It’s been a few years since Japan’s top central banker has been invited to Jackson Hole. The Kansas City branch of the Federal Reserve is today hosting the opening of its annual symposium. Typically, the introduction is given by the President of the KC Fed and then opening remarks from whomever is Chairman of the FOMC.

Outside of those, the idea is to bring together people from all over the world to discuss important monetary and economic topics. In practice, it ends up as an echo chamber exercise in groupthink. The presenters almost always end up being one of two types: central bankers or academic professors of Economics (capital “E”).

Most of the presentations and speeches fall into only one category. They largely congratulate each other for the wonderful jobs everyone is doing, especially those in positions of authority. After a sufficient interval of back slapping and self-congratulations, they then delve into what have been almost constant mysteries and the unending string of serious problems that accompany them. The contradiction always, always goes unnoticed.

At last year’s gathering, Norman Chan, CEO of Hong Kong’s Monetary Authority, gave a short presentation. He might’ve been a better guest at this year’s event given that Hong Kong and its dollar are prominent in 2018 for so many “unexpected” reasons. The rest of the panelists could all tell him that he’s handled everything marvelously and expertly before then attempting a discussion on why HKD is causing so much global anxiety.

Anyway, in August 2017 Mr. Chan was brought in to talk about globalization. It was the year of globally synchronized growth, at least as the mainstream talking point narrative, but it was also in the aftermath of poorly received elections throughout 2016. You can see where they were going. Yes, the populists won big but they’ll soon regret they challenged the status quo when the global recovery does finally kick in – as they all expected it would last August.

Chan’s relatively short prepared remarks spelled out the official global establishment position:

There is also little disagreement, at least among the academia and finance officials present at the symposium, that free trade, open markets, globalization and free movement of capital have contributed significantly to the growth of income and well-being of people, while also narrowing inequality between AEs and EMEs, in the last few decades.

All the right people, the same people who are allowed to speak at these things, agree near unanimously that in the big picture of “the last few decades” things have worked out fabulously.

This is a false equivalence on two key counts. The first is the counterfactual; if globalization had been done differently it would have been far worse. We don’t know that would have been the case, and there is a great deal of historical precedent for the opposite; meaning that under a different type of system the results might have been better, meaning sustainable, than what were actually achieved.

To try and claim it was “their way” or nothing is dishonest.

The second and most important issue is the one they never bother to address simply because they can’t. Every one of these globalization defenses are demanded the long time frame from which to be judged: “the last few decades.” It’s really only the last decade that means anything.

Even if globalization was a success up until, say, August 9, 2007, it sure hasn’t been since. In fact, elections starting in 2016 have shown that the lack of any tangible progress in this last decade threatens to undermine everything that came before. In other words, the last ten years may be all that matter no matter what might have been gained up until them. Three or even four decades of such growth will go up in smoke (perhaps literally) if they lead to one or two without any.

But why?

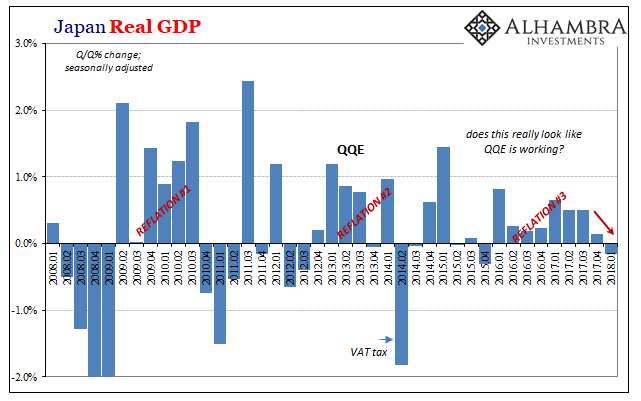

One big reason is Jackson Hole. There is never anything new presented. They chase their tails year after year in the same fashion. The economy is great because it has to be great because central bankers all did big things. Which brings us to Haruhiko Kuroda.

In August 2016, the Bank of Japan’s Governor was given much the same position on the prominent second day (Saturday) overview panel as Norman Chan had taken a year later. The topic for the overall symposium in 2016, however, was quite different; Designing Resilient Monetary Policy Frameworks For The Future. Kuroda’s contribution consisted of talking up QQE and 2016’s NIRP, for which he was heavily congratulated.

