While sentiment has been at best mixed about the direction of the US economy the past few months, the European economy cannot even manage that much. Its most vocal proponent couldn’t come up with much good to say about it – while he was on his way out the door. At his final press conference as ECB President on October 24, Mario Draghi had to acknowledge (sort of) how he is leaving quite the mess for Christine Lagarde.

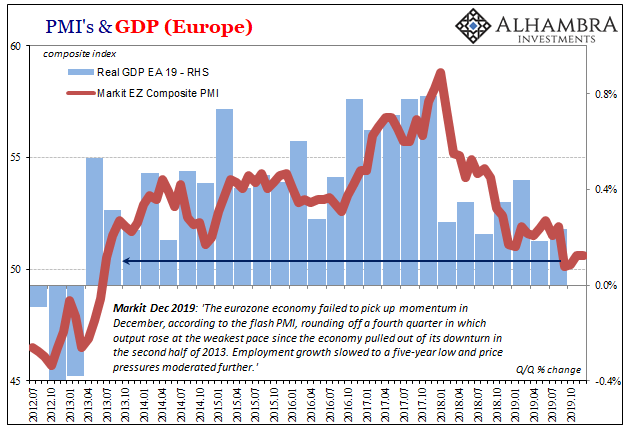

Incoming data since the meeting in September confirm our previous assessment of a protracted weakness in euro area growth dynamics, the persistence of prominent downside risks and muted inflation pressures.

Everyone else has forgotten, but recall what the same guy was saying and not all that long ago. Less than a year ago, in December 2018, while interest rates were plummeting there as elsewhere Draghi was ending the ECB’s QE (after nearly years of it) and getting Europeans ready for rate hikes. He was still quite sure about his having led Europe to its boom-ly booming boom.

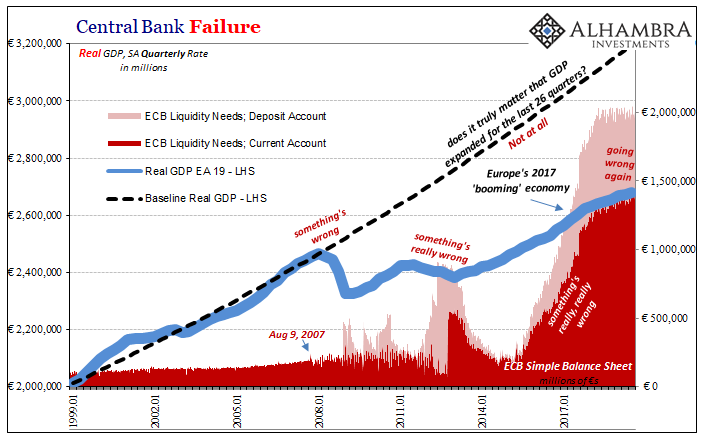

If 2017 was the year of globally synchronized growth creating one for 2018, all those things were going to pay off spectacularly in 2019 as the Continent, along with the rest of the global economy, began to normalize for the first time in a decade. The ECB had even began to publicize expectations of its relatively quick rate hikes.

You need to remember how that was the plan. These people are all let off the hook time and time again because their past promises are never actually held to account.

It’s been this way throughout Mario Draghi’s tortured tenure. In December 2012, for example, the New York Times called his big “promise” Draghi’s and Europe’s finest hour! Why? Because he had established himself and the ECB as powerful instruments to be relied upon when the chips were down, when everything was at its worst – as it seemingly had been earlier that summer.

The best place to start is with an attempt to understand what power is. The British philosopher Bertrand Russell said it was the production of intended effects. By contrast, Steven Lukes, one of the top contemporary power theorists, said in an interview last week that power was the capacity to make a difference in a manner that is significant.

As Draghi has now departed, his ECB has managed to fail on both definitions. It neither produced the intended effects, which were, and remain, normalization accompanying actual economic recovery rather than some hugely watered-down standard of success like term premiums, nor has it made any sort of difference at all. Would Europe have turned out any differently if QE had never been done?

