How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year.

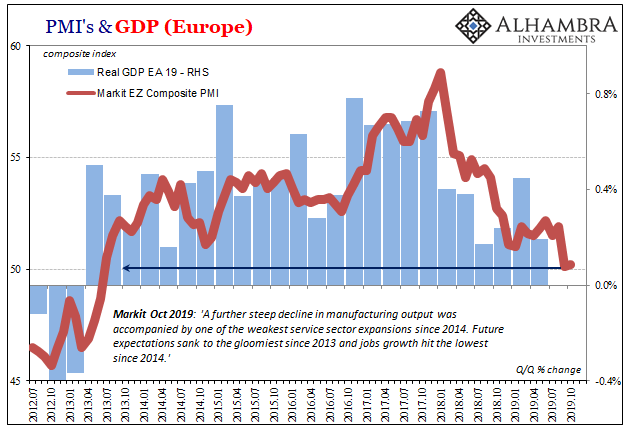

In spite of extraordinarily supportive monetary policy, the euro area economy is showing a considerable, and broad-based, loss of growth momentum since the beginning of this year…

Some German government officials see nothing wrong with that. They are alarmed, instead, by a strong monetary stimulus provided by the European Central Bank and an energy-driven euro area consumer price inflation of 2.1 percent in July.

Can it be extraordinarily supportive monetary policy if it ends up with the distinct the loss of growth momentum everyone saw? Questions you aren’t supposed to ask. Just nod your head and repeat the words.

Thinking the slowdown was a good thing coming at the right time, German officials were only too confident to begin demanding (once again) fiscal prudence, finally an end to Club Med after so many broken promises. “It all looks like Berlin does not care that a combination of fiscal restraint and rising credit costs would promptly throw half of the monetary union into an intractable recession.”

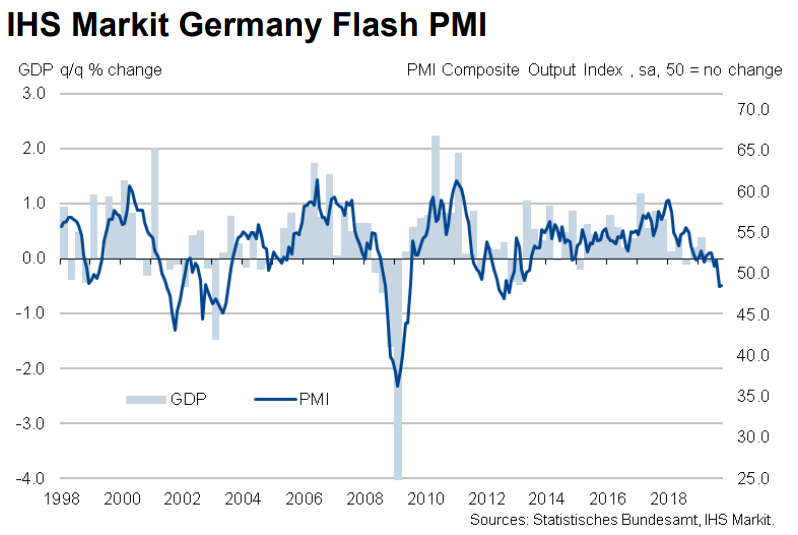

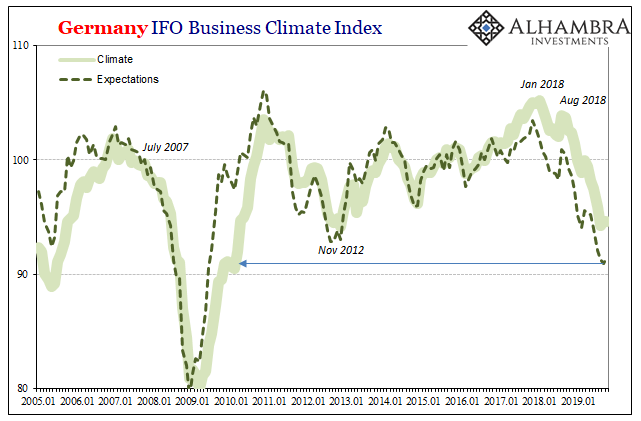

Instead, it has been Germany that “somehow” has led Europe to the brink of actual recession rather than an imaginary one inspired by too many good things like rising wages. The Germany economy may already be caught within one, a recession that by many accounts is still deepening.

But how in the world did it take nearly two years to get this point? That’s not how we are taught to think about economic growth. It happens; or it doesn’t. We are given only a binary option from which to interpret the situation. The economy is in recession; or it is growing and booming.

This persisting grind downward doesn’t fit with any conventions, as the Germans are finding out the hard way. And it leads to any number of false bottoms, such as at the beginning of this year when finally catching up to this other reality central bankers began to (futilely) strike back by turning “dovish.” Always the extraordinarily supportive monetary policy that doesn’t ever seem to be able to support, well, anything.

Germany’s economic growth slowed substantially in 2018, but the eurozone’s economic powerhouse appeared to have avoided a technical recession in the fourth quarter as strong domestic demand countered weaker export sales…

Fears of a technical recession, or two-straight quarters of economic contraction, had emerged last week after industrial production plunged between October and November, highlighting the problems facing the country’s manufacturers…

However, a strong labour market has helped boost domestic demand. Unemployment is now at its lowest level since the re-unification of East and West Germany.

Germany, in the end, didn’t avoid anything. It just took a lot longer than impatient Economists could imagine it would. Expecting at worst a quick recession at the end of 2018, and being relieved not to see one, the German economy and Europe with it seem to have found it a year further down the calendar.

Which is why January 2019’s “dovishness” pales in comparison to October’s. The more dovish the less of any visibly supportive effect.

The situation, to put it mildly, has gone from bad to worse. Even when the numbers tick up, they do so by the smallest margin. Mainstream reports, of course, still blow them way out of proportion because of even more extraordinary extraordinarily supportive monetary policy.

But recent data should warn instead of making that same mistake, the same one everyone’s been making since the very beginning of 2018.

This thing is just now coming to fruition, and, sure as night becomes day, there was nothing the “strong labo(u)r market” could do to stop it (are you paying attention Mr. Powell?) By each and every further indication as we pass each and every month into 2019, for the small upward deviations it only gets worse and worse.

Especially when those small upward moves are at best second derivatives. The only positives about IHS Markit’s ugly German and European data released yesterday was this:

Total new business across the private sector was down for the fifth time in the past six months, though the rate of decline eased slightly thanks to a slower (though still sharp) fall in manufacturing order books.

The future keeps looking worse, but in October it didn’t get worse nearly as fast as it did in September. Thank you Mario Draghi?

Hardly. Contrary to last year’s much more optimistic pessimism, that Germany’s attention to inflation would cause recession in Club Med, it has turned out to be exactly the opposite. European recession, if or when it shows up, will be because German and European officials had no idea what was really happening at the time. And how it can possibly still be happening. Just when they say its done, the next little leg lower.

They welcomed a slowdown that hasn’t yet stopped and shows no signs of being close to doing so. That’s really the point here. You think it can’t go any further and yet it does. Not every month, but most months.

As I’ve said all along, it’s not actually a good sign that a recession hasn’t yet shown up in more than a few (key) spots here or there. That just means the prolonged downturn isn’t close to reaching its end. Which also means that every few months “they” will tell you it has.

That’s the other key point. How would “they” know?

Stay In Touch