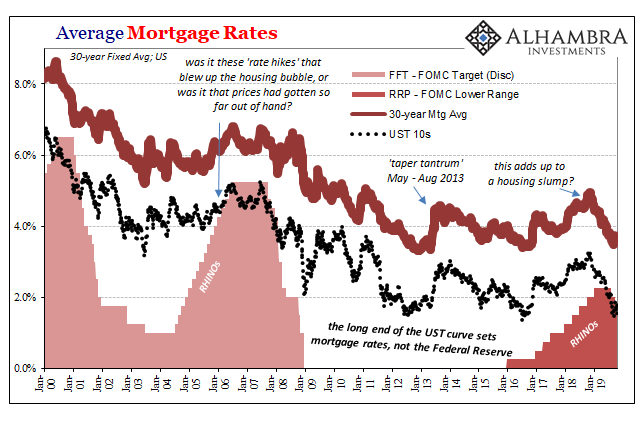

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it.

When policymakers talk about interest rate stimulus, they largely mean the mortgage space.

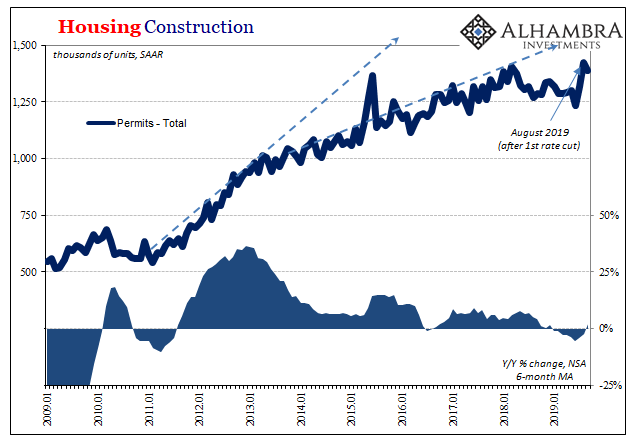

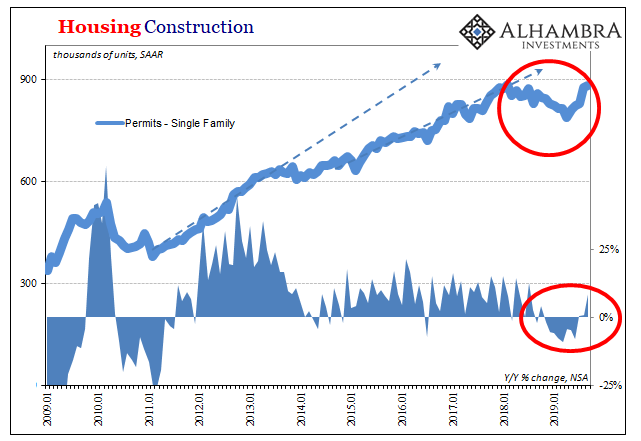

Homebuilders, at least, responded in August 2019 to the first rate cut in a decade exactly the way the FOMC had imagined when policymakers finally came around to considering it. According to the Census Bureau, the number of permits and starts surged right on Powell’s schedule. From a seasonally-adjusted low of 1.23 million (annual rate) in June to 1.32 million in July and then a big jump to 1.43 million the first month after the first rate cut was voted and announced.

From trending down to trending up all in one go. And though permits were down a little in September, the latest data, that doesn’t really tell us much given the noise on a month-to-month basis.

Instead, the construction figures indicate homebuilders at the very least are thinking the rate cuts will help attract more buyers back to real estate. Permits being the first step in the building process, they can, obviously, change their mind if actual demand doesn’t materialize; there’s potentially a huge gap between a permit and a start, and then another one from start to completion and sale.

So far, even before the Fed’s policy shift, buying activity had already been on a bit of an upswing. Builders are likely betting that with Powell on their side this will only continue for the foreseeable future.

