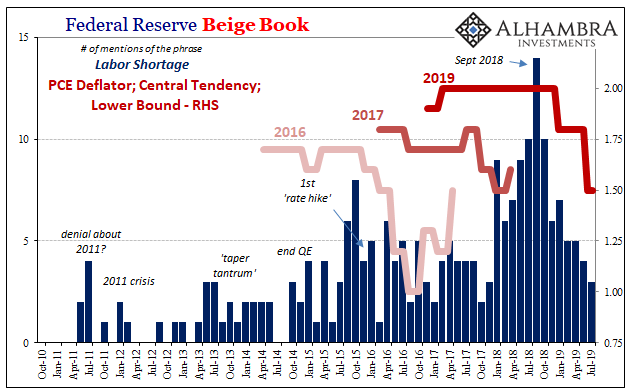

I confess to following the Beige Book lately for mostly entertainment purposes. It was always an exercise in intellectual vanity, an opportunity for Fed Presidents to cram into it their own biases. But to see the FOMC just abandon the LABOR SHORTAGE!!! like they have, that’s not strictly about amusement; though it is to some degree morbidly satisfying just how obviously lacking in conviction they’ve been.

The economy was in danger of overheating, they said.

The latest volume for July 2019 contains but three references to the “labor shortage.” That’s down another one from the past few, and from fourteen (!!!) last September at what was the inglorious height of inflation hysteria. How about that? The Beige Book as involuntary, indirect evidence for the landmine.

As labor shortage anecdotes thin out and vanish, the FOMC’s models confer in marking down inflation expectations as they vanish. An echo chamber of self-delusion.

The unemployment rate hasn’t changed since September 2018, still just 3.7% and a touch higher than the 50-year low. Despite that, clearly something has changed.

Speaking on behalf of the Phillips Curve, Federal Reserve Chairman Powell said recently that it must be dead. How else to explain all this? There can be no relationship between economic slack and inflation; there is no slack by count of the unemployment rate, but because there is also no inflation, he’s left only to rethink the connections.

He says this despite the fact the FOMC has itself given up on one notion of there being no slack. By the way the Beige Book tells it, it’s not the Phillips Curve which may be faulty. The only reason Powell clings to the unemployment rate is otherwise he has to more deeply investigate another possibility he recently admitted:

So monetary policy hasn’t been as accommodative as we had thought.

If everyone got the labor shortage so wrong, that would mean there has been slack all along that past monetary policies never corrected, which would leave Chairman Powell much bigger problems – as even the narrow, general tone of the above statement proposes.

It’s yet another factor going wrong, accumulating with others that have officials just hoping a few rate cuts will be enough to soften a blow they didn’t see coming – because they were caught up celebrating and cheering a labor shortage that clearly didn’t exist.

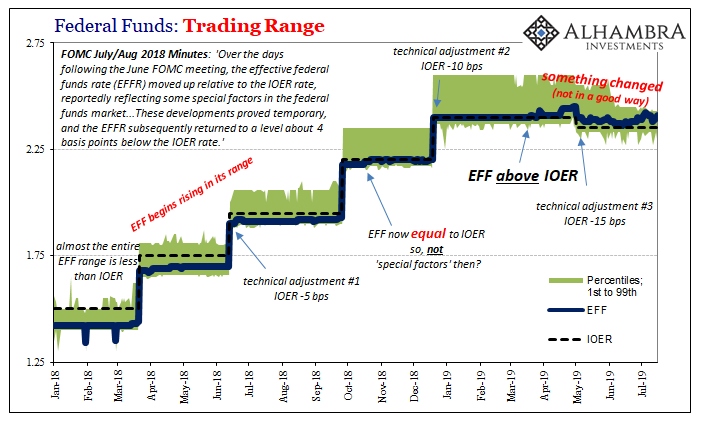

So, how much do you trust these same people who only a few months ago had convinced themselves they were seeing a labor shortage that in reality they saw only because they wanted to see one? Put another way: they really, really want to see rate cuts as powerful stimulus, too. And fed funds was just temporary special factors. QE amounted to a doctrine of “plentiful reserves.” Etc. Etc.

Stay In Touch