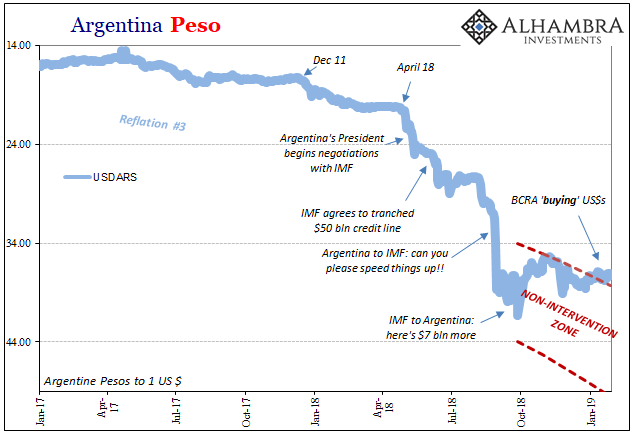

As Argentina’s peso careened toward oblivion, the country’s government begged IMF officials for more money. The organization in June 2018 had already agreed to a bailout expected to total more than $50 billion over three years, the largest in the fund’s history. But it wasn’t working, and as the currency crisis accelerated toward the end of August there was little else that could be done.

In September, IMF officials visited Buenos Aires and agreed to provide about $7 billion more. The new funds came with drastic conditions attached. Argentina’s central bank, Banco Central de la Republica Argentina (BCRA), would have to abandon its previous monetary policy regime (no loss there). The country had to get hold of its money supply first, the prior inflation target no longer any priority.

As for the peso, this is really where the IMF got creative. Seeking to take advantage of market expectations, and thereby craftily creating a new set of them, BRCA would sign an agreement giving up all foreign exchange interventions inside a preset “non-intervention zone.”

The NIZ was initially set at 34 on the high side and 44 to the low, but it will keep moving lower at a rate (marked daily) of 3% per month. The global market expects the peso to fall, so will the BCRA. This will be a controlled decline rather than a crash.

If the peso was to deteriorate precipitously as it had since April, even outside the non-intervention zone BCRA would be restricted to $150 million of peso purchases per day. Such constraint limits the amount of reserves Argentina might burn through at the same time keeping the internal money supply predictable.

At the upper limit, should the peso trend even sideways, with a depreciating band this would set up BCRA to actually purchase “dollars” and build up forex reserves all the while the peso continued to decline. A very neat little trick. This intervention would be limited to $50 million per day.

You have to hand it to the IMF folks for their creativity in turning market expectations to their advantage – at least in the short run. That’s just what happened starting in January 2019. The peso hasn’t really improved but it is no longer crashing. With the zone on the move lower, the peso is now outside the NIZ but on the high side! This has meant the BCRA buying up “dollars” throughout this month.

According to a recent statement from the central bank, it bought the limit on January 22 after having added about $160 million in the weeks before – surely a test of the zone as well as any effects of the opposite purchases on the peso. After all, selling pesos to buy dollars (sterilized) should be ARS negative. So far, it hasn’t been.

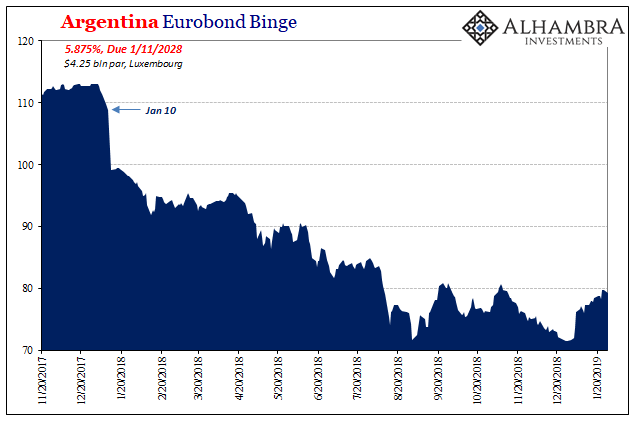

But is the IMF’s stretching its bureaucratic imagination the reason for the growing sense of calm? Is that growing sense a tangible measure of improvement, or is it artificial?