And that’s a weird, convoluted proposition because the central bank does not set the mortgage rate – the Treasury market does. Like UST yields, mortgage rates have been coming back down since last November. The Fed’s rate cut is therefore pure psychology having little to do with actual mortgage costs, a fact that housing developers are figuring and to some extent counting on.

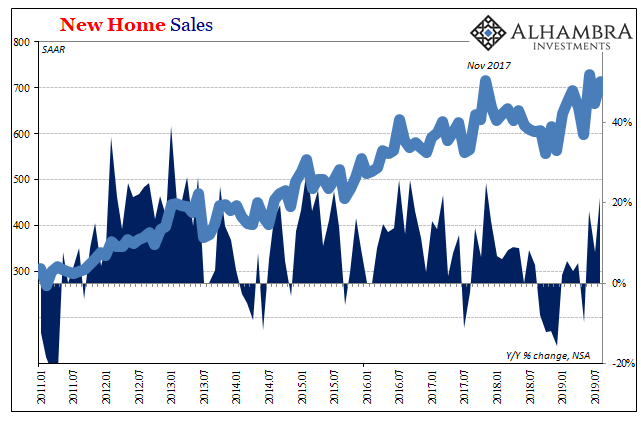

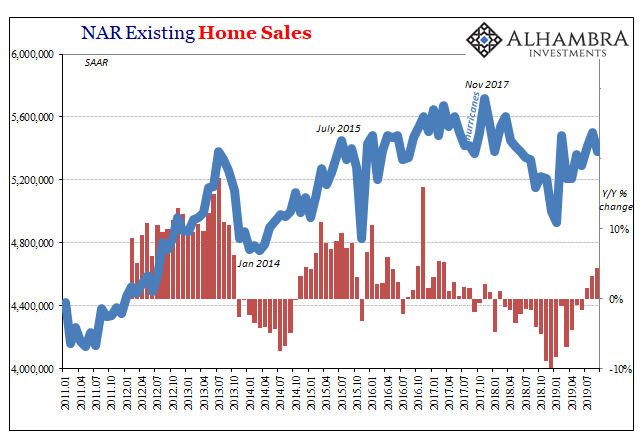

They can already see it when selling their own product. New Home Sales, the final step in the construction process begun by permits, have rebounded from rather dismal levels as have the sales of existing homes (according to the National Association of Realtors). The latter like new home sales began to rebound in July.

Effective moneyless monetary policy already?

Perhaps, but I’m (unsurprisingly) skeptical. If interest rates are indeed responsible for this not-unexpected rebound (nothing goes in a straight line) then that’s more economic weakness embedded within bond market skepticism pushing rates down. In other words, an overall negative economic trend works out to help a small segment of the housing market.

Bargain hunters.

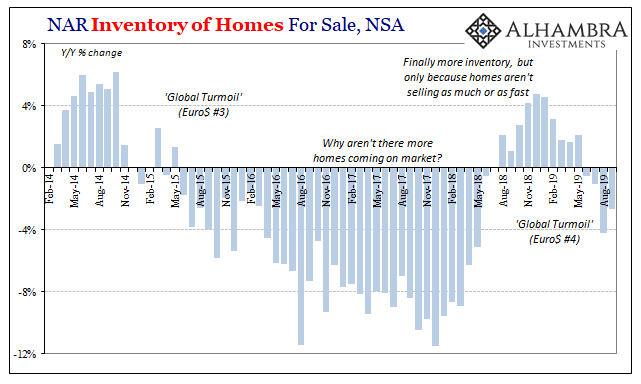

That’s what the NAR’s inventory data suggests (again) outside of that group. For several years up to 2018, the realtors’ trade association had been begging homeowners to jump with both feet into what it saw as a booming economy. Inventory instead remained persistently, frustratingly low following the labor market slowdown (and sluggish not booming recovery) during Euro$ #3.

American homeowners were consistently cautious even as the unemployment rate tumbled.

Inventory only began to rise once the pace of sales slowed as Euro$ #4 developed in 2018. Rising mortgage rates certainly didn’t help, but the shifting uncertainty in jobs due to “overseas turmoil” that’s never exclusively overseas weighed on the market more.

