You have to understand, none of this is about money or even bonds. It is all intended for one thing and one thing only: expectations. This has been the fulfillment of Paul Krugman’s long-ago criticism. The way out is to shock the system, he said. It doesn’t even matter, by this theory, what you do. So long as it is outside of every market expectation, that’s the only goal.

Japan, who was the target of Dr. Krugman’s reproach, and after having consulted with the former Economist (he’s now just a political carnival barker), finally gave in and decided to give it a try. QQE was the “shock and awe” which was intended to “credibly promise to be irresponsible.” I’m not going to recount the reasoning behind all this because it’s both tiresome and absurd.

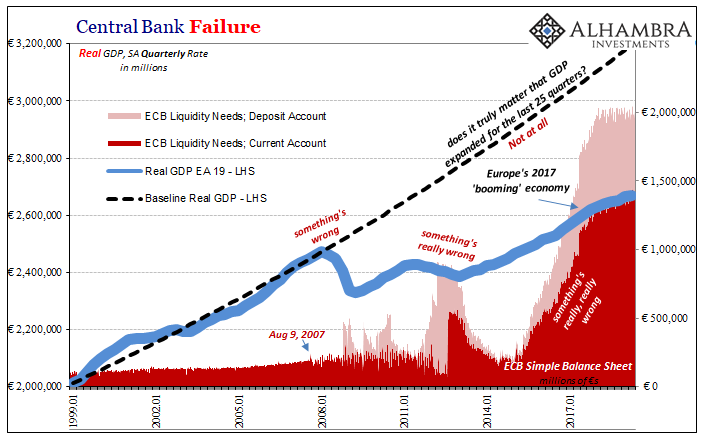

And I’ve done it many times before because it just doesn’t work. How many more promises to be irresponsible do they get?

The essence of the central bank puppet show is exactly this premise. In a world desperate for some monetary answers, some real damn money, central bankers can only think and act in terms of theater.

What can I do to make you think I’m doing more than you ever thought I would?

As ridiculous as that sentence is to write, it is a perfect synopsis of monetary policy in the QE-era. It was the very basis for not just Japan’s QQE but also the Fed’s QE3 (open ended). There’s no money printing in monetary policy because there’s no money anywhere around the central bank. What’s left is only the theatrics.

By October 2014, not even two years into it, Kuroda had already left himself hanging by an ineffectual response. The shock and awe would have to become more shock-y and awe-y. QQE was adjusted to even more QQE.

Kuroda prefers shock and awe. Investors were wrong-footed by the scale of the BOJ’s quantitative easing when it was first announced last year. Now Kuroda has ambushed them again.

Not really. As I always say and write, if you have to do it more than once then it didn’t work the first time. Quantitative easing cannot have been quantitative if you do, and it opens the door to questions about exactly what is easing. Repeating the word over and over does not make it so.

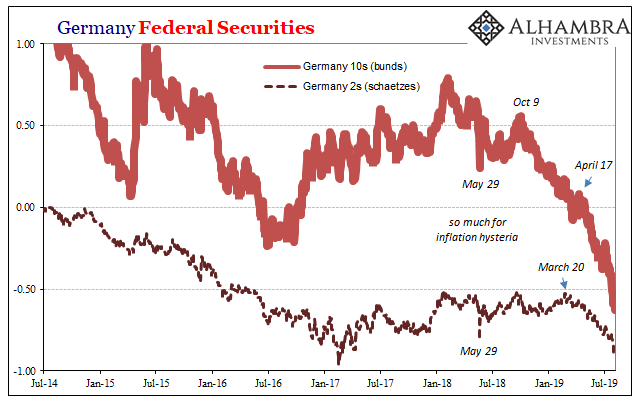

Surprising only Economists and the media, it didn’t work the second time, either. Not even a year and a half following the increased QQE, the Bank of Japan tried again this time in January 2016 a third shock and a third awe with NIRP. Markets weren’t “wrong-footed” then, they simply ignored the puppet show and with plunging bond yields focused on Kuroda’s very obvious desperation.

That’s the thing about all this; if the Bank of Japan would actually supply some money (first, they’d have to figure out what is money) then nobody would care about expectations or shocking and awing. Supply meet demand. But nobody at BoJ, the Fed, ECB, etc., is prepared to get up in front of the world and admit the truth.

Central banks don’t do money. They play games.

Five years after BoJ’s first shock and awe, the Europeans appear to now want to give it a try. Unless they are ready to confess the big lie of the last few decades, what else would they do?

The European Central Bank will announce a package of stimulus measures at its next policy meeting in September that should exceed investors’ expectations, a top official at the central bank said.

Speaking in his offices in Finland’s capital on Thursday, Olli Rehn said the slowing global economy would see the ECB rolling out fresh stimulus measures that should include “substantial and sufficient” bond purchases as well as cuts to the bank’s key interest rate.

“When you’re working with financial markets, it’s often better to overshoot than undershoot, and better to have a very strong package of policy measures than to tinker,” Mr. Rehn said.

All the ECB is doing is pretty much guaranteeing Europe will become Japan. About the only thing in danger of being overshot is how Europe is being set up to be more Japan than Japan.

The world needs an effective monetary response. Olli Rehn like Kuroda or Jay Powell is instead positioning for a bigger theatrical budget. And Janet Yellen says it’s the yield curve that’s crazy. Right.

Stay In Touch