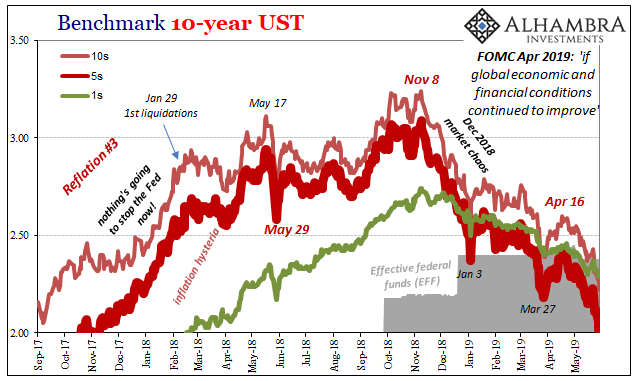

One year ago today, something huge broke inside the global monetary system. Exactly what, we may never know. I believe it was something to do with collateral and securities lending, the kinds of things that brought AIG to its knees in what doesn’t seem like all that long ago. In a rush, over several days, everyone around the world piled into the world’s safest, most liquid assets.

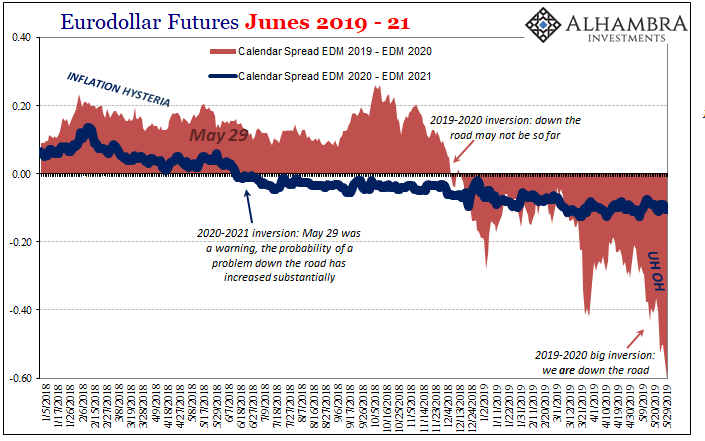

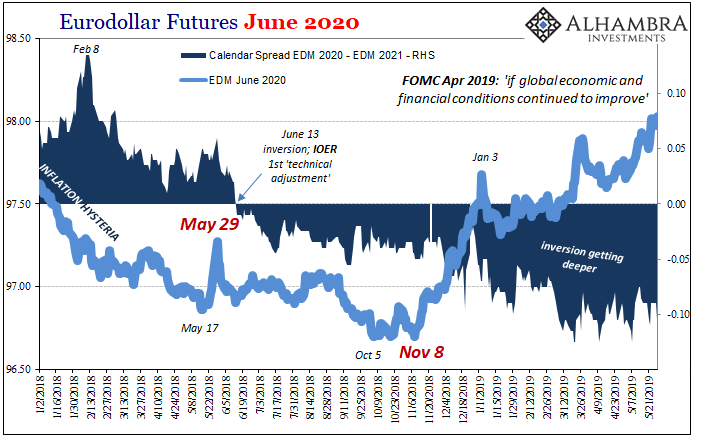

In the immediate aftermath of that rush, other parts of the bond market responded in kind. Eurodollar futures, importantly, its curve began to invert within a few weeks. What that meant in general terms was the market taking May 29 into account. There was a material increase in risk, a sudden and significant rise in the probability of serious problems if still down the road.

