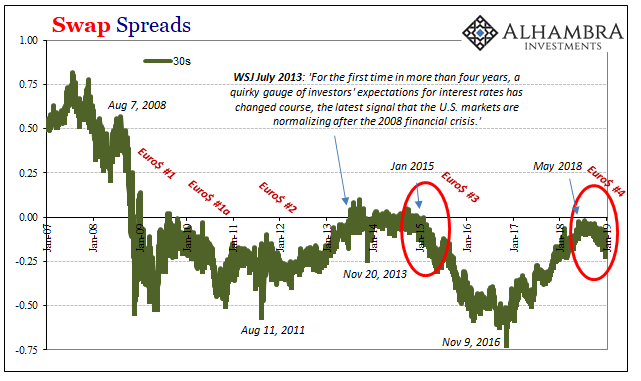

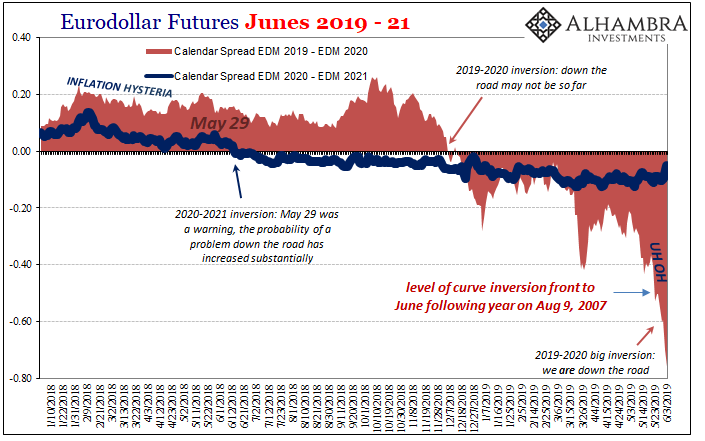

The real conundrum, though, is how freed from the ideological cage of modern Economics we can easily find and appreciate a lot of things which resemble the trajectory of R* in the very places these people tell us not to look:

What all this R* stuff really does is demonstrate that even central bankers are at a loss to explain something they’d rather not explain. It’s why no one ever addresses the elephant in the room: the potential that 2008 wasn’t a recession, that it was a permanent break. How could that be? There’s no way it was Baby Boomers, drug addicts, and Americans living longer all at once at the same time depressed long run growth prospects.

How in the world did anyone think it was a good idea for a branch President to say those words?

And they weren’t even the most ridiculous of the week. Those belonged to Jay Powell. Not his comments about rate cuts, rather why he was in Chicago nervously mentioning the prospect in the first place.

I actually never do this, but this is one time you really should read the whole thing what I’ve written here. If you want to know why we are stuck in this mess, facing the prospects of a nastier Euro$ #4 right now in another experiment proving Milton Friedman’s interest rate fallacy, what the Fed is currently up to is the whole thing.

Right now, “our” central bank is conducting an exhaustive review of its policies in light of how things have turned out.

The condensed version is this: maybe, possibly, perhaps QE wasn’t quite as effective as we thought it would be. The reason? Well, regular everyday folks are too stupid to just accept uncritically how any new and “unconventional” policies work exactly the way we say they do.

Therefore, facing the prospect for more unconventional stuff beyond just QE, by virtue, ironically, of R* and the close proximity to the zero lower bound (now renamed the ELB, or effective lower bound), the way to make these policies effective is, essentially, to stop calling them unconventional and to start treating them like they were just regular operations.

Look, I know it might sound like it but I’m really not making this up. As I wrote:

Monetary policy is something to manage the expectations of consumers and workers. It isn’t actually meant for money dealers. The contradiction is as profound as it is ridiculous…

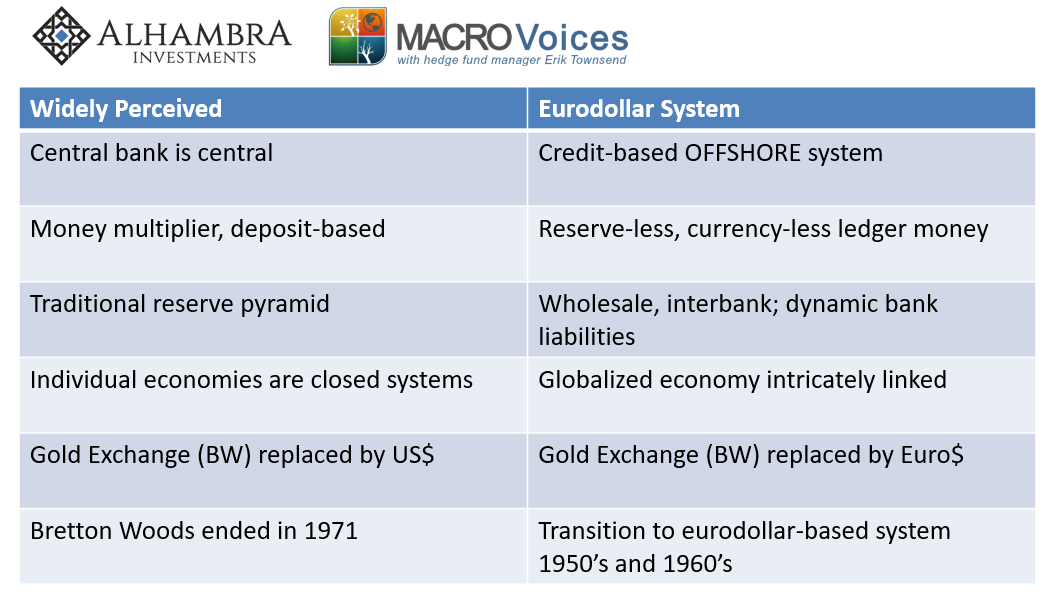

It is also very simple. Long ago, as I’ve noted on so many occasions, Economists and central bankers realized they were having very serious trouble keeping track even defining modern money. Rather than redoubling their efforts to those ends, they decided that by managing expectations they wouldn’t ever have to. It was a gigantic gamble made upon a huge assumption without much evidence.

The Global Financial Crisis and Great “Recession” were the costs of losing the bet.

There’s your R*, swap spreads, and now Euro$ #4 in a nice, tidy little package. And what are all the world’s bond markets saying right now? Money soon…or else.

What are the chances of that? It’s a rhetorical question being priced in curves. Clowns you can at least take serious in their dedication to comedy. It is tremendous disservice to compare them to these unserious central bankers.

The one thing that’s at the heart of all this: central banks are not central. For that one realization, everything falls into place. And it’s exactly why central bankers will further plumb the depths of insanity never more than chasing their tails.

Stay In Touch