Perhaps ARS has benefited directly from the rest of the world’s attention being focused elsewhere during the past few months. Argentina seems like a small issue when China and Europe are poised for something like global recession, and the US moving in more closely behind.

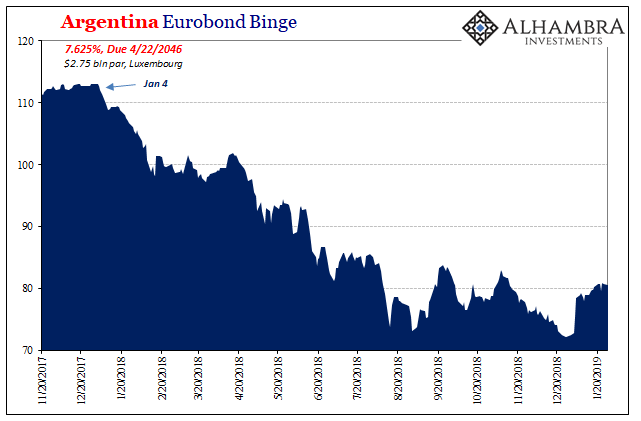

The peso hasn’t really improved nor yet has Argentina’s economy. It seems like the IMF has turned the tables on peso “speculators”, but it could just be those speculators are currently speculating (evilly) somewhere else at the moment. The Eurobond market, for one, isn’t yet buying Argentina’s turnaround.

