Perhaps too much attention was given to “one-and-done”, the knee-jerk disappointment over what everybody is saying was not enough “dovishness.” And while that may have been true as it relates to main star of the puppet show, rate cuts, the FOMC actually did deliver better theater at least with a secondary character.

The latest official statement announced the Federal Reserve has called off QT:

The Committee will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated.

In its implementation notes accompanying the official position, the FOMC spells out what that means.

Effective August 1, 2019, the Committee directs the Desk to roll over at auction all principal payments from the Federal Reserve’s holdings of Treasury securities and to reinvest all principal payments from the Federal Reserve’s holdings of agency debt and agency mortgage-backed securities received during each calendar month. Principal payments from agency debt and agency mortgage-backed securities up to $20 billion per month will be reinvested in Treasury securities to roughly match the maturity composition of Treasury securities outstanding; principal payments in excess of $20 billion per month will continue to be reinvested in agency mortgage-backed securities.

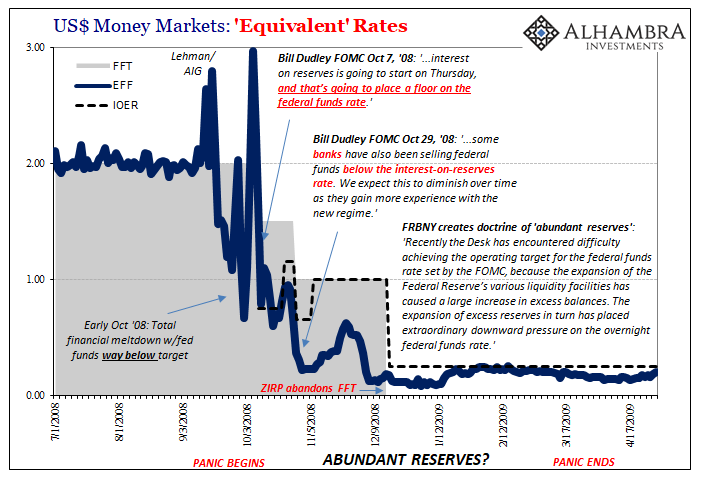

In other words, QT ends today. The system goes back to a “stable reserve” condition that existed between the end of 2014 and the end of 2017 – albeit at a lower absolute level of “reserves.”

It may just be today, but it is interesting how little reaction there was to this. Many people have offered QT as a reason, maybe the primary reason, for what are clear monetary woes. Perhaps markets spring back to life starting tomorrow breathing a huge sigh of relief this bank reserve nightmare is finally over.

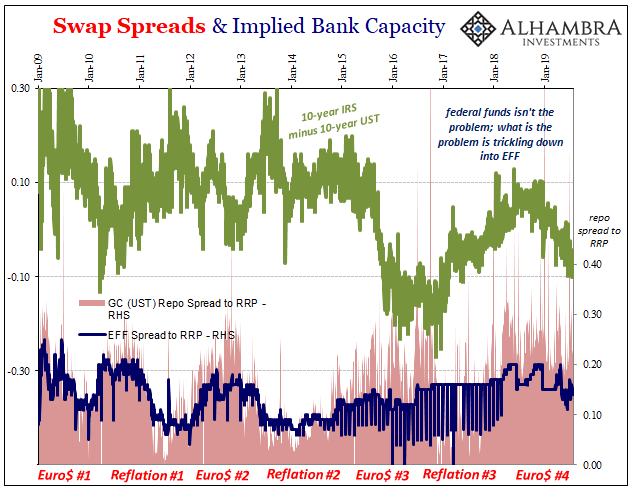

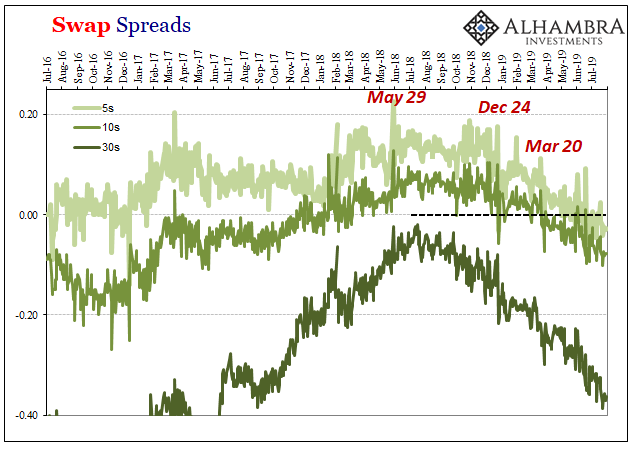

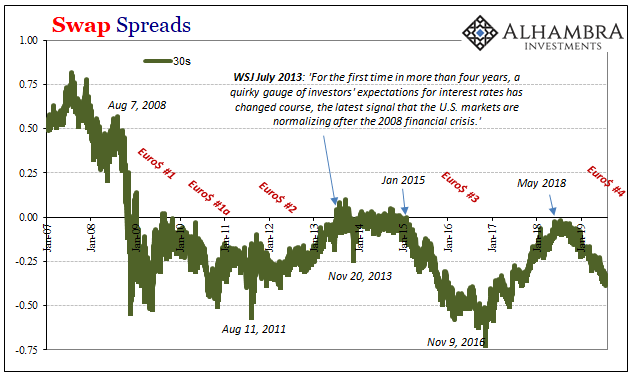

Then again, in trading today there was little to suggest as much. With the repo rate jumping at yet another month-end date (2.609% UST GC; 35.9 bps above current RRP), time will tell. As will swaps, I suspect.

Of course, taking it a step further in the other direction, the way is now immediately open for the next QE (the system needs more reserves! always more!)

Stay In Touch