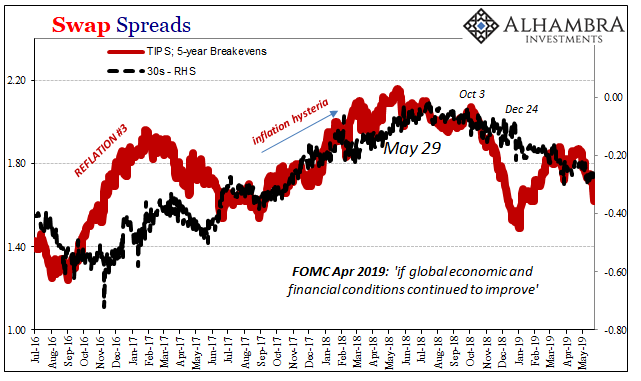

Another very troubling deflationary outbreak.

While all this was going on, the Economists at the Federal Reserve were still sticking to the opposite way. In early May 2018, the FOMC added the word “symmetric” to its standard inflation wording. The statement released accompanying that month’s particular policy meeting made a specific point of spelling out:

Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.

Ever since the inflation target was made explicit in 2012, the objective had only been a 2% one. Now, starting May 2018 moving forward, it was going to be a symmetric goal.

The economy according to officials’ econometric models was really heating up. Rather than clamp down right away, Jay Powell’s gang was making it known how they’d let it run hot for an extended period. This was the symmetry being referred to.

The reason? Inflation wasn’t actually rising as they had been expecting, forecasting, and emphasizing. It was the last piece they needed to prove their boom, the ultimate success after a decade of setbacks and false dawns. It just wasn’t happening even with the unemployment rate falling to, and then below, 4%.

In other words, they knew something was missing but to make up for it our central bankers offered only more of the same puppet show. Subsequent FOMC communications more fully describe just what they mean, therefore what I mean:

Communicating this symmetric inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates and enhancing the Committee’s ability to promote maximum employment in the face of significant economic disturbances.

May 29 communicated quite effectively how something crucial was very wrong deep inside the effective monetary system; to which, the people who claim to be running these things, offered up only a single word. They really think that they can fool people into “optimal outcomes”, this monetary policy stripped of money filled instead with expectations.

By purposefuly adding that one word, orthodox doctrine says it raised inflation expectations which had the effect of lowering real interest rates the moment “symmetric” made its first appearance. To Economists, this is stimulus. To the bond market, eurodollar curve included, it was beyond absurd.

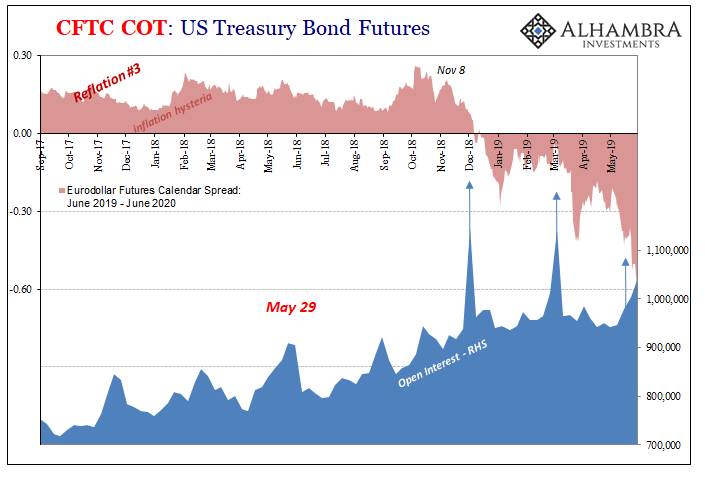

In many ways, this merely confirmed what has come to be expected. Not in the mainstream media which still considers central bankers as competent technocrats. Rather, the bond market even during the “best” days had said the chances of the global economy making it to recovery before something went wrong in money again were slim to none. This was the flattening curves during what was truly inflation hysteria.