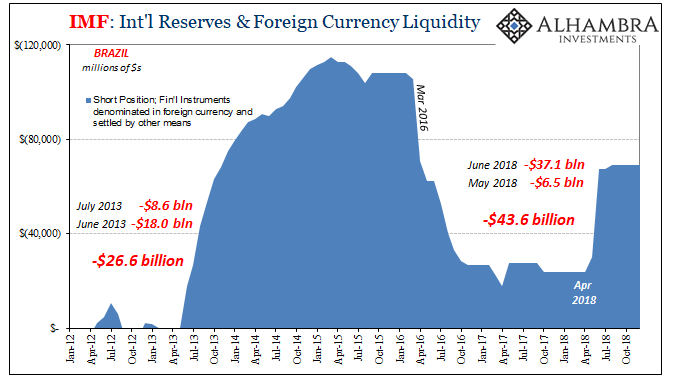

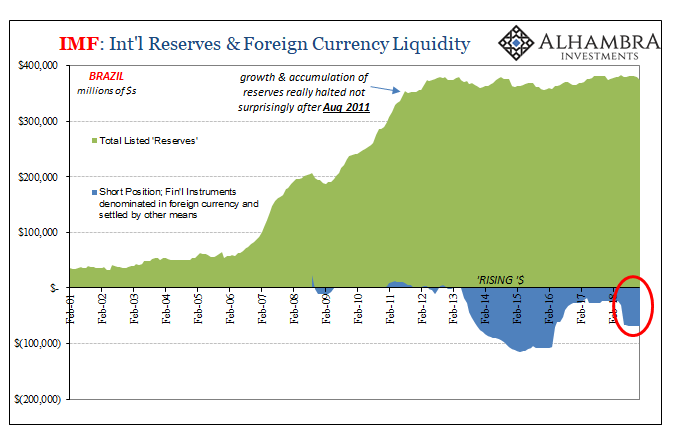

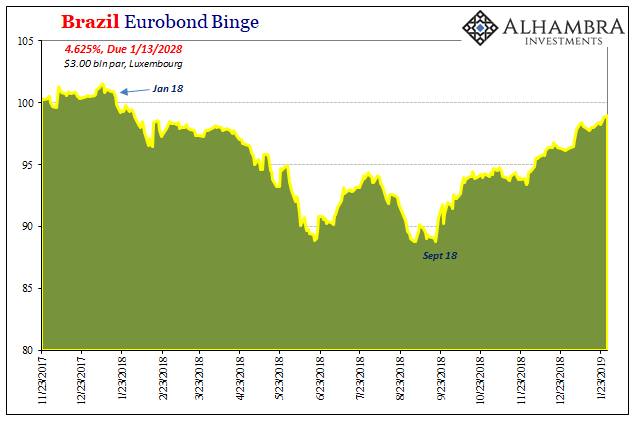

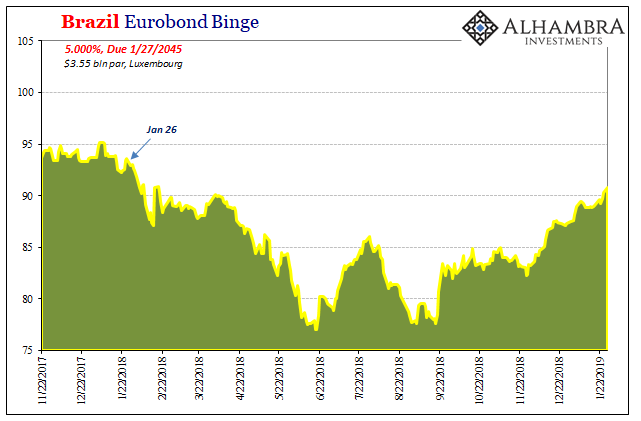

This contrasts with its South American neighbor Brazil. This latter country wasn’t pummeled nearly so bad as Argentina, but it became embroiled in 2018’s EM crisis nonetheless. The Eurobond route closed for Brazil as it did for everyone else.

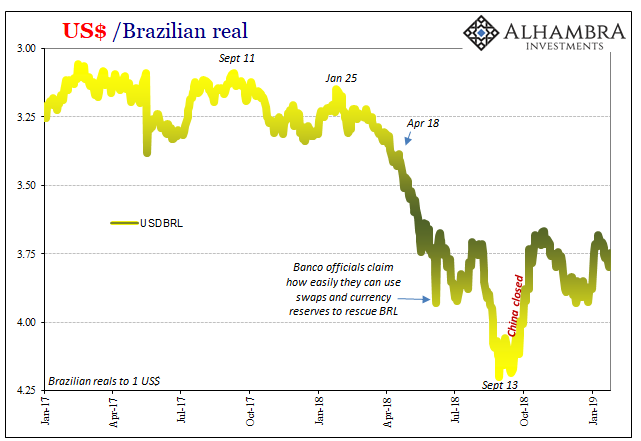

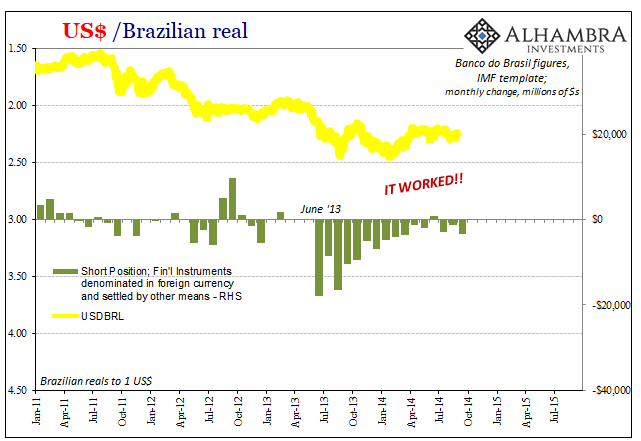

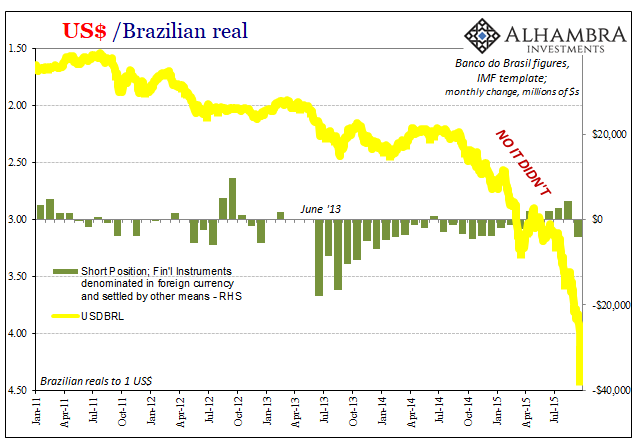

In response, Banco do Brasil spent the middle part of last year insanely burning through swaps. These didn’t have much stabilizing effect, but despite the lack of success the real has trended better anyway.

According to Banco’s statistics, the central bank hasn’t intervened in the cupom cambial since a little bit of activity in August. After dropping considerably in early September, Brazil’s real like Argentina’s peso has stabilized.