Now that sales have picked back up a little, inventory is once again shrinking. The near constant caution which never really went away. Lower interest rates as a bond market matter rather than as central bank stimulus appears to be the more appropriate factor. No new wave of instantly confident home sellers has emerged thinking that the Fed’s rate cut(s) will result in a mass of new buyers.

There’s still the curious absence of owners rushing to list their homes.

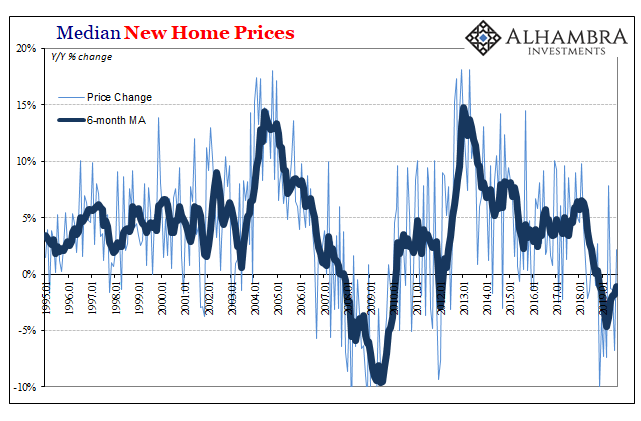

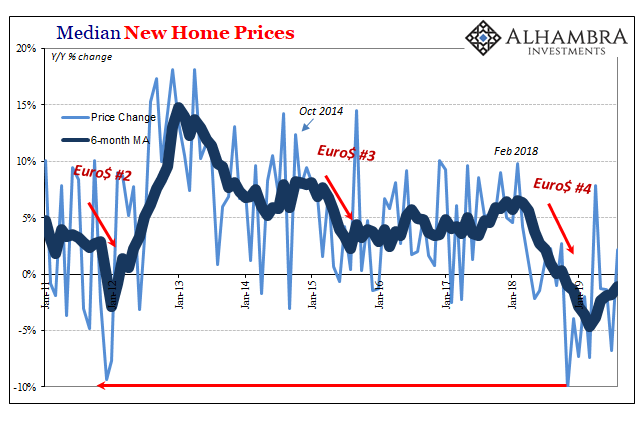

More than interest rates, perhaps the biggest factor has been prices – especially the price at which developers are able to sell off their inventory. Like any other kind of business, home builders have to manager theirs, too, and only have a few tools at their disposal in which to do it.

In a pinch, if demand tails off, you slow down your production so as to avoid too much unsold product (new homes) piling up and then as a last resort you start discounting the price to move what’s already on hand. There’s an added pressure in housing due to financing and liquidity constraints – you can’t hold on to unwanted completions forever.

That’s just what builders had been doing. Beginning in the middle of last year, the rate of increase for the median new home price slowed and then reversed – especially last November (-10.2% year-over-year) when the landmine struck. Over the balance of 2019 to this point (up to the latest figures for August), prices have continued to decline at a rate last seen during the big housing bust.

Sustained home price discounting at completion.

I’m guessing that had a lot more to do with the pickup in home sales, especially new home sales, than the psychology over the Fed or the growing economic concerns contained within 7-year UST yields pushing mortgages rates downward. Bargain hunters showed up as they always do even during the worst economies and markets.

It seems reasonable that builders are now hoping that their appearance heralds the bottom and therefore turnaround for the overall real estate space. The Fed’s rate cuts just might keep that trend in place buoying the confidence of buyers (in theory) long enough such that a real recovery takes shape.

That’s the initial bet, anyway. Maybe this time the Fed’s psychology will pull in some activity.

Beyond August, though, that’s still up in the air. The lack of follow-through in resale sellers significantly detracts from that view. The onrush of bargain hunting doesn’t always lead to an inflection. Dead cats bounce in every kind of market, just the king of interruption which always prevents what might otherwise have been more of a straight line.

Stay In Touch