Right now, everything comes down to the labor market. Does the US economy hang on despite stubborn and evidently non-transitory overseas turmoil cross currents? Or do American consumers rightly confident of the economic situation re-assert themselves via their wallets and deliriously spend the economy back on track?

You better believe Fed Chairman Jay Powell will be watching the data very closely. If there is one thing which will move policymakers more than a plunge at the NYSE, it would be even the smallest possibility of a pure (meaning non-hurricane) negative payroll number. Given the way things stand right now, widespread uncertainty, should it ever look like there is a very real chance the government ends the Establishment Survey’s 107-month streak, the FOMC will have already debated what kinds of assets the next QE will have to purchase so as to overcome Economists’ improper fixation on the ZLB (or ELB as it is now called).

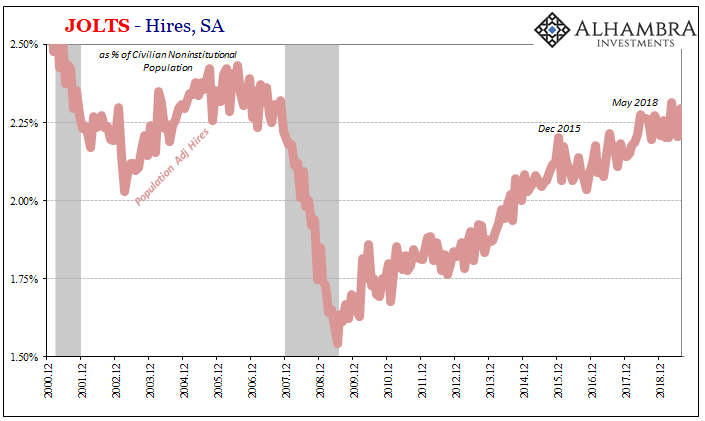

While 2018 proved a transition year, out of reflation and into the more usual eurodollar squeeze deflationary pressures, there were, essentially, two labor figures holding the line on “strong.” The first, obviously, was the unemployment rate. It hasn’t changed; in fact, it is has gotten even better which only proves just how irrelevant it is.

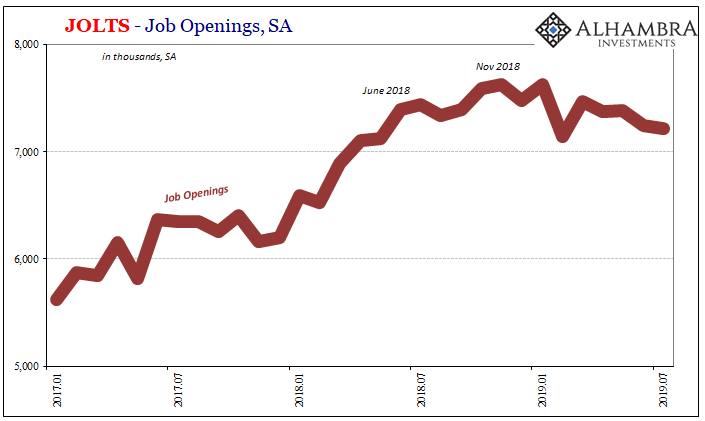

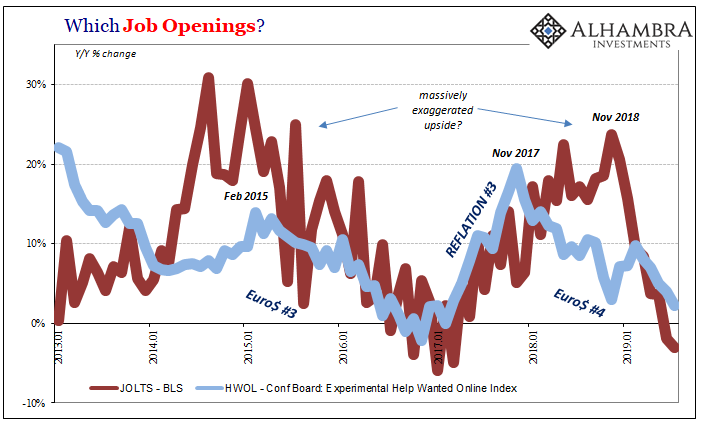

The second was JOLTS and specifically Job Openings (JO). Ostensibly a measure of labor demand, up until November 2018 it seemed to indicate the strong economy everyone (outside of bonds) was then talking about.

But then JOLTS picked up the landmine, too. Since, the FOMC can no longer count JO among its friendlies. Whatever one may think about its performance during 2017 and early 2018 (perhaps overstating labor market and economic strength), there can be no doubt about its signal over the last ten months. A lengthy enough sample:

It has been an unmistakable shift. That doesn’t necessarily mean recession in the US, but it does propose material labor market weakness before one might ever begin.