Unlike Argentina, however, Brazil’s Eurobonds have staged a dramatic comeback. Several benchmark maturities (traded in Luxemburg) are nearing par once again; and those that are still lagging have rallied a considerable amount over the past few months.

Almost certainly some of that positive sentiment is due to the election of Jair Bolsonaro. The rally in offshore markets as well as the improvement in domestic financials goes back to the last polls before the election showing his victory as a foregone conclusion.

With Eurobonds back in play, small wonder Banco hasn’t been needed to provide any swaps for indirectly influencing eurodollar funding. The real isn’t rebounding, but it isn’t crashing any longer, either.

So, it seems as though investors are if not buying Argentina’s turnaround they are no longer indiscriminately selling into its downturn. And they are buying Brazil’s rebound even after the sharp crisis in real earlier last year.

In other words, we are right back at 2014 all over again, at least where certain EM’s are concerned.

Investors responded favorably to the countermeasures put in place after a dicey Summer of 2013, too. For much of the first half of 2014, these were given the same benefit of the doubt. At the time, such a forceful response from Banco seemed a legit winner – until it became clear the economy wasn’t going to withstand those prior monetary shocks.

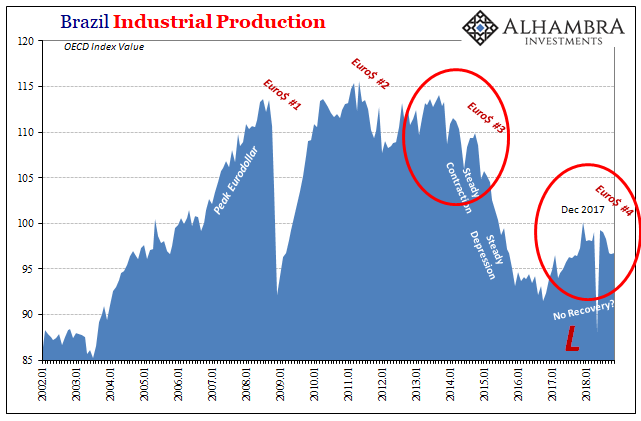

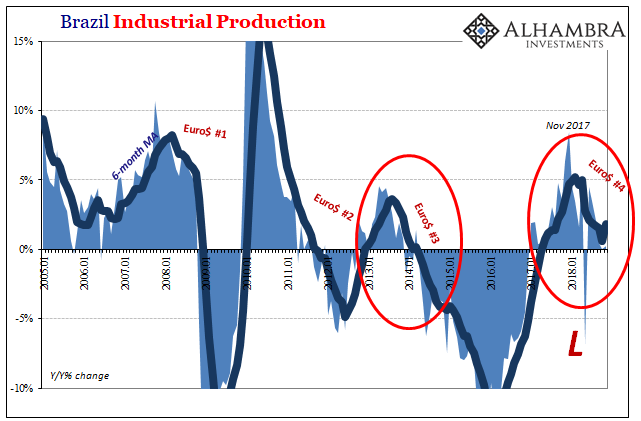

One of the primary reasons was simply the lack of decoupling, the idea that individual economies are separated by oceans of differences as well as literal ones. Brazil’s economic problems could only be compounded by the fact that it wasn’t alone with its eurodollar constraints. The global downturn meant a downturn spread globally (somehow such tautologies still need to be stated outright).

For cases like Brazil and Argentina, “speculators” spend the initial phase of each crisis waiting for each economy to just plain crash right out of the gate. We are taught to believe that central banks and IMF-type organizations are good at what they do (without ever being taught what it is they actually do), and so as these negative monetary/financial/economic processes play out over time there are these very clear ups and downs along the way.

Many get to thinking that central bank programs have been effective in preventing the worst – without realizing, by recalling very recent experience, nonetheless, even the biggest recession isn’t something that shows up overnight. It’s easy to miss the lower highs and lower lows, focusing on how months and months can roll by without catastrophe.