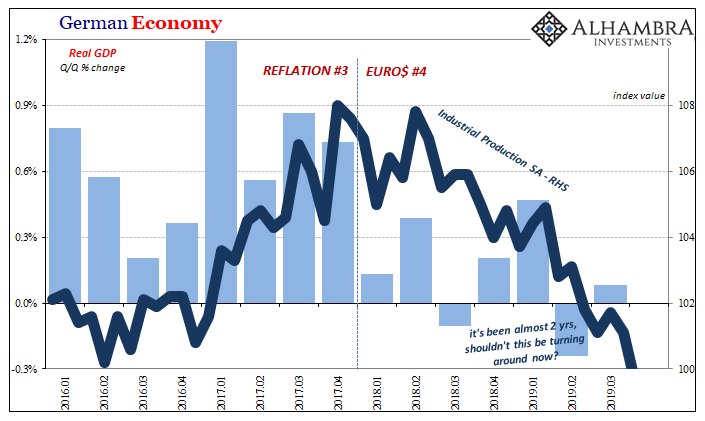

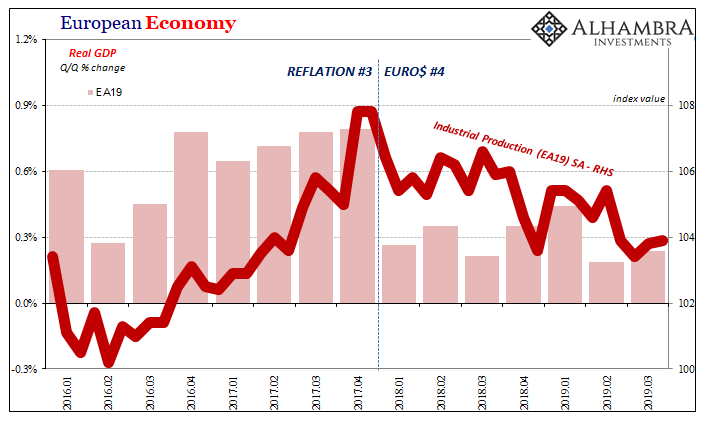

If you think Europe was booming in 2018, where did it go in 2019? Draghi missed something. What he actually missed was even more seriously undermining. All the while he was planning for the recovery, it had already ended and reversed right underneath his feet.

Whatever there was of globally synchronized growth in late 2017, and it wasn’t actually much, it had disappeared almost from the very first business day in January 2018.

The ECB has proved neither credible nor powerful, and as such Mario Draghi leaves for Christine Lagarde not just a mess but more importantly no answers. He never even figured out what the right questions to ask had been.

Released today, IHS Markit’s flash readings on sentiment in the Eurozone economy unfortunately reflect Draghi’s final comments: protracted weakness and the persistent of prominent downside risks.

Why do we care here in America where the party is back on after so easily skating past summer’s transitory “growth scare?”

Simple. Because if Europe isn’t coming back then that’s a pretty solid indication as it pertains to risks for the whole global economy. Europe has been at the forefront of this downturn, and if it is still at risk, or actually in the process, of turning down that’s not a good sign for the US economy, either.

Globally, negative pressures remain. And they continue to be serious.

If the “growth scare” or “recession scare” truly had passed then Mario Draghi would’ve been able to hand over a whole bunch of at least small and debatable positives. Instead, he couldn’t even manage that low bar – even after restarting QE months ago.

In short, if the Europeans are missing something, and the European economy is missing something, that means all good in America? Maybe. Balance of probabilities, though. And I don’t just mean Jay Powell = Mario Draghi.

We don’t know what those downside risks entail – it might mean recession, it might mean some kind of continuing downturn – but they haven’t disappeared despite everyone, especially on this side of the Atlantic, seemingly convinced they have. Based on what US central bankers have to say.

Stay In Touch