Then came the typical “but”, as in QQE is great but:

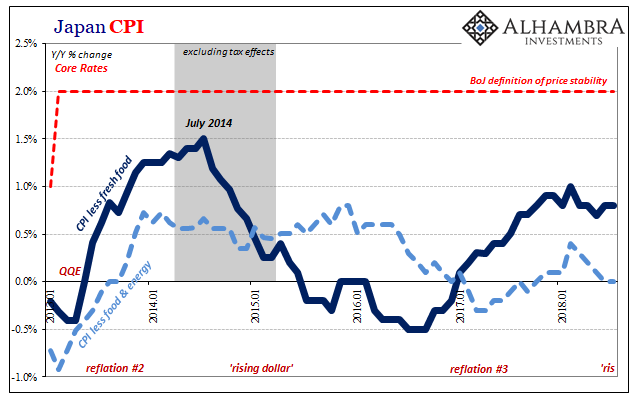

In contrast, a puzzling decline in long-term inflation forecasts was observed in Japan. Even considering the technical difference in the details of the data, it is hard to deny that the recent weakening in long-term inflation expectations in Japan was partly caused by the declines in crude oil prices from 2014.

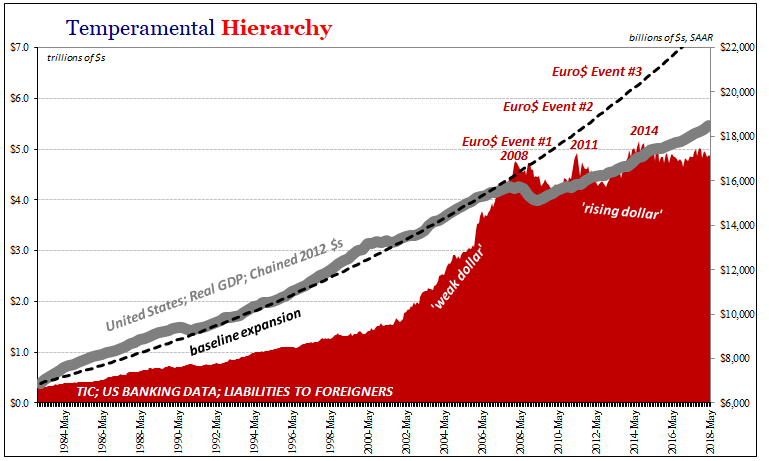

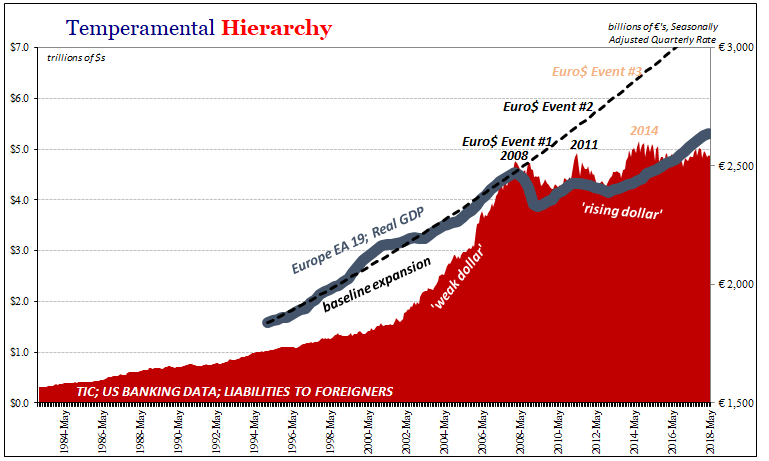

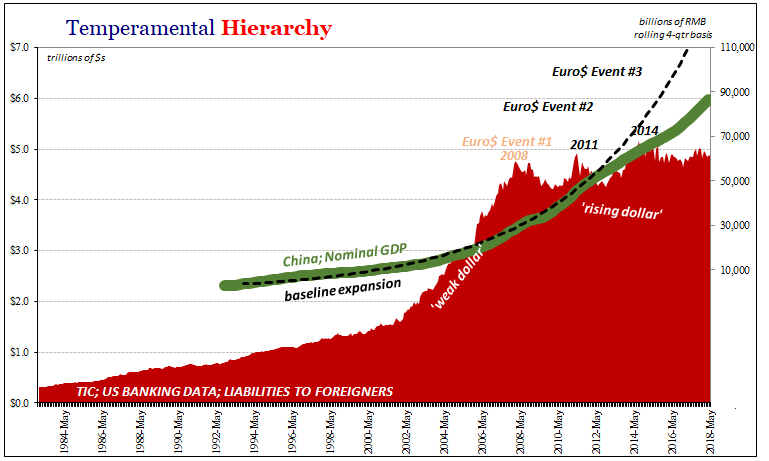

I’ll paraphrase: it all seemed to be going as planned until the oil crash and dollar rise in 2014.