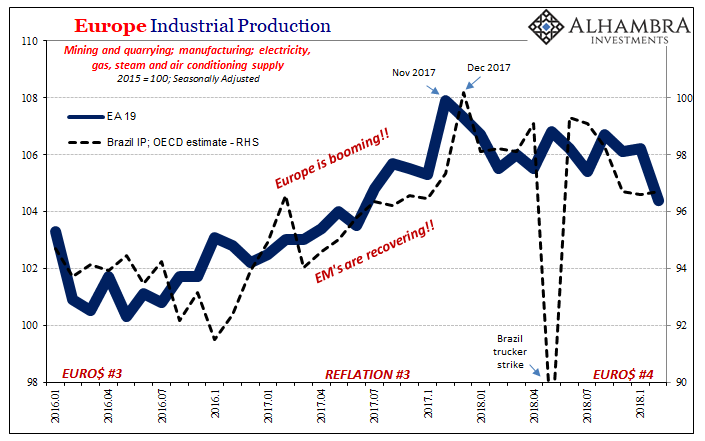

The 2014-16 downturn began in the middle of 2013 for Brazil, and yet it wasn’t until early 2015 that it was perfectly clear the whole thing had fallen apart; that Brazil really was toast. If the EM’s first felt the pains of crisis in the Spring of 2018, does that mean they are good to go by the Spring of 2019?

Maybe if they were separate systems, economic islands left to their own (and the IMF’s) devices. Does initial Brazilian weakness ignore a looming European recession and further China slowdown? Or does it get hammered a second time? It was the latter what took place in 2015.

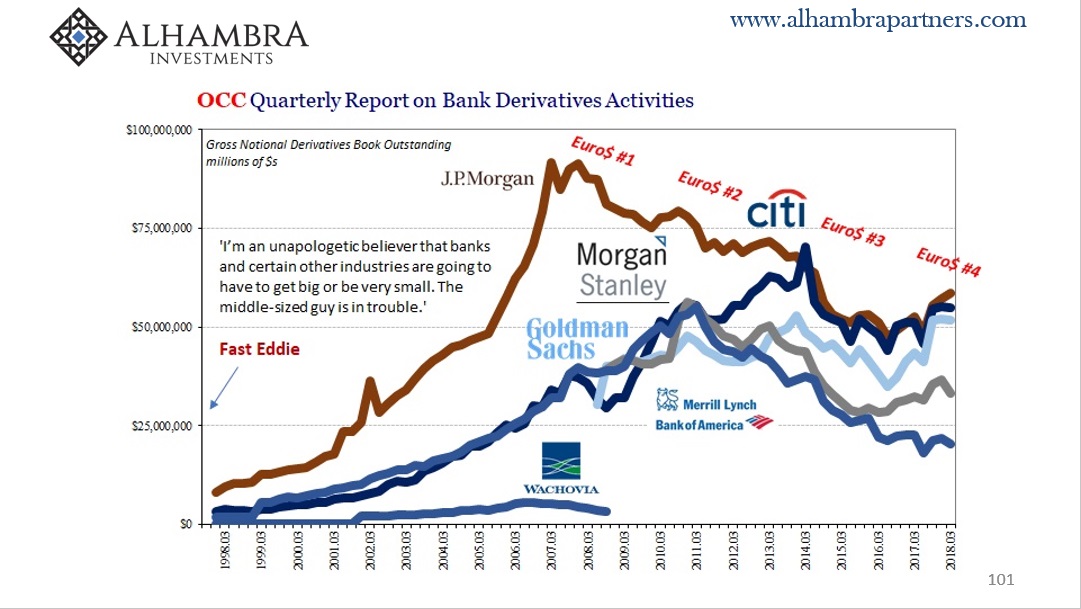

Nothing ever goes in a straight line. It’s easy to believe that the IMF or Bolsonaro will change the local course. It’s much more difficult to see the time variability of the global components, starting with the global currency system. In short, once “it” starts, these Euro$ squeezes, it isn’t stopped by IMF bureaucracies no matter how creative nor presidential elections no matter how they might reshape internal politics.

The one thing we know about 2018, there was an “it.”

And it tends to keep going, striking several different times, until severe economic and financial damage is wrought all across the globe. When the eurodollar system appeared to be working well, economic “miracles” spread all over the world. Now that it only moves from one outbreak of destructive dysfunction to the next, we see instead how there were no winners anywhere.

Just not all at once.

Stay In Touch