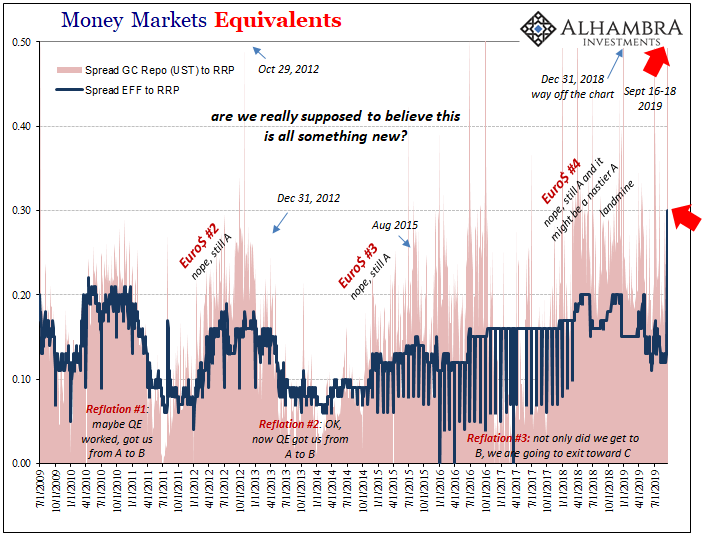

According to DTCC’s repo #s, there’s a good chance fed funds was outside the range today, too. It was put at 3% this afternoon despite this morning’s FRBNY operation, which is still higher than Monday when EFF sat right at the upper bound.

Repo Op Tues: GC repo (UST) 6% despite $53.15 bln.

Repo Op Wed: GC repo (UST) still 3% despite $80.05 bln.Nice work. https://t.co/lKoiQUPAE6

— Jeffrey P. Snider (@JeffSnider_AIP) September 18, 2019

In case it wasn’t clear, I was being sarcastic in the tweet above. Despite these being repo operations, you can’t see any difference in repo.

As the bottleneck passes, I’m sure Powell will declare it a success when it has been revealed as anything but one. That’s why this calendar bottleneck matters; it shows that when push comes to shove, the Fed’s got nothing. The global dollar system in a weakened systemic state, what happens if something really does start to go wrong – not just a calendar bottleneck but a very real collateral bottleneck?

Stay In Touch