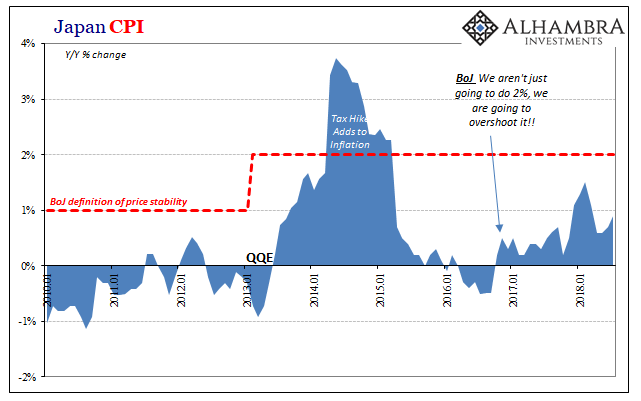

Kuroda hasn’t been invited back to Jackson Hole since. If you can’t influence inflation expectations, let alone generate actual inflation and sustained economic growth, through something like QQE, then QQE2, then QQE with YCC (as was being discussed while Kuroda was speaking in Wyoming in 2016), with a botched NIRP rollout in between, then what are we talking about? Or, more to the point, what aren’t central bankers and academic Economists talking about?

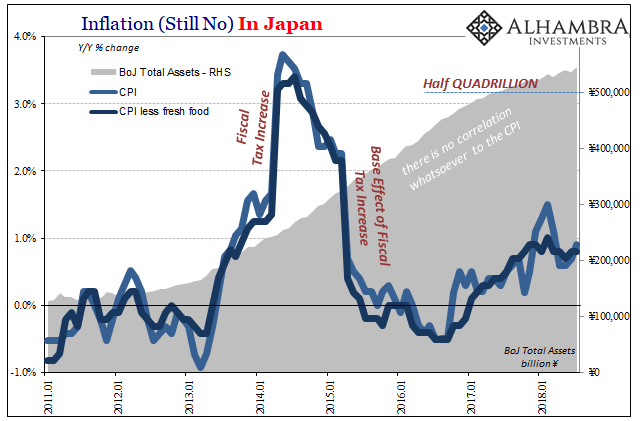

There is no evidence anywhere in Japan that QQE has achieved any of its goals. Not according to the Bank of Japan, though. Before trying to solve the 2014 “mystery”, Kuroda in 2016 extolled the virtuous virtues achieved by QQE: according to their calculations, it (temporarily) raised inflation expectations while placing significant downward pressure on interest rates. Therefore, he preached to the choir, “These two elements together have reduced real interest rates and thus have produced strong easing effects.”

Huh? Those two elements are debatable as to whether they had anything to do with QQE, especially the direction of any bond market. Setting aside those objections, there it is anyway. The big one. What, exactly, constitutes easing? It’s not what it used to be.

In the past it was pretty straightforward. “Stimulus” meant noticeable and unambiguous acceleration in economic activity clearly shown by key factors and variables, inflation primary among them as an entirely monetary phenomenon (to paraphrase Milton Friedman). Not any longer. Now it is, “we central bankers did something, something minor might have happened in response, therefore easing.”

Here’s QQE’s actual record as to “easing:”

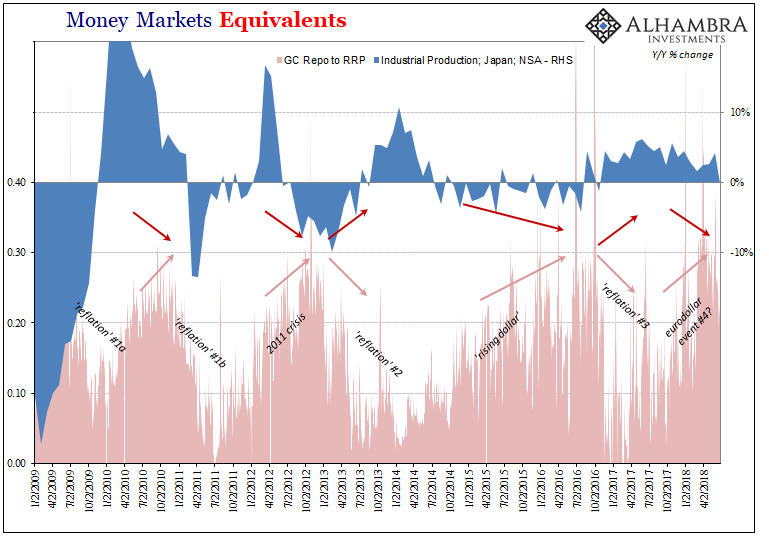

The most troubling aspect of Japan’s economic results, for everyone at Jackson Hole, is how Japan’s economy doesn’t resemble anything the Bank of Japan ever does. Instead, it follows very closely the eurodollar’s various ups and downs. Thus, Kuroda’s reference to 2014 should really hit home, more so that he has no idea what it really means.

Jackson Hole is an exercise in futility, but it does have some twisted merit. Not useful in an economics (small “e”) or monetary context, mind you, its true purpose being pure ceremony. The barbarians are at the gate and the imperial show must go on. The “best and brightest” gather and talk, often about important sounding issues. We barbarians just aren’t supposed to notice how very clear it is that they really have no idea what they are doing.

The Wyoming ritual now stripped of its Japanese isn’t a neutral affair, however. It costs us all big time. More and more every year; every month; every day.

Stay In Touch