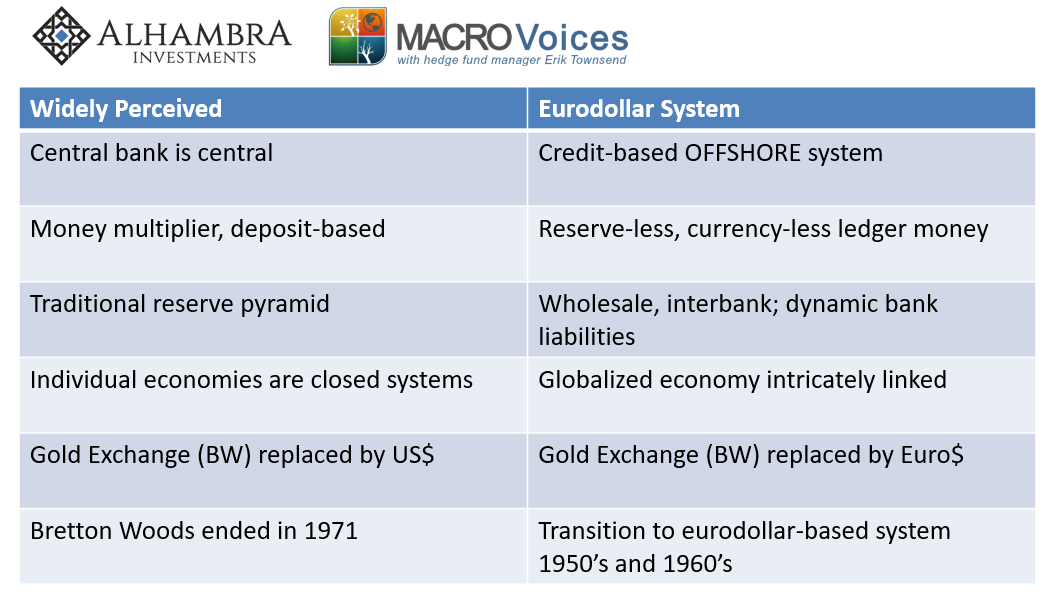

In January 2018, while that was raging, together with Erik Townsend of MacroVoices we deciphered the message embedded within these financial instruments. As it turns out, that information was profoundly accurate.

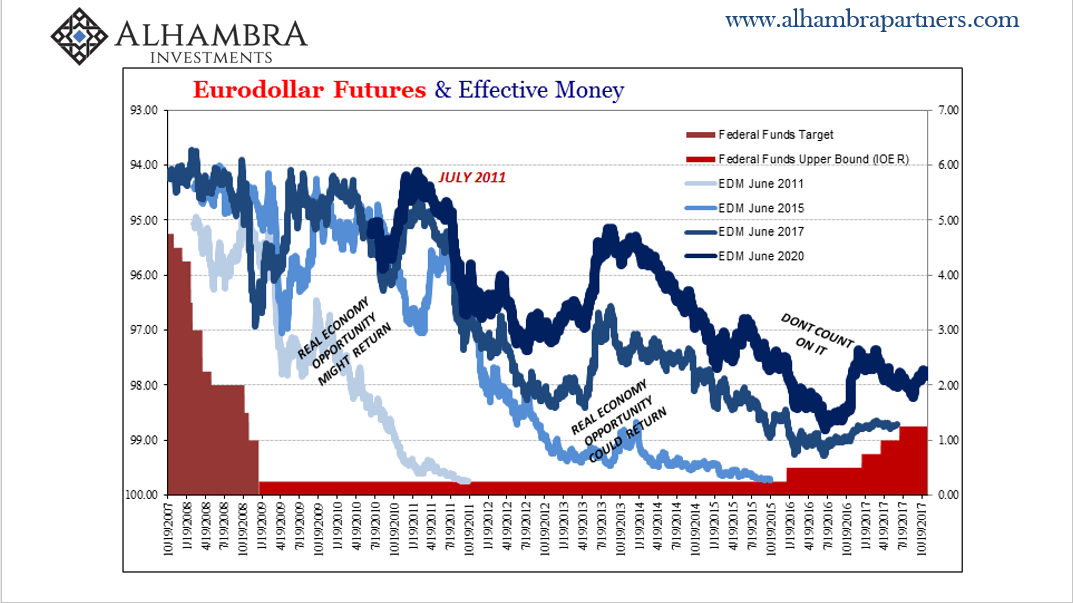

TRANSCRIPT. If you look on Slide 26, for example, if you look at Eurodollar futures, that’s what it’s been telling us over the last ten years, too. That the market is expecting lower short-term interest rates, not higher short-term interest rates.

