The problem continues to be, I’m sure, is one of perception. Economists, politicians, and mostly central bankers have been saying for years that the real economy is the one you see in the unemployment rate. Things are booming. The labor market is awesome, even epically tight.

Between last year and this year, going by the unemployment rate the economy has only gotten better. Why in the world would the Federal Reserve be contemplating rate cuts? After all, who cares if inflation is less than 2%? Tame consumer prices together with plentiful jobs seems like perfection.

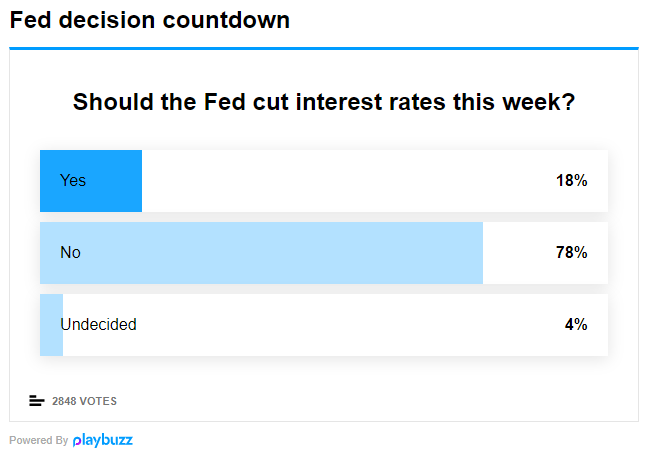

It doesn’t make sense, as one (unscientific) CNBC poll makes plain:

I’ve long written Federal Reserve officials along with their overseas counterparts were setting themselves up for trouble by hyping 2017’s globally synchronized growth and the inflation hysteria that went along with it. They should’ve been paying more attention to China, as I wrote in November 2017:

The downside risks to China’s economy have all re-emerged because they never really disappeared. It was only the narrative that changed. As has become normal, an almost perfect replay of 2014, Economists mistook a relative shift for a categorical one. The best that could ever be said of the global economy, and China’s within it, was that in the second half of last year[2016] and the first part of this year [2017] it wasn’t getting worse. That’s not at all the same as getting better.

That same day in another article:

Central banks are the epitome of PR and media manipulation. And that’s all they are, certainly no money in monetary policy. They’ve done such a masterful job of it that even today no matter how much market data disagrees, people just refuse to believe it.

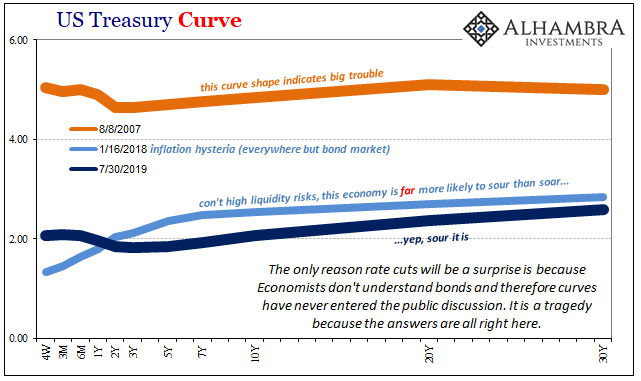

Those markets disagreeing weren’t selling stocks, of course. I was writing about bonds and curves. The flat curve of 2017 was the biggest, deepest, most complex market in the world telling the world that globally synchronized growth was a fiction.

Well, not quite in those terms, not literally. What the flattening curve of late 2017 really said was that the probability everything would go right so that the global economy really would take off was exceedingly small. That’s why it was hysteria; Economists were hyping the equivalent of a lottery ticket.

But that’s not how the rest of the world saw it. The unemployment rate said one thing, the yield curve quite another. The public has no idea about bonds because we’ve all been taught since Day 1 the Federal Reserve and other central banks control all interest rates.

So, in the public mind this hasn’t been a contest at all – there was the unemployment rate and nothing else. If markets counted, there’s only been the DJIA, S&P 500, and NASDAQ.

As if to prove the point, Economist and Nobel Laureate Robert Shiller today on CNBC admits he can’t really see why the FOMC would cut rates, either. Appearing on Trading Nation (thanks M. Simmons), Dr. Shiller said:

We still have a very low unemployment rate. The economy is hot. One could easily make a case for staying the course and doing another interest rate increase at this meeting to cool this economy.

Powell has made himself into the scapegoat before anything really begins, a likely victim of his own boasting. If the economy worsens as the bond market expects over the rest of this year, especially if it becomes a recession, who is everyone going to blame? We already know who the President will (emphatically and repeatedly).

Because of blind adherence to the unemployment rate, Powell has set himself up to be the fall guy. People largely believe that rate cuts aren’t necessary, so if they become necessary it will be considered a case of monetary policy spooking the system. Things weren’t bad until the Fed made them bad by making everyone afraid.

And if share prices fall…

Oh, the irony. The Fed will be blamed for hyping downside risks no one currently believes because the public bought the hype for upside potential that didn’t really exist. Monetary policy and central bankers have left the world upside down.

The public (and politicians) will be seeking to identify the simplest correlations. What changed in 2019? Monetary policy will seem to many the only identifiable and significant difference.

I feel no sympathy for Powell or anyone at the Fed; they had their chance to get it right a very long time ago. Instead, if this unfolds the way I expected years ago it will simply mean being stuck in the same cycle. Blaming Jay Powell’s rate moves (or QT for the more “sophisticated”) guarantees only Reflation #4 and therefore Euro$ #5.

Economists and central bankers hate bonds because they just don’t understand them. For that reason, and because they control the public conversation about them and the economy, the signal was suppressed and never got out. And that’s the real shame because the answers have always been right there in the curves.

Stay In Touch