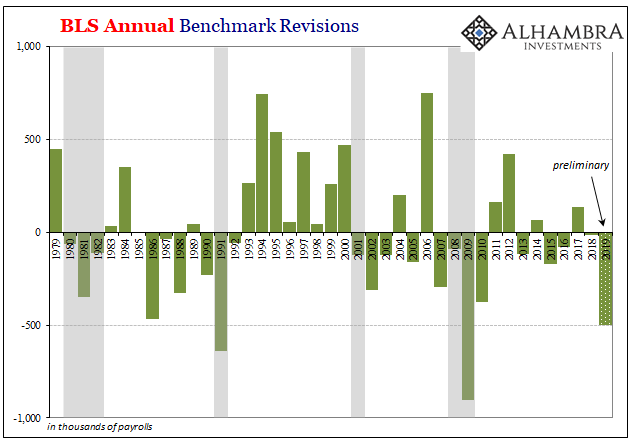

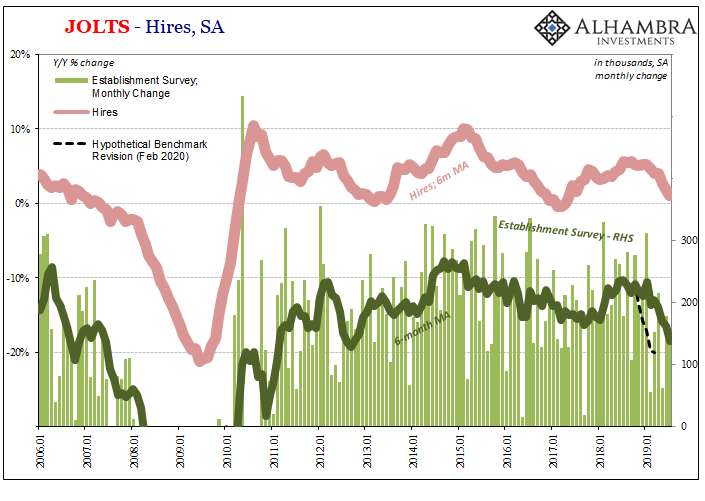

And that’s only where the bad news starts. Like the Establishment Survey, JOLTS will undergo benchmark revisions in the coming months. While the BLS doesn’t divulge any preliminary findings for all the JOLTS series, it only does that for the Current Employment Situation, or CES, we already know that what you see above is the best-case scenario for it.

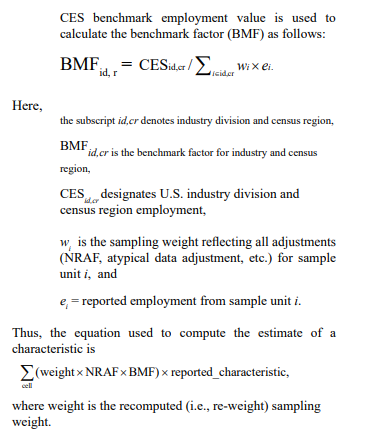

Everything in JOLTS gets tied back to the CES; the BLS adds what it calls a benchmark factor to JO, HI, layoffs and discharges, separations, etc. The JOLTS handbook supplies the agency’s reasoning:

The total employment value is obtained from the CES survey for the basic estimating cell for the month for which estimates are being made. The CES employment estimate is estimated using a much larger sample than JOLTS and is therefore considered statistically more reliable. The CES employment estimate serves as a benchmark for JOLTS employment; benchmarking JOLTS employment to CES employment increases the statistical reliability of all JOLTS estimates.

What all that means is pretty simple; again, we already know that the CES benchmark discovered how one-fifth of previously calculated job gains (Establishment Survey) almost certainly never happened. Thus, the CES way overstated the labor market during some parts between March 2018 and March 2019.

These findings will eventually find their way into all the JOLTS series, too, either through idiosyncratic processes or at the very least via the BMF factor (likely both). The levels of Hires and more importantly Job Openings are undoubtedly significantly weaker than they right now appear.

And right now they appear to show a clear and serious slowdown in the labor market already.

Jay Powell can say all he wants how strong the labor market and the economy is, but it’s not what officials say that matters. It is what they do. They’ve already given in on one rate cut to this point, and almost certainly another will follow pretty soon. And though Powell last week claimed we need rate cuts even though we don’t need rate cuts, his actions will speak volumes.

Volumes full of revisions; narratives and data.

Stay In Touch