We’re not talking about relative to last year. The market doesn’t care what the federal funds was doing last year. It’s in relation to the entire period. Where are short-term interest rates? Where are money alternative rates going to ultimately land when everything shakes out with this cycle?

What the market is saying is that the expected path of short-term rates is hugely stunted. Like we just talked about before, the Fed doesn’t even believe it’s going to get all that high. And the market agrees.

So for deconstructing the long-term bond yield (the two bottom portions, as I showed them before), the Fed thinks it got right. The market is saying: You didn’t. The market is saying: You got it wrong. Inflation expectations are low, as well as the market in Eurodollar futures. Not just Eurodollar futures either.

It’s saying that the Fed is never going to get very high at all. No matter how many rate hikes it thinks it’s going to do, it may not ever get to that level.

With rate cuts now all but certain, the curves had it right the whole time. Some people may be surprised by this, shocked and dismayed, but that’s only because Economics has done the world a tremendous disservice. You are taught all the wrong things starting from the very beginning.

The Fed never did get to 3%. The market had suspected all along, had become conditioned to believe, that when confronted by something real, an actual setback in the effective global money system Yellen/Powell/Empty Suit^n would respond as they always had – with a slightly different puppet show.

This is just what happened, and I think it’s pretty clear why May 29, 2018, shows up on almost every chart that matters. It’s even prominent in economic data scattered all over the world. A true inflection in every sense.

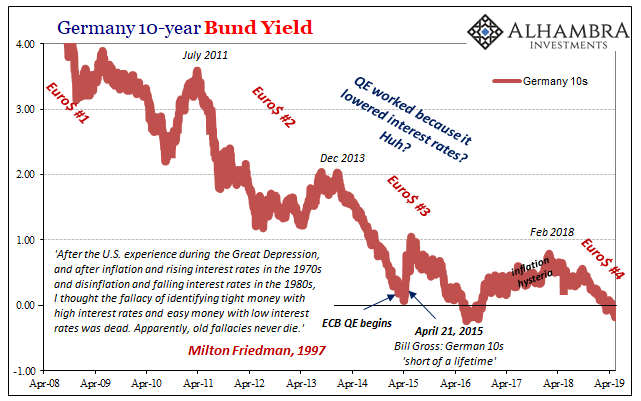

These were the same lessons learned the hard way in 2008 and again in 2011. The central bank isn’t lender of last resort, it doesn’t even operate in the same world. Monetary policy is effectively useless because there really is none.

Now we are here, in one year’s time we have arrived at down the road. If only central bankers and Economists (redundant) would let themselves understand the bond market. Maybe in 2017 when authorities began thinking they had done it, they might’ve instead realized they hadn’t. It was the curves which told them they hadn’t.

Liquidity risks are all over this thing. May 29 didn’t introduce them, it merely showed how they had pushed to a new and more dangerous level/condition. May 29 was the kind of thing the low, flat curves of 2017 had in mind constantly rejecting the inflation/recovery idea. The only reason to dismiss these signals is pure ideological idiocy.

By properly reading the bond market in 2017, that could’ve led authorities in a direction toward the real answer. As I’ve written (too much) lately, it was a damn roadmap; all they had to do was follow it to its end. The answers are all there. They were always there.

It is now too late. Euro$ #4 is here and it appears to be an especially angry one. Markets are reacting pretty violently because when given the chance for monetary substance monetary authorities instead handed them back a puppet show titled “symmetric.”

For all our sakes, smallest of silver linings, let’s hope Euro$ #4 is the one that finally closes down the theater.

Stay In Touch